- China cuts benchmark lending rates for the first time in 7 months in Beijing’s growth push (cnbc)

- Alibaba, JD, and Other China Stocks Rise. What’s Giving Them a Boost. (barrons)

- China Banks Cut Deposit Rates to Aid Margins, Drive Spending (bloomberg)

- Understanding the US Housing Market in 2025: Mortgage Rates, Affordability, and Growth Trends (morningstar)

- Home Depot Maintains Guidance as US Spending Holds Up (bloomberg)

- A Third Of Russell 3000 Energy Companies Trade Below Book Value (zerohedge)

- Natural Gas Power Plants are Energy’s Biggest Buyout Targets (barrons)

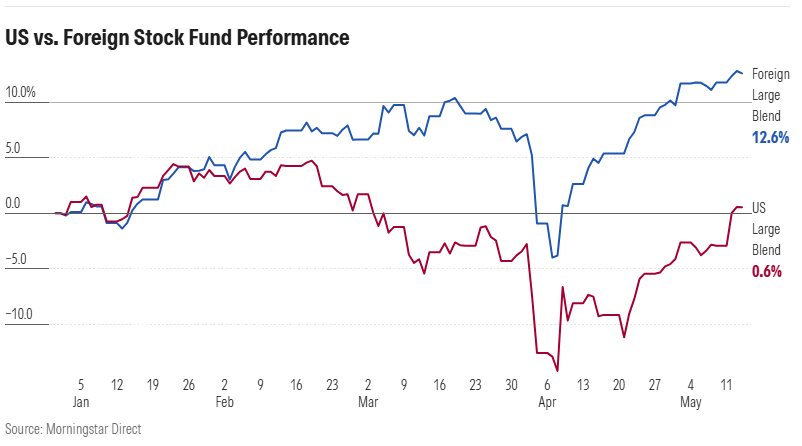

- JPMorgan and Citi See European Stocks Blowing Past the US (bloomberg)

- Citi Sees Weaker Dollar After G-7 Meeting as US Softens Tariffs (bloomberg)

- Dollar set for more weakness as ‘Brand USA’ falls further out of favor (reuters)

- Tax Cuts Are Coming. Moody’s Warning on Debt Won’t Make a Difference. (barrons)

- Fundstrat’s Tom Lee: There’s not much signal in Moody’s U.S. downgrade (youtube)

- 5 Stocks to Buy to Profit From Trump’s Trade Deals (morningstar)

- Exclusive: Intel explores sale of networking and edge unit, sources say (reuters)

- Goldman: Biopharma Valuation Discount Hits Extreme Lows; Key Near-Term Catalysts In Focus (zerohedge)

- Bernstein raises Boeing stock price target to $249, maintains Outperform (investing)

- Retail Traders Go on Record Dip Buying Spree, Calming a Jumpy Stock Market (bloomberg)

- UnitedHealth Built a Giant. Now Its Model Is Faltering. (wsj)

- Nike Will Be the Winner If Dick’s Can Revive Foot Locker (bloomberg)

“BABA Back in Business” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Wednesday, I joined Cheryl Casone on Fox Business “Claman Countdown” to discuss markets, outlook, and more. Thanks to Cheryl and Brooke Haliscak for having me on:

Continue reading ““BABA Back in Business” Stock Market (and Sentiment Results)…”

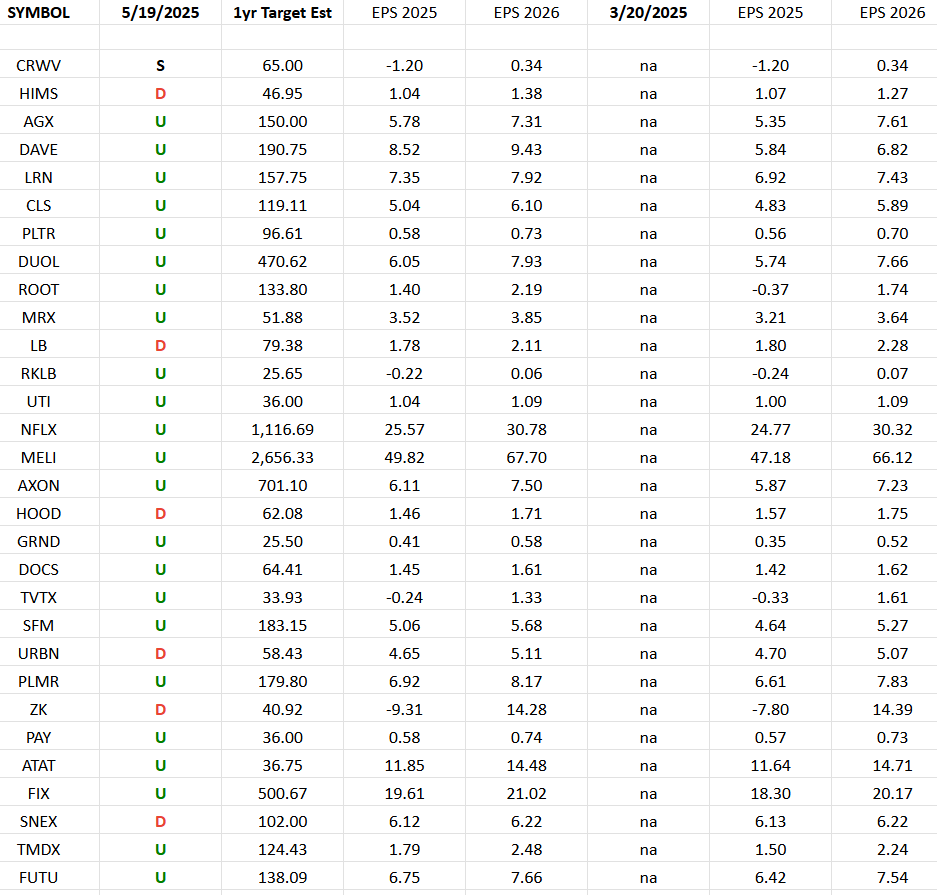

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

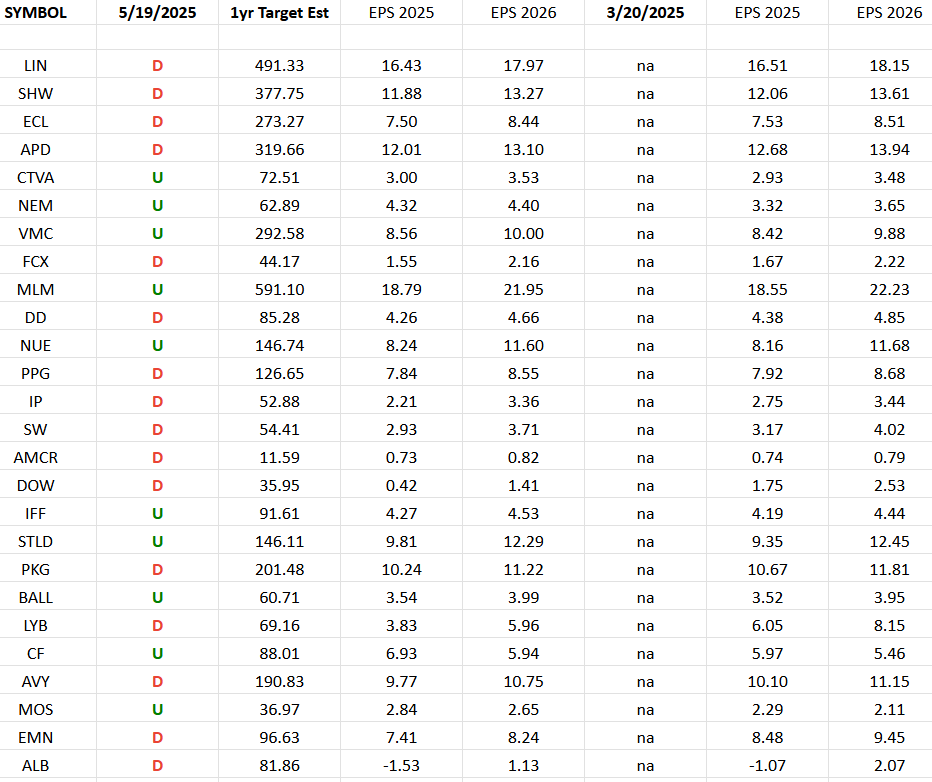

Basic Materials (XLB)- Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2025 and 2026 estimates were today and 60 days ago.

Continue reading “Basic Materials (XLB)- Earnings Estimates/Revisions”

