Skip to content

- Trump to buy oil for strategic reserve to aid energy industry: ‘We’re going to fill it’ (CNBC)

- Gilead Pops After Coronavirus Drug Helps Cruise Ship Patients In Japan Investor’s Business Daily)

- Europe Pledges Billions in Economic Aid in Rare Sign of Unity (New York Times)

- Dow surges nearly 2,000 points after Trump declares coronavirus national emergency (New York Post)

- Trump Says He Supports Pelosi Virus Bill, Urges GOP to Vote Yes (Bloomberg)

- Trump Waives Student-Loan Interest, Stockpiles Oil in Virus Plan (Bloomberg)

- Esports Leagues Are Only Game in Town After NBA and NHL Go Dark (Bloomberg)

- Stocks Retrace 90% of Thursday’s Sell-Off With Trump Address Hitting Mark (Bloomberg)

- Cash-Rich Billionaire Hargreaves Jumps Back Into Market (Bloomberg)

- Trump called on Walmart, CVS, Target, and Walgreens to help slow the spread of the coronavirus as he declares a national emergency (Business Insider)

- Stocks Surge After Trump Promises Speedier Testing (New York Times)

- How Billie Eilish Rode Teenage Weirdness to Stardom (New York Times)

- Deadly viruses are no match for plain, old soap — here’s the science behind it (MarketWatch)

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- China’s coronavirus epicenter reports just five cases (Reuters)

- Here’s everything you need to know about 5G (CNN)

- Google, Walmart join U.S. effort to speed up coronavirus testing (Reuters)

- 7 Stocks That Could Ride Out the Turmoil in Energy Markets (Barron’s)

- The World Is One Big Carry Trade (Institutional Investor)

- Value investors: why are they so calm in a crisis? (Schroders)

- HIV drugs are being used as part of coronavirus treatment (New York Post)

- Here’s What Could Help Calm Markets, According to Wall Street’s Best Minds (Barron’s)

- U.S. Stock Futures and European Equities Surge as Markets Try to Stabilize After Historic Meltdown (Barron’s)

- It’s Time for Warren Buffett to Get Greedy. Here’s What He Might Be Looking to Buy. (Barron’s)

- ‘This Is All Coming to a Head’: Investors React to Market Chaos (Bloomberg)

- Mohamed El-Erian: The stock market looks ‘less scary’ (CNBC)

- Fed to Inject $1.5 Trillion in Bid to Prevent ‘Unusual Disruptions’ in Markets (Wall Street Journal)

- New Coronavirus Test 10 Times Faster Is FDA Approved (Bloomberg)

- Germany Pledges Unlimited Cash as EU Set to Green Light Spending (Bloomberg)

- Oracle earnings show best revenue growth in nearly two years (MarketWatch)

- 11. Trump’s $800 billion payroll tax cut plan would dwarf Obama’s stimulus package from the height of the financial crisis (Business Insider)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

- Time to Buy, Says GMO (Institutional Investor)

- Carl Icahn Boosts Occidental Stake to Almost 10% as Shares Plummet (Wall Street Journal)

- Can Gilead’s Virus Test Results Cure Broader Stock Market Woes? (Investor’s Business Daily)

- Let’s Talk About Coronavirus Bailouts, Before We Need Them (New York Times)

- Stocks Plunge With Virus Response Missing Mark (Bloomberg)

- 21 Stocks To Buy In a Virus Economy (Barron’s)

- Markets Are in Turmoil. Buy These Stocks, Jefferies Says (Barron’s)

- The losers — and even bigger losers — of an oil price war between Saudi Arabia and Russia (CNBC)

- Here’s how Invesco’s top strategist says long-term investors should navigate this market panic (MarketWatch)

- Buffett and Occidental: We’ve Seen This Movie Before (Wall Street Journal)

- Oil Price Shock on Top of Coronavirus Compounding Sovereign Credit Risks (24/7 Wall Street)

- ECB approves fresh stimulus for reeling economy but keeps rates steady (Reuters)

- Private Equity Firms Won’t Waste Another Crisis (Institutional Investor)

- What Warren Buffett thinks of his Occidental investment after shares crashed with oil prices (Yahoo! Finance)

