- China’s Central Bank Cuts Rates. How It Helps Stocks and the Global Economy. (barrons)

- China Weighs Broad Stimulus With Property Support (bloomberg)

- China Shifts to Stimulus Mode (bloomberg)

- China Opens The Gates To More Easing (zerohedge)

- New study ranks New York as America’s best city of 2023 (nypost)

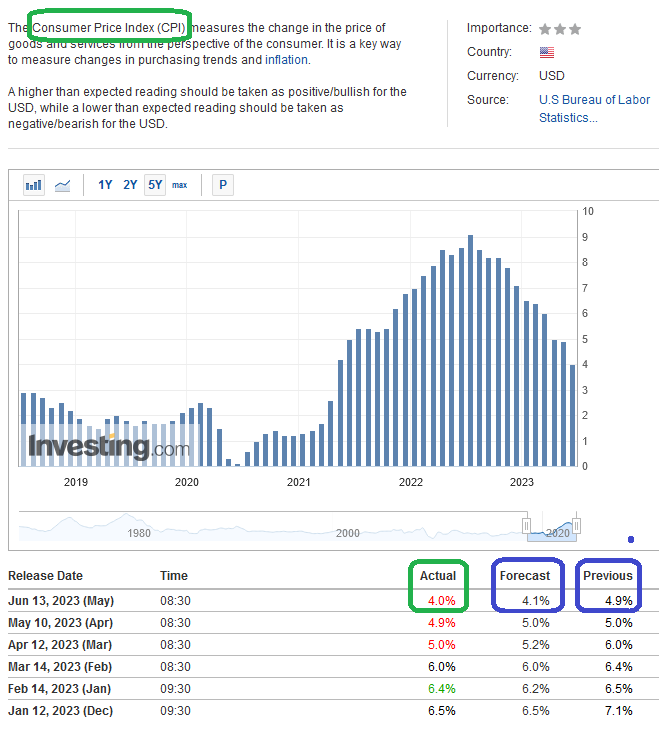

- Inflation rose at a 4% annual rate in May, the lowest in 2 years (cnbc)

- China’s Top Broker Sees Earnings Relief for Hong Kong Stocks (bloomberg)

- Oil prices bounce after China central bank cuts key rate (marketwatch)

- Top 5 China Stocks To Buy And Watch: EV Giant BYD Leads 3 In Buy Zones (investors)

- Intel Could Be Investor in Chip Designer Arm’s Blockbuster IPO (barrons)

- Inflation Slowed Down Again in a Victory for the Fed (barrons)

- Bearish investors are chasing the rally in U.S. stocks. Here’s what that means for the market. (marketwatch)

- Rents Keep Rising, but More Slowly. It’s Good for Inflation. (barrons)

- S. to Allow South Korean, Taiwan Chip Makers to Keep Operations in China (wsj)

- Stock-Market Bulls See Room to Run (wsj)

- Moderating US Inflation Likely to Support Fed Rate Pause (bloomberg)

- Nobel economist Paul Krugman says inflation doesn’t need to get down to 2% and the Fed can back off because people have stopped caring (businessinsider)

- Tech stocks are in a ‘1995 moment’ and poised to boom on the AI revolution, Wedbush says (businessinsider)

- Inflation slows again, CPI shows, and might keep Fed on sidelines (marketwatch)

- China cuts short-term borrowing costs to support recovery (reuters)

Tom Hayes – Public.com Appearance – 6/12/2023

Where is money flowing today?

Be in the know. 24 key reads for Monday…

- Goldman pushes back against bearish Morgan Stanley’s Mike Wilson with new 4,500 S&P 500 target (marketwatch)

- Novartis buys Chinook for $3.5 bln in race to treat rare kidney disease (reuters)

- S. to Allow South Korean, Taiwan Chip Makers to Keep Operations in China (wsj)

- Biogen rises as FDA panel backs Alzheimer’s drug, easing safety concerns (reuters)

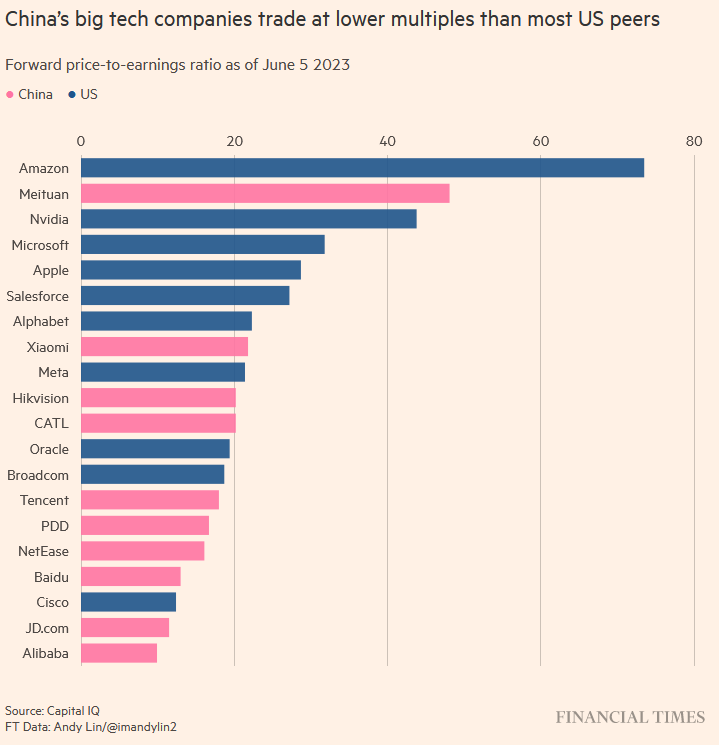

- There are now 252 Chinese groups (companies) trading in the US or Hong Kong that meet the definition of a “net-net” — companies with current assets minus total liabilities greater than their market value, according to S&P Capital IQ. (ft)

- UBS completes Credit Suisse takeover to become wealth management behemoth (reuters)

- Wall Street Firms Up Bets on U.S. Consumers (wsj)

- Jerome Powell’s Big Problem Just Got Even More Complicated (wsj)

- This Company Makes Costco and Amazon’s Store Brands. Its Stock Could Climb 20%. (barrons)

- Rents Keep Rising, but More Slowly. It’s Good for Inflation. (barrons)

- Everyone’s Jumping on the AI Bandwagon—Even Campbell’s Soup (barrons)

- Carnival Stock Rises as Wall Street Sees ‘Zero Signs’ of Slowing Demand Momentum (barrons)

- The Stock Market Says the Fed Will Cut Rates Soon. It Just May Be Right. (barrons)

- S&P 500 exits longest bear market since 1948. What stock-market history says about what happens next. (marketwatch)

- Smile, it’s a bull market in stocks! (yahoo)

- Bye bye bear… New S&P 500 bull market has legs – BofA (streetinsider)

- Hedge Fund Bond Bears Are Relentlessly Shorting Treasuries (yahoo)

- How Hasbro Plans to Revive Its Toy Business (wsj)

- Rudin’s 3 Times Square in NYC lures in new tenants after $25M upgrade (nypost)

- India Inflation Cools Faster Than Expected to 4.25% in May (bloomberg)

- Fed Backs Away From Wages Focus, Bolstering Case for Rate Pause (bloomberg)

- A top analyst says Apple is on the cusp of another monster sales cycle for the iPhone 15 and its share price will break more records (businessinsider)

- Goldman Sachs: These are the 24 best AI stocks to buy now as the technology boosts productivity and profits for decades (businessinsider)

- China’s Plane Shortage Is Good News For Boeing (bloomberg)

Be in the know. 10 key reads for Sunday…

- China’s Inflation Problem? It Has None (wsj)

- Google’s Generative AI Platform Is Now Available To Everyone (forbes)

- CEO Talk Of “Shrink” Hits Record On Earnings Calls Amid Nationwide Shoplifting Crisis (zerohedge)

- Wall Street’s Biggest Bear Admits Defeat: “The Bear Market Is Officially Over… New Bull Market Has Legs” (zerohedge)

- June’s Quad Witching Options Expiration Riddled With Volatility (almanac trader)

- The World’s 18 Highest-Paid Golfers 2023 (forbes)

- Review: The New Lamborghini Urus S Shows Why It’s Among the Best in Its Elite Class (robbreport)

- apple vision pro: all the details of the newest virtual & augmented reality headset (designboom)

- How Much Aid Has the U.S. Sent Ukraine? Here Are Six Charts. (cfr)

- Lights, camera, action! Why U.S. Open-host Los Angeles just may be the golfiest place in America (golf)

Be in the know. 15 key reads for Saturday…

- FDA Advisory Committee Votes in Favor of Biogen Alzheimer’s Drug (barrons)

- Opinion: Biotech stocks could soon get a M&A boost. Here are 3 likely takeover plays. (marketwatch)

- AI Stocks Aren’t in a Bubble. Look at the Numbers. (barrons)

- Why ‘Shareholder Yield’ Is Better Than Dividend Yield. Where to Find It. (barrons)

- Accelerated adoption of AI will drive growth in the public cloud players (barrons)

- Molson Coors Gets Another Bud Light-Driven Upgrade (barrons)

