Skip to content

Energy Stocks Might Finally Have Hit Bottom (Barron’s )

Americans Joining Workforce at Record Rate (Wall Street Journal )

Mike Bloomberg Wants to Build an Influencer Army (Vanity Fair )

Moore Capital ‘Didn’t Try That Hard’ at Succession (Institutional Investor )

20VC: Oaktree Capital’s Howard Marks on The Most Important Skill An Investor Can Have, The Right Way To Think About Price Sensitivity & Where Are We At Today; Take More Risk or Less? (20 min VC )

How One Value Investor Is Weathering the Strategy’s Underperformance (Institutional Investor )

As OPEC+ Reels From China Virus, Libya Threatens Knockout Punch (Bloomberg )

AbbVie Jumps on Strong Earnings. That’s Not the Only Reason. (Barron’s )

The Mormon Church Amassed $100 Billion. It Was the Best-Kept Secret in the Investment World. (Wall Street Journal )

FedEx to Start Mixing Express and Ground Operations (Wall Street Journal )

Week Before Presidents’ Day Bullish since 1990 (Almanac Trader )

2020 Ford GT Adds Power And Turns Heads With Stunning ‘Liquid Carbon’ Edition (Maxim )

Kraft Heinz Could Have Bad News. It’s Time to Buy the Stock. (Barron’s )

The No. 1 Biotech Stock Just Squashed Earnings Views — Here’s Why (Investor’s Business Daily )

Hedge Fund and Insider Trading News: Steve Cohen, Bill Ackman, Laurion Capital, Alden Global Capital, Black Diamond Therapeutics Inc (BDTX), SkyWest, Inc. (SKYW), and More (Insider Monkey )

Trump, Xi Reaffirm Commitment to Phase-One Trade Deal (Bloomberg )

The ‘Dividend Aristocrats’ Add 7 New Members (Barron’s )

Honeywell’s Chief Technology Officer Explains the Significance of 5G (Barron’s )

Elliott Management amasses $2.5B stake in bruised SoftBank (New York Post )

U.S. Jobs Top Estimates With 225,000 Gain, Wages Accelerate (Bloomberg )

The Big Dirty Secret Behind Wind Power (Bloomberg )

Encouraging banks to tap Fed discount window could prevent another repo market freeze, says Quarles (MarketWatch )

Peak Shale Will Send Oil Prices Sky High (OilPrice )

Natural Gas: Capital Retreat To Send Prices 50% Higher (Seeking Alpha )

The end of oil, or just the beginning? (and Sentiment Results) (ZeroHedge )

China Just Cut Tariffs on U.S. Goods. Here Are the Products That Benefit. (Barron’s )

U.S. oil rises as OPEC+ committee calls for deeper cuts to global output amid coronavirus (MarketWatch )

U.S. Trade Deficit Narrows for First Time in Six Years (Wall Street Journal )

Adopting a dog? Coors Light offering $100 toward dog adoption fees for Valentine’s Day (USA Today )

Mattress firm Casper receives sleepy IPO reception (Financial Times )

China cuts Oil tariffs in half (Reuters )

Exxon Mobil Won’t Cut Its Dividend. Here’s Why. (Yahoo! Finance )

These Are the Top Energy Funds of the Past Decad e ( Institutional Investor ) Hedge Fund and Insider Trading News: Ray Dalio, Lee Ainslie, Starboard Value LP, Sound Point Capital Management, First Eagle Investment Management, Coca-Cola Co (KO), Enterprise Products Partners L.P. (EPD), and More ( Insider Monkey ) NYSE Owner Makes Offer to Buy eBay ( Wall Street Journal ) TikTok Eyes Larger Post-Super Bowl Marketing Push ( Wall Street Journal ) Instagram Brings In More Than a Quarter of Facebook Sales ( Bloomberg ) The Trump administration finalizes rule that could shift tariff fights to $6 trillion currency market ( Business Insider ) Why the stock market could jump another 20% this year: Fundstrat ( Yahoo! Finance ) Are Active Funds Better for Fixed-Income Investors? ( U.S. News and World Report ) Trump criticizes ‘failing government schools’ as he pushes school choice ( Fox Business ) OPEC+ delegates weigh new oil cuts as they analyze coronavirus impact ( S&P Global )

