Data Source: Finviz

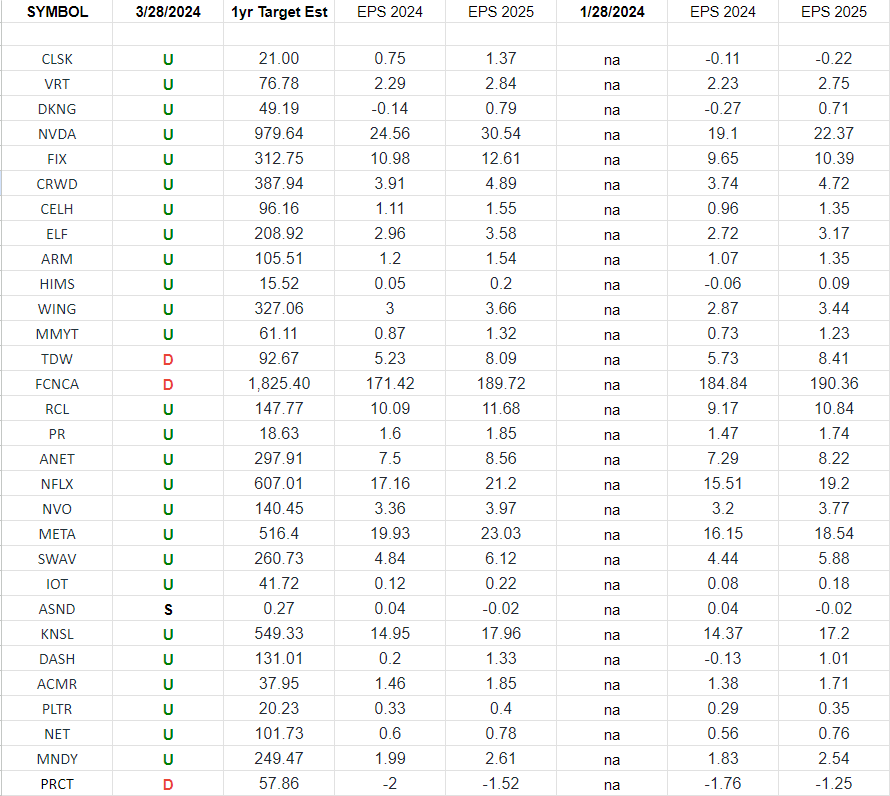

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

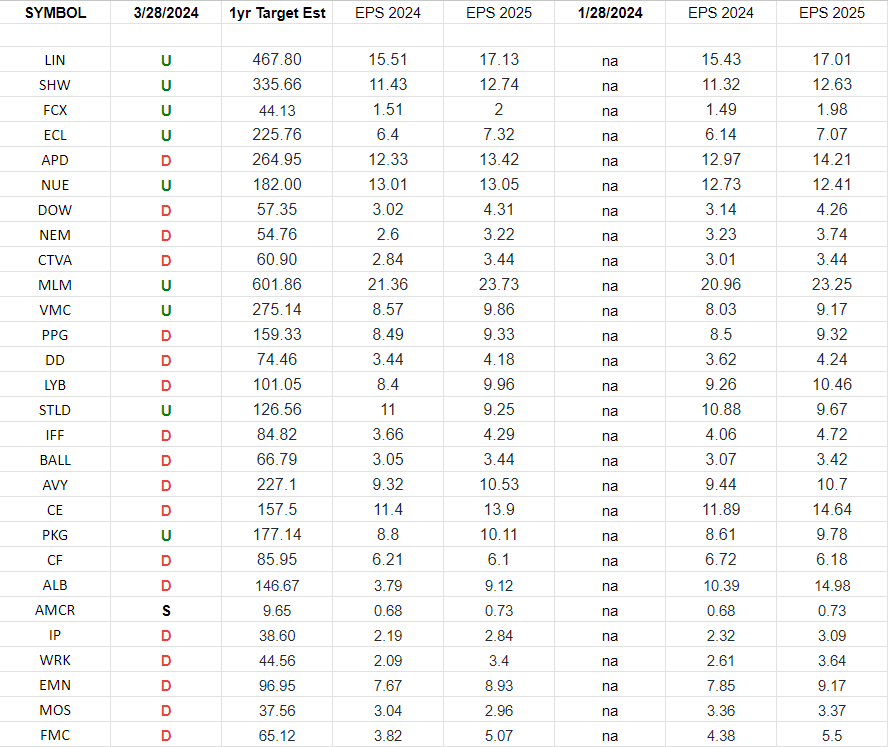

Basic Materials (XLB)- Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2024 and 2025 estimates were today and 60 days ago.

