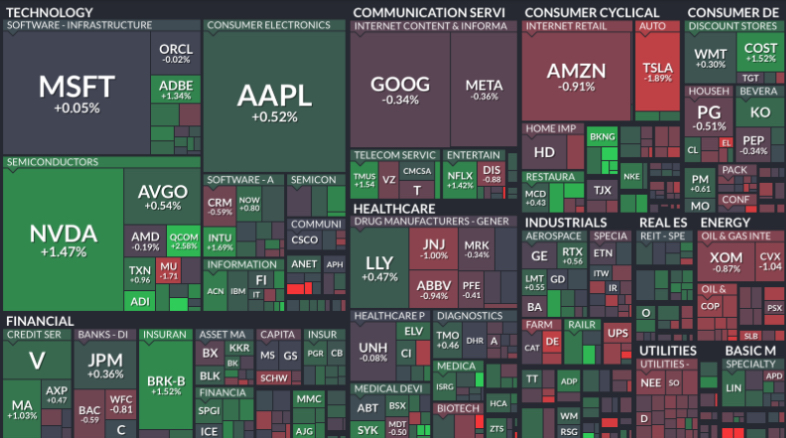

Data Source: Finviz

Quote of the Day…

Be in the know. 11 key reads for Wednesday…

- Alibaba’s Connect Membership May Be a Boon for Overseas Stocks (bloomberg)

- Fed’s annual Jackson Hole conference confirmed a regime change: Thomas Hayes (Fox Business)

- Hayes points to seasonality factors at play as the next few months could see heightened volatility (^VIX) ahead of the election. (Yahoo! Finance)

- New Boeing CEO’s engineer background ‘helpful’ to turnaround (Yahoo! Finance)

- Protests in China on the Rise Amid Housing Crisis (bloomberg)

- Warren Buffett’s Berkshire Hathaway Is Selling Bank of America Stock Again (barrons)

- Chewy Stock Rises. Earnings Jump After Customers Spend More on Pets. (barrons)

- Food Is Getting Cheaper. The ‘Price Gouging’ Fight Has Nothing to Do with It. (barrons)

- Can a Closed Nuclear Power Plant From the ’70s Be Brought Back to Life? (wsj)

- US Mortgage Rates Drop Again to Lowest Level Since April 2023 (bloomberg)

- Reliance, Disney India’s $8.5 Billion Merger Wins Antitrust Nod (bloomberg)

Where is money flowing today?

Tom Hayes – Yahoo! Finance Appearance – 8/27/2024

Be in the know. 20 key reads for Tuesday…

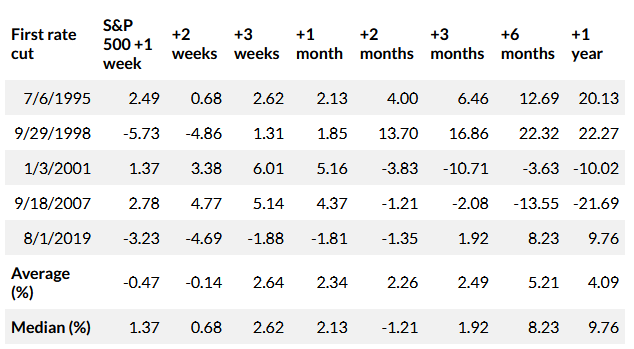

- Will stocks rally or fade after the Fed cuts rates? Here’s what history tells us. (marketwatch)

- There Are Opportunities in Beaten-Down Office Buildings. Where to Find Them. (barrons)

- Boeing Says a Travel Boom in China Will Double Demand for Planes (barrons)

- Fed Cut Could Lift Chinese Stocks. Here’s Who Could Benefit. (barrons)

- China’s PDD (Temu) suffers $55 bln market cap wipeout (reuters)

- Nvidia Earnings Arrive Tomorrow. What the Stock Needs to See. (barrons)

