Hedge Fund Tips with Tom Hayes – Podcast – Episode 225

Be in the know. 20 key reads for Saturday…

- Here’s how well investors would’ve fared if they actually heeded the warnings of Soros, Gundlach and others (marketwatch)

- China’s tools for propping up its stock market (cnbc)

- Walgreens, CVS, and Other Pharmacy Chains Are in a World of Hurt. What’s to Blame. (barrons)

- Intel CEO Pat Gelsinger Bought More Stock, Adds to Mobileye Stake (barrons)

- Cleveland-Cliffs Director Bought Up Shares (barrons)

- Expedia’s Falling Stock Is ‘a Nice Contrarian Buy’ After Earnings (barrons)

- S&P 500 Pushes Above 5000 Mark on Economic Strength (wsj)

- We’re Not Eating Enough Bacon, and That’s a Problem for the Economy (wsj)

- These Weird-Looking Skis Are Easy to Use—and Fit in a Backpack (wsj)

- Which is better for stocks — a Super Bowl win for the 49ers or the Chiefs? (marketwatch)

- Lunar New Year 2024: What history says about the stock market and gold in the Year of the Dragon (marketwatch)

- Bank industry earnings weighed down by one-off charges to replenish federal deposit insurance after regional banking crisis (ft)

- The Fed put is back — and in a stronger, more flexible form (ft)

- The commercial real estate crisis will prompt the Fed’s first rate cut in May, top economist says (businessinsider)

- Tech stocks’ huge gains shouldn’t make investors fear dot-com 2.0 (businessinsider)

- Why Crypto Stablecoins Still Worry the Fed (bloomberg)

- Pepsi has accelerated earnings growth: Al Root (foxbusiness)

- Michelin Guide history: How did a tire company become an elite restaurant rating guide? (cnn)

- Wait, Did Elon Musk Just Hint He’s Going to Buy Disney? (futurism)

- 10 of the Best Small-Cap Stocks to Buy Before They Rebound (morningstar)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- Disney has a plan for winning over younger generations: video games (foxbusiness)

- The PBOC has said it will ensure credit grows rapidly and at a sustainable pace throughout 2024 in an effort to spur corporate borrowing and money supply expansion. (bloomberg)

- Big Tech is taking the spoils of the ad resurgence (yahoo)

- Dividend Stocks Make Sense Now. Here Are More Than 20 to Consider. (barrons)

- 1 Artificial Intelligence (AI) Growth Stock With More Upside Than Nvidia to Buy Now, According to Wall Street (fool)

- Is Golf’s Next Paradise in the Middle of a Florida Swamp? (bloomberg)

- Passive investors have ‘fundamentally broken’ the market, David Einhorn says (businessinsider)

- BANK OF AMERICA: Buy these 34 stocks that are among the cheapest you can scoop up right now with pockets of the market loaded with upside opportunity (businessinsider)

- U.S. CPI revisions ‘a nothing burger,’ economists agree (marketwatch)

- Can Dividend Investing Rise From the Dead? (wsj)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

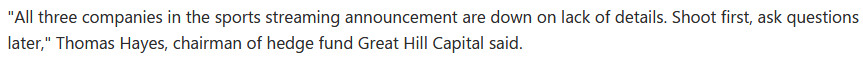

Tom Hayes – Quoted in Reuters article – 2/7/2024

Thanks to Zaheer Kachwala for including me in his article on Reuters. You can find it here: