Data Source: Finviz

Be in the know. 18 key reads for Wednesday…

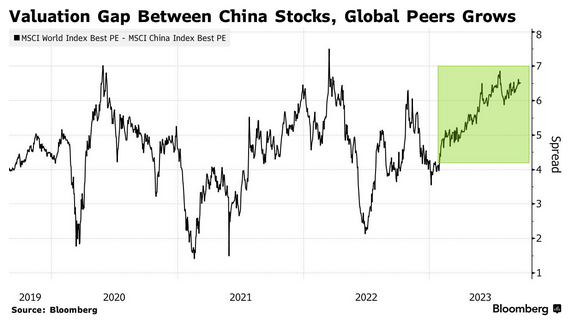

- China Assets Are ‘Ridiculously Cheap,’ Alberta Fund CEO Says (bloomberg)

- Banks Have Problems but Their Stocks Are Cheap. Here Are 5 Worth a Look. (barrons)

- China will just about meet its economic growth target of around 5% for this year, the latest Bloomberg survey shows (bloomberg)

- The Bull Case for the Stock Market Hinges on This Level for the S&P 500 (barrons)

- Amazon Prepares for FTC Fight. A Breakup Might Not Be the Worst Outcome. (barrons)

- For This Pro, China’s Slowdown Won’t Hold Back These Luxury Stocks (barrons)

- China Has Second Thoughts About Controlling Prices in Its Massive Housing Market (wsj)

- Europe’s Secret Weapon at the Ryder Cup Is a Data Geek Called Dodo (wsj)

- IPO Optimism Grows, Fueling Hope for Global Recovery (bloomberg)

- Amgen Could Get a Piece of the Obesity Market (wsj)

- China Starts Local Government Debt Swap Program (bloomberg)

- Musk Warns Biden-Backed 40% UAW Pay-Hike Risks Big 3 Bankruptcy (Again) (zerohedge)

- Nike (NKE) upgraded at CFRA as pullback makes shares more attractive (streetinsider)

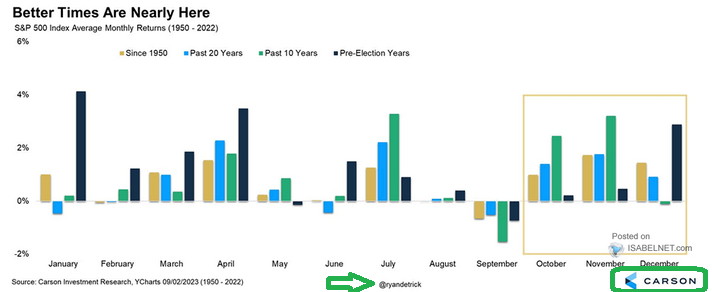

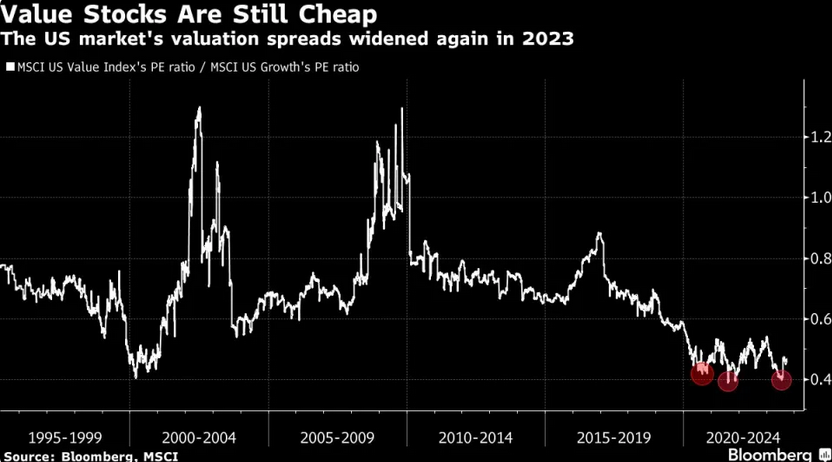

- Rob Arnott sees ‘just near perfect environment for value’ stocks (streetinsider)

- Don’t write off Hong Kong and mainland China despite headwinds, analysts say (scmp)

- FTC’s Amazon antitrust lawsuit faces high bar in US court -experts (reuters)

- China Growth Target Hangs in Balance (bloomberg)

- Emerging markets are ‘big-time on sale’, says NFJ Investment’s John Mowrey (cnbc)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

- Alibaba’s Cainiao Files for $1 Billion-Plus Hong Kong IPO (bloomberg)

- China’s economic situation isn’t as dire as it seems, and policymakers in Beijing were just expecting too much, economist says (businessinsider)

- This Is the ‘Perfect’ Time to Buy Value Stocks on Sticky Inflation, Rob Arnott Says (yahoo)

- Biden Heads to Strike. Can He Square Inflation and Unions? (barrons)

- Why Ford Struck a Deal (barrons)

- A Government Shutdown Is Close. What’s at Stake. (barrons)

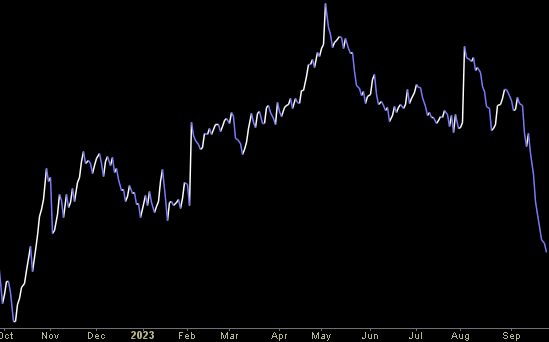

- Hedge funds are boosting bets against U.S. stocks as selloff continues, Goldman Sachs says (marketwatch)

- 11 Beaten-Up Growth Stocks That Look Like Buys—and Aren’t Big Tech (barrons)

- Wall Street analysts expect the S&P 500 to rise 19% over the next 12 months. Here are their 10 favorite stocks. (marketwatch)

- Moody’s warns gov’t shutdown bad for USA’s credit — one month after Fitch downgrade (nypost)

- The Secret Ingredient of ChatGPT Is Human Advice (nytimes)

- Bond Traders Stung by Fed See US Shutdown as Next Big Wild Card (bloomberg)

- Hedge Funds Cut Stock Leverage at Fastest Pace Since 2020 Crash (bloomberg)

- Goldman Sachs: Buy these 22 stocks that will continue to outperform (businessinsider)

- Short Positions Pile Up in Nasdaq Futures, Citi Strategists Say (bloomberg)

- Government shutdown fears rattle US stocks, but history shows upside (streetinsider)

- The elusive Fed ‘soft landing’ nears. Why are Americans so mad about the economy? (reuters)

- Charlie Munger Emphasizes Self-Awareness And Strategy: ‘I Don’t Play In A Game Where The Other People Are Wise And I’m Stupid. I Look For A Place Where I’m Wise And They’re Stupid’ (yahoo)

- The Big Read. The debt-fuelled bet on US Treasuries that’s scaring regulators (ft)

- Economic & Diplomatic Progress Goes Unnoticed By Foreign Investors (chinalastnight)

Where is money flowing today?

Be in the know. 20 key reads for Monday…

- Freshippo Opens a Store a Day in September Expansion Frenzy (alibaba)

- Trendyol’s Path to Profitability in Pictures (alibaba)

- Amazon to Invest Up to $4 Billion in an AI Start-Up. It’s a Warning to Big Tech Rivals. (barrons)

- ‘Get off the train’: Citi CEO sends tough message on big overhaul (ft)

- The IPO Market Might Be Back. Why Investors Should Think Twice About Jumping In. (barrons)

- Utility Stocks Won’t Be This Cheap for Long—and Their Dividends Still Shine (barrons)

- One Auto Union Has Settled. Here Is What It Got From Ford. (barrons)

- Disney, Netflix, Other Media Stocks Rise With End in Sight for Hollywood Writers Strike (barrons)

- Opinion: This bargain-hunting fund manager is finding value in PayPal and other fintech stocks (marketwatch)

- Attention Office Resisters: The Boss Is Counting Badge Swipes (wsj)

- Ford’s Auto Workers in Canada Back Labor Deal With 15% Wage Bump (wsj)

