Be in the know. 55 key reads for Monday…

- China Shares Lifted by Data. Expect More Gains. (barrons)

- Meet the ‘Witch of Wall Street,’ a black-clad pioneering value investor who became the world’s richest woman—but is wrongly remembered as a cheapskate (fortune)

- China kicks off the year on strong note as retail, industrial data tops expectations (cnbc)

- Fed Rate Cuts Are on Hold. 3 Picks if They Come Sooner. (barrons)

- Why Bank of Japan may shake up financial markets before Fed’s next interest-rate decision (marketwatch)

- Inflation is NOT running hot (scottgrannis)

- Apple Is in Talks to Let Google Gemini Power iPhone AI Features (bloomberg)

- Fed rate cuts will be a tailwind for small caps, says Fundstrat’s Tom Lee (cnbc)

- PayPal Stock Has Fallen Far Enough. It’s Time to Buy. (barrons)

- A New Surge in Power Use Is Threatening U.S. Climate Goals (nytimes)

- How China Could Swamp India’s Chip Ambitions (wsj)

- The F-Bomb-Dropping Airline CEO About to Earn a $100 Million-Plus Bonus (wsj)

- Dollar Stores Get Devalued as Low-Income Consumers Struggle (wsj)

- A Big Disney Fight Isn’t Nelson Peltz’s Only Drama (wsj)

- Suspense Builds for Fed as Growth Downshifts and Inflation Lingers (wsj)

- Cisco stock still isn’t back to its 2000 high: Chart of the Week (yahoo)

- Hertz CEO resigns after push to buy Tesla fleet backfires big time for company (foxbusiness)

- Boeing bonds are still coveted by investors despite a rough 2024 for jet maker (marketwatch)

- Steven Mnuchin’s interest in TikTok and NYCB echoes his pre-Trump investment playbook (marketwatch)

- TikTok Bill’s Progress Slows in the Senate (nytimes)

- S. stocks have beaten European equities but won’t for much longer, says JPMorgan (marketwatch)

- The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj)

- Markets capitulate to Fed on interest rates after months-long stand-off (ft)

- US equity funds draw record inflow as investors bet on soft landing (ft)

- ‘Growth company with no growth’: Wells Fargo says Tesla stock could drop 23% in scathing downgrade (businessinsider)

- It’s actually a good time to buy a new car (businessinsider)

- The end of the Realtor monopoly (businessinsider)

- Michelin Unveils 2024 List of Starred Restaurants in Hong Kong, Macau (bloomberg)

- What Must Nelson Peltz Do to Get Some Respect? (nytimes)

- 10 Best Cheap Stocks to Buy Under $10 (morningstar)

- Wall Street Doom Prophesy Falls Flat on Hottest Rally Since 2016 (bloomberg)

- The Consumer Price Index Doesn’t Capture What’s Really Hurting Consumer Confidence (barrons)

- Fast-Food Companies Could Be Heading Toward a Price War. Why McDonald’s Could Win (barrons)

- How the Federal Reserve Could Throw Stocks for a Loop (barrons)

- Masters in Business: Mark Wiedman (bloomberg)

- remembering marcello gandini, italian car designer of lamborghini, ferrari, maserati and more (designboom)

- Ex-Ford CEO warns of ‘real financial trouble’ for EV startups as adoption takes longer than expected (fortune)

- Can Ferrari, the Winningest Team in F1 History, Get Back on Track? We Ask an Expert (robbreport)

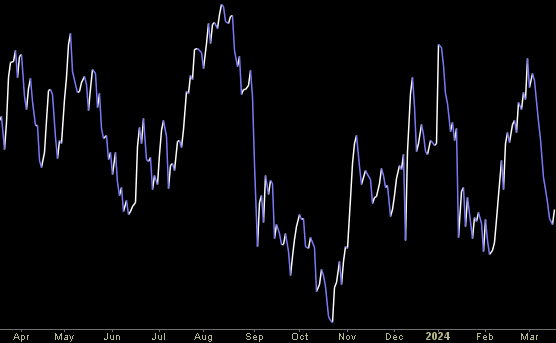

- Weekly Leading Economic Index (advisorperspectives)

- Alexander Hamilton and the Birth of US Industrial Policy (bloomberg)

- Who Will Be the Next James Bond? (townandcountrymag)

- Scottie Scheffler defends Players Championship title with dominant Sunday charge (golf)

- The End of Japan’s Negative Rates Will Be a Slow-Moving Tsunami (wsj)

- Disney Board Seats for Nelson Peltz Are a Long Shot. He’s Winning Just the Same. (barrons)

- Park Avenue landlords boast new leases after glowing Sixth Ave. report (nypost)

- Dan Loeb Enters the Chip Wars (nytimes)

- Florida Is Not So Cheap Compared With New York These Days (bloomberg)

- Carbone Wants to Conquer the World With a Red Sauce Empire (bloomberg)

- There’s Now a Fake Santorini in Abu Dhabi to Lure Luxury Travelers (bloomberg)

- There’s really no need for the Fed to lower interest rates, says Ed Yardeni (cnbc)

- Damo Academy plans to launch latest RISC-V chip this year as chip demand grows (scmp)

- Good news is good news again in markets (ft)

