On Tuesday morning I joined Kristen Scholer at the NYSE to discuss Market Outlook, Fed, Inflation, Earnings and a new long-term position we have initiated. Thanks to Kristen, Cheddar, Kayla Hawkins and Rachel Pire for having me on:

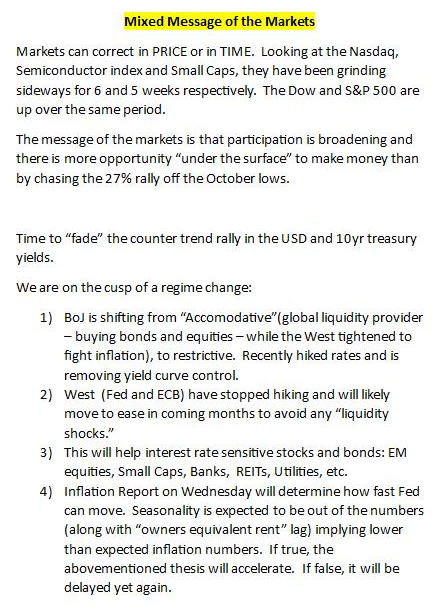

Here were some of my notes ahead of the segment:

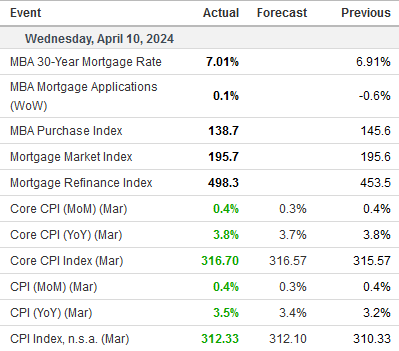

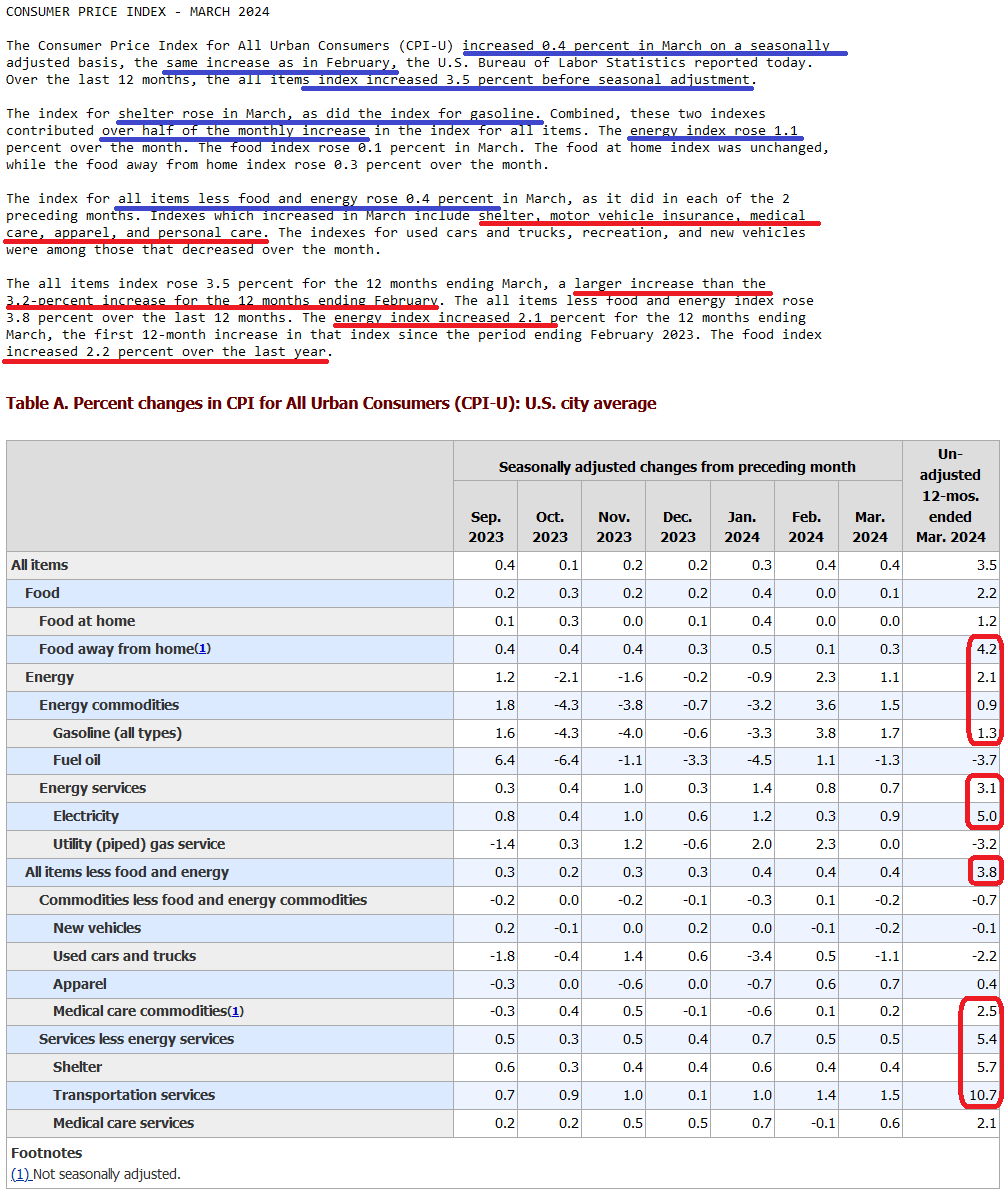

Inflation Report

The numbers:

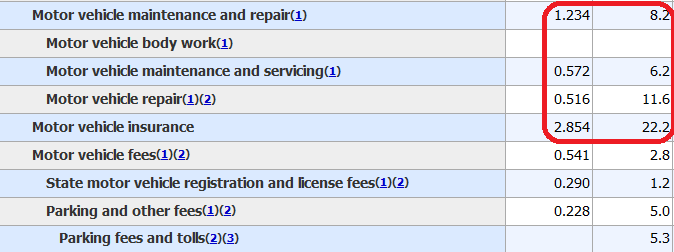

When you look at specific items, Car Insurance stands out in terms of both jump in price and weighting in index:

You will also note that the cost of repairing vehicles has jumped – which should bode well for DIY sales at our Advance Auto Parts position and new car sales – which helps Cooper Standard.