- Ford Says Its Pulling Back on EVs. That’s Not the Whole Story. (barrons)

- The Stock Market Rally Can Expand Beyond Big Tech. This Earnings Season Shows Why. (barrons)

- 6 Stocks That Look Like Buys for a Soft Landing (barrons)

- ‘FOMO’ returns to the options market as traders chase stocks higher (marketwatch)

- Pound hits more than two-year high, dollar back under pressure (streetinsider)

- Watch out for weaker seasonality in September, BofA says (streetinsider)

- Elliott Investment Critiques Southwest Leadership, Overdue Changes (wsj)

- Eli Lilly to sell half-price version of Zepbound weight loss drug (ft)

- China’s export curbs on semiconductor materials stoke chip output fears (ft)

- Temu’s global expansion now looks fraught with difficulty (ft)

- Investors’ expectations for European inflation fall to lowest since 2022 (ft)

- ‘T-Bill and Chill’ Is a Hard Habit for Investors to Break (bloomberg)

- JD.com Unveils $5 Billion Share Buyback as China Concerns Grow (bloomberg)

- The starter home is making a comeback as the housing market thaws for first-time buyers (businessinsider)

Hedge Fund Tips with Tom Hayes (Brendan Ahern – Special Guest) – VideoCast – Episode 253

SPECIAL GUEST: Brendan Ahern – KraneShares CIO – www.ChinaLastNight.com Twitter: @ahern_brendan ETF – KWEB

Article referenced in VideoCast above:

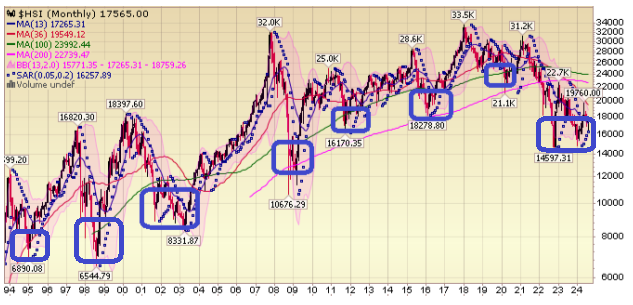

Hang Seng Chart referenced in episode:

Tom Hayes – Fox Business Appearance – Cavuto Coast to Coast – 8/26/2024

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – August 26, 2024

Watch in HD directly on Fox Business

Where is money flowing today?

Be in the know. 14 key reads for Monday…

- Temu parent PDD’s stock tumbles after a revenue miss as competition intensified (marketwatch)

- Alibaba Shareholders Approve Dual Primary Listing, Paving The Way For September Southbound Inclusion (chinalastnight)

- The inside story of the secret backchannel between the US and China (ft)

- How Banks Offload Risk From Their Balance Sheets (bloomberg)

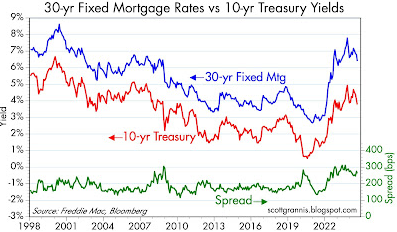

- Mortgage rate relief is coming (scottgrannis)

- To Google or Not to Google? (ps)

- Frank Lloyd Wright’s Only Skyscraper Is Heading to Auction (smithsonian)

- “Black Myth: Wukong” Sparks Video Gaming Surge and Tourism Bookings in China (alizila)

- Milton Friedman’s Shower Scene Is Back (bloomberg)

- Why dividend stocks should be a hot play into fall (cnbc)

- Hilton aims to add 100 new China hotels a year (scmp)

- Nvidia Earnings Are Coming. Big Tech Needs Them to Be Good. (barrons)

- China’s AI Engineers Are Secretly Accessing Banned Nvidia Chips (wsj)

- Intel hiring Morgan Stanley, other advisors for activist defense (cnbc)