This week’s article is going out early as I have an overnight flight tonight.

General Outlook

On Tuesday afternoon, following the inflation report, I joined Nicole Petallides on the Schwab Network to discuss general market outlook, Fed, Inflation, Hedging, Stocks and more. Thanks to Nicole and Kaitlyn Crist for having me on:

Watch Directly on Schwab Network

On Monday evening, I joined Karina Mitchell on CGTN America to discuss our short and intermediate term outlook on markets as well as potential seasonal aberrations related to the imminent inflation numbers. We also pointed to sectors on our radar for opportunity. Thanks to Karina and Nancy Ali for having me on:

Predator’s Ball

Two weeks we did a comprehensive follow up on our Advance Auto Parts position:

“Advance is Advancing” Stock Market (and Sentiment Results)…

We talked about it in the $50’s on Fox Business’ “Making Money with Charles Payne” on November 15, 2023:

and just last week talked about it on Fox Business the Claman Countdown with Liz Claman:

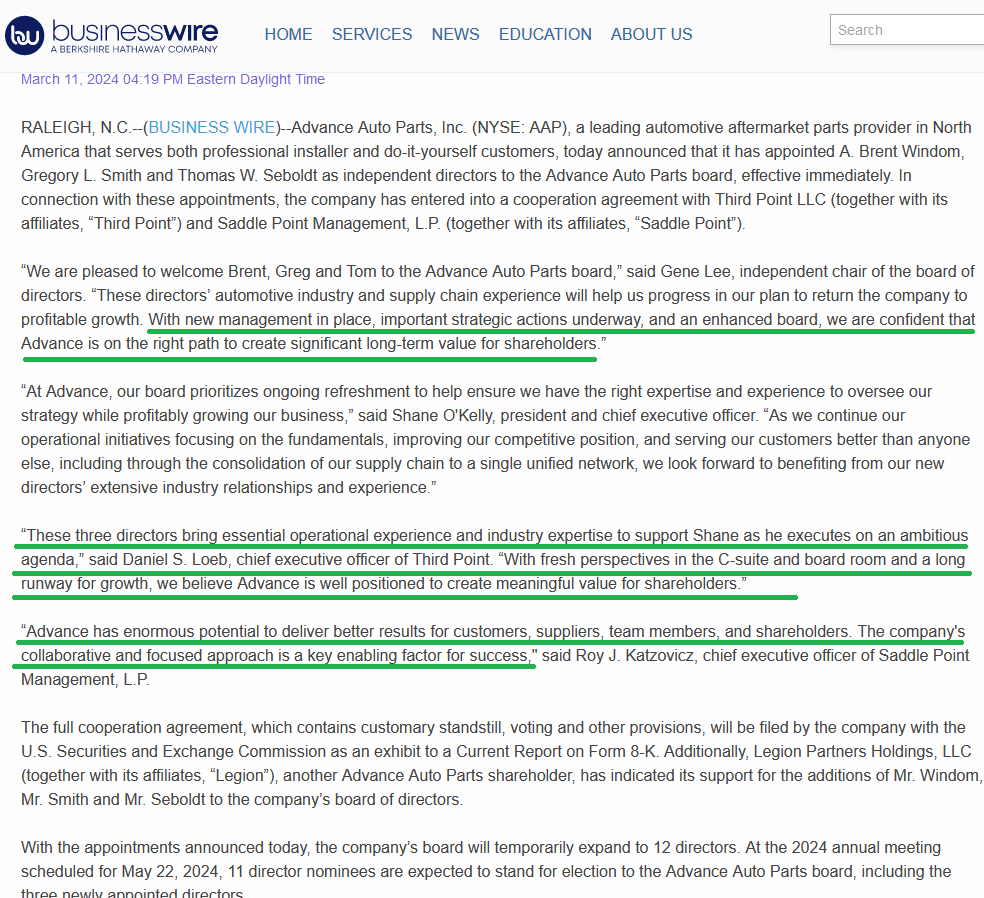

On Monday, the Wall Street Journal broke a story that Dan Loeb’s Third Point had accumulated a large activist stake in Advance Auto Parts and gained 3 seats on the Board. The stock jumped yet again:

Now you might say, “wow, that was lucky Tom!” I would not attribute it to luck for two reasons:

Now you might say, “wow, that was lucky Tom!” I would not attribute it to luck for two reasons:

1) the move has barely begun – as with most positions these have multi-year time horizons. The exception is when we hit intrinsic value well ahead of target (less than a year) like several names last year: Rolls Royce (fully out of position now – final 1/3 ~$5), INTC (still hold 1/3 after taking off 2/3 in high 40s), VNO (exited after ~double), etc. Those are exceptions, not the rule. CPS hit 4x at one point and we haven’t sold a share. Why? because it was nowhere near our estimate of intrinsic value when we initially entered the position in the position ~$5.10. That one may take several years for us to hit our intrinsic value targets.

2) Good things happen when you buy high quality assets at low prices. If you learn nothing else from me, that is the #1 lesson. Not only did activist Dan Loeb come into AAP after us, but it has happened over and over in the last couple of years:

DIS (Disney) – Peltz (pt. 2) and ValueAct came in after us.

VF Corp (VFC) – Engaged Capital and Legion Partners came in after us.

CCI (Crown Castle) – Paul Singer and Elliot Management came in after us.

Four positions (out of a very concentrated portfolio) had billionaire activists see what we saw “price is what you pay, value is what you get” and enter the same companies after us.

Success leaves clues and these folks didn’t become wealthy doing “zero day options” or analyzing “squiggly lines” to get a perceived edge.

The only difference they bring to the table is they can tilt the scales faster to turn the “short term (emotional) voting machine” (of irrationally low prices) to the “long term (fundamental) weighing machine” (of fairly/fully valued prices) by agitating management to make changes more expeditiously – through public pressure.

We get the benefit of riding their coattails while they pay Willkie Farr $2,000/hr to draft threatening letters to the Board and foment change.

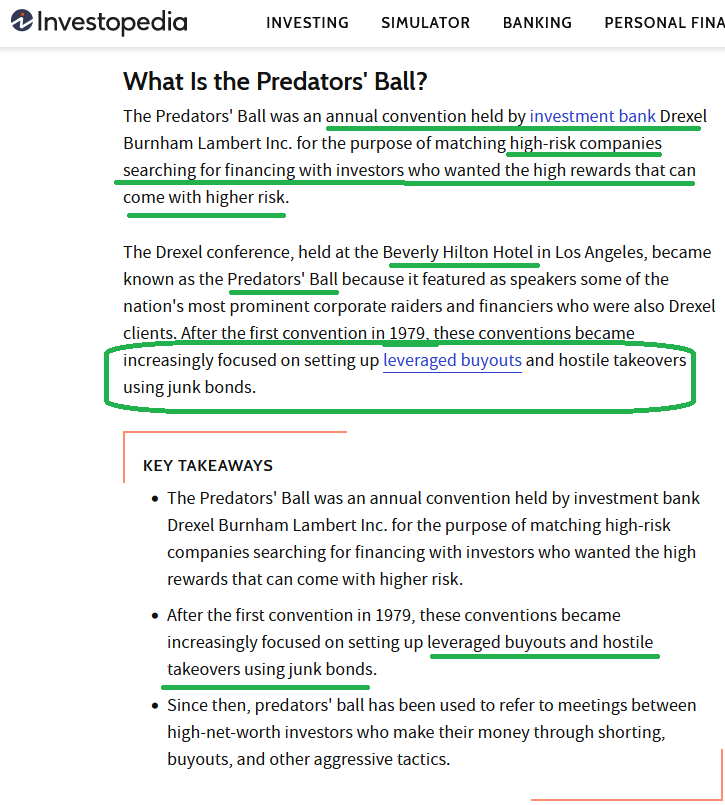

This is not dissimilar to the “Predator’s Ball” days of the 1980’s. The only difference is in the 1980’s activists got the whole company, now they just get a few Board seats!

