Tom Hayes – Quoted in Reuters article – 2/1/2023

Thanks to Ankika Biswas, Johann M Cherian and Shreyashi Sanyal for including me in their article on Reuters today:

Click Here to View The Full Reuters Article

Be in the know. 18 key reads for Wednesday…

- Xi Urges Efforts to Spur Consumption to Propel Economic Rebound (bloomberg)

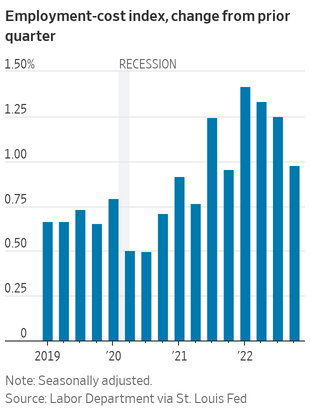

- Cooler Pay Gains Add to Debate on When Fed Might Pause Rate Hikes (wsj)

- China’s Consumers Drive Rebound in Economic Activity (wsj)

- Fed Day Is Here. Jerome Powell’s Tone Will Say It All. (barrons)

- Macau Is Back, Baby. But Choose Your Stock Bets Wisely. (wsj)

- Viktor Shvets Declares Victory for Team Transitory and the Soft Landing (bloomberg)

- Wednesday, February 1, 2023 The Energy Report (Phil Flynn)

- Eurozone’s Economy Outpaced China and U.S. in 2022 (wsj)

- GM’s Fourth-Quarter Profit Soared as Supply-Chain Problems Eased (wsj)

- Gundlach Suspects Fed Will Push Back Against Pivot Narrative (bloomberg)

- Geely’s Lotus Going Public via SPAC at $5.4 Billion Valuation (bloomberg)

- OPEC+ Keeps Output Steady Amid Uncertainty on China and Russia (bloomberg)

- Private payroll growth slowed to 106,000 in January as weather hit hiring, ADP says (cnbc)

- Homebuilder stocks surge after earnings reveal improving demand from buyers despite high mortgage rates (businessinsider)

- US Factory Gauge Falls for Fifth Month to Lowest Since May 2020 (bloomberg)

- Fed Preview: 25bps And Then “The End Is Very Much In Sight” (zerohedge)

- Oppenheimer confident in Amazon (AMZN) 2023/24 AWS revenue estimates (streetinsider)

- Amazon’s Buy with Prime could add $1bn-$3bn in annual EBIT – Morgan Stanley (streetinsider)

Tom Hayes – Quoted in Reuters article – 1/31/2023

Thanks to Manya Saini for including me in her article on Reuters today:

Click Here to View The Full Reuters Article

Where is money flowing today?

Tom Hayes – Yahoo! Finance Appearance – 1/31/2023

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 31, 2023

Watch in HD directly on Yahoo! Finance

Be in the know. 15 key reads for Tuesday…

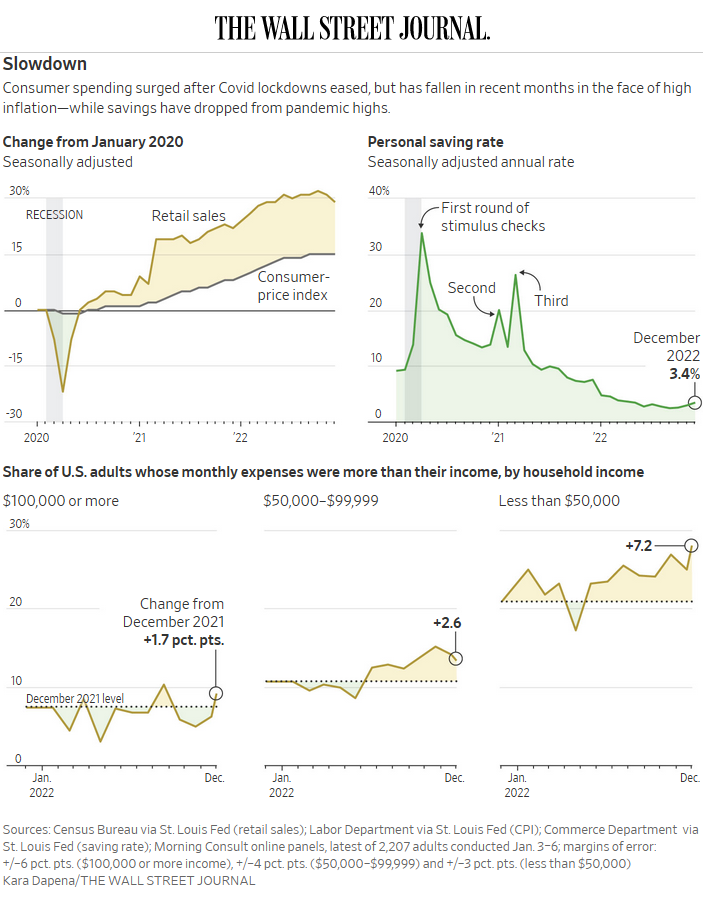

- The U.S. Consumer Is Starting to Freak Out (wsj)

