Data Source: Finviz

Be in the know. 28 key reads for Tuesday…

- Wall Street’s ‘mob psychology’ could fuel a dangerous stock meltup, warns top strategist (marketwatch)

- Daytona 500 highlights: All the top moments from William Byron’s win in NASCAR opener (usatoday)

- Nvidia’s earnings report could kill the momentum driving U.S. stocks higher, regardless of how it turns out. (marketwatch)

- The Economy Is Booming, Data Show. Wall Street Disagrees. (wsj)

- Everything China’s Doing to Rescue Its Battered Stock Market (bloomberg)

- China boosts property funding with first cut in key loan rate since June (cnbc)

- China data shows biggest travel surge since COVID (marketwatch)

- China cuts mortgage rates by record amount to help struggling property sector (marketwatch)

- Wall Street Firms Are Flip-Flopping on Climate. Here’s Why. (nytimes)

- Citi’s Montagu: US equity futures bullish positioning unchanged despite pullback (streetinsider)

- Bernstein raises Disney (DIS) PT, expects positive impact from password-sharing crackdown (streetinsider)

- Is Highflyer Nvidia Losing Its Luster? (institutionalinvestor)

- How War in Europe Boosts the U.S. Economy (wsj)

- Billions Start Flowing to Chip Makers for New U.S. Factories (wsj)

- Tiger Woods Offers a Glimpse of What’s Next (wsj)

- Are Lithium Stocks at Rock Bottom? (wsj)

- Nike Joins Growing List of US Companies Doing Large Layoffs (bloomberg)

- Airbus says competition from China’s Comac C919 is ‘not going to rock the boat’ (cnbc)

- Elon Musk says Neuralink’s first patient can move a computer mouse ‘by just thinking’ (businessinsider)

- Goldman Sachs ups year-end S&P 500 target to 5,200, says Big Tech must do the heavy lifting (marketwatch)

- Nvidia’s Staying Power Is the $2 Trillion Question (wsj)

- These Drug Companies Are Going Nuclear to Fight Cancer (wsj)

- China’s New Securities Chief Meets With Market Participants to Address Concerns (wsj)

- In Rare Move, China Stock Watchdog Vows to Heed Market Criticisms to Avert $5 Trillion Rout (bloomberg)

- China Supercharges Stimulus With Biggest Cut In Mortgage Reference Rate On Record (zerohedge)

- Ozempic Users Slash Snack Buying At Supermarkets, Survey Finds (zerohedge)

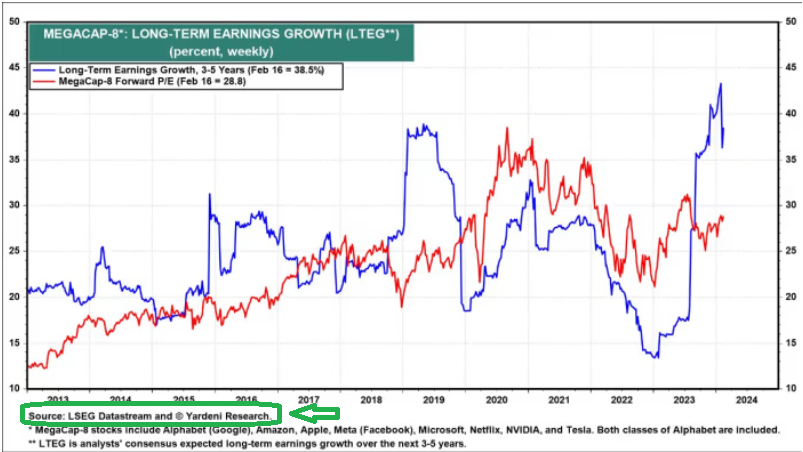

- Lots of positive signals from the market beneath the mega-caps, says Ryan Detrick (cnbc)

Tom Hayes – Fox Business Appearance – Charles Payne – 2/19/2024

Quote of the day…

Be in the know. 17 key reads for President’s Day…

- PayPal stock trades near its cheapest valuation in history, and one Wall Street analyst sees triple-digit upside for shareholders. (fool)

- China’s Premier Urges ‘Forceful’ Action to Boost Confidence (bloomberg)

- China State Banks Earmark $8 Billion for Property Projects. Authorities are stepping up support for housing market. (bloomberg)