- Snowflake Stock Sees Big Buy From Director Mark D. McLaughlin (barrons)

- Copper Traders Are Net Long. That’s a Good Sign for the Red Metal. (barrons)

- Here’s the main driver of the S&P 500’s bull-market rally, according to Fundstrat’s Tom Lee (marketwatch)

- Vista Equity President David Breach Sees Early Signs of Relief in IPO Bottleneck (bloomberg)

- US Household Net Worth Climbs as Stock Rally Offsets Real Estate Drop (bloomberg)

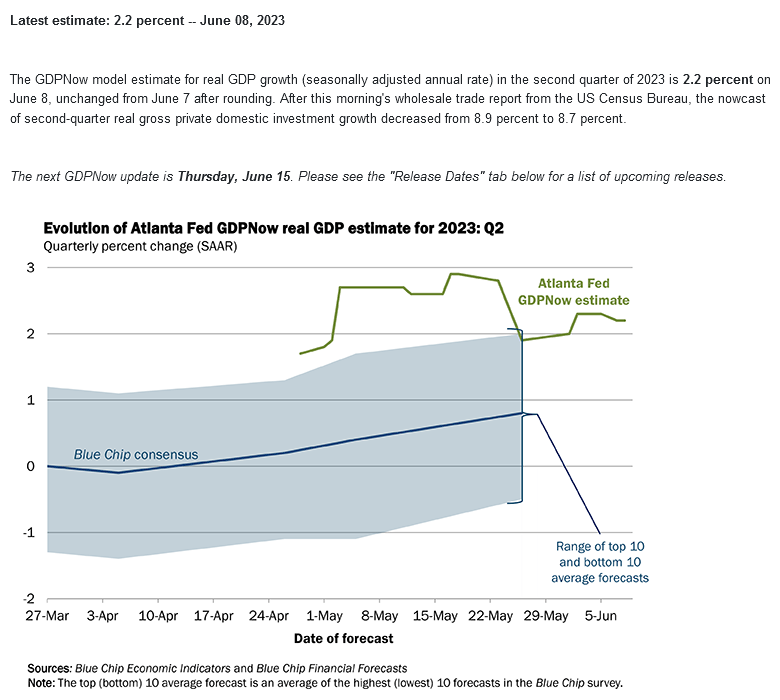

- The stock market is headed for a critical week as investors brace for new inflation data and a key Fed meeting (businessinsider)

- 10 Best Blue-Chip Stocks to Buy for the Long Term (morningstar)

- 5 Book Recommendations From Mohnish Pabrai (acquirersmultiple)

- JPMorgan CEO Jamie Dimon: The economy is still doing fine (cnbc)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 190

Article referenced in VideoCast above:

“The One That Got Away” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 180

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- CSRC: Delisting Risk of US-listed CN Firms Subsides Hugely (aastocks)

- Alibaba Cloud wins deal with coal giant in bid to woo state-owned firms (scmp)

- BABA Dumps 70M SENSETIME Shrs on Mon to Pocket Over $150M (aastocks)

- S&P 500 Starts a New Bull Market as Big Tech Lifts Stocks (wsj)

- CSRC vice-chairman sees more foreign fund flows into A shares despite concerns (scmp)

- Amazon’s stock could be a sleepy AI play, according to UBS (marketwatch)

- Small-cap stocks just experienced their most explosive rally ever by this measure (marketwatch)

- China Central Bank Governor Reiterates Stable Policy Stance (bloomberg)

- Asos turnaround pace frustrates fast-fashion firm’s investors (sky)

- Tesla Stock Leaps On GM Charging Deal. Analyst Calls Move ‘Game, Set, Match’ For Market Control. (investors)

- Biogen Takes Alzheimer’s Drug to FDA Advisers (barrons)

- Less Haggling, More Upselling: How EVs Will Change How You Buy a Car (wsj)

- Boeing Is Rising Again as Travel Rebound Lifts Aviation Stocks (barrons)

- China Stocks Mixed After Weak Inflation Data. Hopes Rise for More Stimulus. (barrons)

- NYC mogul John Catsimatidis offers to buy CNN — and run it for just $1 per year (nypost)

- China Deflation Risk Prompts PBOC Governor to Downplay Fears (bloomberg)

- ‘Buying the dip’ is making a major stock-market comeback in 2023 as strategy heads for 3rd-best year ever (marketwatch)

- Used car prices drop for second straight month (foxbusiness)

- Wall Street has a new favourite phrase and it’s utterly nauseating (ft)

- com Beats as Chinese Travelers Pack Their Bags, Markets React to Major Policy Makers’ Speeches in Shanghai (chinalastnight)