Where is money flowing today?

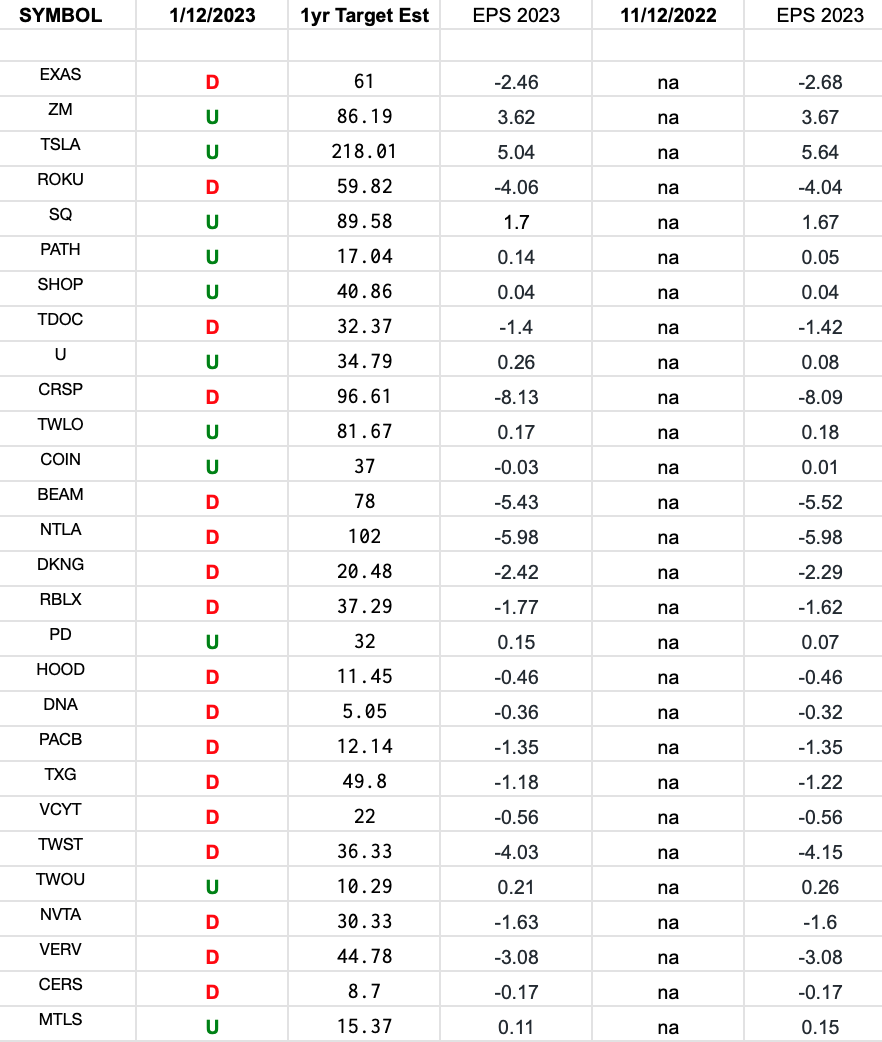

ARKK Innovation Fund Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund top 30 weighted stocks.

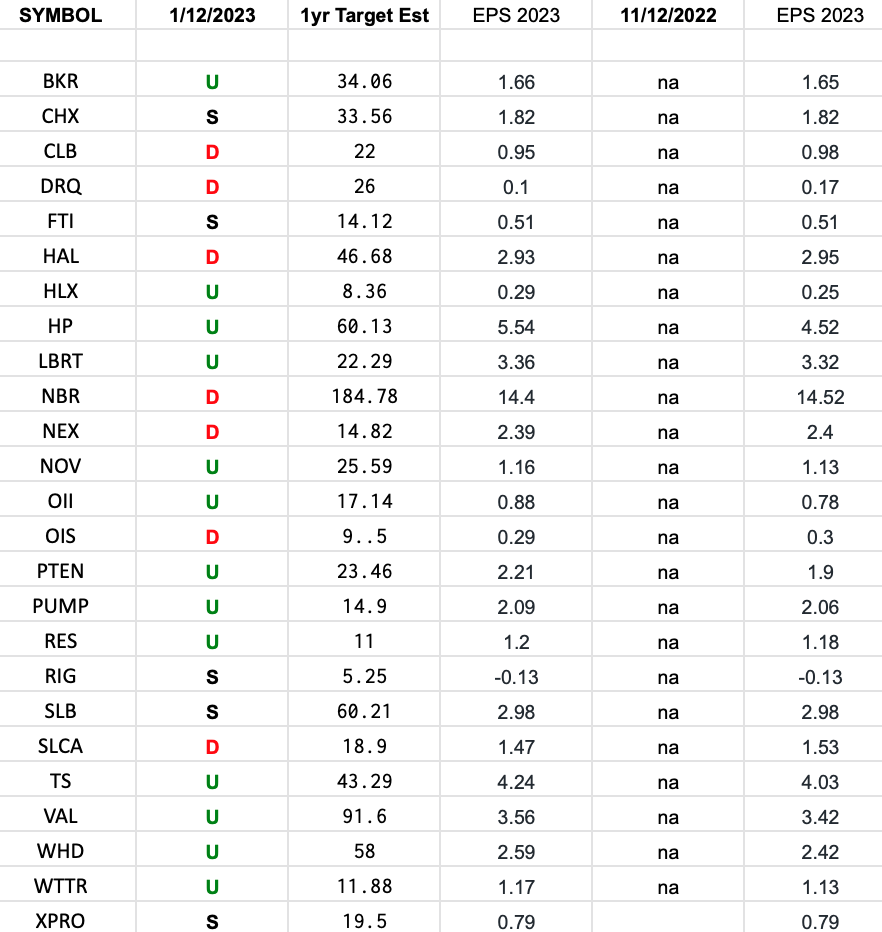

Oil Services (OIH) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil Services Sector (OIH). I have columns for what the 2023 estimates were on 11/12/2022 and today.

Continue reading “Oil Services (OIH) – Earnings Estimates/Revisions”

