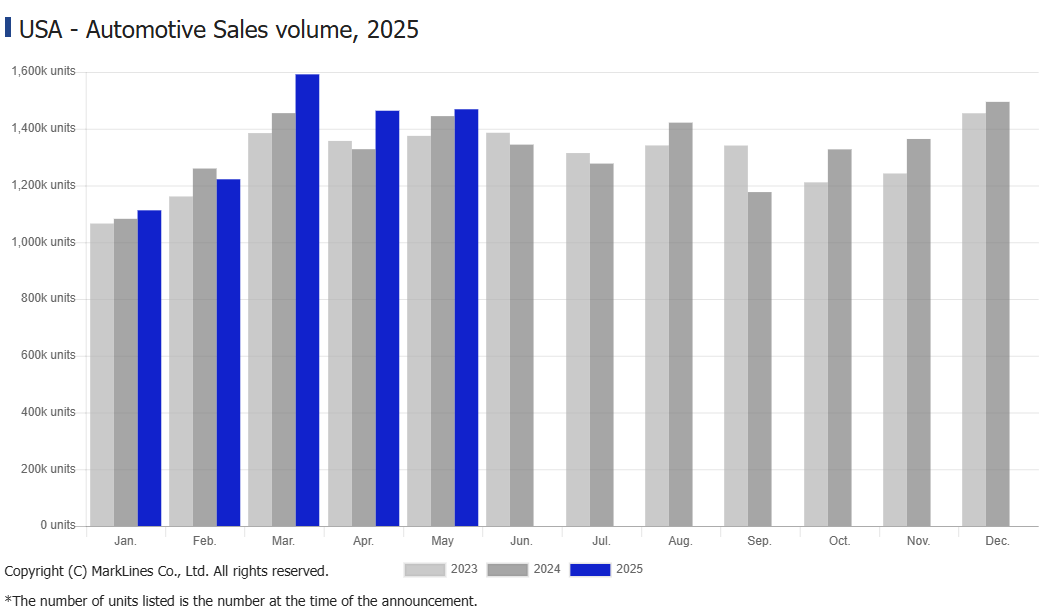

- Ford reports 16% sales increase in May amid employee pricing, tariffs (cnbc)

- U.S. auto sales up 1.4% in May, rush buying before tariff hikes slows (marklines)

- Proposed new auto loan tax deduction could help buyers get break on interest (usatoday)

- Alibaba, JD.com sales surge during 618 shopping festival on the back of subsidy programme (scmp)

- China stocks benefit from shift away from US assets: Natixis (scmp)

- Hong Kong’s Hopes Hinge On Trump-Xi Call & Policy Meeting Stimulus (chinalastnight)

- Action in Hong Kong Equity Markets Stirs Most Excitement in Years (bloomberg)

- Chinese Firms Brush Off US Tariff Risks With Domestic Confidence (bloomberg)

- The U.S. and China Are at Loggerheads Over Tariffs. Why a Trump-Xi Call Is Likely. (barrons)

- The Bull Market Is Being Powered by Stocks Outside the US (bloomberg)

- US Woes Spark Pivot to Europe, Safer Sectors, BC Partners Says (bloomberg)

- AI Data Center Boom Requires A Lot Of Natural Gas (zerohedge)

- Data Centers Added $9.4 Billion in Costs on Biggest US Grid (bloomberg)

- It’s Treasury Vs The Fed: With Fed Sidelined, Bessent Unleashes Record $10 Billion Bond Buyback (zerohedge)

- US Job Openings Unexpectedly Rose in April and Hiring Picked Up (bloomberg)

- Interest rates are normal, the world is not (ft)

- How Low Will the Dollar Go? (nytimes)

- PayPal Unveils Another Credit Card for In-Person Shopping Push (bloomberg)

- Tom Lee: Risk is now of a substantial leg-up rally from here (youtube)

Where is money flowing today?

