“Friends in Low Places” is a song recorded by American country music artist Garth Brooks. It was released on August 6, 1990 as the lead single from his album No Fences.

Given current market conditions and sentiment going into earnings season (starting Friday), I think we should modify the title to “Friends with Low Estimates!”

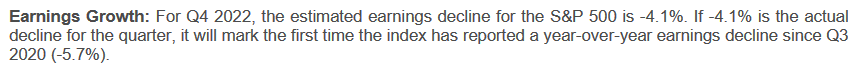

I find it curious that the earnings estimates for Q4 earnings season (of the top 500 US traded public companies) is –4.1%.

Source: Factset

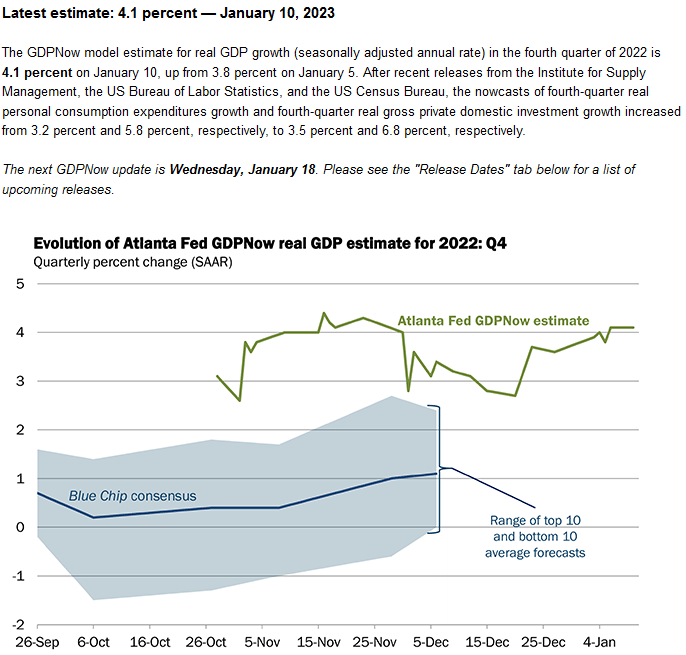

At the same time, Atlanta Fed’s GDP tracking tool GDPNow is saying GDP for Q4 tracked at +4.1%. One of them is going to be materially wrong and my bet is company earnings (are too low). With expectations so low, it sets up for a period of positive surprises moving forward.

Yahoo! Finance – Expectations, Outlook and Investment Ideas

On Wednesday I joined Seana Smith and Dave Briggs to discuss markets. Thanks to Tayor Clothier, Sydnee Fried, Seana and Dave for having me on:

Watch FULL interview in HD directly on Yahoo! Finance

Emerging Markets – CNBC

On Friday I joined Andi Shalini on CNBC “Closing Bell” Indonesia to discuss Emerging Markets/China. Thanks to Fitria Anggrayni and Sasa for having me on:

US Markets – Cheddar

On Monday I joined Kristen Scholer on Cheddar News to discuss US Markets. Thanks to Ally Thompson and Kristen for having me on:

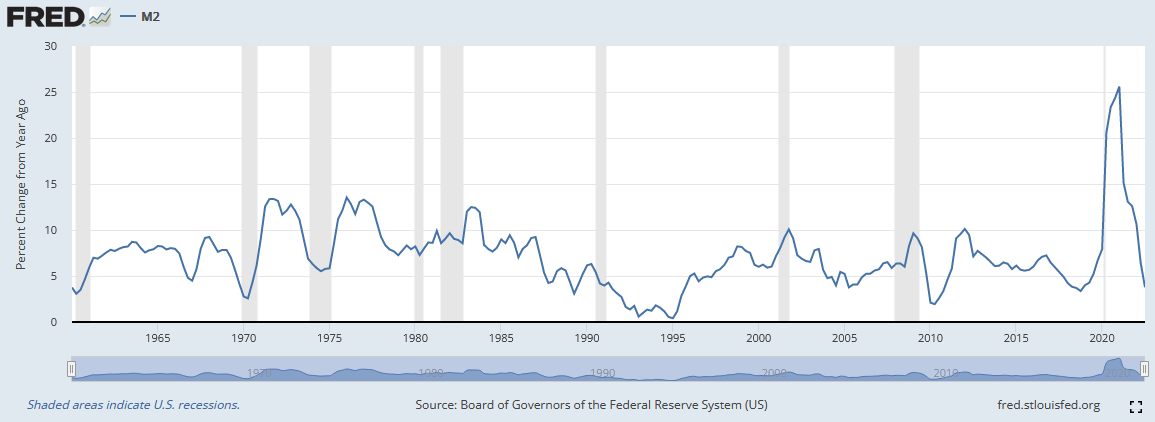

Money Supply (tale of two “cities”)

While US M2 money supply (above) is collapsing, China M2 money supply has been growing at double digits for over a half a year. Now that they have finally re-opened the economy, the effect of this easy policy will start to be seen in the economic and company data in coming months (on a lagged basis). Where do you want to place your bets?