Be in the know. 11 key reads for Thursday…

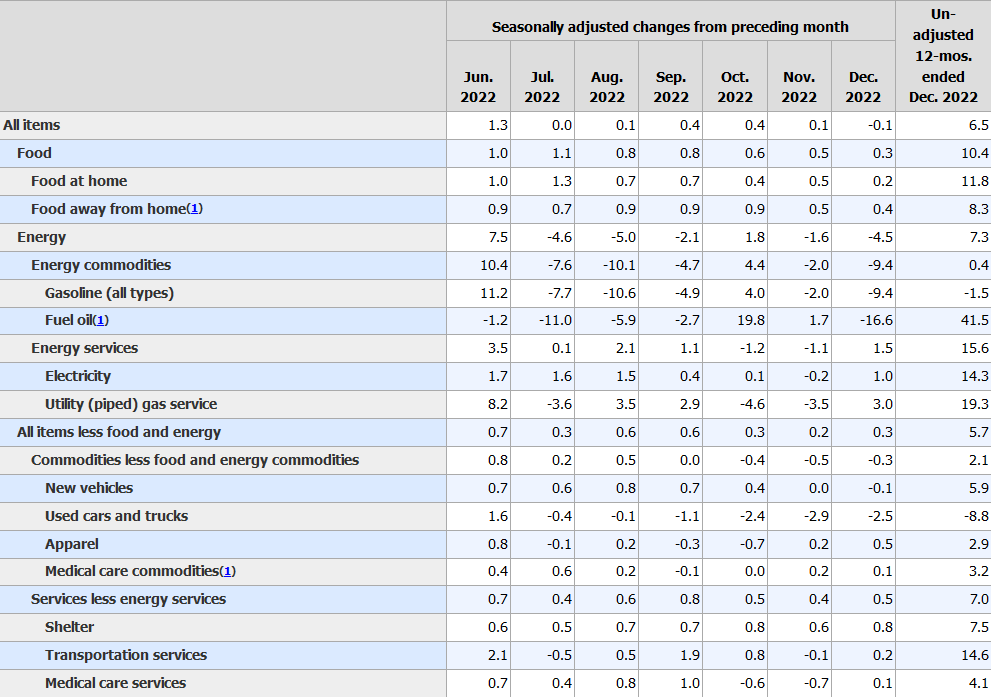

- Consumer Price Index Summary (bls)

- US Inflation Cools Again, Putting Fed on Track to Downshift (bloomberg)

- Inflation rate softens to 6.5% at the end of 2022 and clears path for slower Fed rate hikes (marketwatch)

- Rent Prices Take a Breather. Why Housing Stocks Are for Serious Buyers. (barrons)

- Why value stocks will struggle to repeat their vast 2022 outperformance in 2023 (marketwatch)

- Investors Look to Corporate Reports With Low Expectations (nytimes)

- Fed President Backs Slowdown as Support Mounts for Smaller Rate Move (nytimes)

- Boeing (BA) shares upgraded at Credit Suisse on improved execution (streetinsider)

- TSMC fourth quarter profit beats expectations on robust chip demand (streetinsider)

- Amazon (AMZN) is the most undervalued mega-cap, followed by Meta (META) and Google (GOOGL) – survey (streetinsider)

- Hong Kong to Return as a Top Property Investment Location (bloomberg)

“Friends in Low Places” Stock Market (and Sentiment Results)…

“Friends in Low Places” is a song recorded by American country music artist Garth Brooks. It was released on August 6, 1990 as the lead single from his album No Fences.

Continue reading ““Friends in Low Places” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance Appearance – 1/11/2023

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 11, 2023

Watch FULL interview in HD directly on Yahoo! Finance

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 22 key reads for Wednesday…

- China Is Opening Fast. Don’t Miss the Rebound for Stocks. (barrons)

- The Rest of the World Is Running With the Bulls (bloomberg)

- Shanghai eyes 5.5 per cent consumption-led economic growth for 2023 (scmp)

- Used car prices post biggest drop ever as new luxury car sales boom (yahoo)

- Jamie Dimon Is Changing His Tune About an Economic Hurricane. He’s Not Alone. (barrons)

- Trust the bond market, not the Fed, on interest rates, Gundlach says (marketwatch)

- 18 stock picks in a ‘Goldilocks’ scenario for U.S. consumers (marketwatch)

- Rents Take a Breather. Why Housing Stocks Are for Serious Buyers. (barrons)

- European Stocks Are Outshining U.S. Peers (wsj)

- Disney Adds Lower Priced Theme Park Access and Perks (wsj)

- China Jet Fuel Demand Set To Soar Ahead Of Lunar New Year (zerohedge)

- Hedge Fund Shorting Of Tech Stocks Hits Record High, Goldman Prime Finds (zerohedge)

- JPM Trading Desk Sees 85% Odds CPI Print Will Push S&P At Least 1.5% Higher (zerohedge)

- Where The World’s Ultra-Wealthy Live (zerohedge)

- Analysts praise Boeing (BA) after ‘strong’ December orders/deliveries (streetinsider)

- Activist investor Bluebell Capital builds stake in Bayer AG, pushes for breakup reports Bloomberg (streetinsider)

- As Infrastructure Money Lands, the Job Dividends Begin (nytimes)

- Fed’s No-Rate-Cut Mantra Rejected by Markets Seeing Recession (bloomberg)

- China Shows Why Emerging-Markets Investing Is So Much Fun (bloomberg)

- Mortgage refinance demand surges, as homeowners take advantage of lower interest rates (cnbc)

- Iconic West Coast burger chain heads east in big expansion (foxbusiness)

- What Terry Smith gets wrong (and right) this time on Unilever (ft)