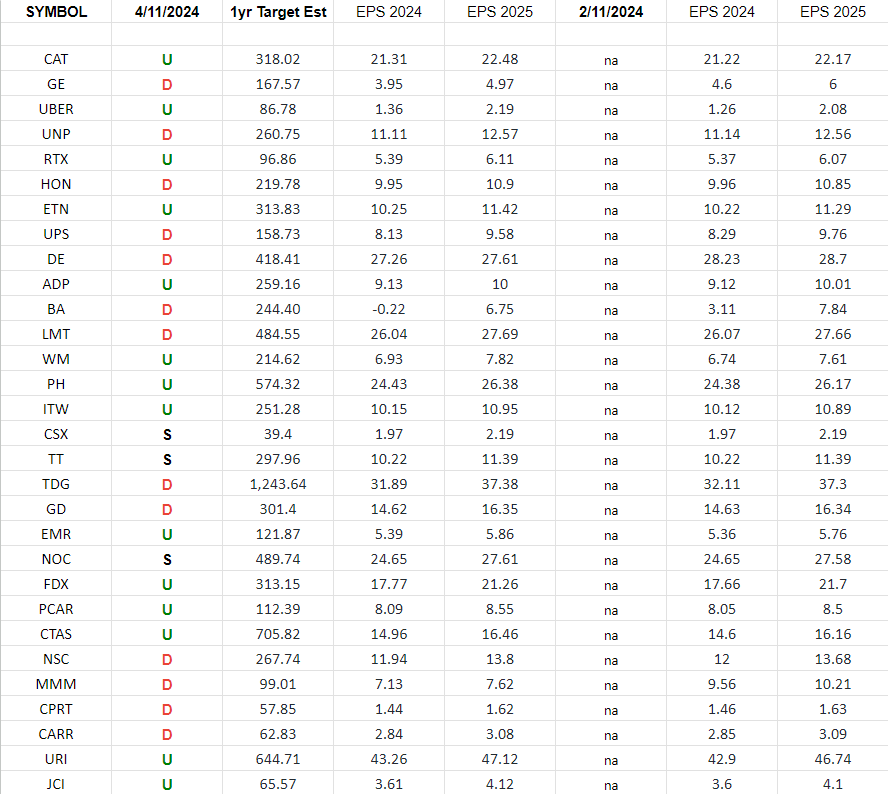

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. I have columns for what the 2024 and 2025 earnings estimates were on 2/11/2024 and today. The column under the date 4/11/2024 has a letter that represents the movement in 2024 earnings estimates since the most recent print (2/11/2024).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”