- Chinese Automaker FAW Group Taps Alibaba Cloud’s Gen AI for Business Intelligence (alizila)

- Yellen says US-China relations on ‘stronger footing’ (ft)

- Alibaba Cloud cuts prices again, this time for international customers as AI generates surging demand (scmp)

- Alibaba Group Invests for Strategic Growth with Cainiao Share Purchase Offer (alizila)

- Alibaba News Roundup: Share Repurchase Update; Alibaba Cloud Launches Open Source Video Generation Tools (alizila)

- These 10 perfect McLarens are for sale. Which one would you pick? (classicdriver)

- Moderate growth and disinflation still alive and well (scottgrannis)

- For the Ultimate Lesson in Car Control, Go Drifting (roadandtrack)

- Bugatti EB110: The First Modern Hypercar Is 30 Years Old (roadandtrack)

- Lexus GX550 vs. Land Rover Defender 130 vs. Mercedes-Benz G550: Which Luxury SUV Is Best Off-Road? (roadandtrack)

- Japan had a vibrant economy. Then it fell into a slump for 30 years. (npr)

- VF Corp. To Roll Out 300 Additional Mono-Brand Retail Stores (sgbonline)

- Vans’ OTW Label Is Taking the Past & Making It Better (highsnobiety)

- Earnings Season Is Coming. What the Market Needs Now. (barrons)

- Many investors are more exposed to China than they think, says Brendan Ahern (cnbc)

- 0:02 / 8:39There’s still ‘gas in the tank’ in this stock market rally, says Fundstrat’s Tom Lee (cnbc)

- The Big Read. Is Japan finally becoming a ‘normal’ economy? (ft)

- Global dominance of biggest stocks rises to highest in decades (ft)

- Jamie Dimon Says 8% Rates Could Lie Ahead (barrons)

- Doubts Creep In About a Fed Rate Cut This Year (wsj)

Tom Hayes – Quoted in Reuters article – 4/5/2024

Thanks to Zaheer Kachwala, Harshita Varghese, Priyanka G, Jaspreet Singh and Purvi Agarwal for including me in their article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 20 key reads for Sunday…

- How A Texas Oil Billionaire Hit A Gusher In Hotels (forbes)

- Earnings Season to Test Stock-Market Rally (wsj)

- Is the S&P 500 Flashing a Spring Sell Signal? (kimblechartingsolutions)

- Dollar Tree, Walgreens CFOs Snap Up the Stocks (barrons)

- Nvidia’s Stock Reaches Crossroads At Key Fibonacci Price Level (kimblechartingsolutions)

- 18 Surprising Facts About the McLaren P1 Hypercar (robbreport)

- United States Non Farm Payrolls (tradingeconomics)

- Masters in Business: Ed Hyman (bloomberg)

- Buy Carnival Stock. Choppy Market Conditions Will Pass. (barrons)

- We “stepped on our own foot” in recent years, admits Alibaba chairman Joe Tsai (technode)

- Biogen, Moderna, and 6 More Healthcare Stocks That Wall Street Thinks Have Upside (barrons)

- Walgreens, CVS, and Other Pharmacy Chains Are in a World of Hurt. What’s to Blame. (barrons)

- Big Pharma Stocks Need a Rethink. Investors Keep Making the Same Mistake. (barrons)

- How Ozempic and Wegovy Could Break the Healthcare System (barrons)

- Stock Market Will Feel a Tremor if Payrolls and Inflation Keep Rising (barrons)

- Krispy Kreme Stock Jumps on Upgrade. McDonald’s Deal Could Boost Earnings. (barrons)

- The World’s First Flying Motorcycle Could Hit the Skies by the End of the Decade (robbreport)

- Inside Italy’s Grand Hotel Villa Serbelloni, The Ultimate Lake Como Retreat (maxim)

- This Revived Lamborghini Countach Channels Classic Wedge-Shaped Supercar (maxim)

- Alibaba to test rocket package delivery service with China’s startup Space Epoch (technode)

Be in the know. 7 key reads for Saturday…

- 33 Undervalued Stocks (morningstar)

- Happy Coca-Cola Dividend Day Warren Buffett (DGI)

