“Proud Mary” is a song by American rock band Creedence Clearwater Revival written by John Fogerty. It was released as a single in January 1969 by Fantasy Records and on the band’s second studio album, Bayou Country. The song became a major hit in the United States, peaking at No. 2 on the Billboard Hot 100 in March 1969, the first of five singles to peak at No. 2 for the group. (Wikipedia)

The salient lyrics that represent the current market are as follows:

Big wheel keep on turnin’

Proud Mary keep on burnin’

Rollin’, rollin’, rollin’ on the river

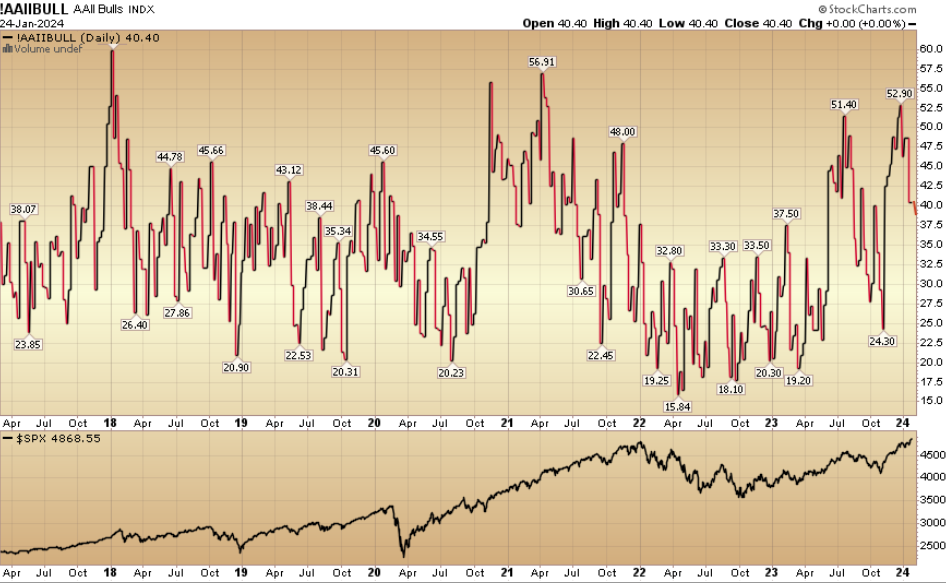

Fogerty said of the song, “It was obviously a metaphor about leaving painful, stressful things behind for a more tranquil and meaningful life.” This is a metaphor for the market breaking out to new highs after 2 years of choppy consolidation of gains. We have referred to this chart repeatedly as a deterrent from getting too cute/SHORT the market after the turn of the year:

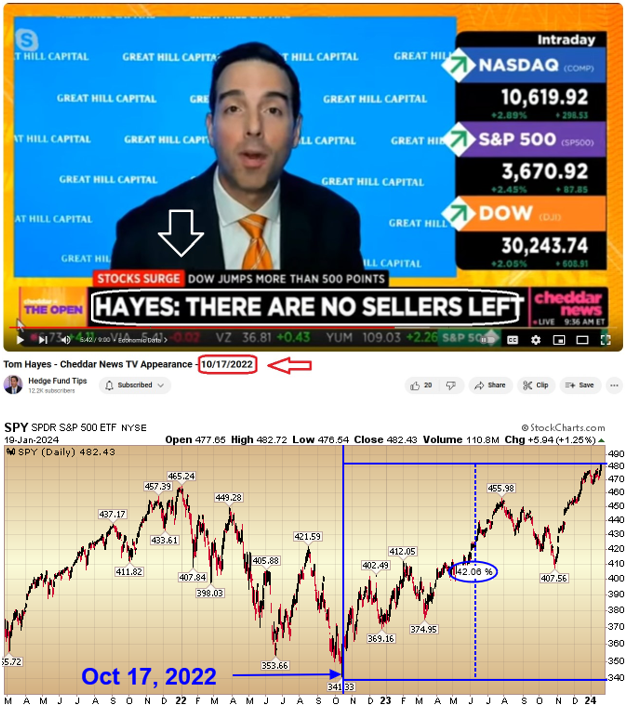

On October 17, 2022, we laid out the case for buying equities when everyone was selling “in the hole.” Here’s what happened next:

On November 7, 2023 I joined Liz Claman (on Fox Business) when people were skeptical that the lows were in, to which I replied “If you’re a short seller right now, what you need to know into year-end is, THE BEATINGS WILL CONTINUE UNTIL MORALE IMPROVES!”