Predator’s Ball

These “Balls” put many people on the map and created Bilionaires from thin air. Milken financed Carl Icahn, Nelson Peltz, Ron Pearlman, Steve Wynn, Henry Kravis, T. Boone Pickens, Reginald Lewis and many more – BEFORE they were household names…

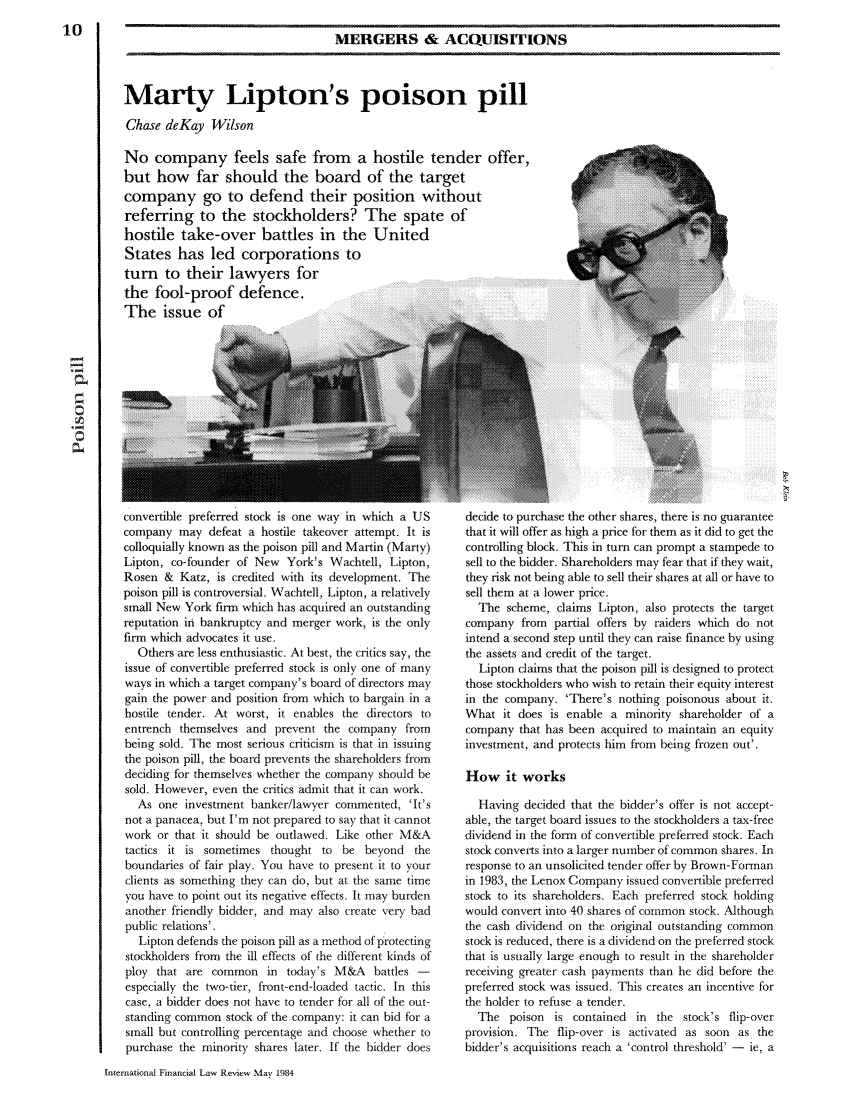

It worked until Marty Lipton (of Wachtell Lipton) invented the poison pill. Here’s how it works:

With the advent of the “shareholder rights” plan or “poison pill” activists were now incentivized to publicly agitate for change and fight for seats on the Board. Beyond that, their powers have become significantly limited relative to the swords they wielded in the 1980’s.

