Skip to content

10 Undervalued Energy Stocks for 2020 (24/7 Wall Street )

Biotech Stocks Are In a Position to Break Out in 2020, Analysts Say (MarketWatch )

Opinion: Takeaway from Abu Dhabi money conference: So much money is looking to find a home (MarketWatch )

BOJ to begin lending ETFs to prop up market liquidity (Reuters )

The J. Paul Getty (Energy) Stock Market (and Sentiment Results) (ZeroHedge )

Oil Stocks To Buy As Prices Rebound: Here Are U.S. Shale, Market Cap Leaders (Yahoo! Finance )

Think the Dow Is OId-Fashioned? It Beat the S&P 500 Over 5 Years. (Barron’s )

The Best Cars—Including Two Electric Vehicles—I Drove in 2019 ()

Tesla shares close at a record high. Next stop $420? (CNBC )

‘I couldn’t have been more wrong’: Legendary investor Stanley Druckenmiller reveals a mistake he made that cost him major market returns (Business Insider )

The ‘ultimate smart money indicator’ is signalling a big move in the stock market by the end of the week (MarketWatch )

China says in touch with U.S. on signing of Phase 1 trade deal (Reuters )

Biotech Analysts See Deals, Drug Data Carrying 2020 Performance (Yahoo! Finance )

Investors Pony Up More Than $2B for Distressed Fund (Institutional Investor )

US House poised to approve USMCA trade deal (Financial Times )

DuPont Has Narrowed Its Focus. Analyst Sees a Winner for 2020. (Barron’s )

8 Oil Stocks Goldman Sachs Says to Buy in 2020 (Barron’s )

Stanley Druckenmiller Is Embracing Risk Again, Just ‘Timidly’ (Bloomberg )

U.S. Energy Chief Shrugs Off Permian Oil Slowdown as a ‘Pause’ (Barron’s )

Saturday before Christmas expected to be the biggest U.S. shopping day of 2019 (Reuters )

Why Fund Managers Are Cranking Up the Risk (Institutional Investor )

Trump adviser hints at next big trade deal (Fox Business )

The U.S. housing market is taking off: Morning Brief (Yahoo! Finance )

A Berkshire Hathaway decade in review: Here are the biggest takeaways from Warren Buffett’s annual shareholder letters (Business Insider )

Dollar Is Poised to Weaken Just in Time (Bloomberg )

The Two Countries Dictating Oil Prices In 2020 (Yahoo! Finance )

The Trade Deal Doesn’t Fix Everything. The Market Doesn’t Care. (Barron’s )

Animal-Care Provider Zoetis and 6 More Companies Are Raising Dividends (Barron’s )

Global Economy Shows Signs of Regained Footing (Wall Street Journal )

Upbeat Chinese Economic Data Buoy Commodities (Wall Street Journal )

This year’s really big rally doesn’t mean 2020 needs to be a down year, history shows (CNBC )

UK unemployment falls to lowest level since 1975 (BBC )

US Single-Family Building Permits Reach 12-Year High (Zero Hedge )

Worst to First in 2020 (Oil Stocks)? (Yahoo! Finance )

7 Greatly Undervalued Dow Stocks for Upside and Dividends in 2020 (24/7 Wall Street )

Embattled Oil Stocks Occidental and Chesapeake See Large Insider Buys (Barron’s )

Lighthizer Scores a Trifecta of Wins for Trump’s Trade Agenda (Bloomberg )

A Warren Buffett Protégé on the Most Critical Thing She’s Learned About Turning Companies Around (Fortune )

Opinion: There’s more upside for biotech even after 24% gains in two months (MarketWatch )

Villains or visionaries? Hedge funds short companies they say ‘greenwash’ (Reuters )

Fresh off election win, Boris Johnson seeks new Brexit legislation ‘before Christmas’ (MarketWatch )

Stock market ‘melt-up’ coming soon: Bank of America (FoxBusiness )

Bond funds revel in white-hot year for fixed income (Financial Times )

Analysts: 9 Stocks Will Grow Sales The Most Next Year (Investor’s Business Daily )

Barron’s Picks And Pans: Charles Schwab, Disney, Sprint, Netflix And More (Yahoo! Finance )

Biotech Stocks Are Poised to Rise in 2020, Analyst Says. Here Is His Top Pick. (Barron’s )

The Pound Is Only Heading in One Direction (Bloomberg )

Where Can Investors Find Value in a Long Bull Market? Here Are Our 10 Stock Picks for 2020. (Barron’s )

Lachlan Murdoch Purchases ‘Beverly Hillbillies’ Mansion for Record Price (Fortune )