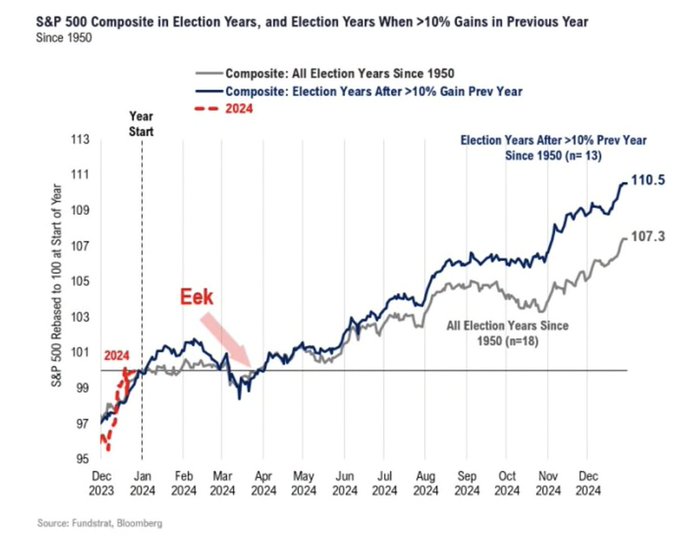

Now it’s getting trickier. As everyone was calling for a big correction after the year-end rally, on 1/8/2024 I joined Charles Payne to say “new highs BEFORE we get a normal correction:”

We got new highs. So now what? Statistically this shorter term roadmap from historic data is playing out – which would imply a bit more upside to draw in all of the resistant bears from October 2022 AND 2023 through now. Once they have all flipped a healthy pullback should be in order:

Source: Fundstrat

For my latest thoughts I joined David Lin on Thursday. You can find his channel here:

Yesterday I had the privilege to speak at the Sequire Investor Summit in Puerto Rico. It was comprised of many Family Offices, Public Company CEOs and high net worth investors. You can view it here:

CLICK HERE for the accompanying notes/slide deck

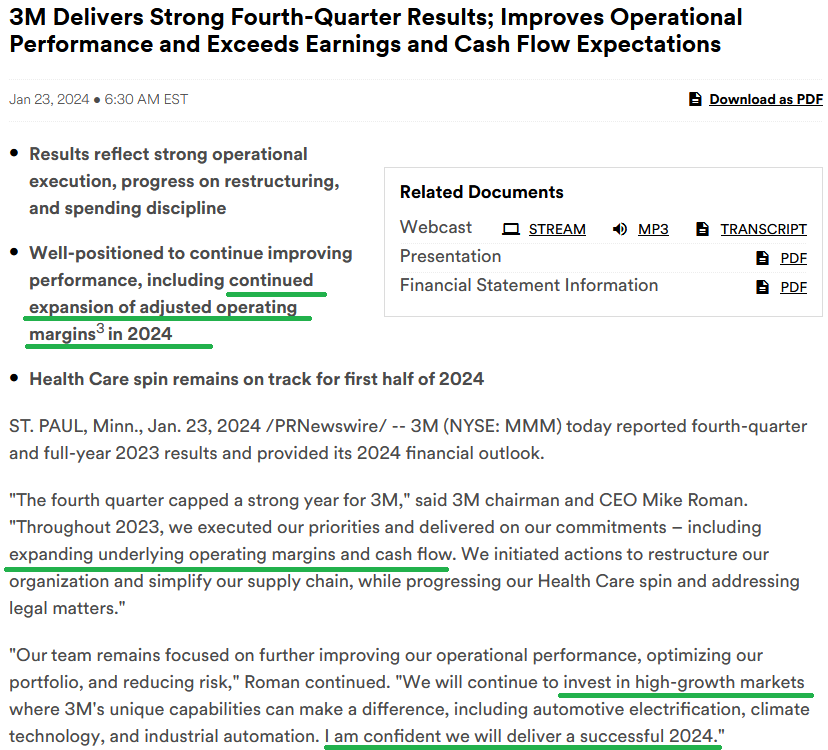

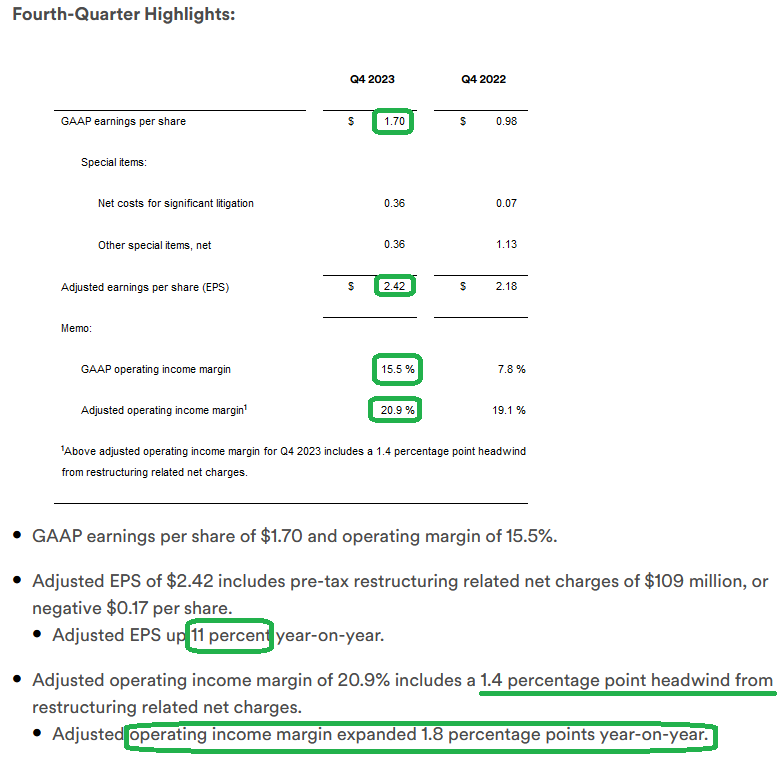

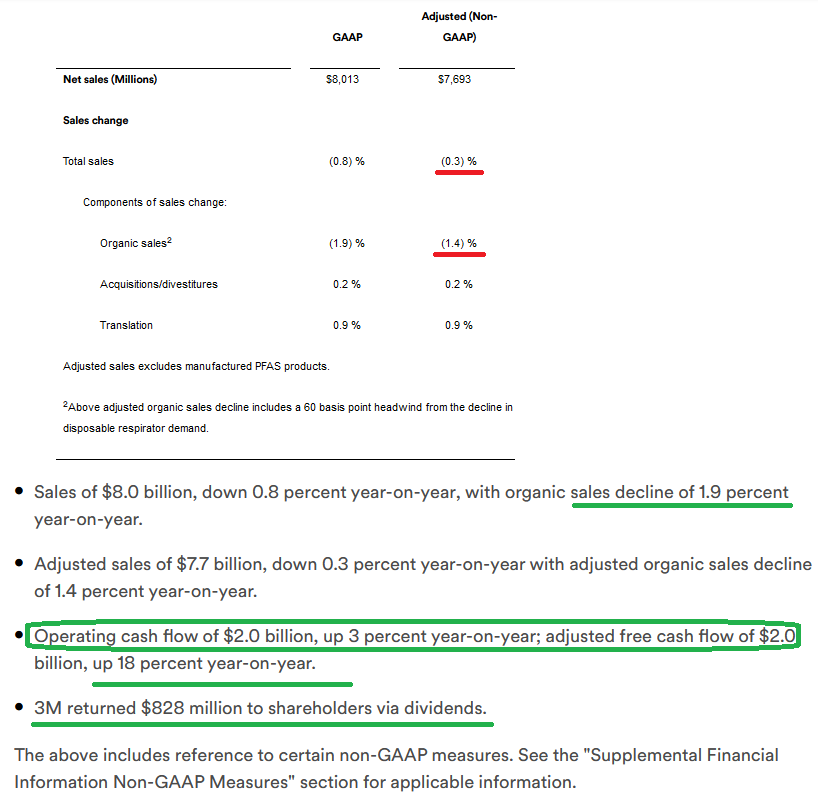

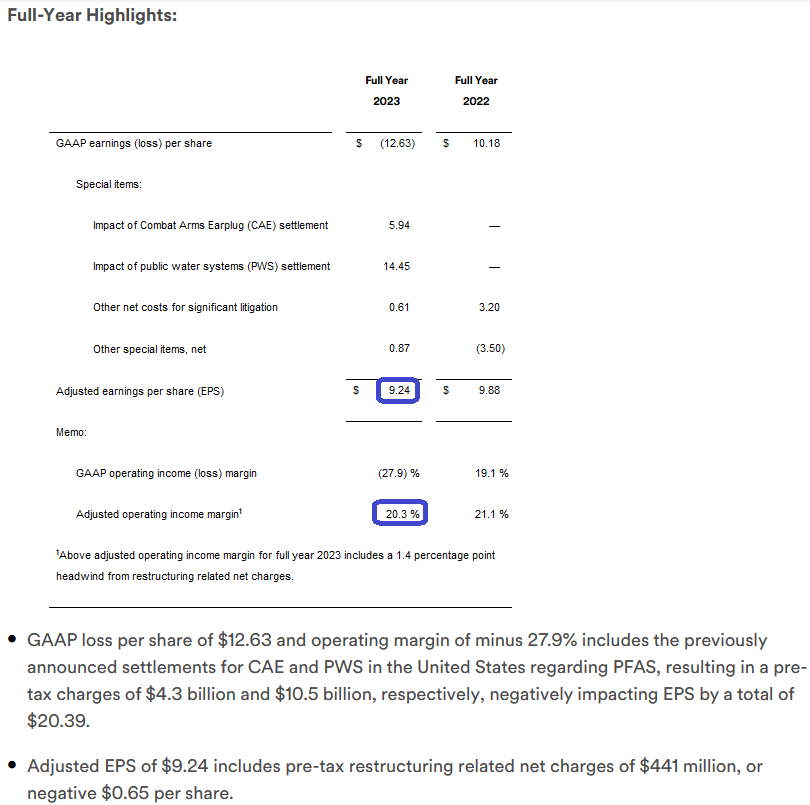