Biotech Giant Surges On Plan To Test Coronavirus Drug In Humans (Investor’s Business Daily )

Flu and HIV Drugs Show Efficacy Against Coronavirus (The Scientist )

The Final Frontier of Streaming: ViacomCBS Launches Star Trek (Barron’s )

OPEC Scrambles to React to Falling Oil Demand From China (New York Times )

Oil rebounds on potential for further OPEC+ supply cuts (Street Insider )

How an Och-Less Och-Ziff Changed Its Attitude, Its Leadership – and Its Name (Institutional Investor )

Global junk bond issuance hits monthly record (Financial Times )

Here are the risks to watch in the CLO market, says industry group made famous by ‘The Big Short’ (MarketWatch )

YouTube brought in $15 billion in advertising revenue in 2019 — 9 times more than Google paid to acquire the site 14 years ago. (Business Insider )

A Hedge Fund With 29% Return Record Is Shorting Tesla Bonds (Bloomberg )

Saudis Weigh Large 1M barrel/day Oil Cuts in Response to Coronavirus (Wall Street Journal )

OPEC+ considering further 500,000 bpd oil output cut: Sources (CNBC )

Gilead Drug to Undergo Human Trials in China to Cure Coronavirus (Bloomberg )

Gilead Sciences (GILD) Shares Surges as Remdesivir May Be Effective in Treating Coronavirus (Street Insider )

Experimental drug for coronavirus to be tested in Wuhan (Global Times )

Cocktail of flu, HIV drugs appears to help fight coronavirus: Thai doctors (Reuters )

Toronto patient with 1st confirmed case of coronavirus discharged from hospital (CityNews )

The ‘Odd’ Part of the Economy That Baffles Steve Schwarzman (Institutional Investor )

He Really, Really Wants to Win at Cornhole (Wall Street Journal )

The Rotation To Value Is Inevitable (ZeroHedge )

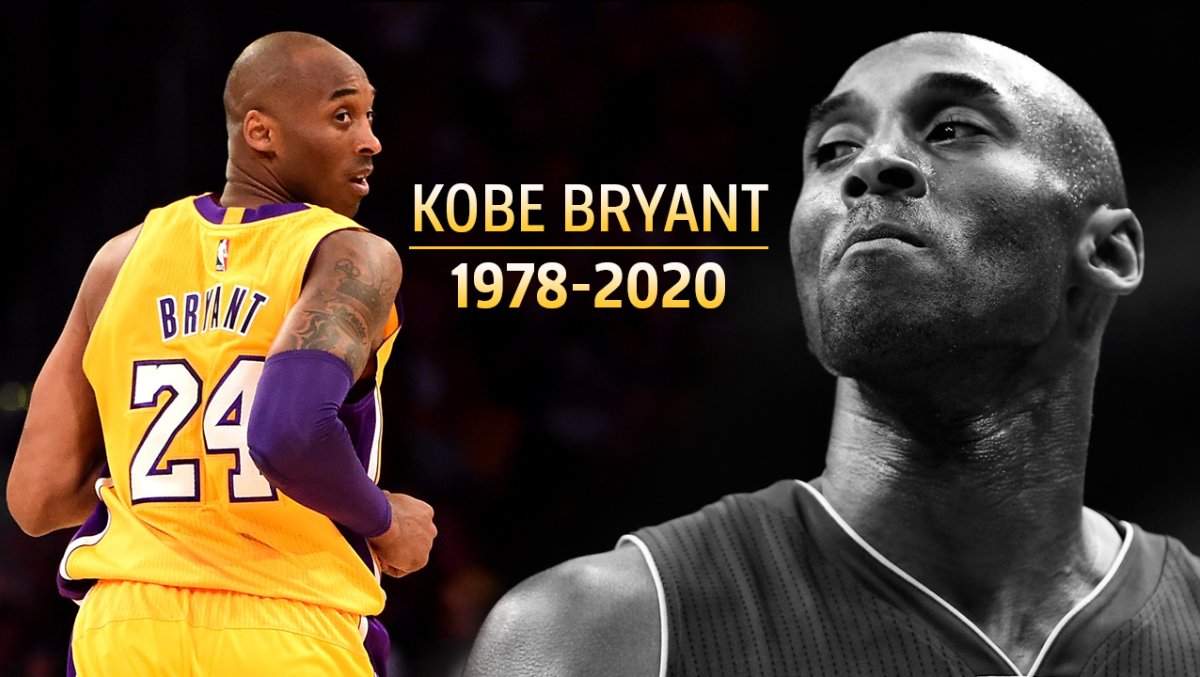

Kobe Bryant’s Last Great Interview (YouTube )

