Be in the know. 18 key reads for Wednesday…

- China rally hasn’t been chased by options traders, Bank of America says (marketwatch)

- Regional Bank Stocks Are Hated Again. It’s Time to Buy. (barrons)

- Media Mogul Byron Allen: This is just a speed bump for Disney, ‘Bob Iger is the best of the best’ (cnbc)

- The Fed has to cut because the economy is running out of gas, says Jim Cramer (cnbc)

- Stock buybacks hit highest level since 2018 (yahoo)

- Teva Pharmaceutical’s stock climbs as schizophrenia treatment shows promise (marketwatch)

- Billions in Chips Grants Are Expected to Fuel Industry Growth, Report Finds (nytimes)

- Celebrities pay this NYC man big bucks to get them reservations at exclusive eateries (foxbusiness)

- US 30-Year Mortgage Rate Falls for First Time Since March (bloomberg)

- Intel flags revenue hit as U.S. revokes certain export licenses to Chinese customer (reuters)

- Ledecky’s 800m gold medal hopes boosted as McIntosh opts out (reuters)

- Chinese firms’ earnings to rebound amid a pickup in the economy: UBS (scmp)

- Alibaba seeks growth in Mongolia with marketplace selling Chinese goods (scmp)

- These are the potential ‘shock’ scenarios around next week’s inflation data, says Goldman Sachs (marketwatch)

- Sweden becomes second major central bank to cut rates (marketwatch)

- Bond King Bill Gross to Bond Funds: Drop Dead (barrons)

- 3 Restaurant Stocks That Are Vying to Be the Next Chipotle (barrons)

- Rents Set to Be Last Domino to Fall in Global Inflation Battle (bloomberg)

Where is money flowing today?

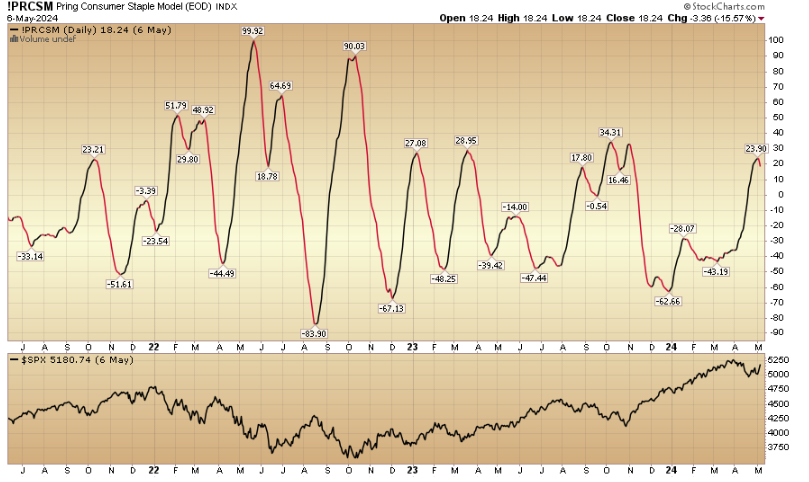

Indicator of the Day (video): Pring Consumer Staple Model

Be in the know. 15 key reads for Tuesday…

- Cooper Standard Reports Continuing Year-over-year Margin Improvement in First Quarter 2024, Sees Upside to Full-year Guidance (cooperstandard)

- China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+ (cnbc)

- 10-year Treasury yield heads for fifth day of declines after buyers emerge (marketwatch)

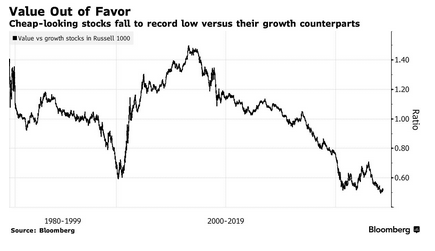

- Einhorn Says Markets Are ‘Broken.’ Here’s What the Data Shows. (bloomberg)

- Overseas institutions encouraged to invest in domestic tech companies (peoplesdaily)

- Chevron CEO says natural gas demand will outpace expectations on data center electricity needs (cnbc)

- Why Disney Stock Is Down After Earnings Topped Estimates (barrons)

- The Stock Market Is Recovering. Why It Could Keep Gaining. (barrons)

- Pfizer Is Adding a Wall Street Analyst to Its C-Suite. What He Thinks the Company Needs to Do. (barrons)

- American Wagyu Is Drawing in a New Breed of Investors as Demand Grows (barrons)

