Data Source: Finviz

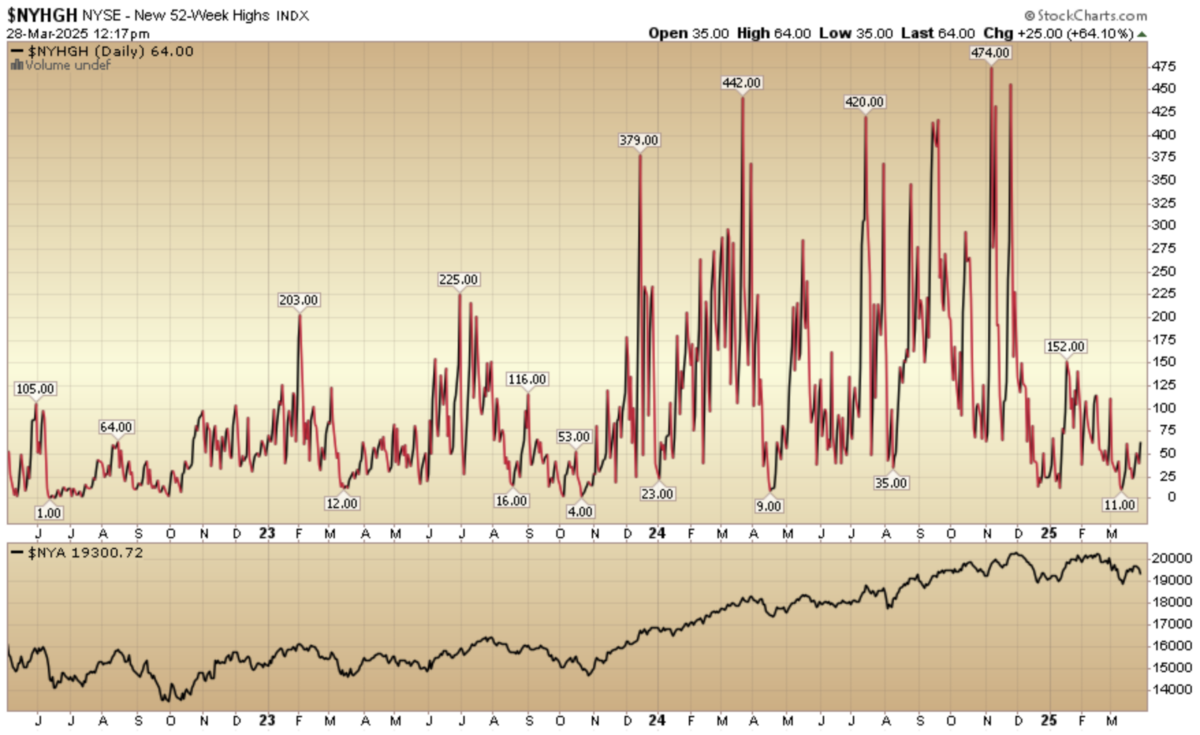

Indicator of the Day (video): NYSE New 52 Week Highs

Quote of the Day…

Be in the know. 23 key reads for Friday…

- Alibaba has staged a quiet $100 billion rally — AI and Jack Ma’s return are at the heart of it (cnbc)

- Alibaba (BABA) PT Raised to $170 at Mizuho, ‘Top Pick in Asia Internet’ (streetinsider)

- Alibaba launches AI model that can process images and video on phones and laptops (scmp)

- Apple Needs a Boost in China. Alibaba Might Have the Key. (barrons)

- Xi Jinping Meets Global Business Leaders Amid Trade Tensions (nytimes)

- Europe’s Industrial Outlook Buoyed by Defense Drive (wsj)

- UK Retail Sales Rise Again as Consumers Enjoy Higher Incomes (bloomberg)

- Trump Turmoil Has Macron Eyeing Euro Challenge to Dollar (bloomberg)

- What Trump’s Auto Tariffs Mean for Car Buyers and Automakers (wsj)

- Why AutoZone and Other Car- Part Stocks Are Gaining on Trump Tariffs (barrons)

- Toyota February Global Sales Rise as Japan Shipments Surge (bloomberg)

- Intel’s New CEO Vows to Compete with Nvidia’s Best AI Server (barrons)

- Three Intel board members to retire in latest shakeup amid turnaround (reuters)

- Etsy-eBay combination would make sense, could be worth $85/share, says Piper (thefly)

- US gas players refocus on Haynesville basin, buoyed by Trump LNG plans (reuters)

- The Best Basic Materials Stocks to Buy (morningstar)

- US pending home sales rebound in February (reuters)

- Poor consumer sentiment is still just talk (ft)

- Core inflation in February hits 2.8%, hotter than expected; spending increases 0.4% (cnbc)

- The Last Time Investors Really Got Excited for Tech Infrastructure (bloomberg)

- Is Ozempic Really the Reason Americans Are Snacking Less? (wsj)

- Lululemon Stock Falls as Financial Guidance Disappoints. Consumers Are Cautious, CEO Says. (barrons)

- Nvidia Stock Drops. Why the Chip Maker Can’t Find Its Footing. (barrons)

Where is money flowing today?