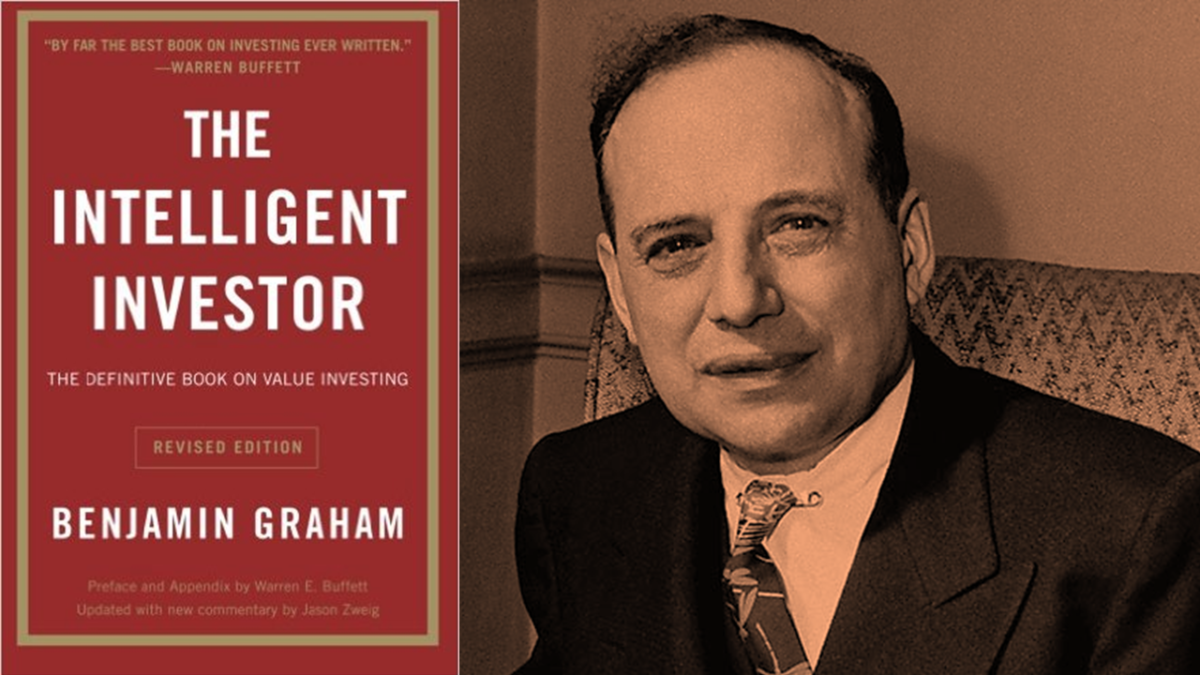

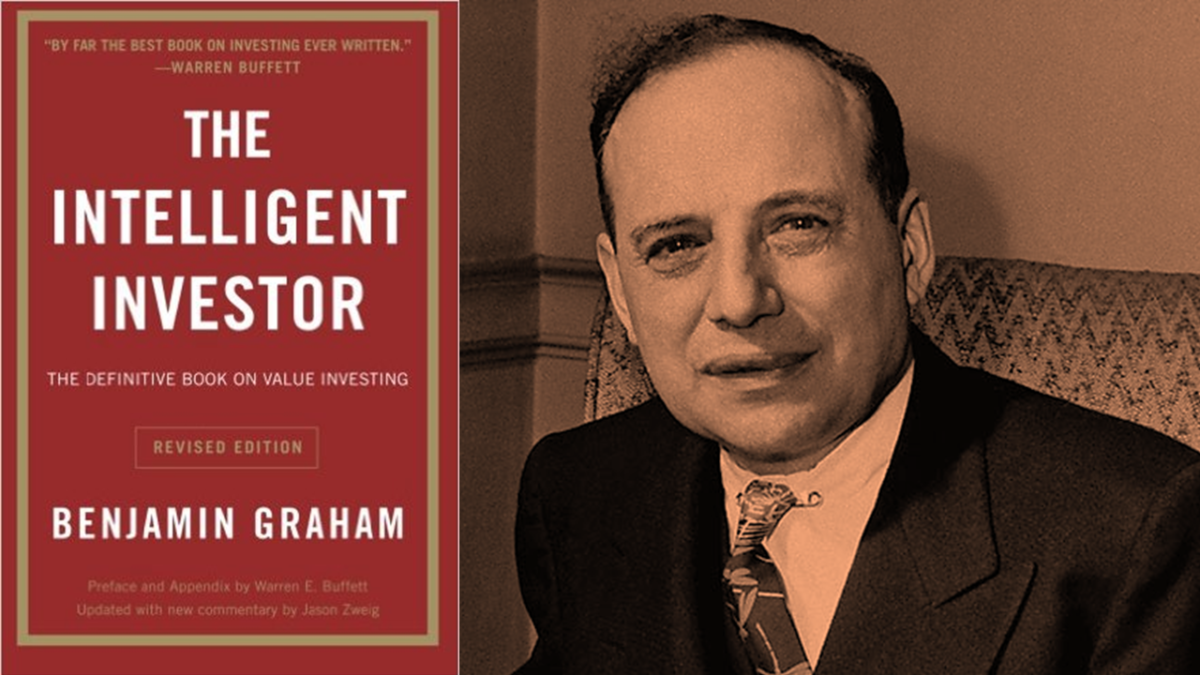

- What Benjamin Graham Would Tell You to Do Now: Look in the Mirror (Wall Street Journal)

- China’s Stocks Have Recouped Most CoronavirusStocks to Buy Amid the Selloff (Barron’s)

- U.S. Consumers Just Got a $725 Billion Windfall. Here’s How. (Barron’s)

- Coronavirus Is Bad — and Good — for Biotech Stocks (Barron’s)

- How China Slowed Coronavirus: Lockdowns, Surveillance, Enforcers (Wall Street Journal)

- Inside Saudi Arabia’s Decision to Launch an Oil-Price War (Wall Street Journal)

- Here’s why people are panic buying and stockpiling toilet paper (CNBC)

- The Bank of England cut rates by 0.5% in an emergency coronavirus response, mirroring the Fed. Business Insider)

- China’s Stocks Have Recouped Most Coronavirus Losses. Key Points to Watch for the U.S. (Barron’s)

- Goldman Sachs analyzed bear markets back to 1835, and here’s the bad news — and the good — about the current slump (MarketWatch)

- Oil jumps after rout on stimulus hopes, Russian signal on OPEC talks (Reuters)

- Global Markets Are Rising After Trump Hints at Tax Cut Over Coronavirus (Barron’s)

- Stocks Fall More Than 7% in Dow’s Worst Day Since 2008 (Wall Street Journal)

- The Fed Offers Repo Market $50 Billion More to Ease Rate Pressure (Barron’s)

- Russia’s Oil War Has a Political Objective, Says Analyst (Barron’s)

- Interesting: Bullish Percent Transports (Hedge Fund Tips)