Here’s What Every Michelin 3-Star Restaurant in the US Is Serving on New Year’s Eve (Robb Report )

We Have a Trade Deal and Brexit Clarity. That’s Good News for Stocks. (Barron’s )

TOP 10 concept cars of 2019 (designboom )

This Mind-Blowing Mojave Desert Compound Will Train Astronauts For Life on Mars (Maxim )

Fed’s Clarida Dismisses Weak Retail Sales, Says Outlook Solid (Bloomberg )

Artificial Intelligence And Machine Learning Lead Charts: 2020 Tech Trends (ValueWalk )

The Top 20 Destinations For 2020 (Forbes )

ECRI Weekly Leading Index Update (Advisor Perspectives )

China to target around 6% growth in 2020, step up state spending: sources (Reuters )

U.S. Mnuchin says trade deal with China to boost global economy (Reuters )

Warren Buffett said an 89-year-old carpet seller would ‘run rings around’ Fortune 500 CEOs. Here’s the remarkable story of Mrs B (Business Insider )

It’s Time To Get Greedy In The Energy Sector (The Felder Report )

GOLDMAN SACHS: These 20 unloved stocks are spring-loaded for surprisingly big gains in 2020 (Business Insider )

U.S.-China trade deal swaps tariff rollbacks for farm, energy purchases (Reuters )

Here are the best-performing stocks of the decade (CNBC )

PBD TOP 100 MOVIES (Patrick Bet-David )

U.S. and China Reach ‘Phase-One’ Deal Easing Trade Tensions (Bloomberg )

McDonald’s launching first vegan meal in the UK (New York Post )

Boris Johnson’s chance to forge a new role for Britain (Financial Times )

Here’s what the new trade deal means for the markets (CNBC )

What you need to save monthly to retire with $1 million to $3 million, broken down by age (CNBC )

Tradeoffs: The Currency of Decision Making (Farnam Street )

Automation and artificial intelligence could save banks more than $70 billion by 2025 (Business Insider )

These 3D-Printed Houses Could Solve Homelessness (Futurism )

Gary Keller — How to Focus on the One Important Thing (#401) (Tim Ferriss )

Hedge Funds Have Taken Smaller Active Bets — and Delivered Less Alpha — Since the Financial Crisis (Institutional Investor )

Bull Markets Last Much Longer Than You Think (A Wealth of Common Sense )

One Ratio to Rule Them All: EV/EBITDA (Focused Compounding )

John Malone Has A Very Simple Approach To Screening For Opportunities (GreenBackD )

Copper’s seasonal rally underway (Almanac Trader )

The NHL’s Best Fans 2019: No. 4 Golden Knights Prove Hockey Can Thrive In The Desert (Forbes )

Regeneron (REGN) Upgraded to “Top Pick for 2020†and “Outperform†by Credit Suisse (TheFly )

US and China agree to phase one trade deal, December Chinese tariffs canceled (Fox Business )

100 Books Everyone Should Consider Reading (AOM )

Fed Statement on Repo Operations (NY Fed )

Fed Aims a Half-Trillion Dollar Liquidity Hose at Year-End Risks (Bloomberg )

Johnson secures crushing UK election victory (Financial Times )

Watch Out, China: Why Investors May Flock to India Next (Institutional Investor )

Shares and sterling soar as trade and Brexit fog lifts (Reuters )

Trump says Britain, U.S. free to strike new trade deal after Brexit (Reuters )

Are Energy Stocks Hot Again? (Oil Price )

Emerging Markets Cut Rates With Russia Following Turkey, Brazil (Bloomberg )

Happy birthday, Taylor Swift! (New York Post )

The Hedge Fund CQS Is Looking at Unloved Parts of the Credit Market for 2020 (Barron’s )

Big Pharma’s Coming Back in 2020. ()

Navy SEAL: How To Pick Yourself Back Up From Failure (Investor’s Business Daily )

Trump meets with top trade advisers to strategize before major China tariff deadline (Fox Business )

Saudi Aramco touches $2tn valuation on second day of trading (Financial Times )

Why Exxon’s Stock Could Hit $100 In 2020 (Oil Price )

The “Crazy Rich Asians” Stock Market (and Sentiment Results) (ZeroHedge )

Continental Resources founder Harold Hamm steps down as CEO (Financial Times )

U.S. producer prices unchanged; underlying inflation soft (Reuters )

Oil prices rise on OPEC deficit forecast (Reuters )

The Fed Did Everything It Needed To By Doing Nothing (Barron’s )

The Fed could consider buying other short-term Treasuries, Powell says (Barron’s )