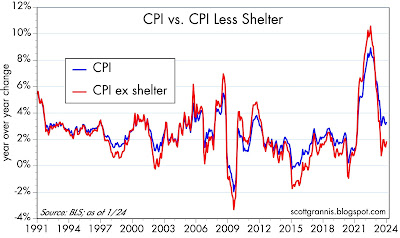

- The CPI overshoot is a statistical artifact (scottgrannis)

- Year of the Dragon Starts With Roar for the Tourism Industry, says Alibaba’s Fliggy (alizila)

- Any stimulus signs emerging ahead of the key annual meetings in March, where the leadership announces the economic growth target and development goals, will thus be closely watched.(bloomberg)

- Stock Bulls Turn to Europe for Cheap Alternative to Magnificent Riches (bloomberg)

- Tourism to Hong Kong and Macau also surged, as did trips to places such as Singapore where Chinese travelers were able to enjoy relaxed visa rules. (bloomberg)

- China’s National Team Is Back at Work as Stock Trading Resumes (bloomberg)

- China’s Hainan Cuts Down Payment for First-Home Buyers (bloomberg)

- China’s JD.com in Early-Stage Talks to Buy UK Retailer Currys (bloomberg)

- What’s really happening with the Evergrande liquidation (npr)

- The great dollar store backlash (thehustle)

- Jerome Powell plans to cut interest rates despite persistent inflation (nypost)

- Market’s Bullishness On Euro Against Dollar Looks Misplaced (zerohedge)

- Goldman Sachs raises S&P 500 price target on earnings strength (streetinsider)

- Some regional electric grids ‘in trouble’ over the next few years, says Skylar’s Bill Perkins (cnbc)

Quote of the Day…

Be in the know. 10 key reads for Sunday…

- Robb Report’s 2024 Car of the Year: The 10 Contenders (robbreport)

- Masters in Business: Bill Dudley (bloomberg)

- Up 7 of Last 12 After Presidents’ Day but Still Weak Long Term (almanac trader)

- Natural Gas Crashes Into Historic 25-Year Price Support (kimblechartingsolutions)

- Michigan Consumer Sentiment Essentially Unchanged in February (advisorperspectives)

- Producer Price Index: Wholesale Inflation Inches Down to 0.9% in January (advisorperspectives)

- Weekly Leading Economic Index (advisorperspectives)

- Banner week for billionaire investor Carl Icahn – a total of four board seats at JetBlue and American Electric Power will go to deputies as Icahn celebrates his 88th birthday (fortune)

- Big Shale means ‘consolidate or get eaten,’ Wall Street is all in, and one of the ‘last original wildcatters’ will become America’s richest oilman (fortune)

- We Drove The Ferrari Roma Spider Through Italy’s Sardinian Mountains (maxim)

Be in the know. 15 key reads for Saturday…

- A US productivity boom may explain how inflation slowed amid a strong economy (cnn)

- This Tech Stock Is a Bargain Waiting to Be Found. Just Bring a Calculator. (barrons)

- Fed’s Bostic Argues for Patience on Rate Cuts. Here’s His Case. (barrons)

- Consumer Sentiment Stalls in February (barrons)

- Want your stock picks to beat index funds? Look at companies with one key metric. (marketwatch)

- Small-cap stocks haven’t been this volatile in nearly a year. What it means for the long-suffering sector. (marketwatch)

- Finding Stocks to Buy Is Getting Harder. 6 Shorts to Consider, From an Analyst. (barrons)

- The Stock Market Is Melting Up. Prepare for a Short-Term Correction. (barrons)

- JPMorgan and State Street quit climate group as BlackRock scales back (ft)

- Intel in Talks for More Than $10 Billion in Chips Act Incentives (bloomberg)

- How Uber Beat the Skeptics and Became Profitable (bloomberg)

- Odd Lots Newsletter: Who Cares When the Rate Cuts Start? (bloomberg)

- Top Investors Share the Toughest Lessons They Had to Learn (bloomberg)

- 4 Warren Buffett Stocks to Buy Now (morningstar)

- This 30% Undervalued Stock Is a Buy After a 7% Dividend Increase (morningstar)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 226

Article referenced in VideoCast above:

“Goolsbee Saves The Day!” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 226

Article referenced in podcast above:

“Goolsbee Saves The Day!” Stock Market (and Sentiment Results)…