- Xi Urges Efforts to Spur Consumption to Propel Economic Rebound (bloomberg)

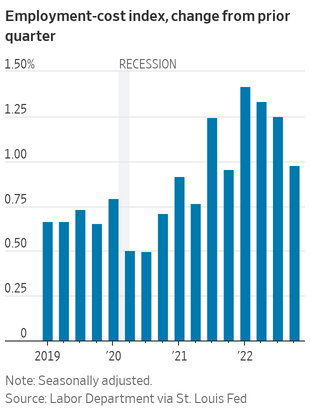

- Cooler Pay Gains Add to Debate on When Fed Might Pause Rate Hikes (wsj)

- China’s Consumers Drive Rebound in Economic Activity (wsj)

- Fed Day Is Here. Jerome Powell’s Tone Will Say It All. (barrons)

- Macau Is Back, Baby. But Choose Your Stock Bets Wisely. (wsj)

- Viktor Shvets Declares Victory for Team Transitory and the Soft Landing (bloomberg)

- Wednesday, February 1, 2023 The Energy Report (Phil Flynn)

- Eurozone’s Economy Outpaced China and U.S. in 2022 (wsj)

- GM’s Fourth-Quarter Profit Soared as Supply-Chain Problems Eased (wsj)

- Gundlach Suspects Fed Will Push Back Against Pivot Narrative (bloomberg)

- Geely’s Lotus Going Public via SPAC at $5.4 Billion Valuation (bloomberg)

- OPEC+ Keeps Output Steady Amid Uncertainty on China and Russia (bloomberg)

- Private payroll growth slowed to 106,000 in January as weather hit hiring, ADP says (cnbc)

- Homebuilder stocks surge after earnings reveal improving demand from buyers despite high mortgage rates (businessinsider)

- US Factory Gauge Falls for Fifth Month to Lowest Since May 2020 (bloomberg)

- Fed Preview: 25bps And Then “The End Is Very Much In Sight” (zerohedge)

- Oppenheimer confident in Amazon (AMZN) 2023/24 AWS revenue estimates (streetinsider)

- Amazon’s Buy with Prime could add $1bn-$3bn in annual EBIT – Morgan Stanley (streetinsider)

Be in the know. 18 key reads for Wednesday…