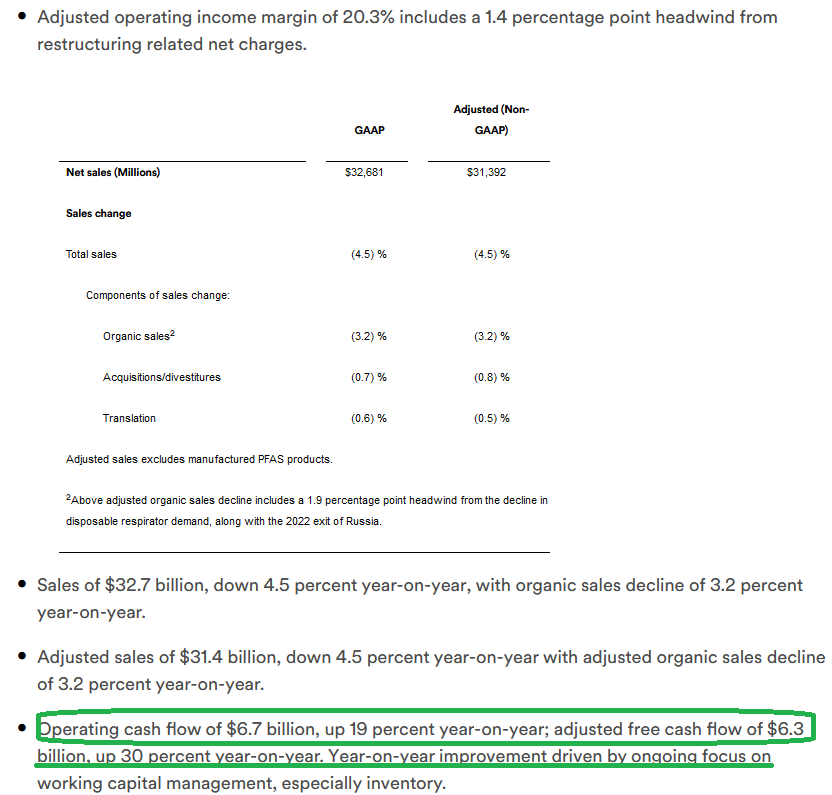

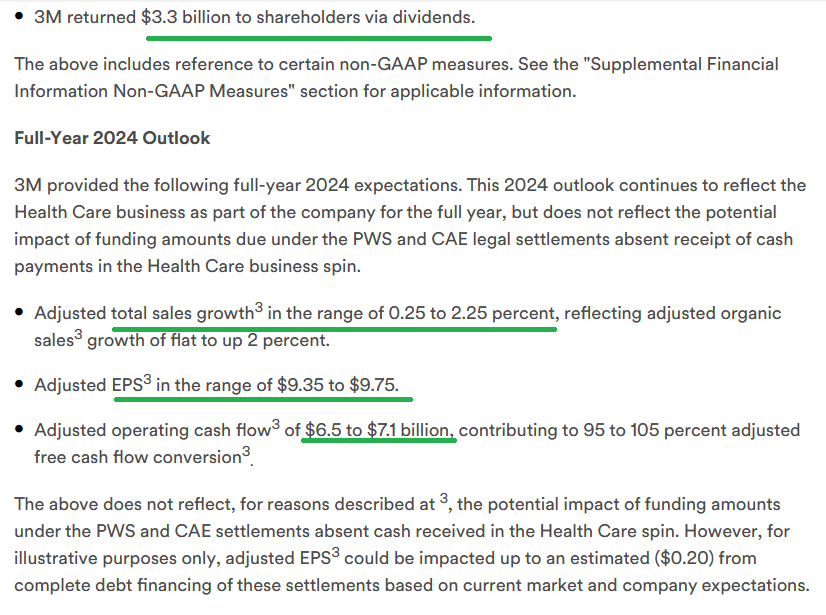

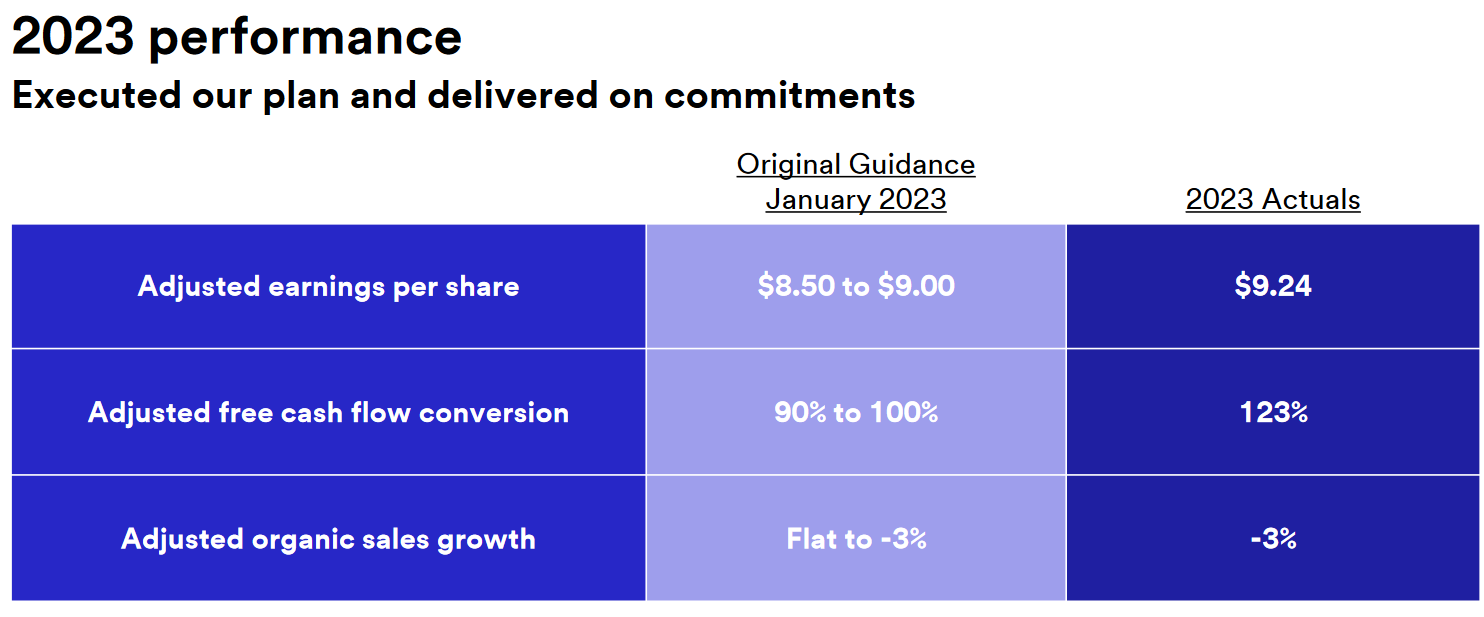

3M Update:

The market is temperamental on this one. If we see high to mid-$80’s we may take the opportunity to add some for the long-term. We’ll get paid a ~6.5% dividend to wait – from a company that has grown the dividend every year for over 65 years (and is generating $6.5-$7B/yr of Operating Cash Flow).

Now onto the shorter term view for the General Market:

Now onto the shorter term view for the General Market:

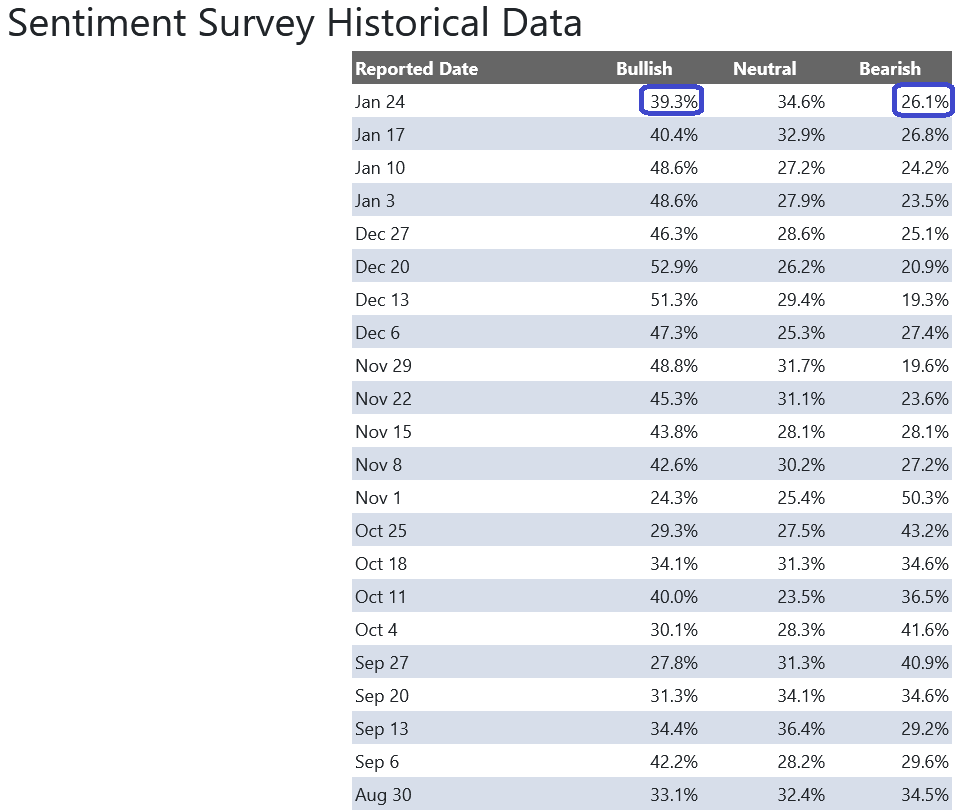

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 39.3% from 40.4% the previous week. Bearish Percent ticked down to 26.1% from 26.8%. Retail investors are cooling their jets a bit.