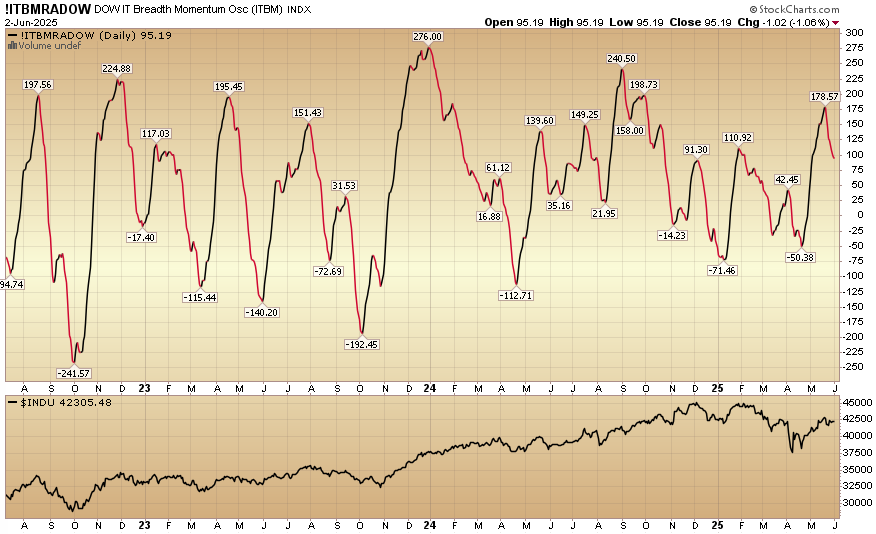

Indicator of the Day (video): DOW Intermediate Term Breadth Momentum Oscillator

Quote of the Day…

Be in the know. 17 key reads for Tuesday…

- Buy ‘Defensive’ Stocks. You’ll Be Glad You Did. (barrons)

- Boeing CEO Ortberg is winning hearts on Wall Street. Here’s the latest vote of confidence. (marketwatch)

- Boeing 737 MAX Production Tops 38 Jets Per Month For First Time In Years (zerohedge)

- Why Bernstein thinks Boeing stock is the best idea in Aerospace & Defense (investing)

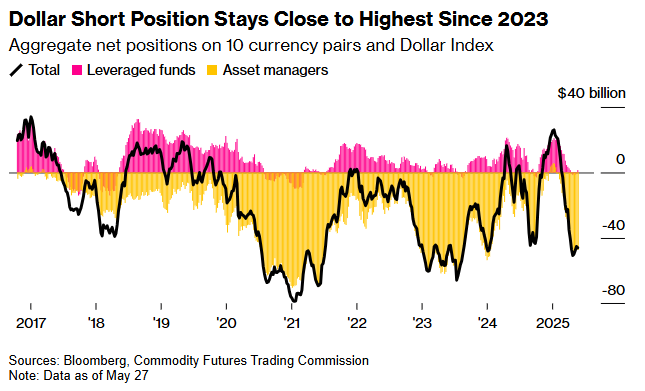

- The Dollar Had Its Biggest Drop to Start the Year. It Could Get Worse. (barrons)

- FX options market positioned for further dollar weakness (reuters)

- 2025 Biopharma Industry Outlook: Growth, Innovation, and Emerging Risks (morningstar)

- Biotech M&A shows signs of life (ft)

- Emerging-Market Stocks Gain as China Data Refuel Stimulus Hopes (bloomberg)

- Hong Kong stocks near 2-month high on ‘likely’ Trump-Xi trade talks (scmp)

- Temu’s daily US users cut in half following end of ‘de minimis’ loophole (nypost)

- Walt Disney Co. to Lay Off Hundreds (wsj)

- Fed’s Goolsbee Says Rates Can Fall If Trade Policy Is Resolved (bloomberg)

- White House ‘close to the finish line’ on some trade deals, says Treasury official (cnbc)

- 3 reasons it’s a great time to buy a home, according to Compass’ CEO (businessinsider)

- Recession? Atlanta Fed Hikes US Q2 Growth Outlook To Highest Since 2021 (zerohedge)

- Deutsche Bank lifts S&P 500 year-end target amid Wall Street upgrade wave (streetinsider)