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

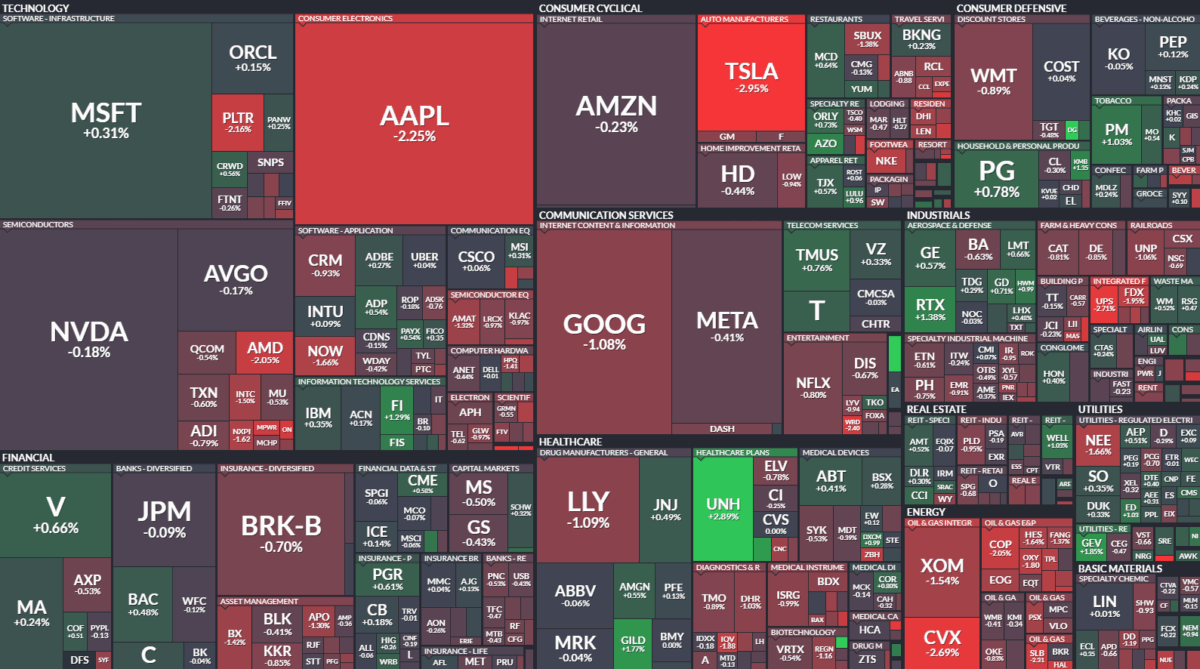

Where is money flowing today?

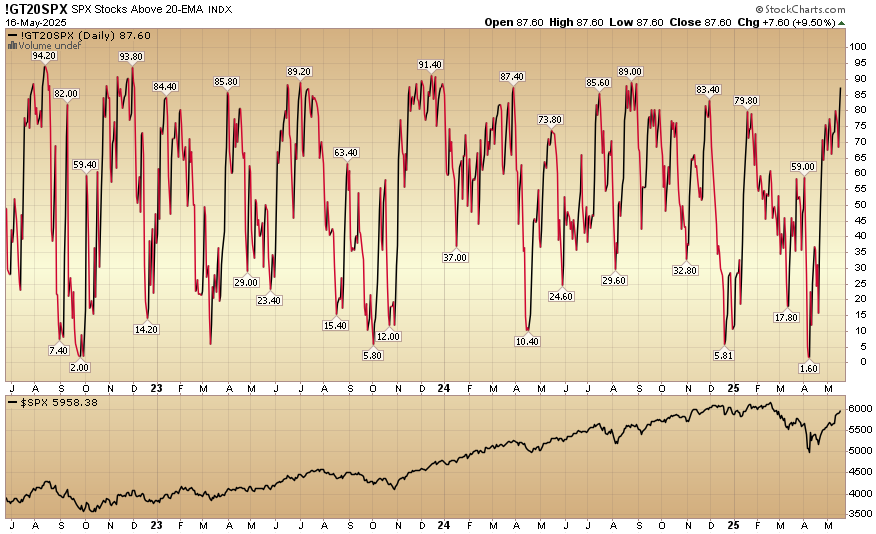

Indicator of the Day (video): S&P 500 Stocks Above 20 EMA

Quote of the Day…

Be in the know. 21 key reads for Monday…

- Wall Street Banks Bet on Emerging Markets After Wasted Years (bloomberg)

- Despite US Rebound, International Stock Funds Continue to Lead (morningstar)

- Alibaba cements AI leadership as cloud unit reports fastest growth since 2022 (scmp)

- Exclusive | ‘Still a good time to buy’: Goldman urges value investors to make ‘precise’ stock picks (scmp)

- Ant Group Global Unit Brings in $3 Billion Ahead of Spinoff (bloomberg)

- Breaking down the US and Chinese markets’ recoveries (ft)

- Morgan Stanley’s Wilson Says Buy US Stock Dips After Moody’s Cut (bloomberg)

- Goldman Prime: OWICs Galore, Hedge Funds Stopped-In During Biggest Squeeze Since Dec 2021 (zerohedge)

- M&A Target Stocks Surge in Bet on Wall Street Dealmaking Rebound (bloomberg)

- Big Tech Goes From Stock Market’s Safest Bet to Biggest Question (bloomberg)

- What are the key similarities and differences between 2025 and 2000 (streetinsider)

- Bessent Dismisses Moody’s Downgrade as ‘Lagging’ Indicator (barrons)

- Why the U.S. consumer may be more resilient than many think (marketwatch)

- Intel debuts AI GPUs for workstation system as it works to gain ground on Nvidia, AMD (yahoo)

- Johnnie Walker Maker Diageo Expects Tariff Hit, But Sticks With Guidance (wsj)

- Diageo plans $500 million in cost savings by 2028, lowers tariff impact view (reuters)

- House Republicans Advance Trump’s “Big, Beautiful Bill” After Weekend Of Negotiations (zerohedge)

- Will Anyone Take the Factory Jobs Trump Wants to Bring Back to America? (wsj)

- Spain Boosts Costlier Gas Power to Secure Grid After Blackout (bloomberg)

- Clean Energy Is Under Attack Even Where It’s Booming (wsj)

- First LNG ship bunkering hub in US Gulf Coast secures permits to start work (reuters)