Continue reading “Basic Materials (XLB)- Earnings Estimates/Revisions”

“More to Grow or Time to Go?” Stock Market (and Sentiment Results)…

On Tuesday afternoon I joined Charles Payne on Fox Business to discuss market indicators, market outlook and three positions. Thanks to Charles, Nicholas Palazzo and Kayla Arestivo for having me on: Continue reading ““More to Grow or Time to Go?” Stock Market (and Sentiment Results)…”

Be in the know. 20 key reads for Thursday…

- China’s economy is on track for ‘strong’ March performance, survey says (cnbc)

- The Big Read. Will Xi’s manufacturing plan be enough to rescue China’s economy? (ft)

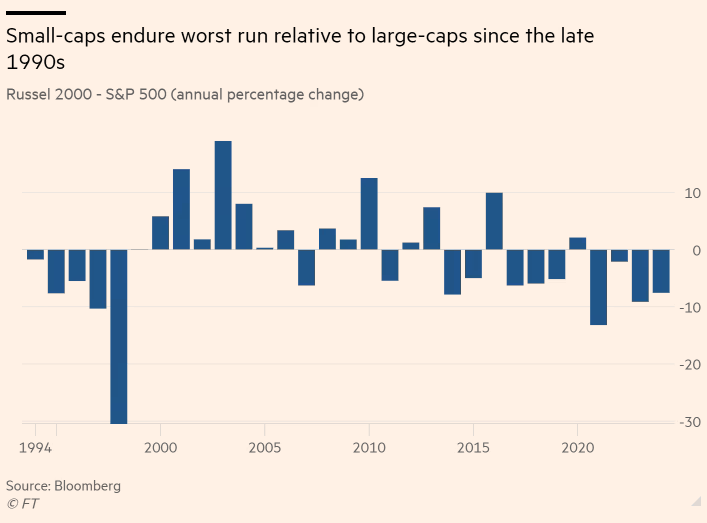

- “The only other time you’ve seen relative multiples this cheap was during 1999 and 2000, and that ended up being a great decade for small-caps,” she said. (ft)

- Reddit Insiders Selling Days After IPO; Shares Fall Late (investors)

- China Signals More Property Support, But Substance to Be Key for Turnaround (wsj)

- Why the Fed’s Waller Is in ‘No Rush’ to Cut Rates (barrons)

- The Stock Market Is So Strong, Even Some Skeptics Won’t Bet Against It (barrons)

- China’s Xi meets with U.S. business leaders, calls for closer ties (marketwatch)

- China’s Xi Seeks to Soothe Anxieties of American CEOs (wsj)

- Barron’s: Nvidia Stock Slips. Why It Might Lose Out in a Frothy Market. (marketwatch)

- Opinion: Boeing had a good week cleaning house — but now comes the hard part (marketwatch)

- These GE and 3M Spinoffs Are Set to Join the S&P 500 (barrons)

- Los Angeles Office Tower Dumped by Brookfield Faces Foreclosure Sale (bloomberg)

- 3M’s Healthcare Spinoff Stock Fell. This Is What It’s Worth. (barrons)

- Individual investors are buying fewer stocks, but using more leverage (marketwatch)

- Disney, Florida Settle Litigation Over Special District. Sunnier Skies Could Be Ahead. (barrons)

- Point72 Takes a Large Stake in Fox (institutional investor)

- Taobao to Launch Several Biz-Friendly Initiatives for All Platform Merchants Starting Apr (aastocks)

- The market may be due for a decline. Cramer explains why you shouldn’t fear it (cnbc)

- Vans Skateboarding and Anthony Van Engelen Skate to the Future with the All-New AVE 2.0 (vans)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 15 key reads for Wednesday…

- China: Industrial profits hit a 25-month high amid signs of bottoming out (ing)

- China’s Xi meets U.S. executives as businesses navigate bilateral tensions (cnbc)

- Xi Says US CEOs Should Invest in China, Economy Hasn’t Peaked (bloomberg)

- Airbus Has Its Own Issues. Can It Keep Its Lead Over Boeing? (barrons)

- Boeing Needs a New CEO. What History Says About Who Can Right the Stock. (barrons)

- Commercial real estate is itching for a rebound two years after start of Fed rate hikes (marketwatch)

- Fees in Settlement. It Could Save Merchants $30 Billion. (barrons)

- Although Chinese consumer confidence has yet to meaningfully rebound, the overall mood has started to improve slightly, Madjo wrote. (barrons)

- Boeing Delivered Just 3 MAX Jets in a Week. That Is a Good Thing. (barrons)

- Krispy Kreme Stock Rises Sharply on Sweet Deal With McDonald’s (barrons)

- Home Prices Rose at Fastest Pace Since 2022 in January (barrons)

- This bull market is not over, says Wharton’s Jeremy Siegel (cnbc)

- The Office Market Is in Turmoil. So Why Are Rents More Expensive? (wsj)

- Canada Goose to cut 17% of its corporate workforce (cnbc)

- Boeing Delivered Just 3 MAX Jets in a Week. That Is a Good Thing. (barrons)