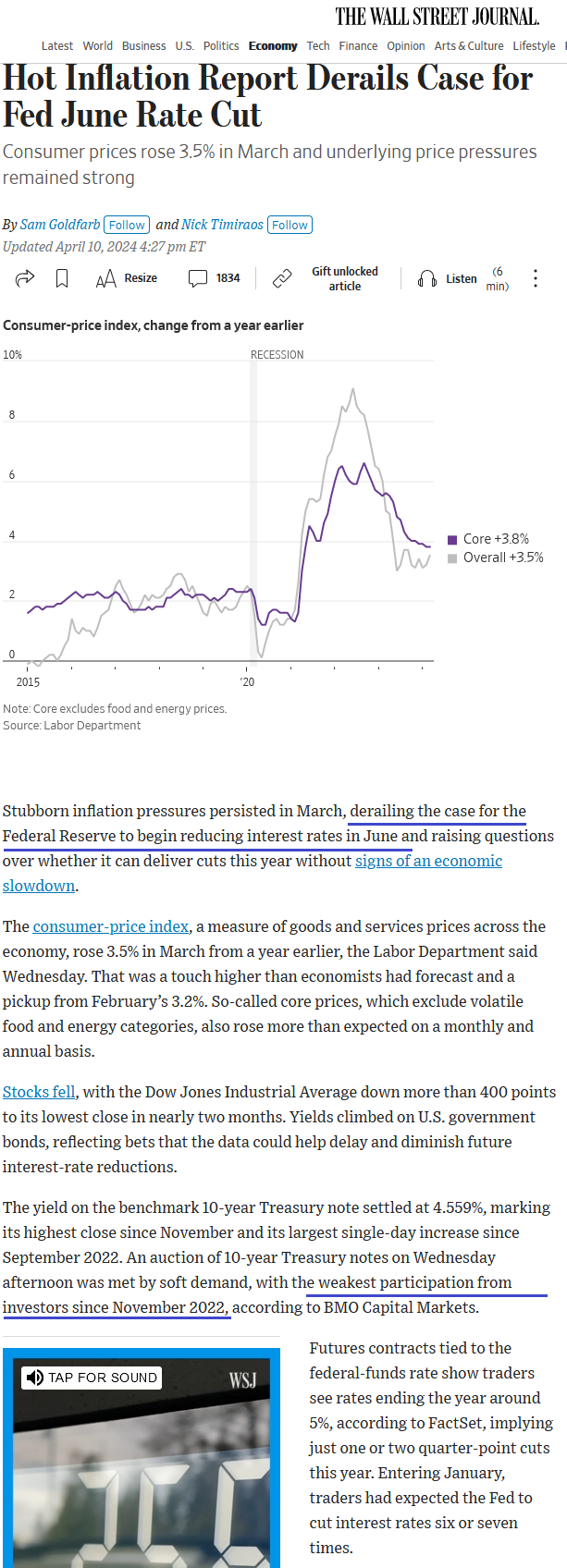

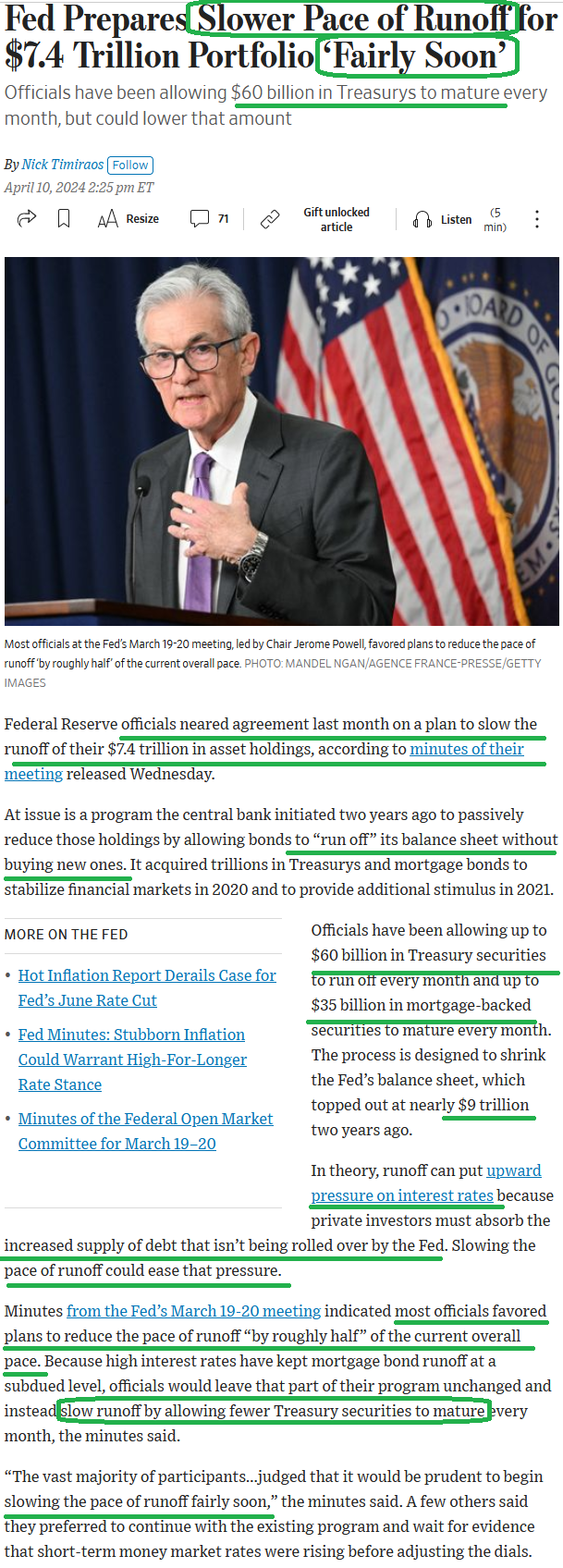

Here is the “fed whisperer’s” (Nick Timiraos) commentary about it:

On the one hand, cuts look like they have been pushed out to at least July (for the time being) – which is restrictive:

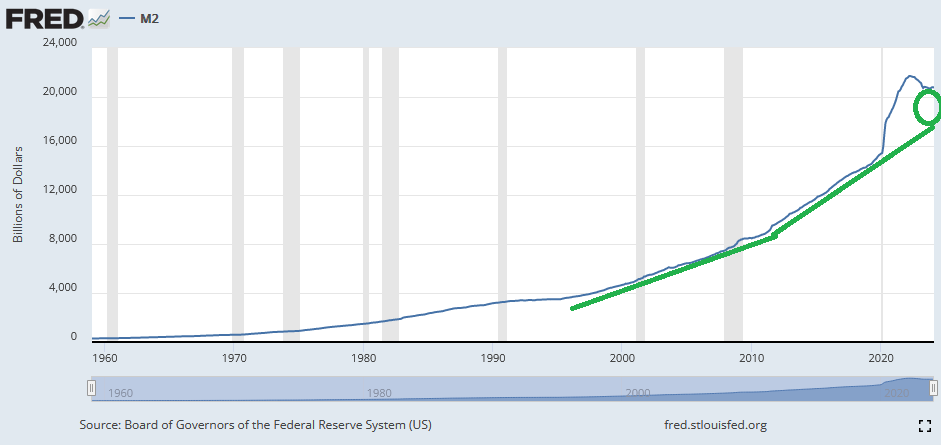

On the other hand, the Fed is planning to cut Quantitative Tightening in half – according to the Fed Minutes released on Wednesday. This is accomodative – especially because M2 Money Supply is still well above trend:

On the other hand, the Fed is planning to cut Quantitative Tightening in half – according to the Fed Minutes released on Wednesday. This is accomodative – especially because M2 Money Supply is still well above trend:

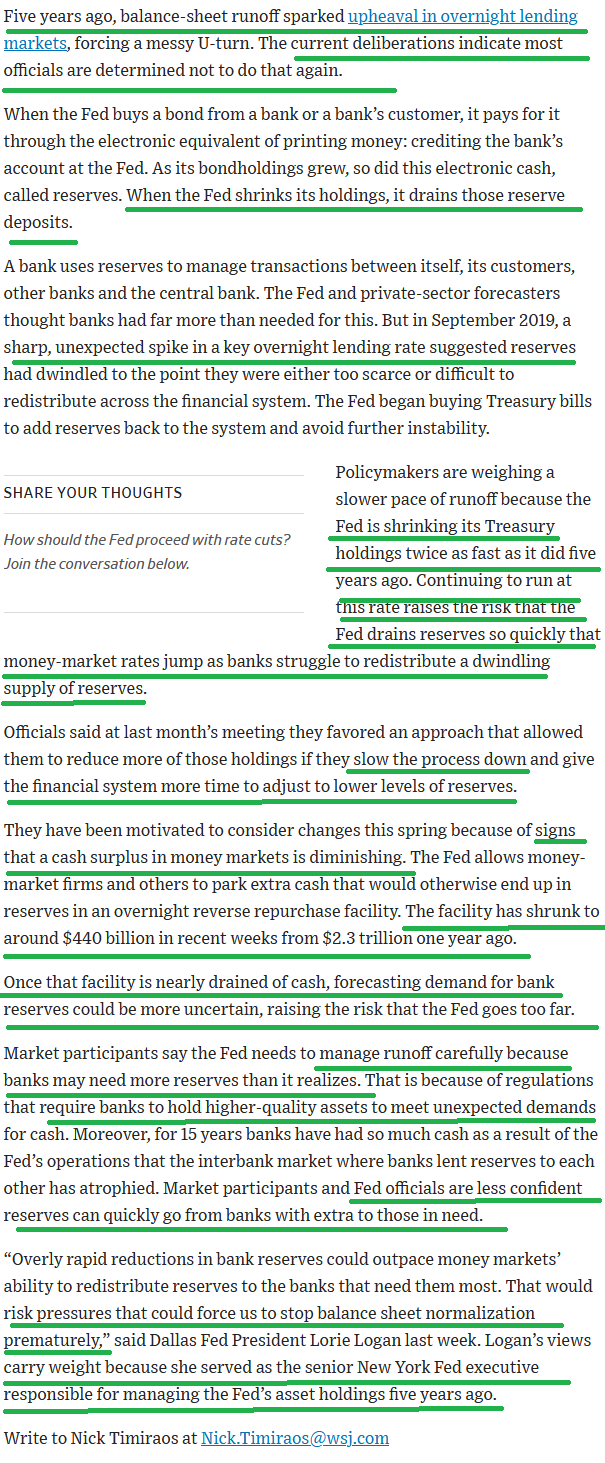

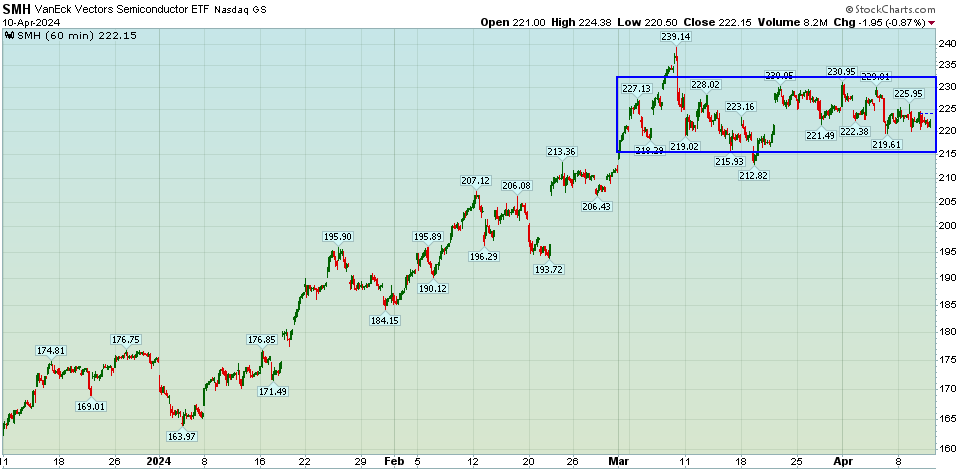

The chart we posted with a warning last week:

Has now morphed into this version of breakdown this week:

Will our hedges work out as we anticipated a 3-8% pullback, or will the market continue to correct in TIME (flat last 5-6 weeks) versus price? We don’t know – which is why we are positioned for all eventualities. Small leveraged hedges/shorts plus long equities.

Will our hedges work out as we anticipated a 3-8% pullback, or will the market continue to correct in TIME (flat last 5-6 weeks) versus price? We don’t know – which is why we are positioned for all eventualities. Small leveraged hedges/shorts plus long equities.