How Amazon Keeps Defying Gravity (New York Times )

February’s First Trading Day: DJIA & NASDAQ up 76.2% of the Time Last 21 Years (Almanac Trader )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Inside big tech’s quest for human-level A.I. (Fortune )

Fed’s Clarida: U.S. economy in good place, coronavirus a ‘wildcard’ (Reuters )

Hedge Fund and Insider Trading News: Jamie Dinan, Ray Dalio, Israel Englander, Air Products & Chemicals, Inc. (APD), Cidara Therapeutics Inc (CDTX), and More (Insider Monkey )

The First Action-Packed ‘Fast and Furious 9’ Trailer Is Here (Men’s Journal )

This American-Made Supercar Could Make History With a Win at Le Mans (Maxim )

Hedge Fund Tips – Episode 15 – VideoCast. Stock Market Commentary. (ZeroHedge )

Using Fiscal Stimulus To Stave Off A Recession (Podcast) (Bloomberg )

The Big Question Hanging Over China’s Virus Attack: How Long Before Containment? (Barron’s )

Barron’s Picks And Pans: Intel, Johnson & Johnson, T-Mobile And More (Yahoo! Finance )

Why hedge funds are still searching for the next big thing (Financial Times )

4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s )

4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s )

James Bond’s favorite car maker Aston Martin gets rescue investor (New York Post )

UK formally leaves the European Union and begins Brexit transition period (CNBC )

What Third Point Is Worried About in 2020 (Institutional Investor )

S&P 500 wipes out gain for the year on coronavirus fears (Financial Times )

The Inner Game: Why Trying Too Hard Can Be Counterproductive (Farnam Street )

How Warren Buffett Made 50% Returns During His Partnership Days | Warren Buffett’s Investment Strategy Explained (Macro-Ops )

Eight Things I Never Knew About Jack Dorsey (Ramp Capital )

Ray Dalio Is Still Driving His $160 Billion Hedge-Fund Machine (WSJ )

Drugmakers Are Racing to Develop a Coronavirus Vaccine (Barron’s )

Fed moves to ease some restrictions under the Volcker rule (CNBC )

Russia’s Ministry of Health names three drugs that can treat new Chinese coronavirus (RT )

OPEC curbs, supply risks to buoy oil prices in 2020: Reuters poll (Reuters )

New coronavirus: How soon will a treatment be ready and will it work? (New Scientist )

After Brexit, the EU Will Have to Be Flexible, Too (Barron’s )

Brexit is happening tonight: Here’s how we got here, and what comes next (CNBC )

Biotech Giant Biogen Banks On Alzheimer’s Approval In 2020 Outlook (Yahoo! Finance )

Ray Dalio: We ‘Don’t Have a Clue’ How Coronavirus Will Impact Markets (Institutional Investor )

Trump set for acquittal as bid to call witnesses falters (Financial Times )

Pound Ends Tough Month on a Bright Note After BOE Decision (Bloomberg )

BoE’s Carney says rate cut would have led to above-target inflation (Reuters )

Biogen Rallies After Q4 Earnings Top Views (Investor’s Business Daily )

Ken French: ‘There Is No Way to Tell’ If Value Premium Is Disappearing (Institutional Investor )

Alibaba Stock Looks Like a Buy on China Virus Fears (Barron’s )

The one word that defined Davos, investing in India’s hyper-growth, and fading recession fears (Business Insider )

Here’s what is worrying one stock-market bull (MarketWatch )

OPEC May Move Up Meeting As Coronavirus Continues To Batter Oil Prices (OilPrice )

US Oil Exports Could Explode After Once In A Lifetime Power Shift In China (OilPrice )

US energy ‘junk’ bonds hammered by oil plunge (Financial Times )

The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…(ZeroHedge )