190 Managers overseeing ~$526B AUM responded to this month’s BofA survey.

OUTLOOK:

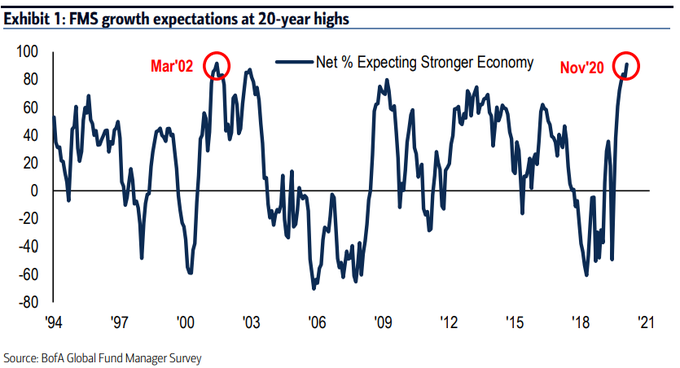

-Most bullish Fund Manager Survey (FMS) of 2020 on the back of vaccine, election, macro.

-66% now say macro in “early-cycle” phase, not recession.

-91% of the respondents expect a stronger economy in the next 12 months, the highest level since 2002 and 2009 (beginning of new cycles).

-Record net 73% of investors expect a steeper yield curve.

-Net 24% of surveyed investors expect value stocks will outperform growth stocks, highest since February 2019.

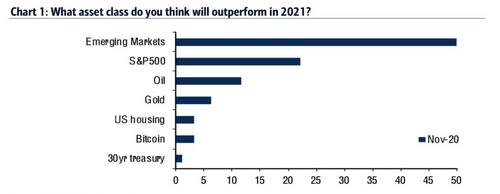

-Assets that investors expect to outperform next year: emerging markets, S&P 500 and oil.

-Largest proportion on record said EM currencies are undervalued.

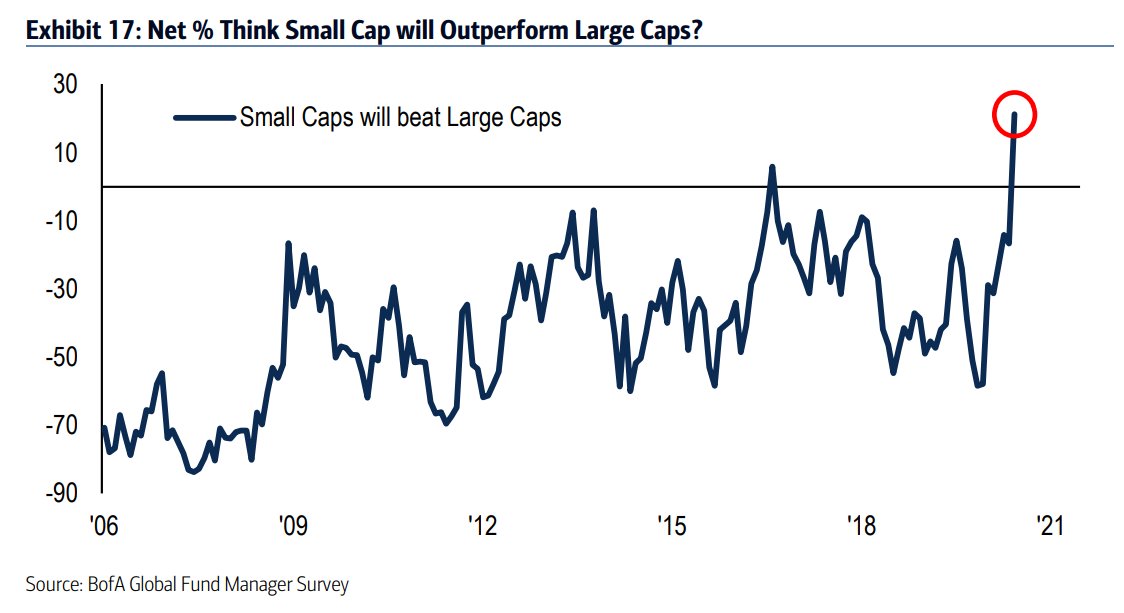

-Net 21% saying that small-caps will outperform large-cap stocks.

-CIOs still want CEOs to improve balance sheet (47%), but desire for capex (the 2021 key to sustained economic recovery) on the rise (38%).

-20 year high in GDP expectations.

SENTIMENT:

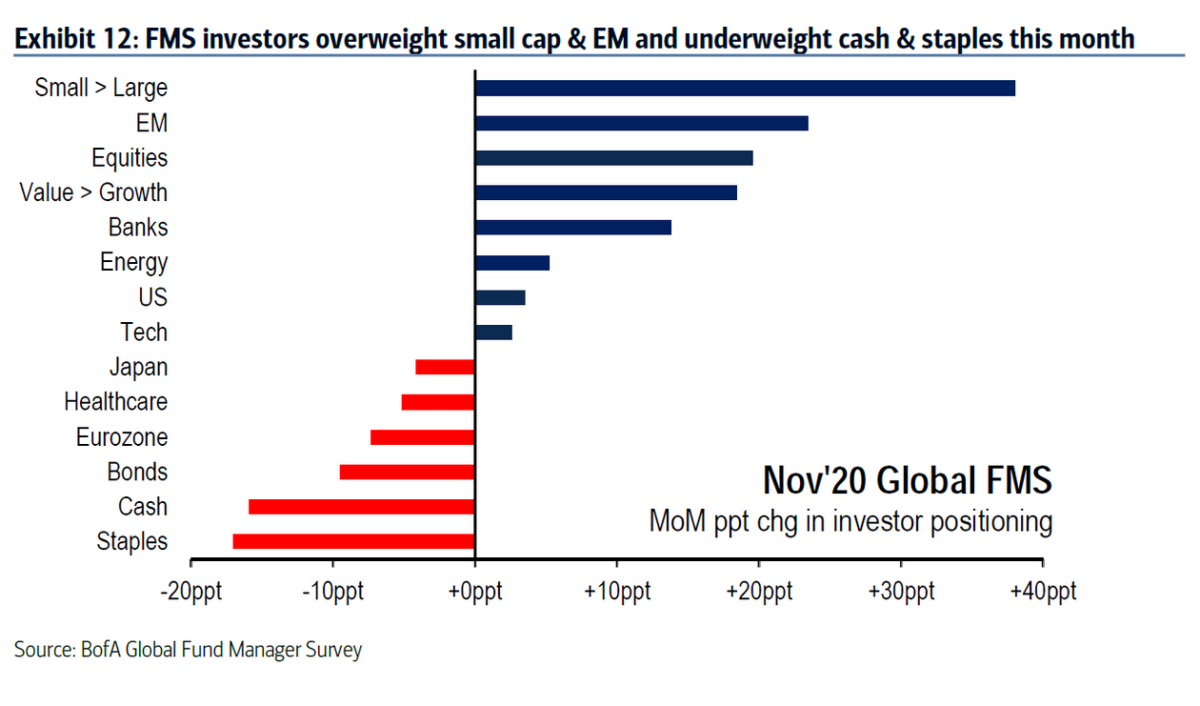

POSITIONING:

-3 favorite 2021 Year Ahead trades: l. long Emerging Markets 2. long S&P500 3. long oil.

