- GDP Growth Surged in Fourth Quarter for Strong Finish to 2023 (barrons)

- China Stocks Are World’s ‘Best Value Proposition’ to Gavekal (bloomberg)

- Airlines Can Complain About Boeing All They Want. Why It Doesn’t Matter. (barrons)

- Here are 3 things investors need to know about how the Fed might roll back quantitative tightening (marketwatch)

- U.S. initial jobless claims up 25,000 to 214,000 in latest week (marketwatch)

- Insurers Rake In Profits as Customers’ Premiums Soar (wsj)

- China Moves to Boost Bank Lending in Broad Effort to Prop Up Growth (wsj)

- China property stocks jump as Beijing takes steps to boost liquidity in the beleaguered sector (cnbc)

- 5 reasons the stock market rally will broaden in 2024, according to forecaster who nailed 2023’s surge (businessinsider)

- China wants domestic investors to stop buying so much foreign stock (businessinsider)

- Chinese retail investors hit by big losses in ‘snowball’ derivatives (ft)

- Fintech giant Ant Group sets up AI unit led by former Google researcher (scmp)

- Hong Kong stocks recoup US$400 billion, China plans to restore market confidence (scmp)

- Fairlead’s Katie Stockton charts the next move for small caps (cnbc)

“Proud Mary” Stock Market (and Sentiment Results)…

“Proud Mary” is a song by American rock band Creedence Clearwater Revival written by John Fogerty. It was released as a single in January 1969 by Fantasy Records and on the band’s second studio album, Bayou Country. The song became a major hit in the United States, peaking at No. 2 on the Billboard Hot 100 in March 1969, the first of five singles to peak at No. 2 for the group. (Wikipedia) Continue reading ““Proud Mary” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Be int he know. 10 key reads for Wednesday…

- 3M CEO on earnings: We expect a successful 2024 (cnbc)

- Alibaba Gains as Jack Ma, Joe Tsai Buy $200 Million in Stock (bloomberg)

- Cramer’s Mad Dash: 3M (cnbc)

- China Weighs Stock Market Rescue Package Backed by $278 Billion (bloomberg)

- Small-cap stocks had a rough start to 2024 — but could shine the rest of this year, says stock market’s biggest bull (marketwatch)

- China ETFs jump after report Beijing may support its stock market (marketwatch)

- China Appears to Backpedal From Video Game Crackdown (nytimes)

- China reportedly exploring launch of stabilization fund to shore up battered stock market, analyst says it’s ‘necessary’ (streetinsider)

- Chinese stocks soar as Premier Li Qiang calls for ‘forceful’ steps to end rout (scmp)

- Small-Cap Stocks Look Like Winners. It’s Time to Buy (barrons)

Where is money flowing today?

Be in the know. 12 key reads for Tuesday…

- Why China Is Considering Rarely Used Special Bonds to Stimulate Its Economy (bloomberg)

- Bill Gross: Fed Should Stop QT and Lower Rates (bloomberg)

- Expect U.S. stocks to tack on another 5% before the next pullback, veteran Wall Street strategist says (marketwatch)

- Dollar Longs Are Steadily Throwing The Towel In (zerohedge)

- MrBeast reveals he made $250,000 from X video (bbc)

- Votes for Sale! A Startup Is Letting Shareholders Sell Their Proxies (wsj)

- The 20-Year-Old Amateur Who Just Eclipsed Tiger Woods and Phil Mickelson (wsj)

- Gucci Owner Buys Manhattan Building for $963 Million (bloomberg)

- How One Debt-Laden Company Could Create a Storm for Private Jets (wsj)

- Margins will be the key driver of S&P 500 ROE in 2024 – Goldman (streetinsider)

- Exclusive: China moves to support yuan (reuters)

- Alibaba’s online flea market Xianyu launches bricks-and-mortar store in China in latest innovation (scmp)

Where is money flowing today?

Be in the know. 15 key reads for Monday

- The Fed has to start cutting rates to avoid tipping the economy over, and 8 cuts are coming in the next 2 years, Bank of America chief Brian Moynihan says (businessinsider)

- Here’s when Morgan Stanley thinks the Fed will likely start tapering QT (streetinsider)

- Chinese buyers return to Hong Kong’s luxury property market as activity picks up (scmp)

- Companies rush to bond market in record $150bn debt splurge (ft)

- I Rented a Tesla for a 1,600-Mile Road Trip. I’ll Think Twice Next Time. (barrons)

- S., Arab Allies Push Hostage-Release Plan Aimed at Ending Israel-Hamas War (wsj)

- Two important events this week could determine the future of Fed rate policy (cnbc)

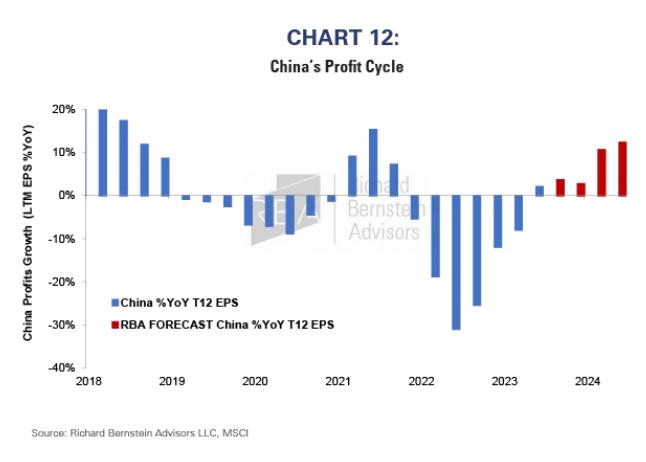

- A bearish signal is flashing for the market’s hottest stocks – and it shows there’s a can’t-miss opportunity brewing for investors, RBA says (businessinsider)

- These are the 30 best investments to make now as US stocks rally to record highs, according to bullish strategists at 3 large investment firms (businessinsider)

- 4 for ’24: Year Ahead Outlook (rba)

- Regional banks pullback is what we’ve been waiting for, says Jim Cramer (cnbc)

- S&P Earnings Estimates (Morgan Stanley)

- S&P Net Profit Margin (Goldman Sachs)

- The Cavalry Comes To Mainland Market’s Rescue, Week in Review (chinalastnight)

- American consumers haven’t been this upbeat about the economy since 2021 (businessinsider)

MONEYSHOW Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 16, 2024

Be in the know. 15 key reads for Sunday…

- Charlie Munger – Daily Journal Corp. (holdings)

- 2024 Performance Car of the Year (roadandtrack)

- Weekly Leading Economic Index (advisorperspectives)

- Alibaba Platforms Fuel $66B in U.S. Product Sales, Spurring Job Growth (alizila)

- Econ Battle Zone: Disinflation Confrontation (npr)

- The Top 20 Landowners In America According To A New Report (forbes)

- 15 Best Dividend Stocks to Buy for 2024 (usnews)

- CT’s top pizza restaurants of 2024, according to Connecticut Magazine (Connecticut Magazine)

- The Car Dealership Billionaire No One Knows (forbes)

- Be Patient: Zuckerberg’s Big New AI Bet Won’t Revolutionize Your Life Anytime Soon (cnet)

- The ‘Seinfeld’ Double-Dip Is Exactly as Gross as It Seems, According to Science (mentalfloss)

- This Is What’s Driving the Big Surge in US Oil Production (bloomberg)

- Rory McIlroy avenges last week’s loss, blitzes field over weekend to cruise to fourth Dubai title (golfdigest)

- Economic slowdown on top of lower inflation begs for major adjustments (scottgrannis)

- Maserati almost couldn’t let go of this early MC12 (classicdriver)