- Reed Hastings, Co-Founder of Netflix — How to Cultivate High Performance, The Art of Farming for Dissent, Favorite Failures, and More (#730) (Tim Ferriss)

- Yielding Almost 5%, This Undervalued Dividend Stock Is a Buy (morningstar)

- The Long View. Rising Fed chatter is not making life in markets easy (ft)

- The 100 Best Restaurants in New York City in 2024 (nytimes)

- Supercar Blondie Is Going Into the Auction Business (barrons)

Hedge Fund Tips with Tom Hayes – Podcast – Episode 233

Article referenced in podcast above:

Rising Sun or Fallen One? Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 233

Article referenced in VideoCast above:

Rising Sun or Fallen One? Stock Market (and Sentiment Results)…

Where is money flowing today?

Be in the know. 20 key reads for Friday…

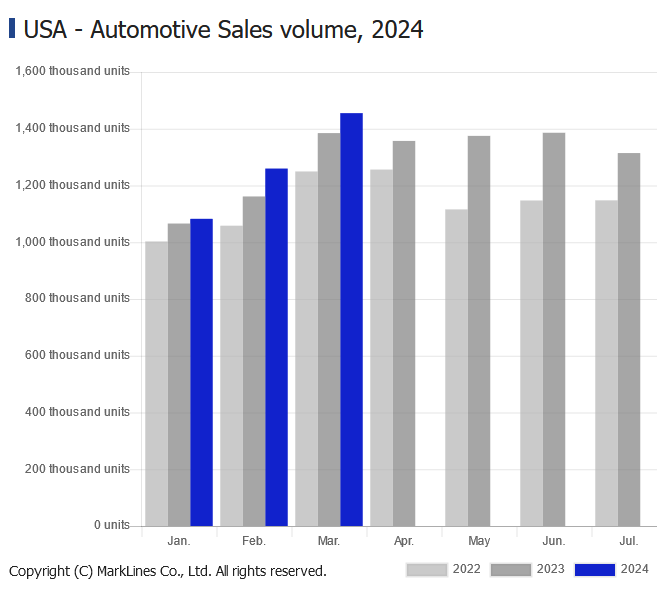

- USA – Automotive Sales Volume, 2024 (marketlines)

- S Added 303,000 Jobs in March, Surging Past Estimates (bloomberg)

- Chinese fintech Ant Group targets global growth after Jack Ma’s exit (ft)

- Services PMI Beats, Biden & Xi Discuss The San Francisco Vision (chinalastnight)

- Joe Tsai Co-founder & Chair of Alibaba | In Good Company | Norges Bank Investment Management (Norges Bank)

- Disney to crack down on password-sharing after CEO Bob Iger wins board fight (nypost)

- Europe’s Biggest Asset Manager Is Looking to Buy Dips After Missing Out on Stocks Rally (bloomberg)

- Fixing Boeing’s Broken Culture Starts With a New Plane (bloomberg)

- Four Seasons’ New Yacht Cruises Come With Record-High Price Tags (bloomberg)

- Fed on Track to Cut in June, Morgan Stanley’s Zentner Says (bloomberg)

- Biden Tells Netanyahu US Support Hinges on Protecting Civilians (bloomberg)

- Earnings Season Is Coming. What Markets Need Now. (barrons)

- Nvidia’s stall means the momentum trade has lost its mojo. (marketwatch)

- Yellen Is Back in China. What She Could Actually Accomplish. (barrons)

- Intel expects to be the world’s second-largest contract chip producer by 2030, trailing only TSMC. (barrons)

- Stocks Drop After Fed Officials Cast Doubt on Rate Cuts (wsj)

- The Underrated iPhone App That Makes Everyday Tasks Easier (wsj)

- Fed’s Kashkari raises prospect of zero rate cuts — but Goldman says that would be ‘very surprising’ (cnbc)

- Ford to “Re-Time” New EV Production, Expand Hybrid Production (mishtalk)

- The Big Read. Will Xi’s manufacturing plan be enough to rescue China’s economy? (ft)

Where is money flowing today?

(Equal Weight) Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Equal Weighted Biotech ETF (XBI) top 30 holdings.

Continue reading “(Equal Weight) Biotech Earnings Estimates/Revisions”