- Goldman Sachs raises US real GDP growth forecast (streetinsider)

- TikTok’s Business, in Charts (wsj)

- The Fed’s Challenge: Has It Hit the Brakes Hard Enough? (wsj)

Quote of the Day…

Be in the know. 10 key reads for St. Patrick’s Day…

- How AI Is Sparking a Change in Power (barrons)

- Investors Don’t Need to Sweat the Latest Boeing 737 Safety Incident. The Data Show Why. (barrons)

- Dan Yergin Is Concerned About AI-Fueled Boom in Electricity Use (bloomberg)

- The Everything Rally Comes to Derivatives Market (bloomberg)

- Apple Without AI Looks More Like Coca-Cola Than High-Growth Tech (bloomberg)

- America’s Office Fire Sale Has Barely Begun (wsj)

- Berkshire Bought Back About $2.3 Billion in Stock (barrons)

- The Big Read. The battle over TikTok (ft)

- Barclays explains why S&P 500 keeps rallying despite hot CPI, PPI data (streetinsider)

- Investors should buy cheap portfolio insurance now before stock market turns volatile, Goldman warns (marketwatch)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 230

Hedge Fund Tips with Tom Hayes – Podcast – Episode 230

Be in the know. 8 key reads for Saturday…

- China’s Fiscal Stimulus Plan May Be Bigger Than It Appeared (bloomberg)

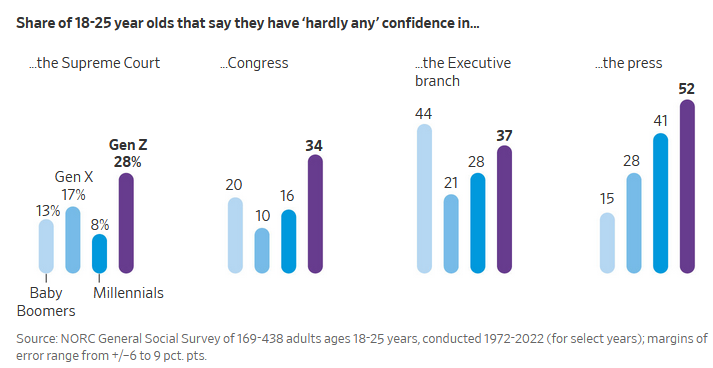

- The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters (wsj)

- Sorry Stock Bulls, the ‘Wall of Cash’ Isn’t All Headed Your Way (wsj)

- UK Inflation Expectations Fall to Lowest Since BOE Hikes Began (bloomberg)

- 2024 Ford F-250: A Primitive, Powerful Beast of a Truck (wsj)

- This Rare Ferrari Dino 246 Spider Is A Sought-After Tribute To Enzo’s Son (maxim)

- The DNA of a Warren Buffett Company (morningstar)

- Warren Buffett Minds the GAAP (wsj)

Hedge Fund Tips (PCN) – Position Completion Notifications

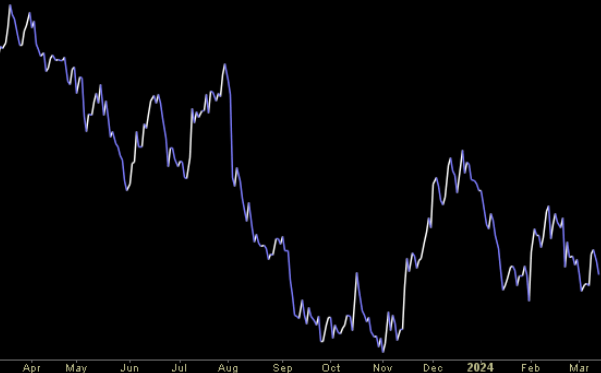

Where is money flowing today?

Be in the know. 15 key reads for Friday…

- AMD Rally Looks More Fragile Than Nvidia’s as Traders Bid Up AI (bloomberg)

- PayPal Stock Has Fallen Far Enough. It’s Time to Buy. (barrons)

- Cockpit Mishap Seen as Likely Cause of Plunge on Latam Boeing 787 (wsj)

- Nvidia led Phase 1 of the AI trade, these are the next three, says Goldman Sachs (marketwatch)

- Disney’s Proxy War Is Getting Very Noisy. What Really Matters. (barrons)

- Steven Mnuchin’s Bid for TikTok Isn’t as Strange as You Think (barrons)

- Boeing’s problems don’t change the overall outlook for the commercial aerospace industry. Planes are in hot demand. (barrons)

- Deals Are Coming Back. These 8 Companies Are Buyout Candidates. (barrons)

- As War Rages On, the Stock Market Shrugs It Off. Will It Last? (barrons)

- Dollar Store Stocks Tumbled. That Might Be a Buying Opportunity. (barrons)

- Options trades to exceed stocks for first time since 2021 as $5 trillion in contracts come due Friday (marketwatch)

- Real-estate prices have bottomed out and it’s now time to buy, Blackstone president says (marketwatch)

- Nvidia is no longer Wall Street’s favorite stock. This company is. (marketwatch)

- Private Equity Wants Your Credit Card Debt. And Car Loan. And Mortgage. (wsj)

- Why That Hot Biotech IPO Could Be a Winner (wsj)