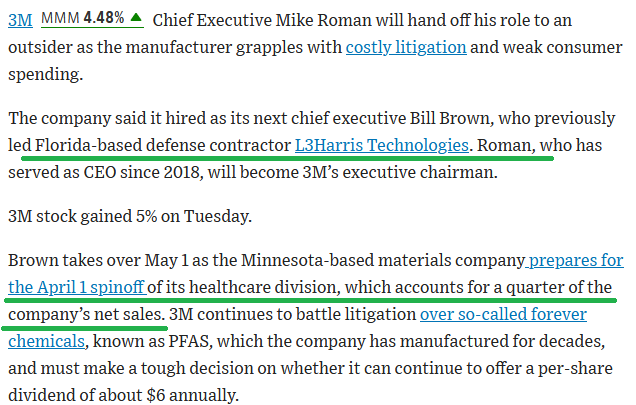

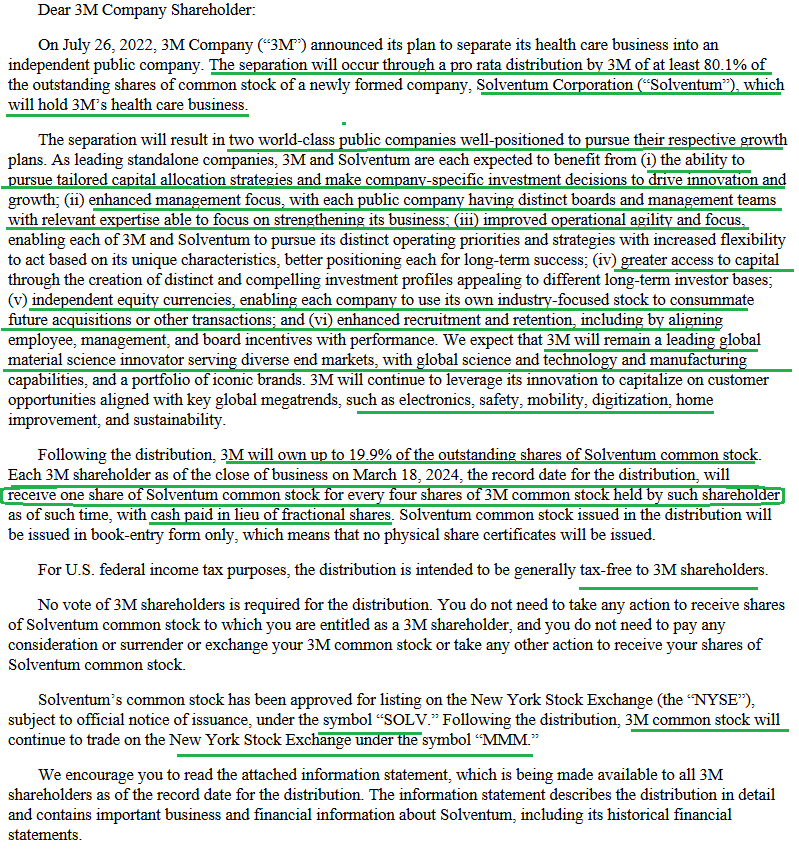

MMM Update

Our last update on 3M was after earnings on January 23, 2024:

Prior to that we gave an update on November 30:

“LONG Santa, SHORT the Grinch” Stock Market (and Sentiment Results)…

Since then there have been three major positive developments:

1. New CEO

source: wsj

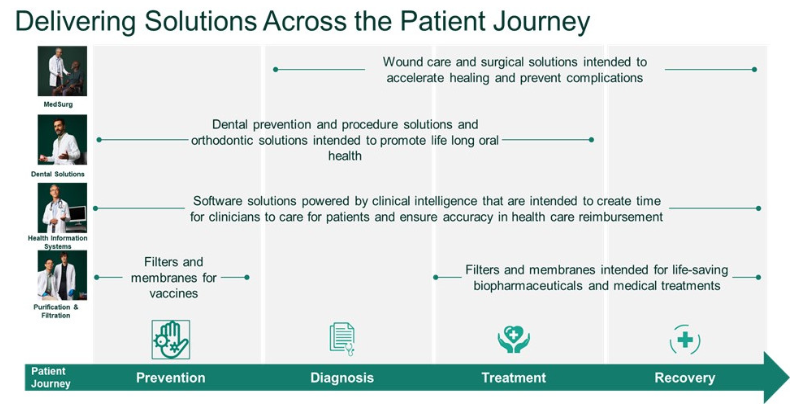

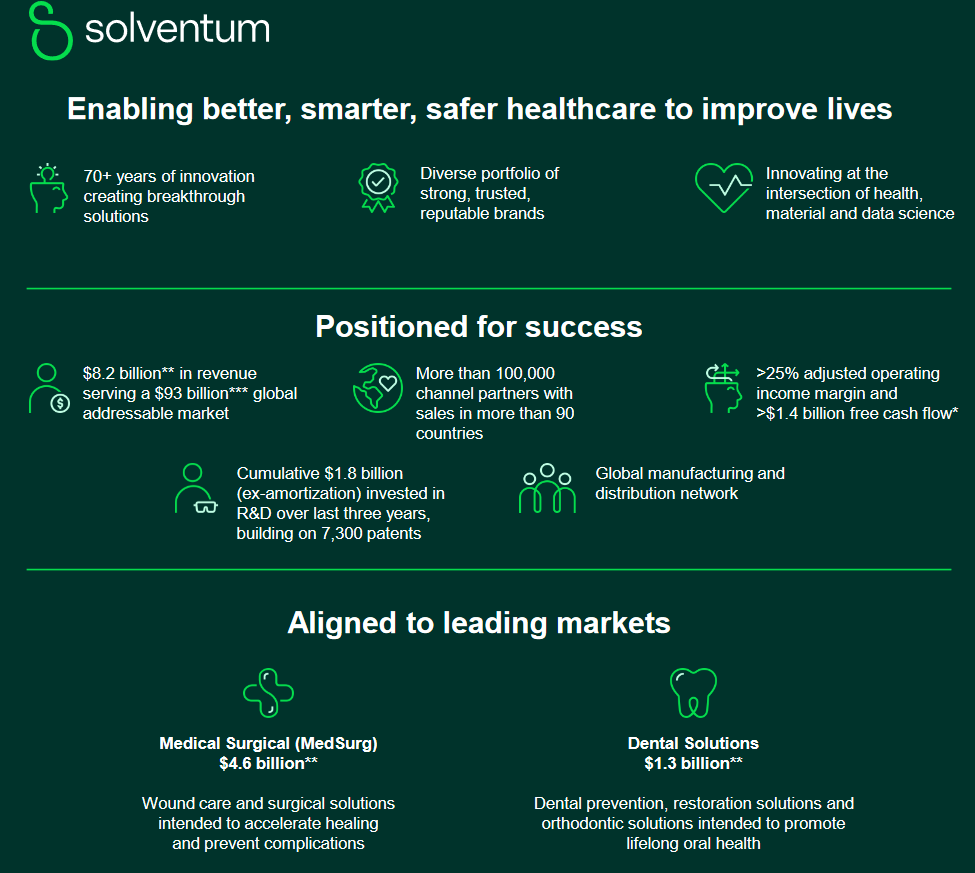

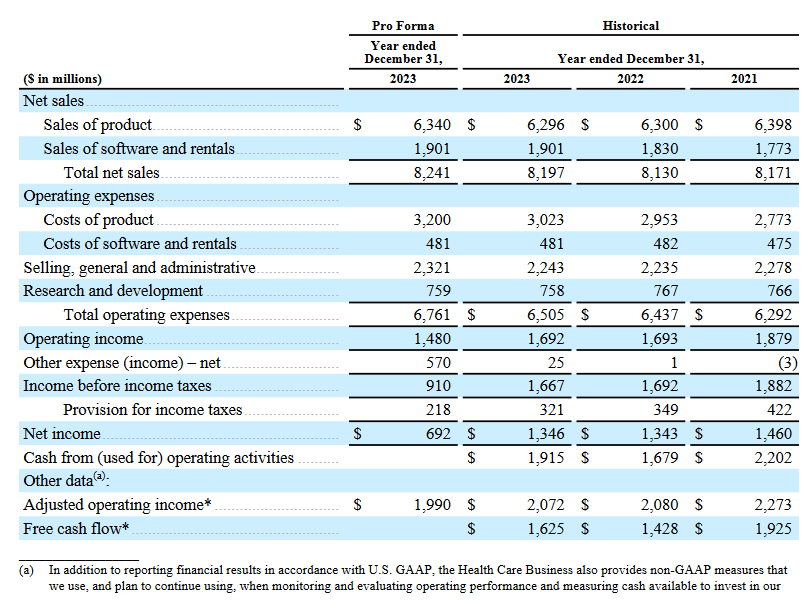

2. Healthcare Spin

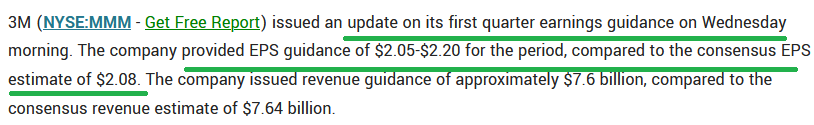

3. Guidance Upgrade

Now onto the shorter term view for the General Market:

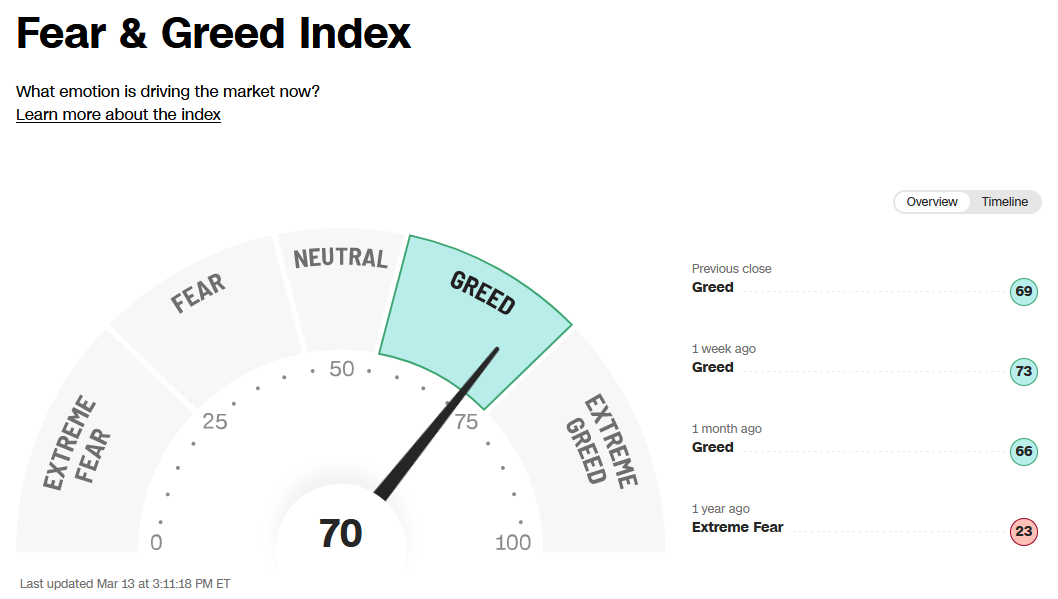

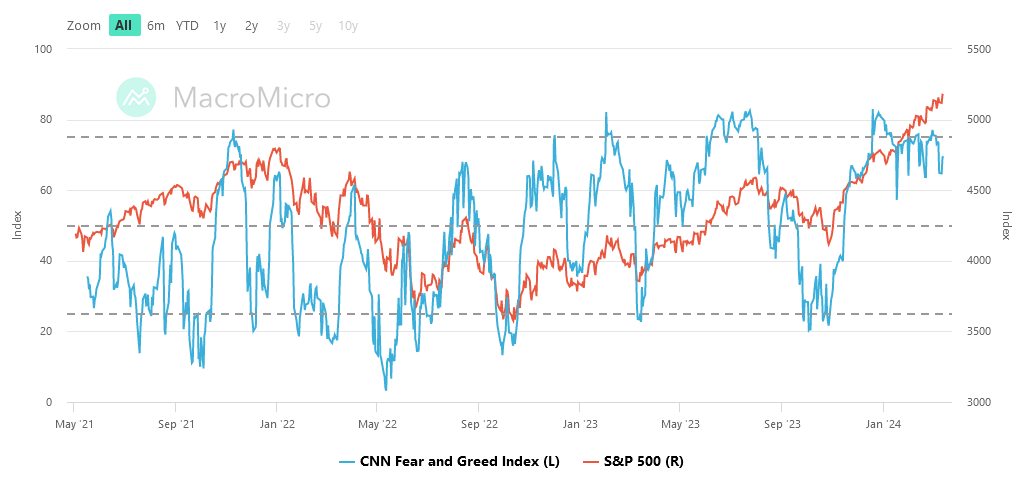

The CNN “Fear and Greed” dipped from 74 last week to 70 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 93.99% this week from 88.99% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 93.99% this week from 88.99% equity exposure last week.

Our podcast|videocast will be out late tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 raise. We will re-open to smaller accounts $1M+ again sometime in Q2. Larger accounts $5-10M+ can access bespoke service beforehand at their preference here.

*Opinion, Not Advice. See Terms