Tom Hayes – CGTN America Appearance – 6/2/2025

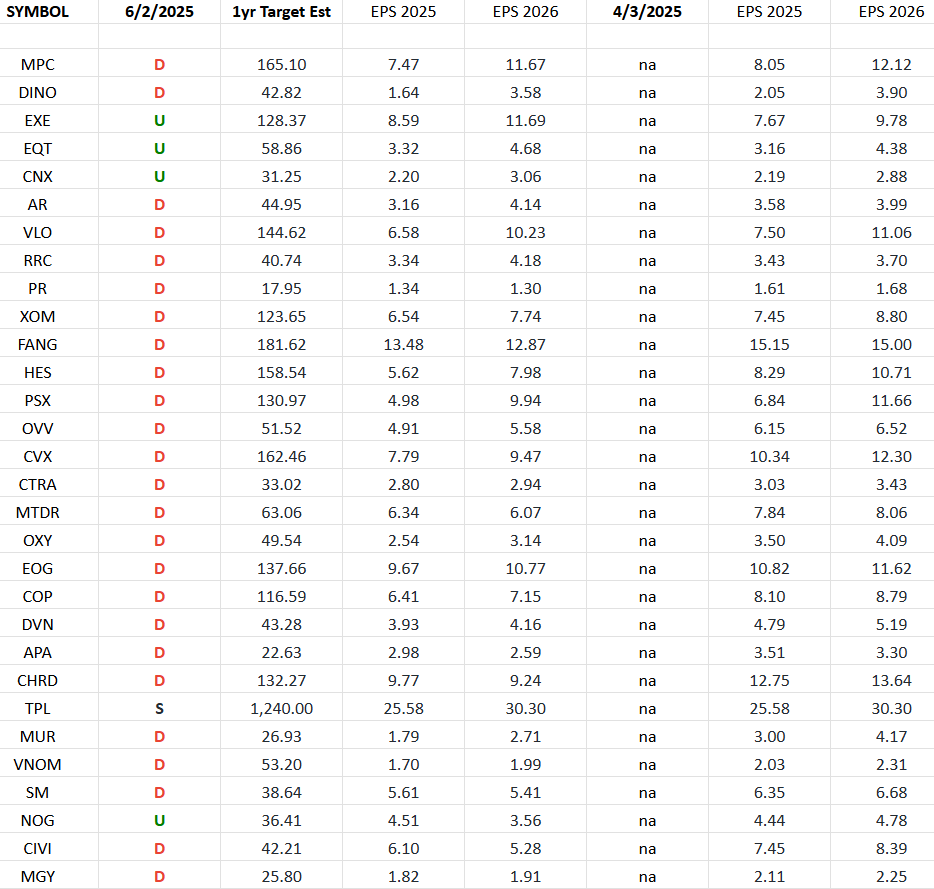

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2025 and 2026 estimates were on 4/3/2025 and today.

Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

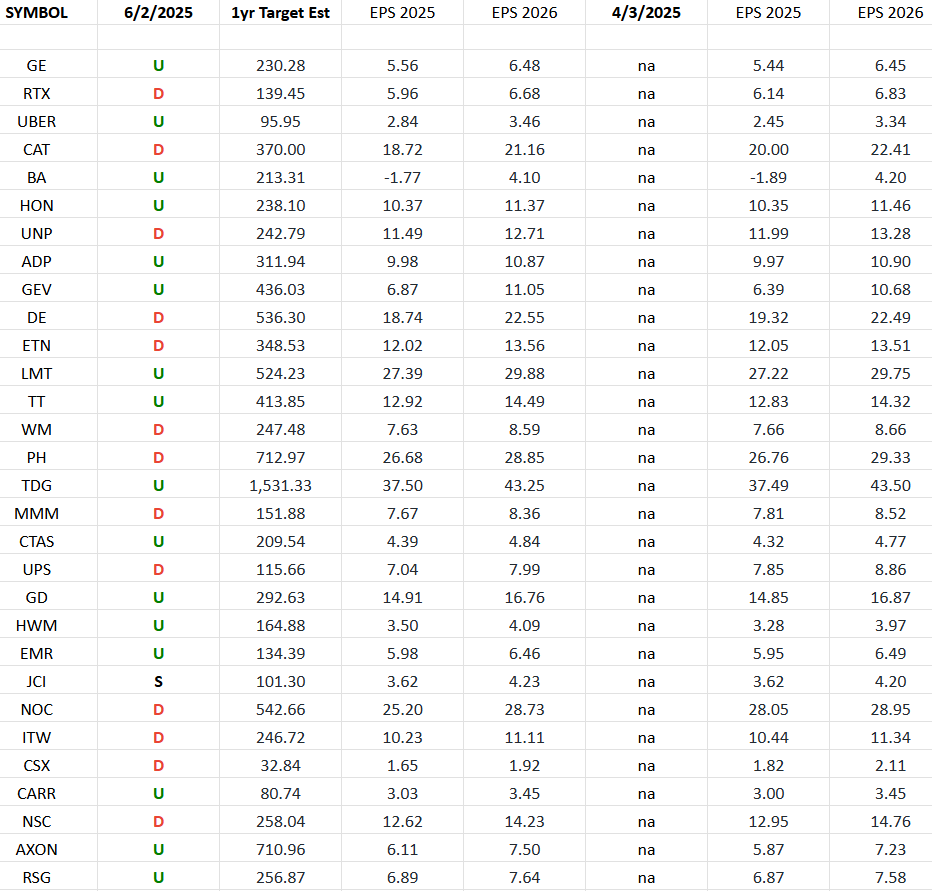

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. I have columns for what the 2025 and 2026 earnings estimates were on 4/3/2025 and today. The column under the date 6/2/2025 has a letter that represents the movement in 2025 earnings estimates since the most recent print (4/3/2025).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”