Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 26, 2024

Tom Hayes – NYSE TV Appearance – 9/26/2024

NYSE TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 26, 2024

Watch in HD Directly on NYSE TV

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Intel Has a Great Chip for the First Time In Years (barrons)

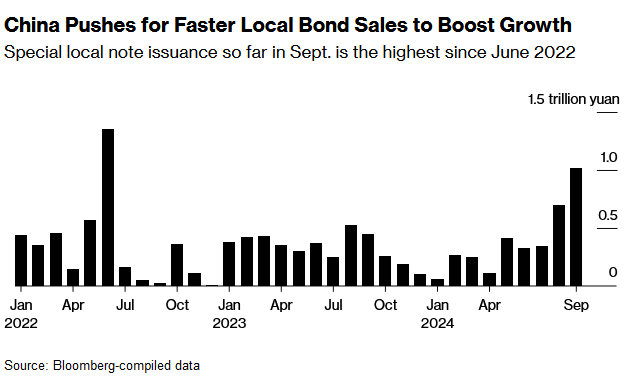

- China’s Politburo Supercharges Stimulus With Housing, Rates Vows (bloomberg)

- China pledges to ensure fiscal spending among steps signaling urgency (bloomberg)

- Hedge Funds Snap Up Chinese Equities on Stimulus Optimism (bloomberg)

- House, Senate Approve Spending Bill to Keep Government Open (barrons)

- Alibaba’s Singles’ Day preparation includes US$5.7 billion in aid to merchants (scmp)

- China Weighs Injecting $142 Billion of Capital Into Top Banks (bloomberg)

- China Seeks to Resolve Structural Issues to Shore Up Employment (bloomberg)

- Fed’s Kugler Sees Plenty More Rate Cuts Ahead (barrons)

- Why now may be a good time to take ‘opportunistic’ profits in gold and silver (marketwatch)

- The Policy Dragon Awakens As Mainland China & Hong Kong Rally (chinalastnight)

- Visa Is in the Hot Seat. MasterCard and Others Could Benefit. (barrons)

- Boeing, Union to Resume Pay Talks as Strike Nears Third Week (bloomberg)

- Tracking Hurricane Helene’s Latest Path (bloomberg)

- PayPal expands services to allow merchants to buy and sell crypto (cnbc)

- Here are the most important days for the stock market between now and the November election, according to BofA (businessinsider)

- Wall Street just got another sign that dealmaking is on its way back (finance.yahoo)

- Dollar General asks shareholders to reject investment firm’s stock-purchase offer (marketwatch)

- China’s yuan continues upward climb after Beijing’s stimulus roll-out (scmp)

- Chinese homeowners cheer Beijing’s move to cut mortgage rates by a half point (scmp)

“Cowboys Owner Full of Gas” Stock Market and Sentiment Results…

General Market Updates

On Friday, I joined David Lin on “The Lin Report” to discuss implications of the front-loaded 50bps Fed cut. Thanks to David for having me on. As always, my conversations with David have a history of going viral and pulling significant engagement. This was a good one! Watch here to find out why: Continue reading ““Cowboys Owner Full of Gas” Stock Market and Sentiment Results…”

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Wednesday…

- Chinese yuan hits strongest level against dollar in over 16 months as investors assess PBOC stimulus (cnbc)

- China to Give Cash Handouts for the Poor in Rare Use of Aid (bloomberg)

- Nvidia CEO Jensen Huang Sold $713 Million of Stock. (barrons)

- China’s Stock Market Awakens From a Long Slumber. It’s Not Too Late to Ride It Higher. (barrons)

- Berkshire Hathaway Sold More BofA Stock. It Now Owns 10.5%. (barrons)

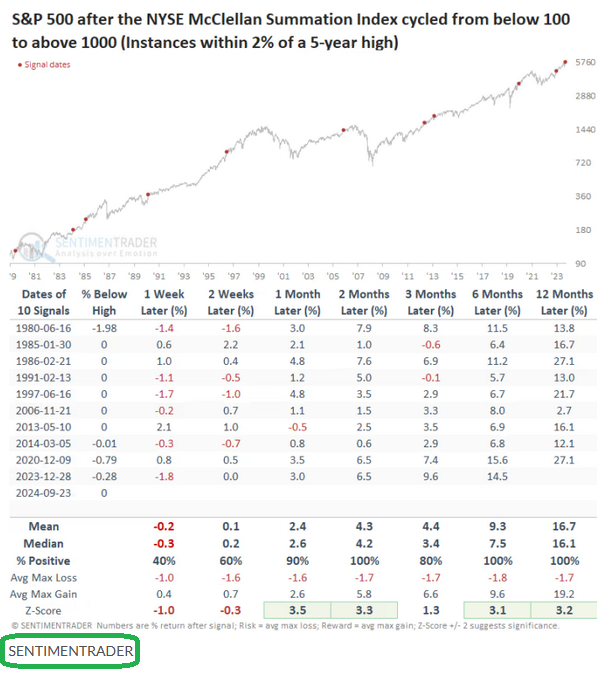

- Stock-market indicator with a near-perfect track record is flashing a ‘buy’ signal (marketwatch)

- Real Estate Stocks Have Come Too Far, Too Fast. What to Do With Them Now. (barrons)

- A wave of retail investor cash may hit the stock market when interest rates reach this level (marketwatch)

- Chinese stocks extend gains after Beijing’s stimulus bazooka (marketwatch)

- Location, Location, Golf Simulator. A Developer Cracks the Office Market Code. (wsj)

- China Boost Sends EM Stocks to Longest Winning Streak Since July (bloomberg)

- China central bank cuts medium-term loan rate (reuters)

- Still ‘plenty of upside’ in China trade: BTIG (streetinsider)

- Fed’s Bostic says economy returning to normal, policy should also ‘normalize’ (streetinsider)

- What China’s biggest stimulus since the pandemic means for US investors: Morning Brief (yahoo)

- Investors welcome ‘unprecedented’ central bank loans to try to boost markets but analysts say fiscal stimulus is needed (ft)

- China’s US$114 billion stock market rescue plan sparks hope for rally (scmp)

- Monetary Policy Bazooka Unleashed (chinalastnight)

- US Mortgage Rates Fall Again, Triggering Big Wave of Refinancing (bloomberg)

- China Cuts One-Year Policy Rate by Most Ever in Stimulus Drive (bloomberg)