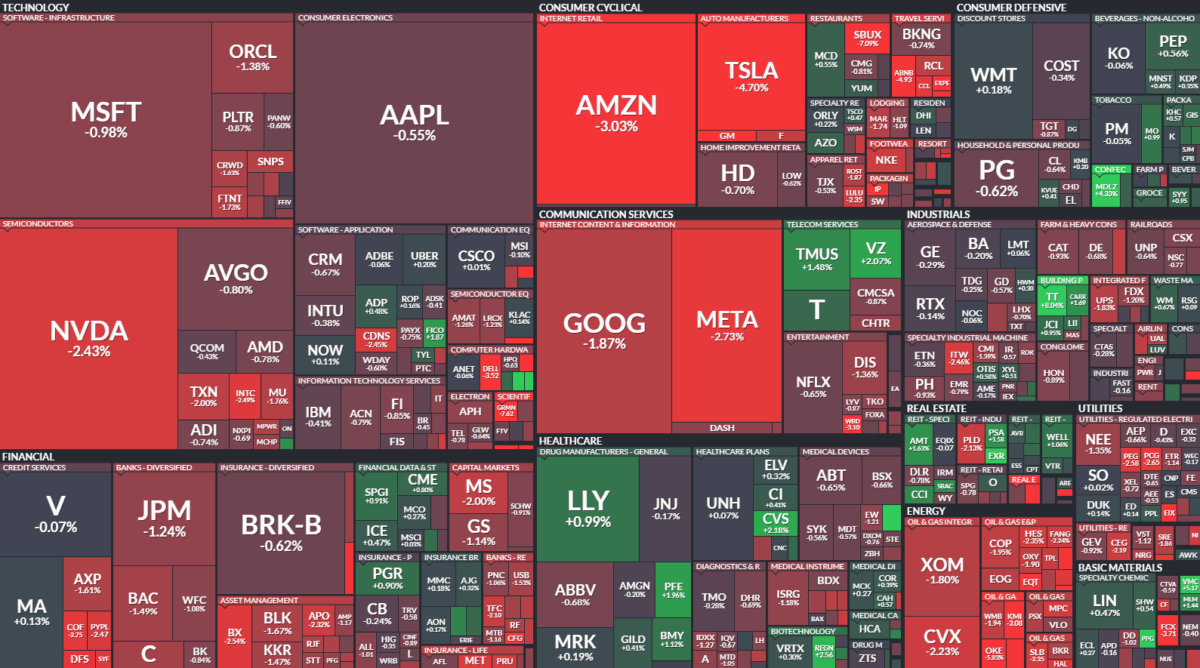

Data Source: Finviz

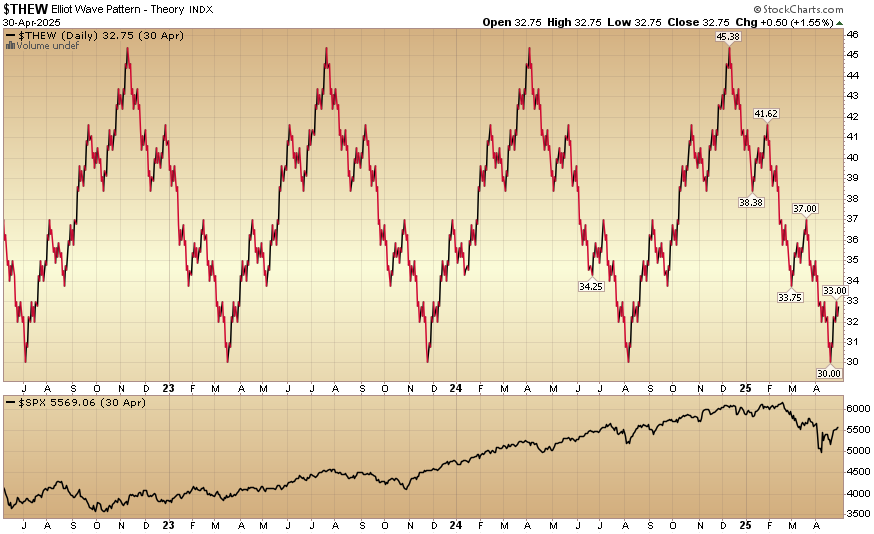

Indicator of the Day (video): Elliot Wave Pattern Theory

Quote of the Day…

Be in the know. 26 key reads for Thursday…

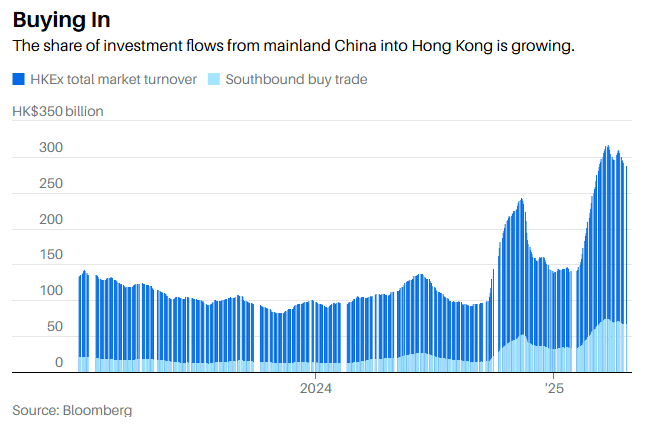

- Chinese Stocks Look Like an Opportunity Amid Trump’s Tariff Chaos (barrons)

- China signals opening for trade talks with US (ft)

- US Has Reached Out to China to Initiate Tariff Talks, CCTV Says (bloomberg)

- Alibaba’s Qwen3 AI model family helps narrow tech gap between China and US: analysts (scmp)

- Goldman’s First-Take On Alibaba’s Hybrid Qwen3 Model (zerohedge)

- Chinese Automakers Report Robust Sales Growth in April (wsj)

- How the New Trump Tariffs on Car Parts Will Work (wsj)

- A Small, Affordable Pickup Truck? It’s Finally Here (wsj)

- Ford to Delay Price Increases to See How Rivals React to Tariffs (bloomberg)

- Home Builders Are Piling on Discounts as They Struggle to Entice Buyers (wsj)

- America’s housing crisis: Realtor.com CEO says there is way to solve it (foxbusiness)

- US Pending Sales of Existing Homes Increase by Most Since 2023 (bloomberg)

- US Treasury chief urges Fed to cut rates (reuters)

- U.S. Treasury Won’t Boost Bond Sizes for Refunding, Signals Changes to Buybacks (barrons)

- Small-Cap Stocks Have Suffered. It’s Time to Be Cautiously Optimistic. (barrons)

- EU to Present Trade Proposals to US Negotiators Next Week (bloomberg)

- Millions of people in Europe lost power for hours on Monday, and no one knows why (marketwatch)

- Biggest Dollar Slump Since 2022 Hints at More Losses Ahead (bloomberg)

- U.S. Economy Shrank in First Quarter as Imports Surged Ahead of Tariffs (wsj)

- E-Commerce Sellers Brace for End of De Minimis (wsj)

- The 10 Best Companies to Invest in Now (morningstar)

- Estée Lauder Forecasts Return to Sales Growth in 2026 (bloomberg)

- Albemarle maintains 2025 outlook due to lithium tariff exemptions (reuters)

- Baxter shares rise as Q1 earnings top estimates, guidance raised (investing)

- Crown Castle Reports First Quarter 2025 Results and Maintains Outlook for Full Year 2025 (investing)

- Comstock Resources beats Q1 estimates, stock rises 3.5% (investing)

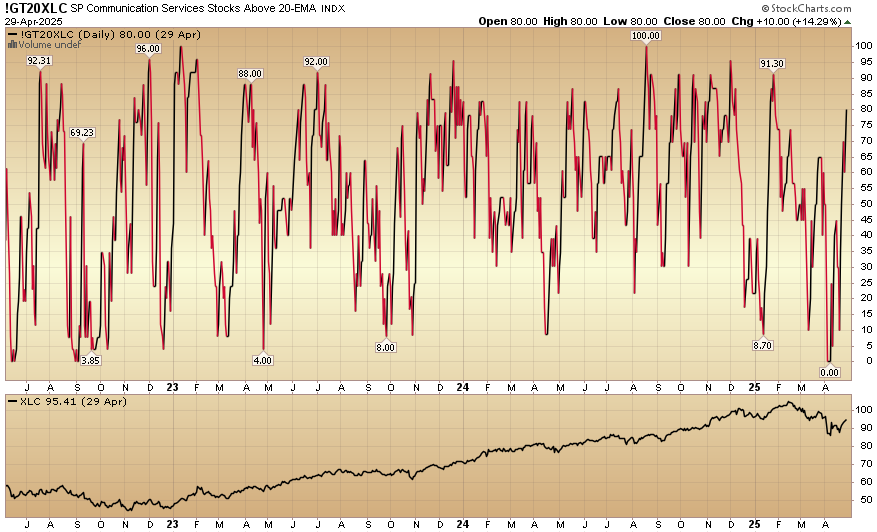

“In Leaders We Trust” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

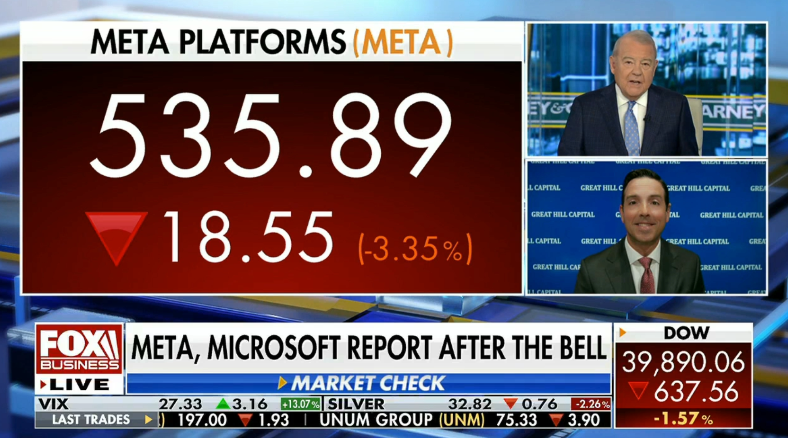

On Thursday, I joined Liz Claman on Fox Business “Claman Countdown” to discuss markets, the Fed, trade, PayPal, and Boeing. Thanks to Liz, Brooke Haliscak, and Jake Mack for having me on:

Continue reading ““In Leaders We Trust” Stock Market (and Sentiment Results)…”