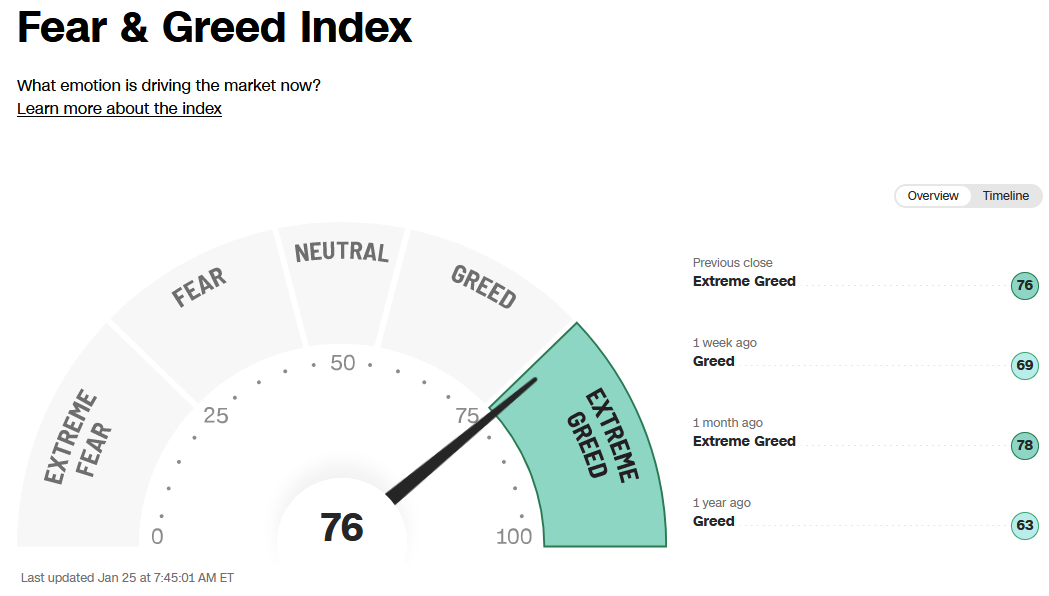

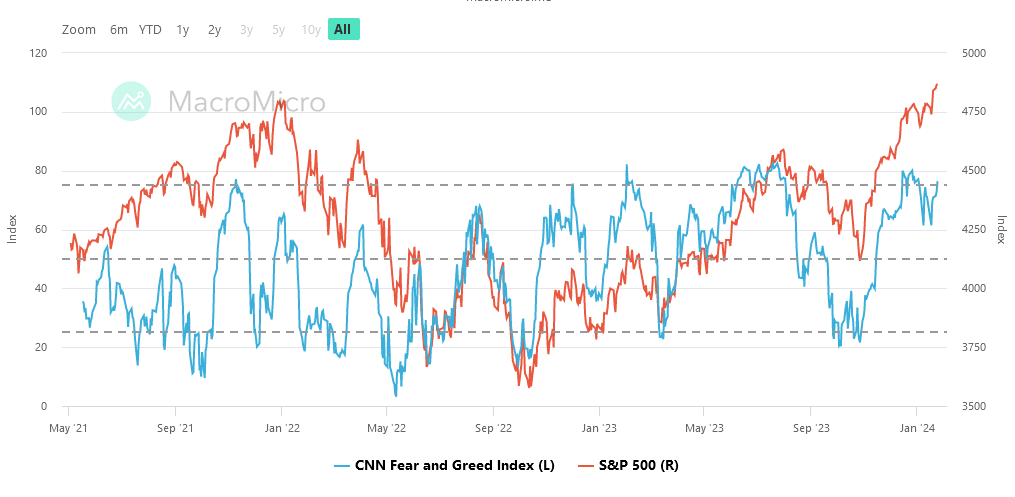

The CNN “Fear and Greed” jumped from 58 last week to 76 this week. By this metric, investors are a bit giddy. You can learn how this indicator is calculated and how it works here: (Video Explanation)

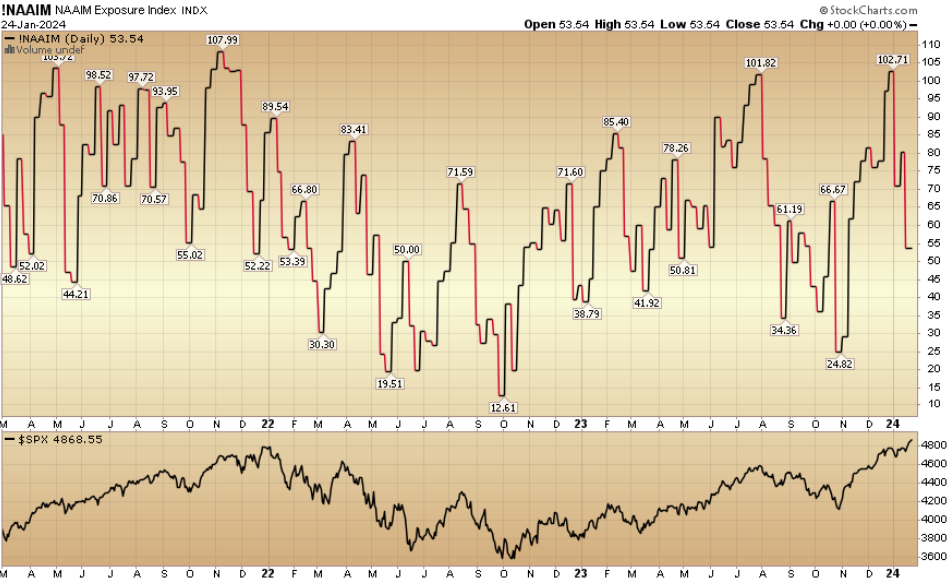

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 53.54% this week from 80.18% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 53.54% this week from 80.18% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow.

*Opinion, Not Advice. See Terms