Supercar maker McLaren to skip electric vehicles. Here’s why — and what it will build instead. (USA Today )

Cisco says its new silicon, software, router products will ‘change the economics of the Internet’ (Yahoo! Finance )

Apple (AAPL) China iPhone Shipments in Nov Declined Sharply – Credit Suisse (Street Insider )

Japan and the Art of Making the Same Mistakes Over and Over Again (Wall Street Journal )

Britain Votes in an Election That Will Set the Course of Brexit (Wall Street Journal )

US weekly jobless claims race to a more than 2-year high (CNBC )

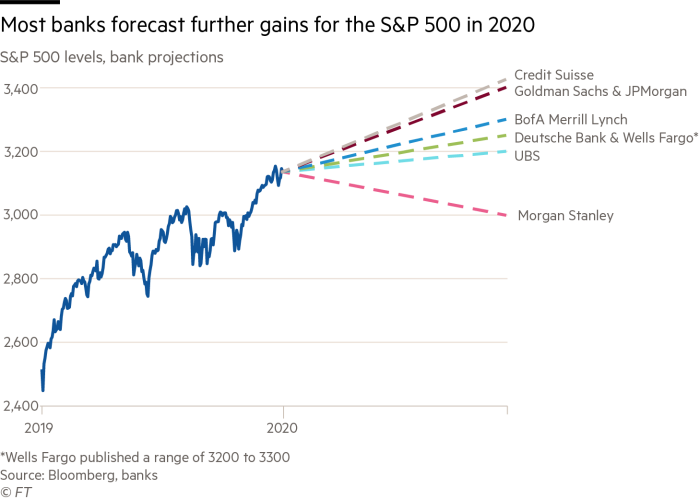

Wall Street expects bull run to continue in 2020 (Financial Times )

OPEC sees small 2020 oil deficit even before latest supply cut (Reuters )

Industrial Stocks Could Rebound on Trade News, Analysts Say (Wall Street Journal )

The 5 books Bill Gates recommends you read this holiday season (CNBC )

Exxon Mobil prevails in New York climate change lawsuit (Reuters )

The stock market will ‘breathe a sigh of relief’ if President Trump is re-elected in 2020, says billionaire Howard Marks (MarketWatch )

Asleep No More, Traders Buy Hedges ‘Like World Is About to End’ (Bloomberg )

Ray Dalio Is Now Mentoring Hip-Hop Mogul Sean ‘Diddy’ Combs (Bloomberg )

Saudi Aramco shares jump 10% in oil group’s trading debut (Financial Times )

Bank of America is becoming the Amazon of retail banking (Yahoo! Finance )

Jobs surge boosts housing market (FoxBusiness )

Brexit Stocks That Could Soar If Boris Johnson Wins the U.K. Election (Barron’s )

The ‘Dividend Aristocrats’ have nearly matched the S&P’s return (Barron’s )

The Federal Reserve Is Primed to Launch ‘QE4’, Strategist Says. Others Say That’s Not Likely. (Barron’s )

Sicilian Homes Went Up for Auction Starting at €1. More Than 100,000 People Called. (Wall Street Journal )

Ken Griffin Has Another Money Machine to Rival His Hedge Fund (Bloomberg )

The Fed is expected to hold rates steady and vow to keep short-term lending markets stable (CNBC )

‘Gundlach ratio’ suggests bond yields may rise (MarketWatch )

Christine Lagarde Needs to Be a Negotiator—But Also a Plumber (Wall Street Journal )

Yuan Is Offering Interesting Entry Point at Current Levels: Pictet WM (Yahoo! Finance )

6 Strong Buy Oil and Gas Stocks Called to Surge in 2020 (24/7 Wall Street )

Here’s What It’s Like To Drive a $210,000 McLaren (Barron’s )

The Time to Buy Home Depot Stock Is Now, Analysts Say (Barron’s )

JP Morgan is bullish on Vietnamese banks, says sector offers high growth and profitability (CNBC )

The Federal Reserve’s Meeting Starts Today. Here’s What You Need to Know. (Barron’s )

The Fed will stay in hibernation until at least summer: CNBC survey (CNBC )

Big-name US investors take aim at beaten-up energy sector (Financial Times )

Democrats and the Trump administration near a tentative North American trade deal (CNBC )

There’s no better place to put your money than the U.S., says hedge-fund manager Kyle Bass (MarketWatch )

Ross: US close to largest trade deal in history of the world, 170,000 jobs (Fox Business )

US and Chinese trade negotiators planning for delay of December tariff Fox Business )

Next Oil Rally May Be Made in Texas, Not Vienna (Wall Street Journal )