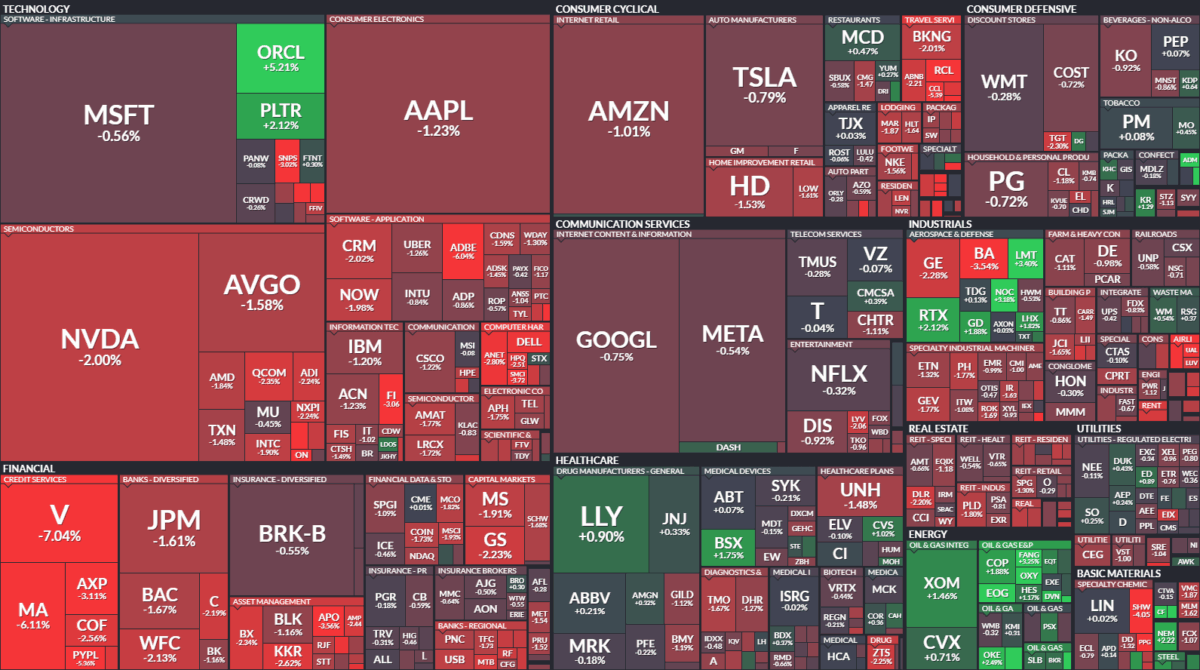

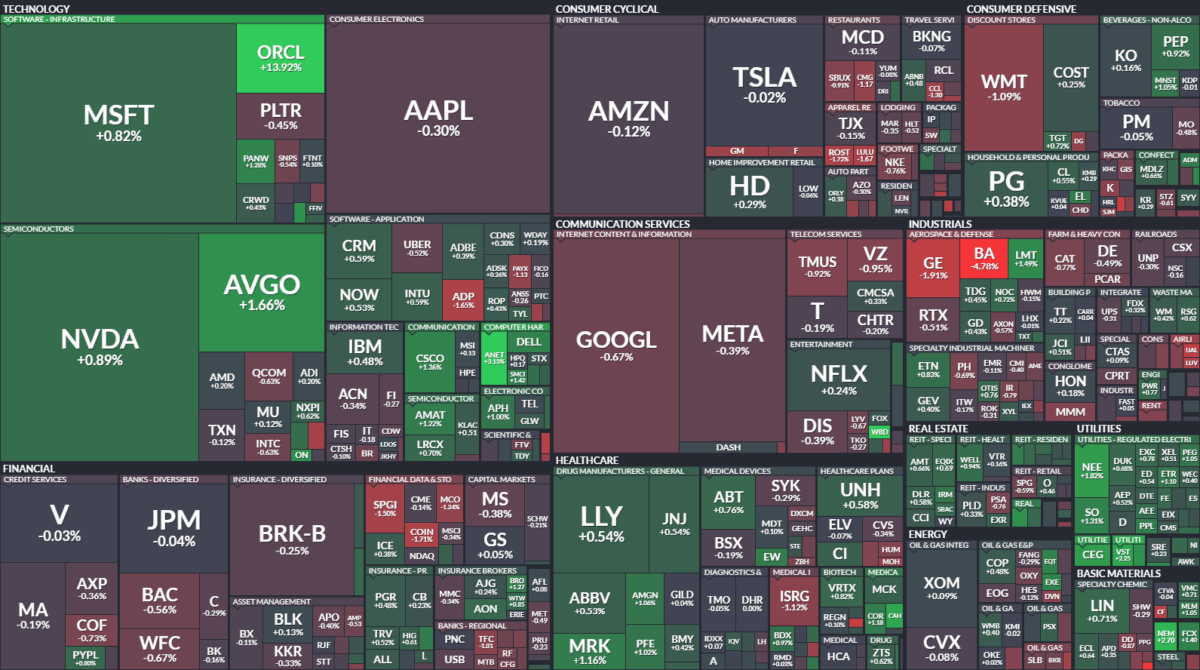

Data Source: Finviz

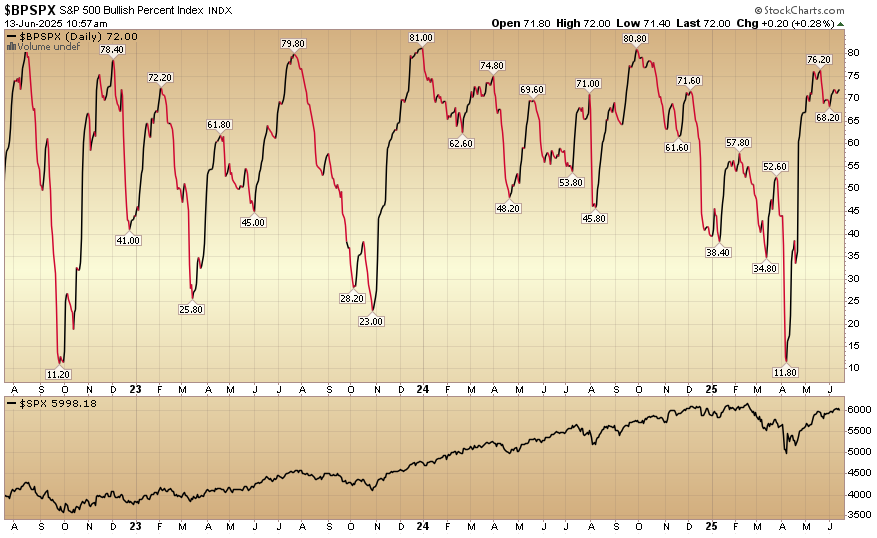

Indicator of the Day (video): S&P 500 Bullish Percent

Quote of the Day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 21 key reads for Friday…