- High-Yield Bonds Are Sinking as Bankruptcy Fears Hit the Oil Patch (Barron’s)

- How a Saudi-Russian Standoff Sent Oil Markets Into a Frenzy New York Times)

- As Stock Markets Plunge, Trump Calls for Economic Response to Coronavirus (New York Times)

- Why falling oil prices could boost the Marcellus Shale (Yahoo! Finance)

- Treasurys plunge as Trump floats payroll tax cut amid coronavirus maelstrom (Fox Business)

- Wall Street CEOs to meet at White House (Fox Business)

- New Jersey’s Investment Chief Wants Talent. Here’s How He’ll Get It. (Institutional Investor)

- Lloyd Blankfein Predicts ‘Quick Recovery’ For Markets (Benzinga)

- Cabot Oil & Gas Is One Company Rising in Oil-Sector Carnage (Yahoo! Finance)

- The economy is ‘like a coiled spring’ and a sharp rebound is possible, analysts predict (CNBC)

- Russia to Start Foreign Currency Sales After Ruble Wipeout (Bloomberg)

- These Energy Stocks Were Lighter Than Air Monday (Wall Street Journal)

- Trump Surprised Staff With Vow to Detail Virus Aid Package Today (Bloomberg)

- How the Federal Reserve Can Ease the Coronavirus Panic (Wall Street Journal)

- NY Fed raises repo limits to ensure ample supply of bank reserves (Reuters)

- Never Mind The Stock Market. The Real Pain Will Be in the Credit Markets. (Barron’s)

- Hedge-fund manager who called the coronavirus market meltdown says selloff is overdone, covers shorts (MarketWatch)