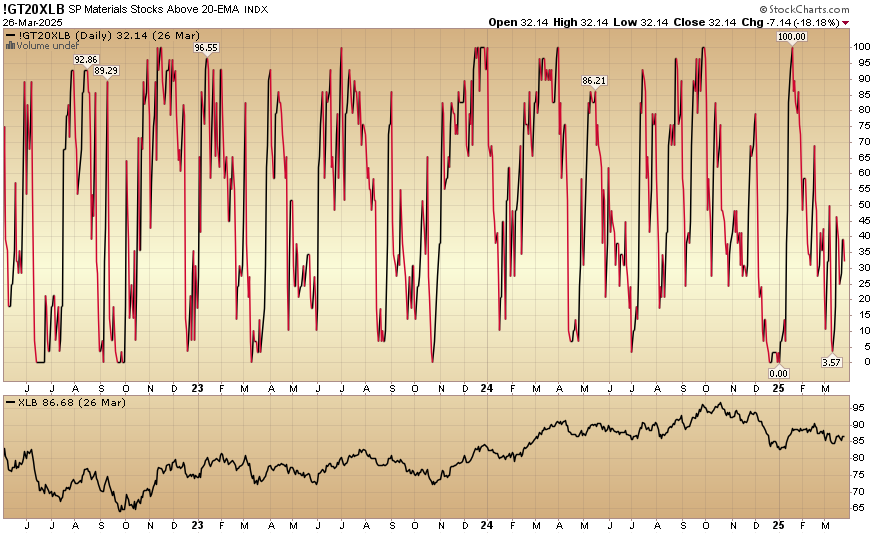

Indicator of the Day (video): S&P Materials Stocks Above 20 EMA

Quote of the Day…

Be in the know. 24 key reads for Thursday…

- Intel CEO Lip Bu Tan Completes $25 Million Stock Buy (barrons)

- Former Intel CEO Pat Gelsinger Makes a Few More Long-Shot Bets (wsj)

- TSMC’s $100bn pledge to Trump will not revive US chipmaking, says ex-Intel chief (ft)

- Alibaba Shows Off New AI Model After Warning U.S. Big Tech. It Looks Made for Apple. (barrons)

- Xiaomi Stock and the Rest of China’s ‘Terrific 10’ Are the Tech Bet for 2025 (barrons)

- China Raises Record $200 Billion From Bonds in Stimulus Signal (bloomberg)

- Chinese consumer companies signal spending is picking up again (cnbc)

- Alibaba launches new open-source AI model for ‘cost-effective AI agents’ (cnbc)

- Vice Premier Promotes Internet Companies (chinalastnight)

- US Economy Grew 2.4% Last Quarter, Faster Than Previous Estimate (bloomberg)

- Bank of America mortgage applications jumped 80% in Q1, executive says (reuters)

- Trump announces 25% auto tariffs. What it means for your next car purchase (usatoday)

- Asian, European Auto Stocks Fall After Trump Pledge to Impose 25% Tariffs on Imported Vehicles (wsj)

- Don’t Blame Trump for All of the Stock Market’s Problems (wsj)

- Bankers Were Dreaming of M&A Riches Under Trump. It Hasn’t Worked Out, Yet (bloomberg)

- U.S. Stocks Will Lag for Some Time. Here’s the Good News. (barrons)

- Hedge Funds Scoop Up Cyclical Stocks as Tariff Fears Swirl (bloomberg)

- Economic Growth Now Depends on Electricity, Not Oil (wsj)

- An Unusually Active Hurricane Season Is in Store for the Atlantic (bloomberg)

- Boeing Stock Could Gain From the Navy’s New Fighter Jet. How to Value the Decision. (barrons)

- Boeing-Lockheed’s Vulcan Approved for US Defense Launches (bloomberg)

- Why Brad Jacobs Is Spending $11 Billion on a Roofing Supply Business (bloomberg)

- Nvidia Stock Slumps. Everything Goes Wrong Everywhere, All at Once. (barrons)

- AI stocks weak on word Microsoft drops data center leases in U.S. and Europe (streetinsider)

“The Times They Are A-Changin'” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Friday, I joined Ash Webster on Fox Business “Varney & Co” to discuss the bottoming process, Warren Buffett, sentiment, positioning, and outlook. Thanks to Ash and Christian Dagger for having me on:

Continue reading ““The Times They Are A-Changin’” Stock Market (and Sentiment Results)…”