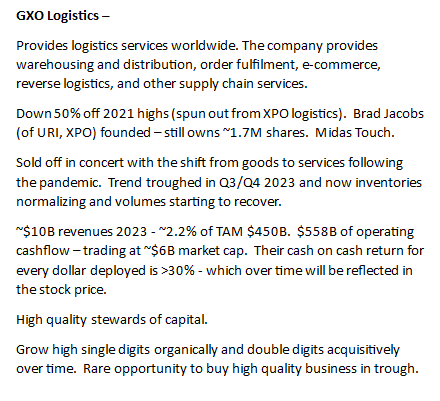

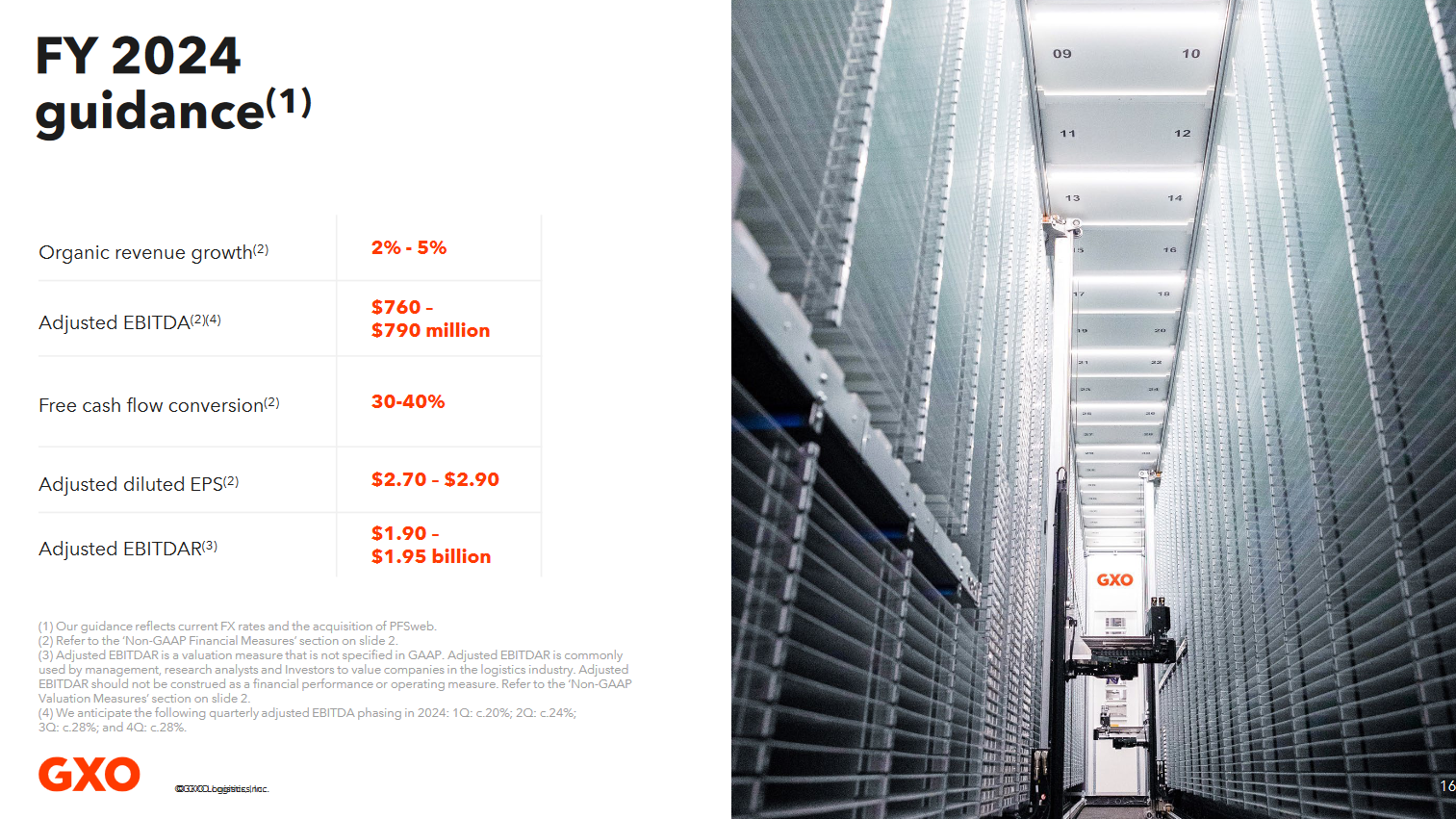

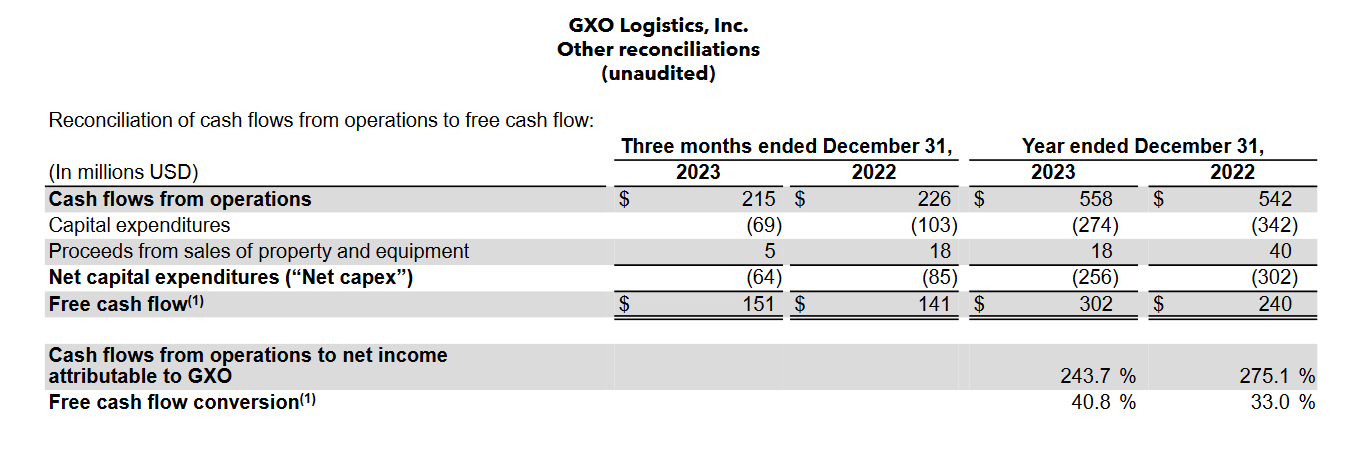

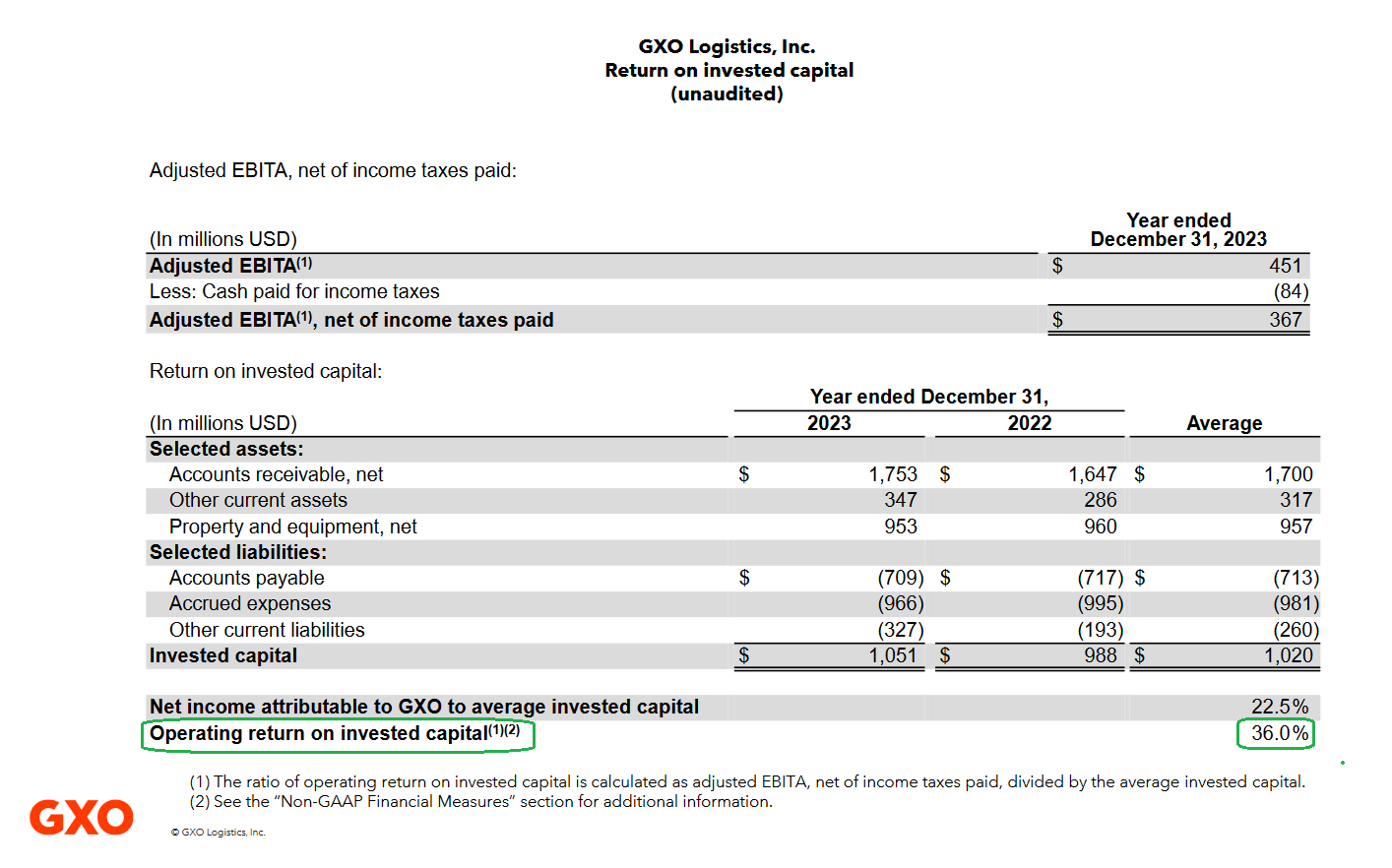

GXO Logistics

GXO Logistics

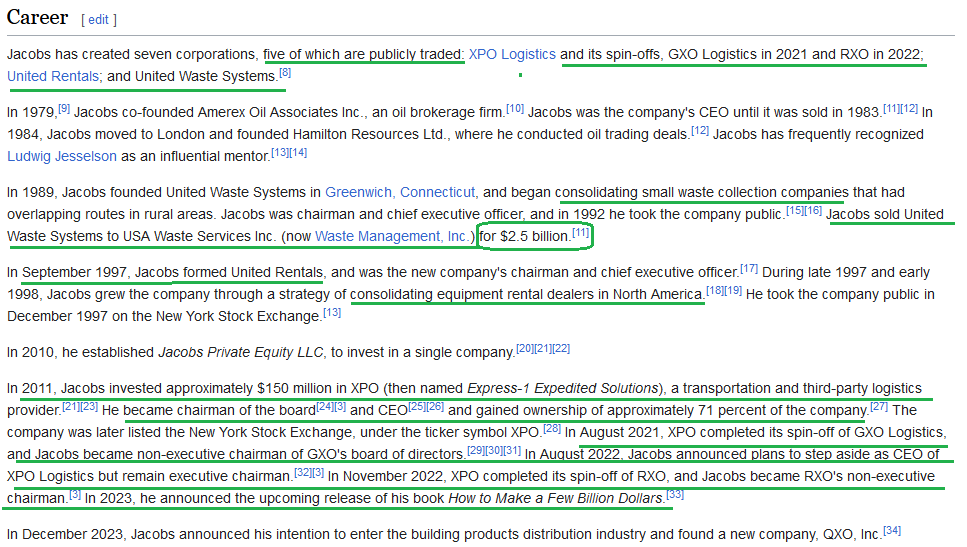

This is a new position across portfolios with space. It is one of Brad Jacobs’ companies. For those of you who don’t know Brad Jacobs, he has the Midas touch. He successfully executed 5 public company – multi-billion dollar rollups – and then wrote a book on how he did it “How to Make a Few Billion Dollars.” I am halfway through the audiobook (it’s what I do at swim meets)!

Here’s how he made $4B for himself and tens of billions for his shareholders:

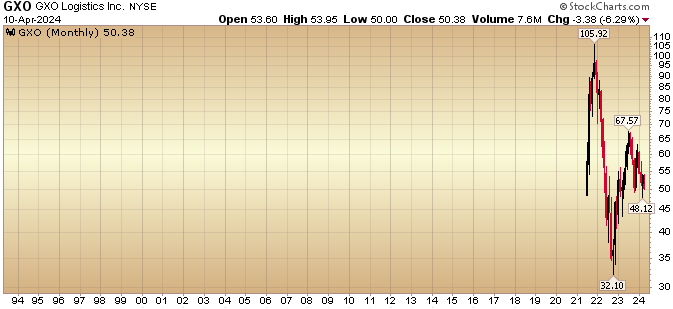

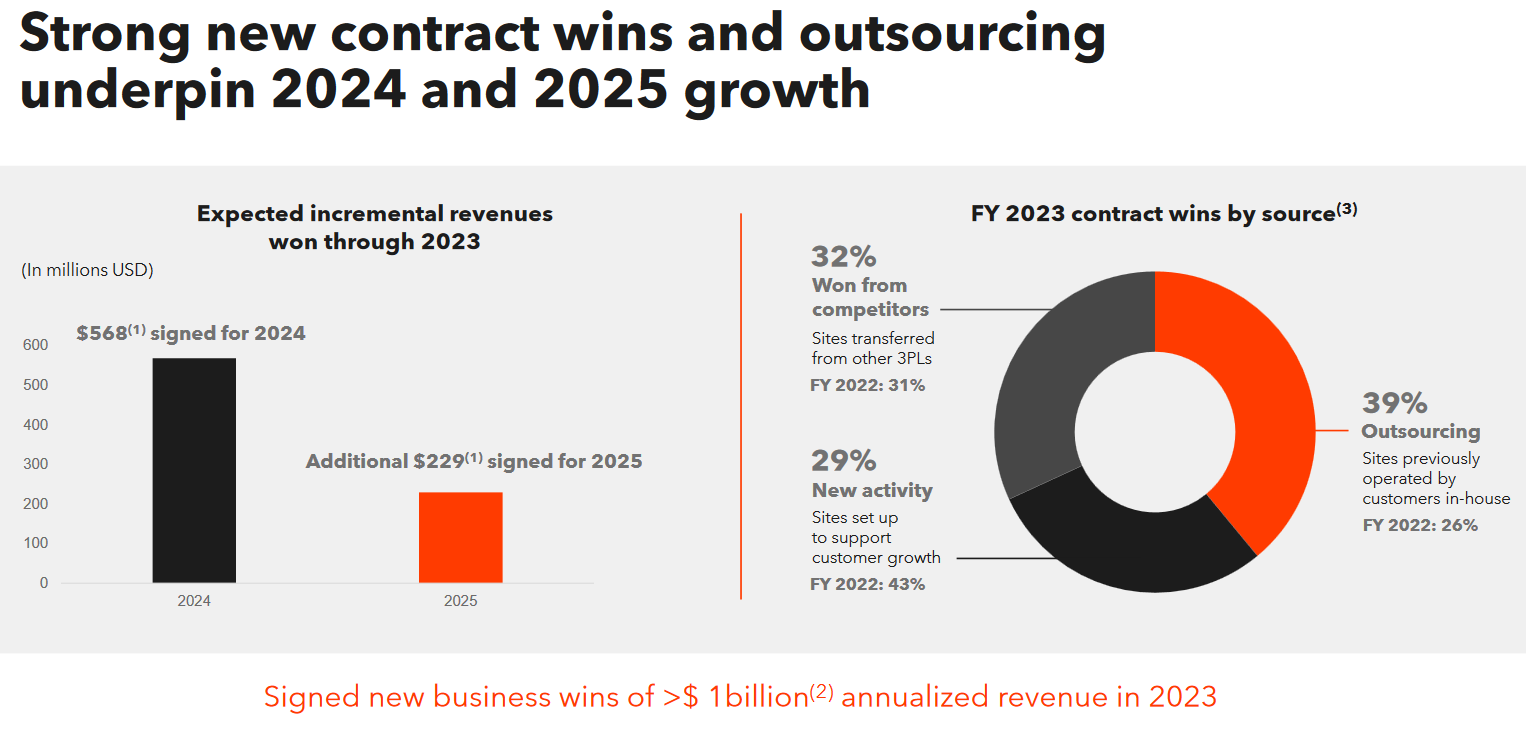

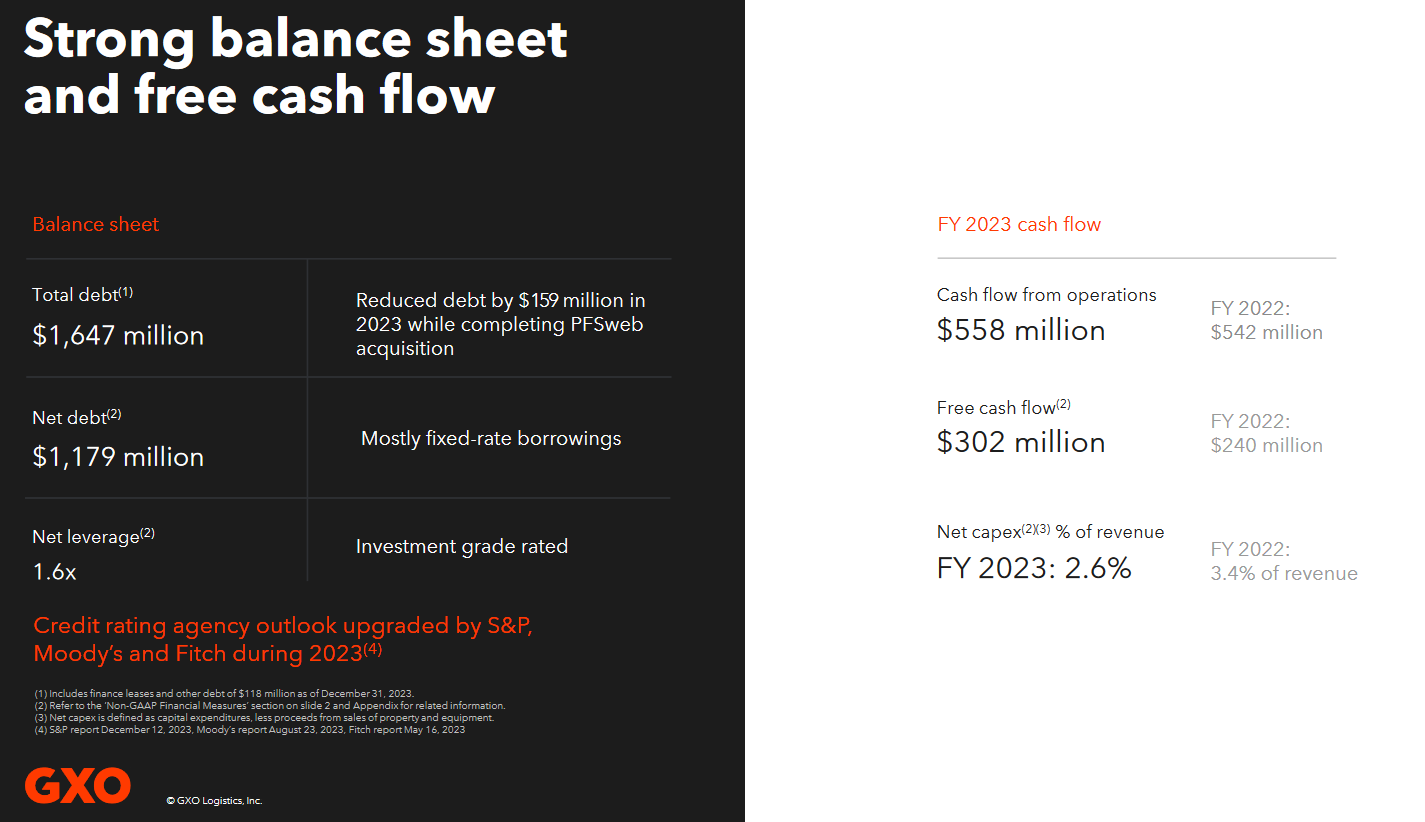

And now we have the opportunity to get in on one of the spinoffs from XPO (at a >50% markdown from highs) that we believe is “just getting started.”

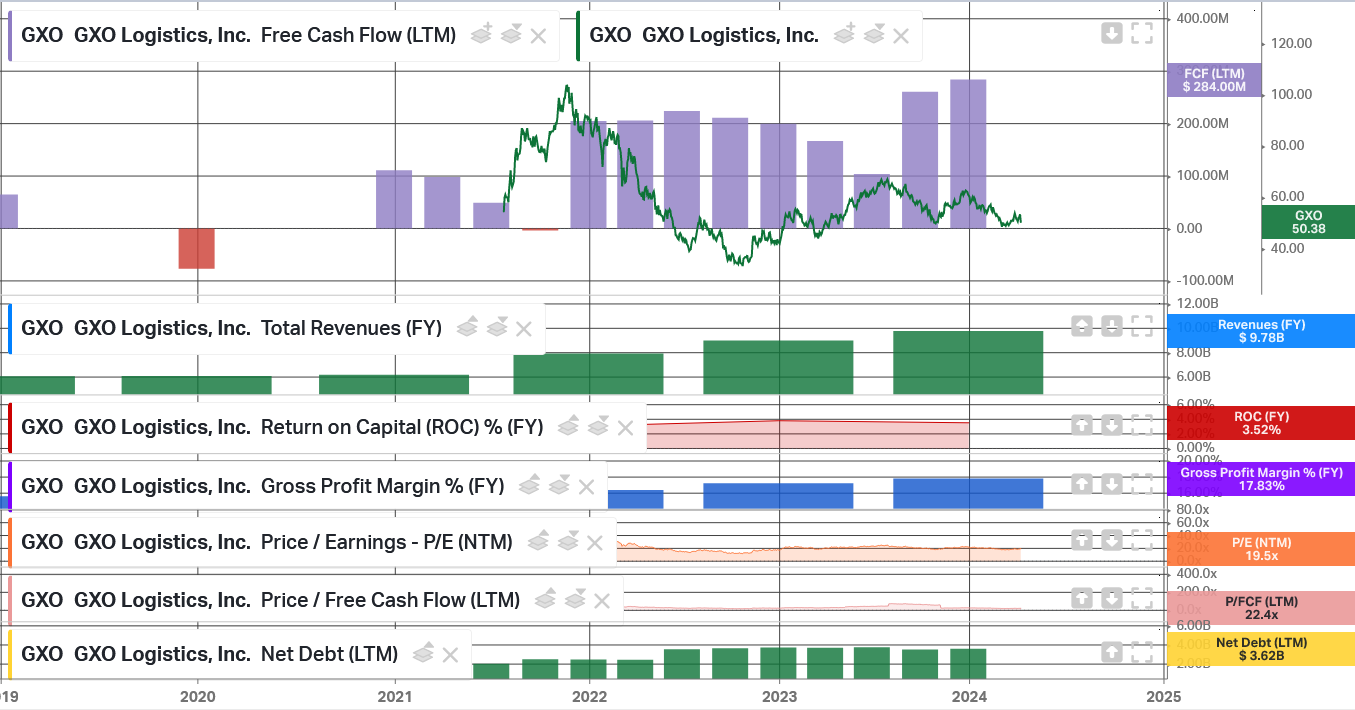

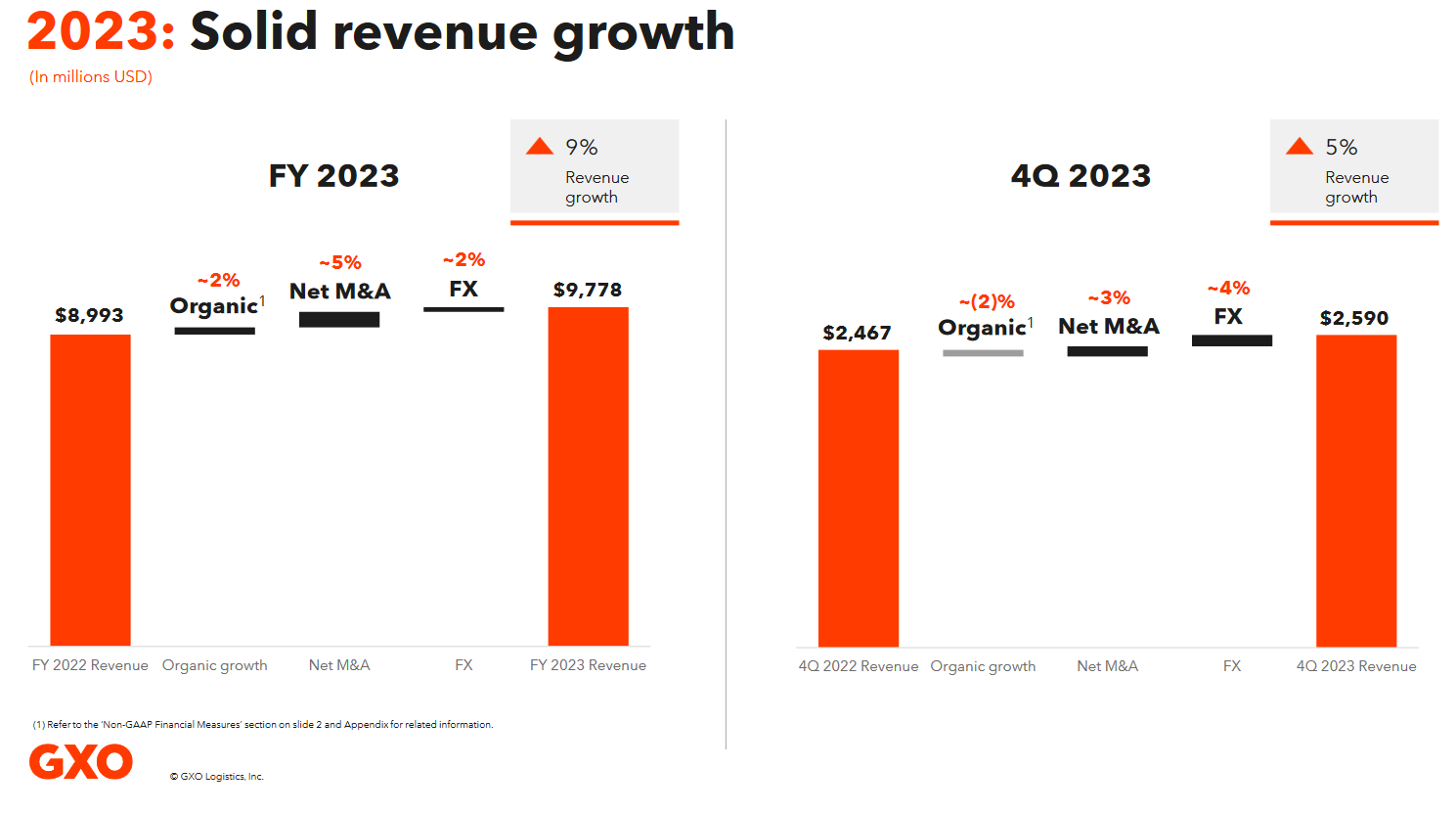

GXO gets paid per client units, so as the economy seesawed from “goods” consumption to “services” consumption post-pandemic, the perception of the stock fell – even though the performance of the underlying business held together:

GXO gets paid per client units, so as the economy seesawed from “goods” consumption to “services” consumption post-pandemic, the perception of the stock fell – even though the performance of the underlying business held together:

Conditions are now normalizing back to a balanced demand for goods and services. I posted a summary of my notes at the top of this article for this new position – along with my interview from the NYSE. We have a nice sized starter position and intend to buy more over time if the prices weaken on market pullbacks. As always, opinion, not advice – see terms above.