- How the Trump Campaign Took Over the G.O.P. (New York Times)

- Saudi Aramco shares dive, Gulf debt hit as oil price plunges (Reuters)

- Putin Dumps MBS to Start a War on America’s Shale Oil Industry (Yahoo! Finance)

- Virtu Financial founder says stock market is ‘one big opportunity right now’ (CNBC)

- How Tupperware Lost Its Grip on America’s Kitchens (Wall Street Journal)

- All Your Coronavirus Travel Questions Answered (Wall Street Journal)

- What’s Your Workout? A Huge Leap to Replace the Rush of Ice Hockey (Wall Street Journal)

- Bonds Rally as Stocks Close Lower (Wall Street Journal)

- The US government has never had a better opportunity to truly reshape our economy (Business Insider)

- Wash Your Hands—but Beware the Electric Hand Dryer (Wired)

- The Koenigsegg Gemera is the world’s most wickedly weird hybrid (The Verge)

- Episode 977: Where’s The Vaccine? (NPR Planet Money)

- CRISPR Treatment Inserted Directly into the Body for the First Time (Scientific American)

- Did Passive Investing Fuel A Bubble In Tech Stocks? (Podcast) (Bloomberg Odd Lots)

- A simple guide to the vaccines and drugs that could fight coronavirus (Vox)

- ‘Unclean! Unclean!’: The Questionable History of Quarantines (Popular Machanics)

- Sam Zell Is Buying the Dips in Energy (Chief Investment Officer)

- 11 Stocks and ETFs for a Post-Virus World (Barron’s)

- Volatility (ValueWalk)

- 12 Dividend Stocks to Buy Amid Turmoil in the Markets (Barron’s)

- Oil Plunges 8% as OPEC Can’t Find Agreement (Barron’s)

- How to Find a Bottom in Industrial Stocks Using Dividend Yields (Barron’s)

- Jack Welch Remembered by Businessweek’s Former Executive Editor (Bloomberg)

- These nine companies are working on coronavirus treatments or vaccines — here’s where things stand (MarketWatch)

- Using Models to Stay Calm in Charged Situations (Farnam Street)

- What Happens to Stocks After a Big Down Month? (A Wealth of Common Sense)

- Should I Sell My Stocks? (The Irrelevant Investor)

- Jim Cramer: I’m With Warren Buffett on This One (TheStreet)

- China Stocks Are Handily Beating U.S. Since Coronavirus Outbreak. Here’s Why (Bloomberg)

- Billionaire Sam Zell says he is buying some ‘ridiculously low’ stocks in the wild market swings (CNBC)

- ‘Bond King’ Gundlach says Fed panicked and short-term rates are ‘headed toward zero’ (CNBC)

- ValueAct’s Jeffrey Ubben buys BP and says oil company can be ‘part of the solution’ (CNBC)

- OPEC deal in jeopardy as Russia stalls over deepest round of supply cuts since 2008 (CNBC)

- Bullard Says Fed Watching Virus Fallout, Willing to Do More (Bloomberg)

- Fed’s Kaplan thinks U.S. can avoid coronavirus recession as Williams says central bank will keep using tools (MarketWatch)

- Can Gilead Change Its Dim Fortunes On An Immuno-Oncology Buyout? (Investors)

- Global equity outflows hit $23bn on coronavirus fears (Financial Times)

- Be Like Warren Buffett in Times Like These. Here’s How. (Barron’s)

- Federal Reserve Retools Capital Rules for Largest U.S. Banks (Wall Street Journal)

- Market-Beating Bank CEOs Are a Rare Breed (Wall Street Journal)

- Cramer’s most trusted market indicator says to start buying stocks (CNBC)

- Larry Kudlow Says ‘We’re Not Going to Panic’ Over the Economy (Bloomberg)

- Capitulation Moment? ‘We are giving up on energy’, say Jefferies analysts, who compare beaten-down sector to ‘62 Mets (MarketWatch)

- Oil prices rise on report OPEC agrees 1.5 million barrel-per-day production cut (MarketWatch)

- Buffett-Backed 30-Year-Old Goes to War With Latin American Banks (Bloomberg)

- Exxon CEO sticks to spending targets despite oil downturn (Reuters)

- The Old Dominion “Snapback” Stock Market? (and Sentiment Results) (ZeroHedge)