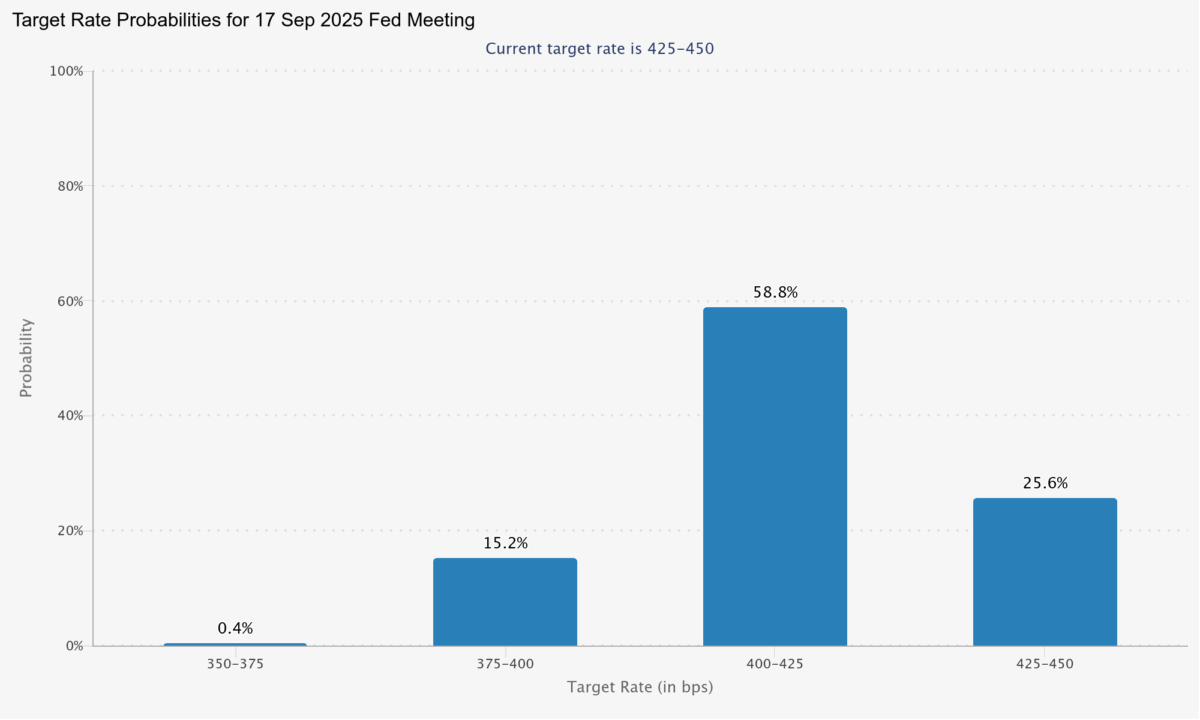

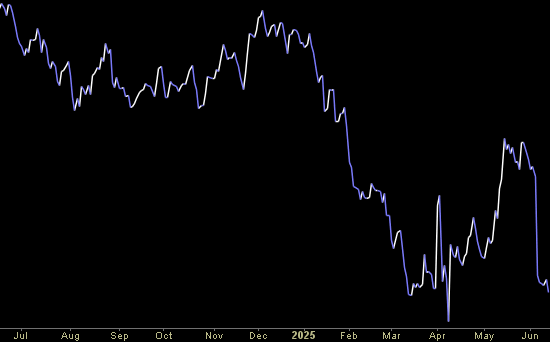

- Traders Resume Fully Pricing In Two Fed Rate Cuts This Year (bloomberg)

- Rate-Cut Optimism Buoys Wall Street (wsj)

- The Case for Rate Cuts Is Growing (wsj)

- Easing US Capital Rules Will Cut Treasury Yields, Eurizon’s Jen Says (bloomberg)

- Dollar’s Slump Is Worst Since 1980s. Don’t Expect a Quick Rebound. (barrons)

- Morgan Stanley says the new ’bull case’ for stocks is emerging (streetinsider)

- UBS identifies stock winners amid structural growth tailwinds (streetinsider)

- Trend-Followers Stumble Into One of Their Worst Years (institutionalinvestor)

- Mortgage rates under 7% as housing leans into buyer’s market (yahoo)

- Data Centers Pose Threat to Electric Grids, US Regulator Says (bloomberg)

- Your Electric Bill Is Rising Faster Than Inflation. Here’s Why. (wsj)

- Alibaba Movie Unit’s Pivot, Rebrand Bring $2 Billion Value Gain (bloomberg)

- Global EV sales rise in May as China hits 2025 peak -Rho Motion (reuters)

- Walmart, Aflac and 8 Other Dividend Aristocrats That Also Wear Buyback Crowns (barrons)

- The Best Healthcare Stocks to Buy (morningstar)

- The Only Remedy for Intel’s Woes May Be a Breakup (wsj)

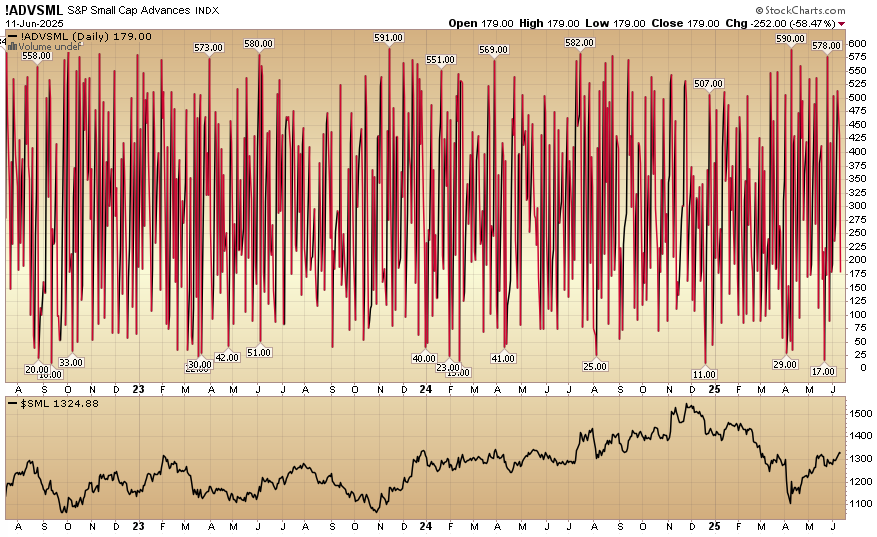

- US Equity Funds Hit by Biggest Outflows in 11 Weeks, BofA Says (bloomberg)

- Beverage giants target ‘fourth category’ of alcoholic drinks to bring in younger generation (foxbusiness)

- This bull market is alive and well, says Carson Group’s Ryan Detrick (youtube)

- Estee Lauder Launches in the Amazon.ca Premium Beauty Store (investing)

- How PayPal is using Venmo, Honey transactions to win over marketers to its ads business (digiday)

Tom Hayes – BBC World Business Report Appearance – 6/11/2025

BBC World Business Report Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 11, 2025