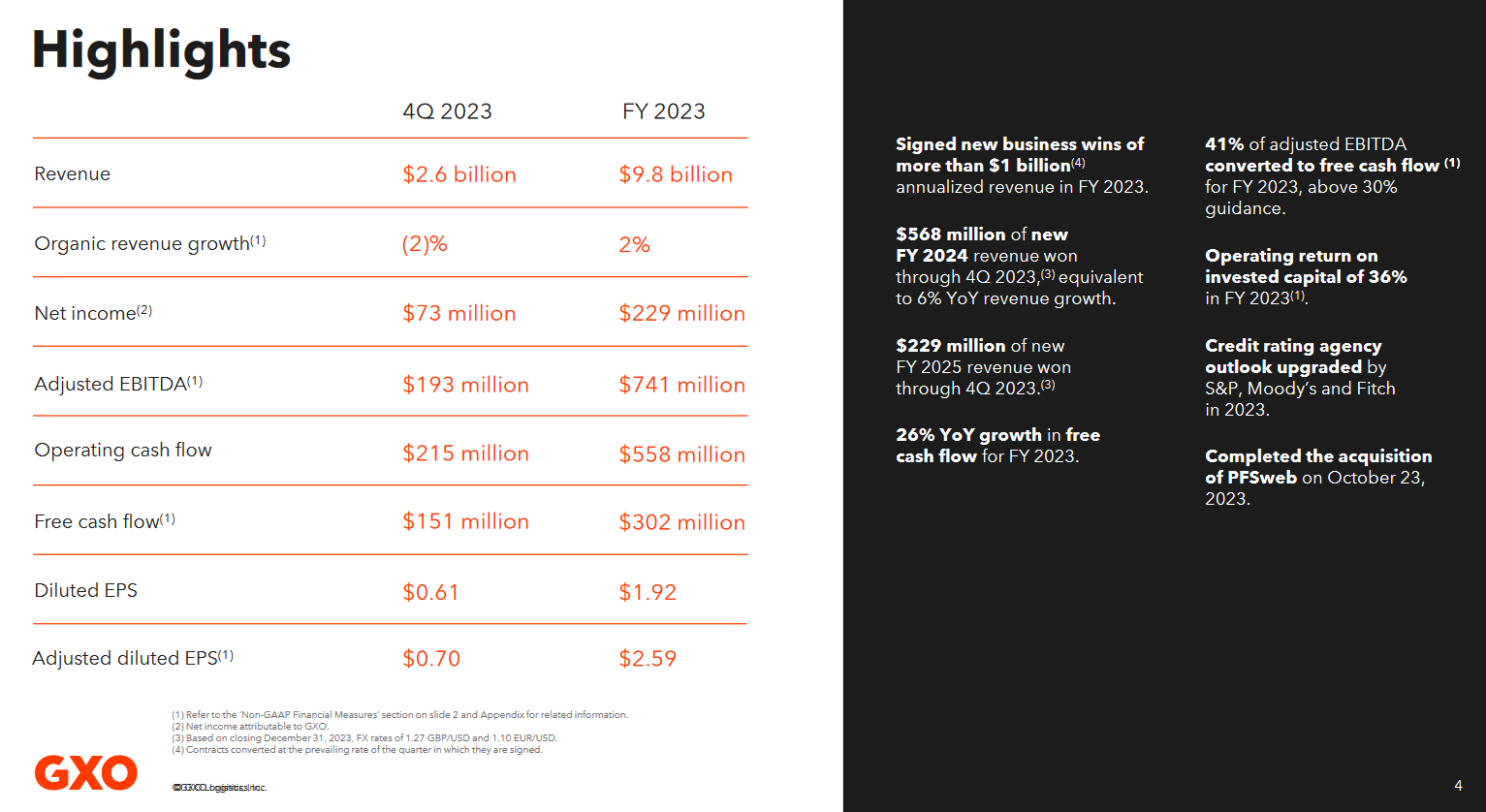

More granular explanation of the business from Investor Day Presentation around time of Spin: Presentation Transcript

Most recent earnings call transcript: click here

Now onto the shorter term view for the General Market:

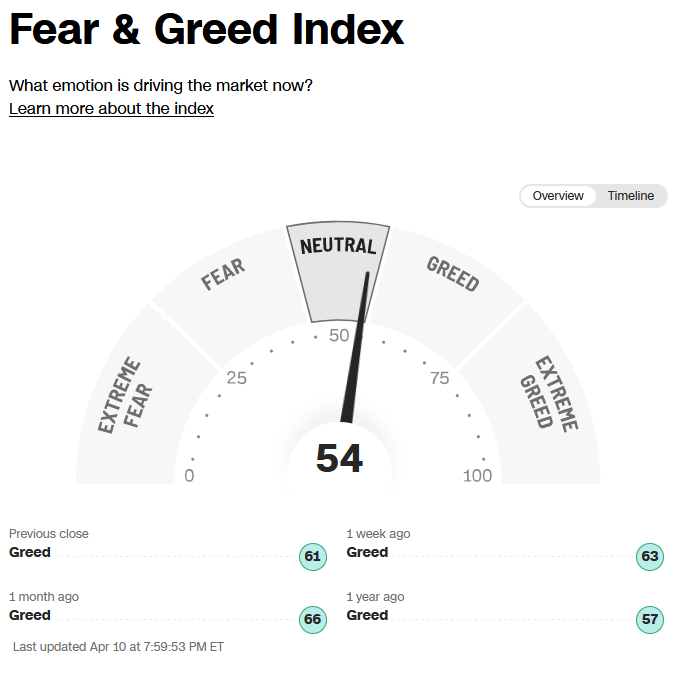

The CNN “Fear and Greed” declined from 62 last week to 54 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

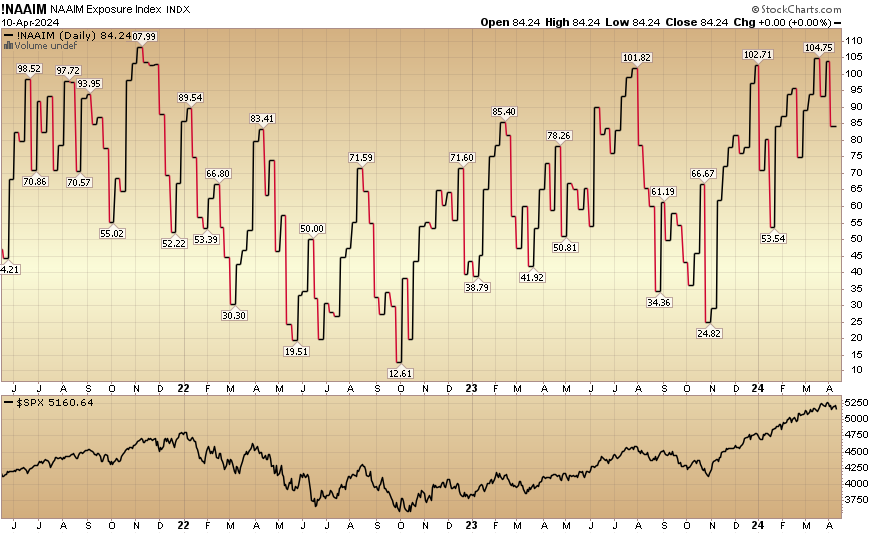

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 84.24% this week from 103.88% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 84.24% this week from 103.88% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 raise. We are now re-opening to smaller accounts $1M+ again starting today and will remain open for the next two weeks. To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.