- GM’s Profit Soars as Supply-Chain Problems Ease (wsj)

- Worker Pay Gains Cooled Modestly Late Last Year (wsj)

- China’s Economic Activity Rebounds Sharply After Reopening (bloomberg)

- Foreigners Scoop Up China Shares With January Inflow at Record (bloomberg)

- M.F. Upgrades Global Outlook as Inflation Eases (nytimes)

- Meta Turnaround Could Trap Bears (wsj)

- Pfizer Bids Adieu to Covid Boom Years (wsj)

- New China Rule Threatens to Disrupt U.S. Solar Ambitions (wsj)

- Ford Cuts Prices of EV Mustang Mach-E (wsj)

- Why Auto Marketing Looks Poised for Growth in 2023 (wsj)

- Why China Will Never Lead on Tech (wsj)

- Fed Meeting Preview: Powell Won’t Break S&P 500 Rally; Wage Growth Eases (investors)

- What the Stock Market’s Strong January Means for the Rest of the Year (barrons)

- Home Prices Are Slowing (barrons)

Tom Hayes – TVRI World Appearance – 1/30/2023

TVRI World – Thomas Hayes – Chairman of Great Hill Capital – January 30, 2023

Watch Directly on TVRI World

Where is money flowing today?

Be in the know. 25 key reads for Monday…

- China Vows to Boost Consumption to Power Economic Recovery (bloomberg)

- China Stocks Set to Enter Bull Market on Return From Holidays (bloomberg)

- Hedge Funds Boost Treasury Shorts to Record on Doubts Over Rally (bloomberg)

- China’s Tourist Sites Swarmed During Holiday Despite Covid Risks (bloomberg)

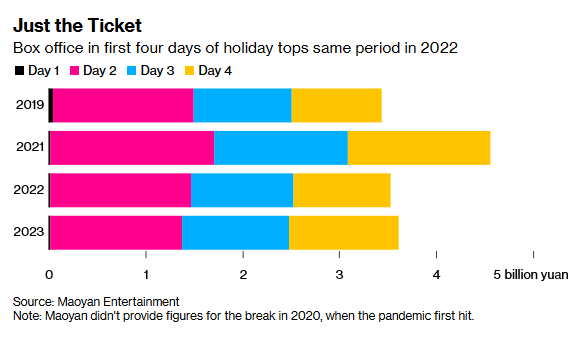

- China Holiday Travel, Box Office Rebound After Covid Zero (bloomberg)

- China Junk Dollar Bond Prices Swing From Record Low to Longest Winning Streak (bloomberg)

- Short Sellers Feel the Pain in Stock Market’s 2023 Rally (wsj)

- Israel Strikes Iran Amid International Push to Contain Tehran (wsj)

- China PBOC Extends Monetary Policy Tools for Green Sector (bloomberg)

- Taiwan Stocks Poised for Bull Market as Chip Shares Extend Gains (bloomberg)

- Bull Market Beckons China Stock Traders as Consumption Revs Up (bloomberg)

- Fed Set to Shrink Rate Hikes Again as Inflation Slows (bloomberg)

- China Says Covid Deaths Fell Even as Lunar Holiday Spread Virus (bloomberg)

- Indonesia Signals End of Hikes as Fed Peak Rate Comes to View (bloomberg)

- Chinese Search Giant Baidu to Launch ChatGPT-Style Bot (bloomberg)

- Fed Debates Whether Wages or Low Unemployment Will Drive Inflation (wsj)

- How Nasdaq’s Stellar Run Could Squash Tech’s Bear Market (barrons)

- The Stock Market Has Flipped the Script. What’s Behind the Reversal. (barrons)

- Dollar’s Decline Is a Rare Nasdaq Tailwind as Earnings Loom (bloomberg)

- Crash Test This Week for Market Versus Real World (bloomberg)

- Wharton professor Jeremy Siegel says the Fed risks sparking a disaster if it hikes rates higher than markets are expecting at its upcoming meeting (businessinsider)

- Buyback Blackout Ends With A Bang: Why Goldman’s Trading Desk Sees Rally Lasting Until Mid-Feb (zerohedge)

- Ford to cut prices while ‘significantly’ increasing Mach-E production amid Tesla cuts (streetinsider)

- Lowe’s successfully tests system to solve organized retail crime (foxbusiness)

- The Year of The Rabbit Hops To It (chinalastnight)