- Theme Parks Pin Hopes on a Fall Rebound After Summer Flop (wsj)

- Ackman Doubles Down on Bond Short That’s Still Flawed (bloomberg)

- Secret ‘James Bond’ Tunnels May Become a Tourist Attraction (bloomberg)

- Opinion: Let’s debunk the bears’ top arguments against further stock market gains (marketwatch)

- Why traders aren’t buying the Fed’s ‘higher-for-longer’ vision (reuters)

- 6 Hong Kong share listings this week set to raise up to US$458 million (scmp)

- China Markets Rebound, Alibaba’s First Spinoff Approaches, Week in Review (chinalastnight)

- The US is on the brink of a new growth cycle (ft)

- Most strategies are focusing on ways to insulate China operations rather than reduce them (ft)

Be in the know. 15 key reads for Sunday…

- What the Fed is overlooking (scottgrannis)

- Starbucks invests $220 million in China’s coffee market expansion (technode)

- Alibaba to inject $2 billion into its Turkish unit as it doubles down on overseas plans (technode)

- Domestic US Banks See Big Deposit Outflows Last Week But Loan Volumes Picked Up (zerohedge)

- U.S. Dollar Double Top? (kimblechartingsolutions)

- Hedge funds rush to unwind bets against gilts (ft)

- America’s Billionaires Love Japanese Stocks. Why Don’t the Japanese? (wsj)

- How Rupert Murdoch Outfoxed American Media (forbes)

- Weekly Leading Economic Index (advisorperspectives)

- The Most Expensive Homes in Every State, From Alabama to Wyoming (robbreport)

- Review: Apple iPhone 15 Pro & Pro Max (maxim)

- A black market, a currency crisis, and a tango competition in Argentina (org)

- How Dumb Money Got So Smart (townandcountrymag)

- How Hollywood insures its biggest stunts (thehustle)

- Rory McIlroy says amateurs are ‘pretty scared’ of this shot. Here’s his easy fix (golf)

Be in the know. 23 key reads for Saturday…

- Disney Stock Could Climb 50%, J.P. Morgan Says (barrons)

- China Market Gloom Spurs Fund Managers to Seek for Hidden Gems (bloomberg)

- Tech money is finally flowing again, and it may be just the beginning (marketwatch)

- Yields Are Near Their Peak. You Shouldn’t Wait to Buy Bonds. (barrons)

- Bank Stocks Are Stronger Than You Think. It’s Time to Get In. (barrons)

- Las Vegas Sphere’s Debut Could Lift 3 Dolan-Linked Stocks (barrons)

- This Busted Bank Merger Is Fixing Itself. Its Stock Is Worth Buying. (barrons)

- China Is in Trouble, but It’s Not as Bad as Some Think (barrons)

- The Stock Market’s Drop Was the Worst Since March. Is It September or Something More Sinister? (barrons)

- UAW Strikes at More GM and Stellantis Sites, But Spares Ford (wsj)

- Novel Approach Would Avoid Shutdown, Force Congress to Keep Working (wsj)

- Five Clues to Where the UAW Strike Is Headed Next (wsj)

- The Hedge Fund Meltdown That Rescued Your Stock Portfolio (wsj)

- Advance Auto Parts Insider Bought Up the Embattled Stock (barrons)

- Auto parts makers’ stocks rally, as UAW’s expanded strike provides a boost (marketwatch)

- The economy is about to slow down. That’s the time for retail stocks, says Goldman Sachs. (marketwatch)

- S. and China Agree to New Economic Dialogue Format (nytimes)

- Raffles London and the new era of super-luxe hospitality (ft)

- Sam Corcos, Co-Founder of Levels — The Ultimate Guide to Virtual Assistants, 10x Delegation, and Winning Freedom by Letting Go (Plus: Creating Leverage with Tools, Systems, and Processes) (#694) (tim)

- Part 3: 10 Of The Best Stock Market Investing Books Of All Time (2023) (acquirersmultiple)

- How Shipping Helps Explain the World (bwater)

- 10 Best Value Stocks to Buy for the Long Term (morningstar)

- Warren Buffett on Living Off Dividends In Retirement (dividendgrowthinvestor)