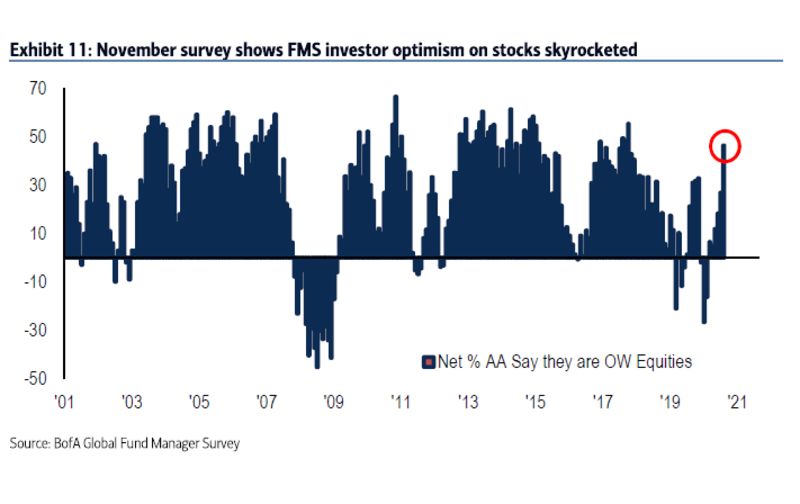

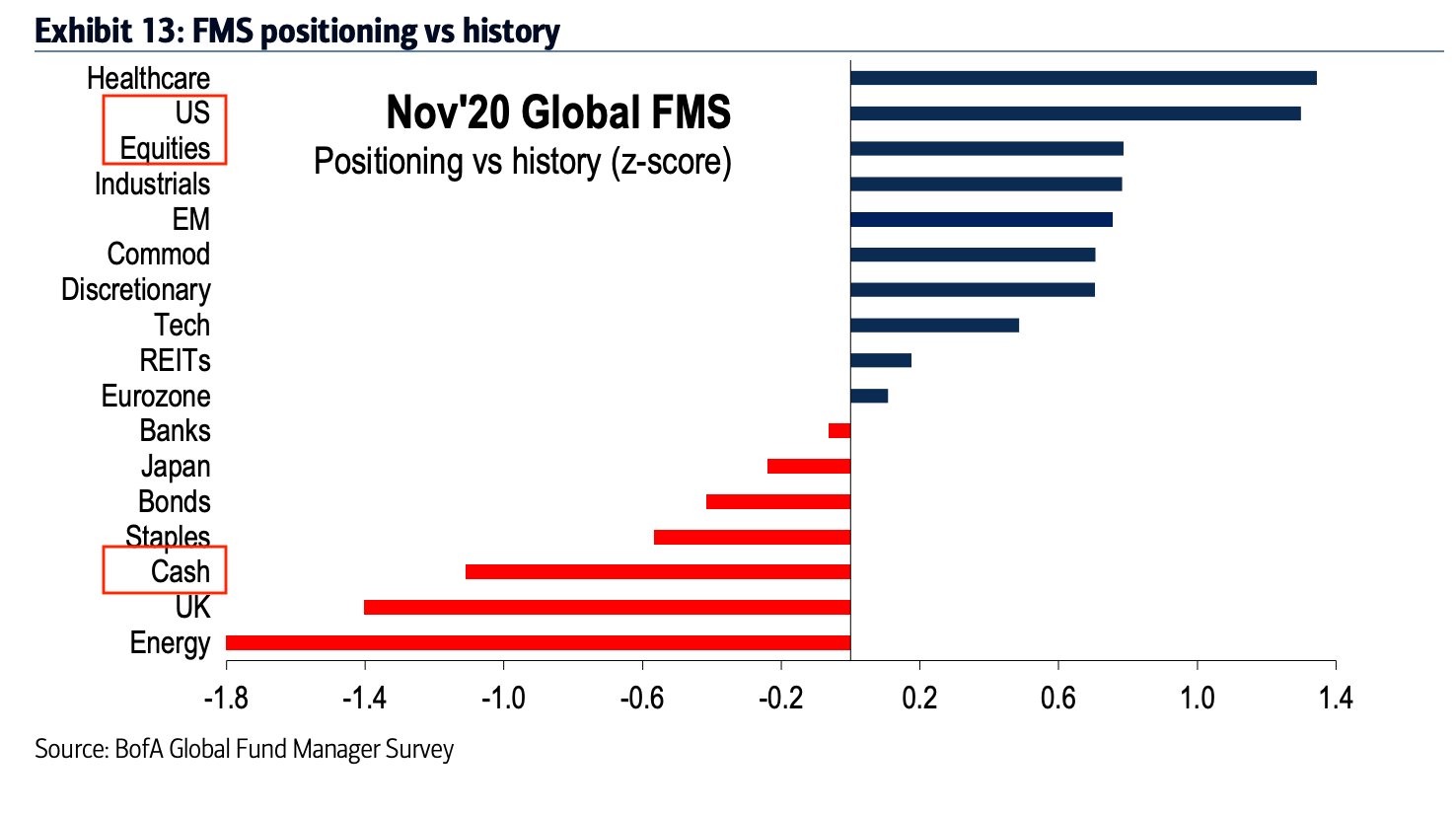

-Big jump in equity, small cap & EM exposure.

-Rotation to Emerging Markets, small cap, value, banks funded by lower allocation to cash bonds, staples.

-Allocation to equities (net overweight 46%) highest since Jan’18 and close to extreme bulish (ie >50%).

-Net 6% of fund managers say they’re taking higher than normal risk levels, highest level since January 2018.

-Allocation to U.S. stocks increased 4 percentage points to net 23% overweight.

-Allocation to euro-area stocks dropped 8 percentage points to net 18% overweight.

-Net 36% of investors overweight EM stocks, making it the survey’s most-preferred region.

-U.K. stocks remain the survey’s biggest underweight.

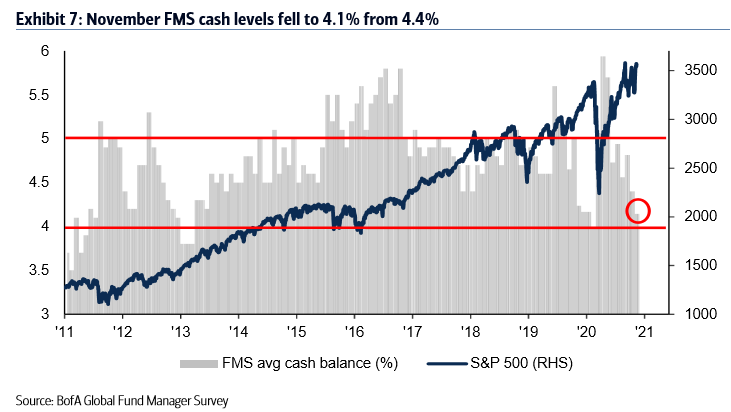

-Big drop in cash at 4.1% down from 4.4% (<4% = “sell”). BofA says is “close to triggering FMS Cash Rule ‘sell signal.'”

-Cash levels now below the pre-COVID-19 level (was 4.2% in Jan).

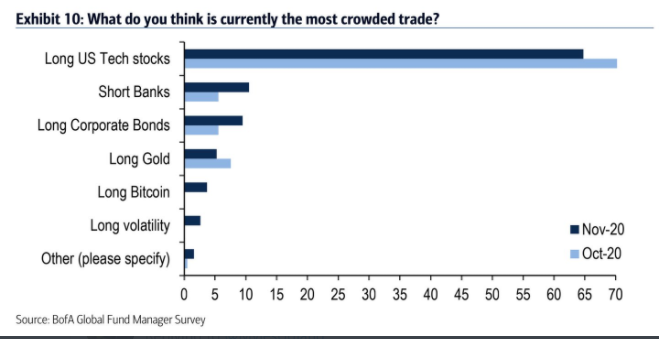

MOST CROWDED TRADE:

-long tech stocks

-short banks

-long corporate bonds

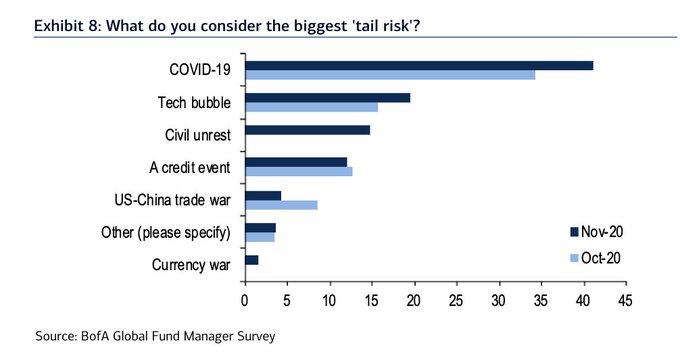

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

-Michael Hartnett, “reopening rotation can continue in Q4 but sell the vaccine in coming weeks/months as we think we’re close to full bull.”

-Contrarian Trades: “Q4 contrarian bulls would position for completion of “full bull” reopening rotation via longs in Japan, Eurone, UK and energy stocks; contrarian bears would position for flatter yield curve trades e.g. long staples heading into Late 2020 early 2021 top.”