- ‘Green Shoots’ Grow Out of Control on Wall Street (wsj)

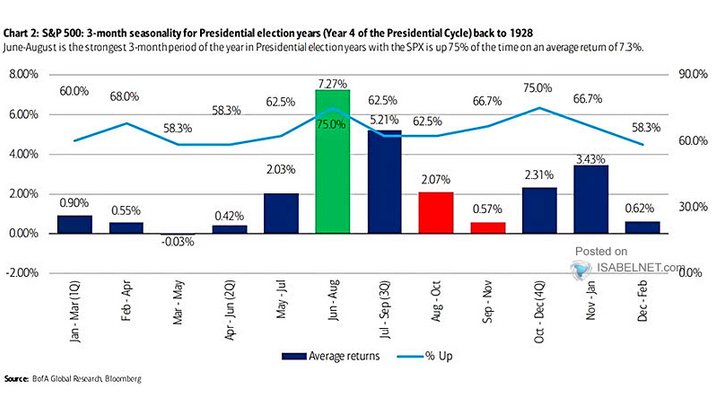

- Buy stocks in May because inflation is set to plunge through the rest of 2024, Fundstrat’s Tom Lee says (businessinsider)

- The streaming future Disney promised is finally here as cable TV decays (cnbc)

- 3M Cut Its Dividend: It’s Time to Buy the Stock (yahoo)

- Disney CFO Hugh Johnston on Q2 results, strength of consumer and streaming growth (cnbc)

Where is money flowing today?

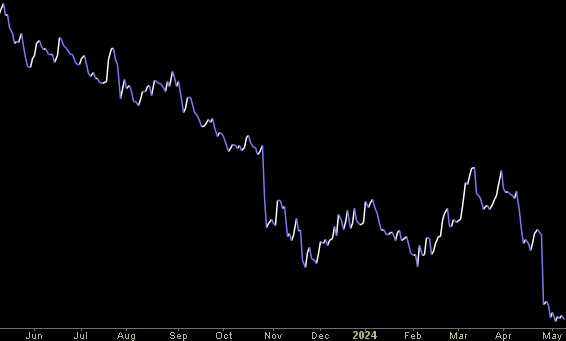

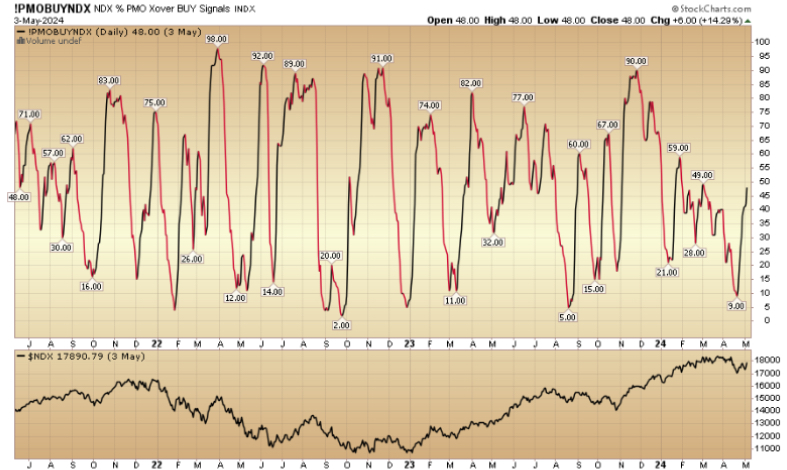

Indicator of the Day (video): Nasdaq percent of stocks PMO crossover buy signals

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 10 key reads for Monday…

- A Rising Yen Is Good for Stocks. Here’s Why. (barrons)

- China’s stock market has staged a big rebound that’s poised to push on, strategist says (businessinsider)

- Slower Hiring Boosts Hopes of a Late-Summer Rate Cut (wsj)

- Full recap of Warren Buffett’s comments at the Berkshire Hathaway annual meeting: ‘I hope I come next year’ (cnbc)

- Warren Buffett says Berkshire Hathaway is looking at an investment in Canada (cnbc)

- Former CEO Howard Schultz says Starbucks needs to overhaul its customer experience (marketwatch)

- Boeing’s Starliner set for historic launch that will take two NASA astronauts into space (marketwatch)

- ECB rate cut case getting stronger, says chief economist Lane (reuters)

- Foxconn sees record April sales with 19% jump, offers positive Q2 outlook (scmp)

- China Stocks’ Rally Can Sustain for a Bit, Goldman Sachs Says (bloomberg)