Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in Reuters article – 2/8/2023

Thanks to Shubham Batra and Johann M Cherian for including me in their article on Reuters today:

Be in the know. 10 key reads for Wednesday…

- Forget Bed Bath & Beyond’s Stock. Look at Its Bonds. (barrons)

- Biden Puts Semiconductors at the Forefront (wsj)

- China’s economy will grow 5% this year, Fitch Ratings says in upgraded forecast (cnbc)

- US junk bonds rally on economic ‘soft landing’ bets (ft)

- CVS Health reports big revenue beat, on the heels of $10.6 billion deal to buy Oak Street Health (marketwatch)

- Royal Caribbean launches debt offering due 2030, to refinance debt due 2023 and 2024 (marketwatch)

- No wonder Powell didn’t commit to extra hikes. Here are five reasons the January jobs report may be too good to be true. (marketwatch)

- Why Biden’s 4% buyback tax could boost stock prices and dividends (marketwatch)

- The Investor Behind the $1 Billion Bet on Bed Bath & Beyond (wsj)

- Home-Buying Companies Stuck With Hundreds of Houses as Demand Slows (wsj)

- Alibaba Stock Jumps On ChatGPT News, But Is BABA Stock A Buy Now? (investors)

- Fed’s Powell says strong jobs report shows why more rate hikes may be needed (usatoday)

- Wall Street Veteran Explains Why He’s Still All-In on US Housing (bloomberg)

- Chinese food delivery firm Meituan plans to hire 10,000 workers as U.S. tech giants ax jobs (cnbc)

- Alibaba (BABA) stock rises on report it is developing ChatGPT-like AI bot (streetinsider)

- A Jim Simons Market Mystery — Solved? (institutionalinvestor)

- Elon Musk Reacts As ‘Big Short’ Michael Burry Finds His Way Back On Twitter To Take Back ‘Sell’ Call (benzinga)

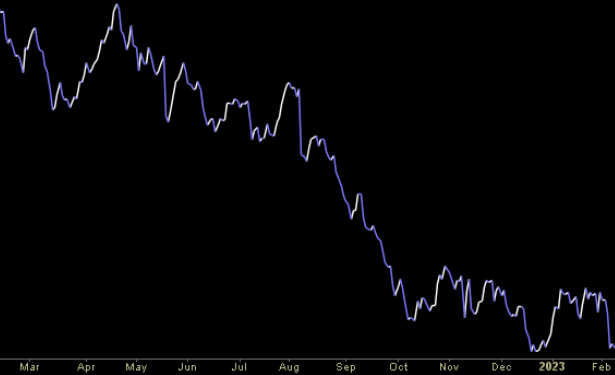

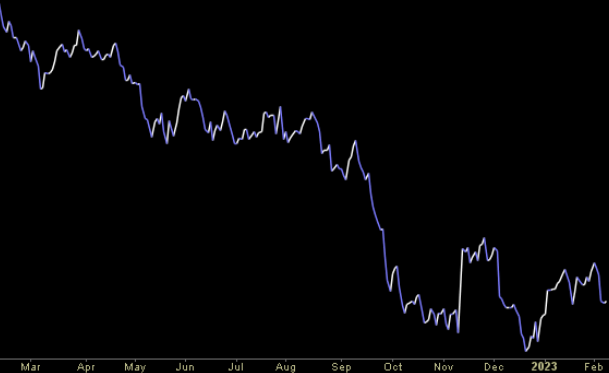

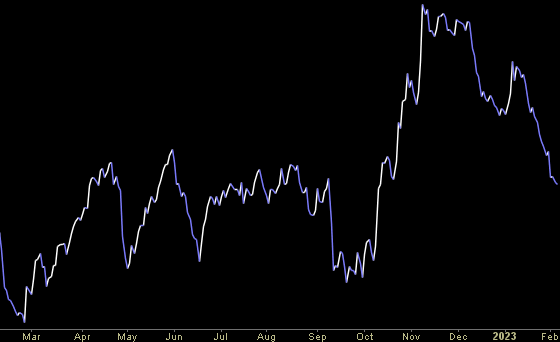

Tom Hayes – Quoted in Reuters article – 2/7/2023

Thanks to Ankika Biswas and Medha Singh for including me in their article on Reuters today:

Tom Hayes – Public.com Appearance – 2/7/2023

Where is money flowing today?

Be in the know. 22 key reads for Tuesday…

- Deals Are Creeping Back. Don’t Expect a Surge Just Yet. (barrons)

- Rangers’ Jacob Trouba delivers helmet-launching hit, dominates ensuing fight (nypost)

- The Market’s Breadth Is Improving as More Stocks Join Rally (wsj)

- CVS Nears Deal for Oak Street Health. The Sector Could Be Hot for M&A in 2023. (barrons)

- How the U.S. dollar could put this stock-market rally to a big test (marketwatch)

- Pfizer Is Moving Beyond Covid. Why Its Stock Is a Buy. (barrons)

- Biotech Stocks Will Mean a Big Year for Deals. Who Could Benefit. (barrons)

- The IPO market froze in 2022. Here’s what’s needed for it to thaw in the new year (marketwatch)

- Illumina Attracts Challengers for DNA Sequencing Ahead of Earnings (barrons)

- Housing Market Shows Signs of Thawing (wsj)

- Boeing plans to cut about 2,000 finance and HR jobs in 2023 (nypost)

- Inflation-battered shoppers turn to dollar stores for groceries (nypost)

- China’s richest ‘will keep buying luxury goods’ as middle classes tighten belt (scmp)

- Indonesia may raise nearly US$2 billion from 3 state company IPOs (scmp)

- Balloon Pops Blinken’s Visit, For Now (chinalastnight)

- Google unveils ChatGPT rival Bard, AI search plans in battle with Microsoft (reuters)

- JPMorgan’s Kolanovic Calls Latest Stock Rally a Bear-Market Trap (yahoo)

- These Are the Top 10 Holdings of Carl Icahn (247wallst)

- Can This Billionaire Drive Lotus Better Than Richard Gere? (bloomberg)

- What will TV look like in three years? These industry insiders share their predictions (cnbc)

- Trader Positioning Ahead Of Powell Hints At Another Delta Squeeze (zerohedge)

- Adani Companies Report Profits, Easing Market Rout (wsj)