Now onto the shorter term view for the General Market:

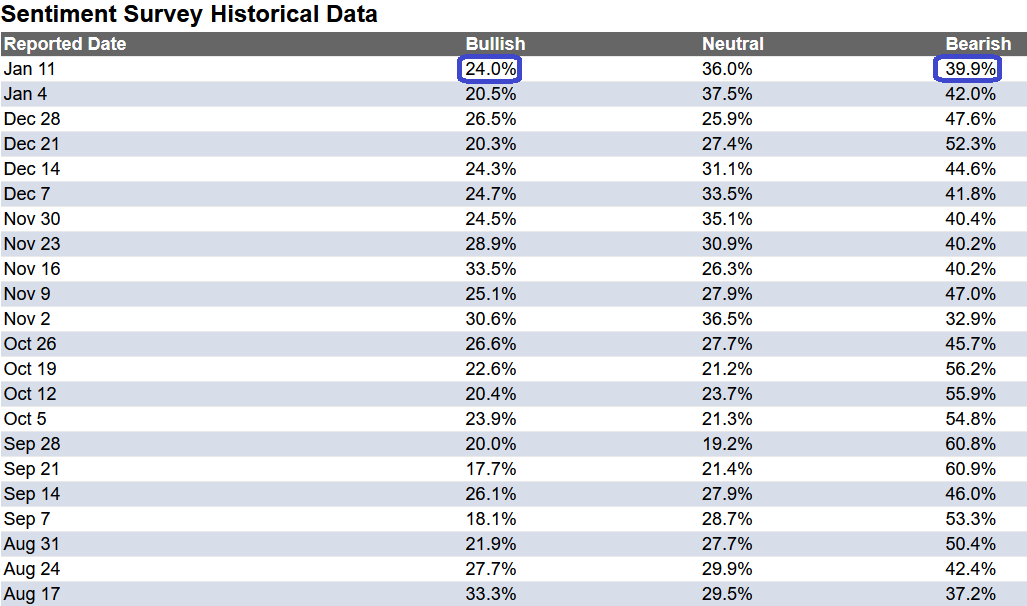

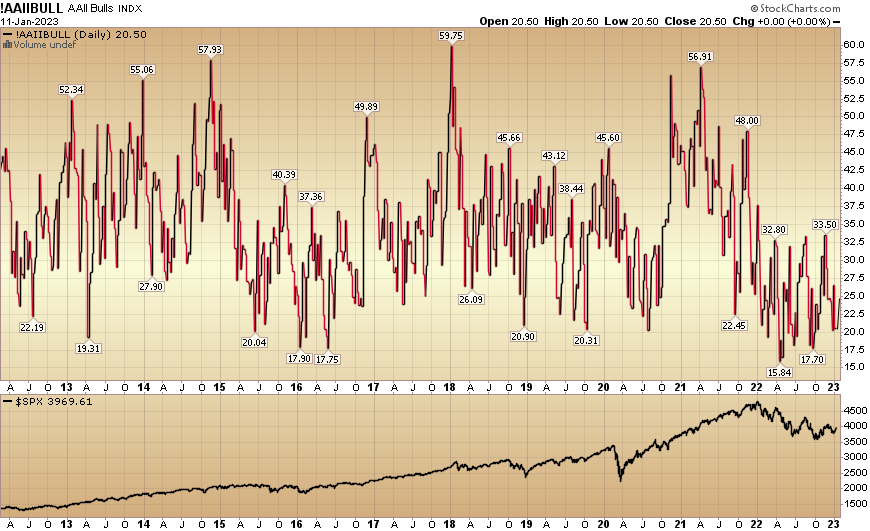

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose modestly to 24% from 20.5% the previous week. Bearish Percent ticked down to 39.9% from 42%. Sentiment is still fearful for retail traders/investors.

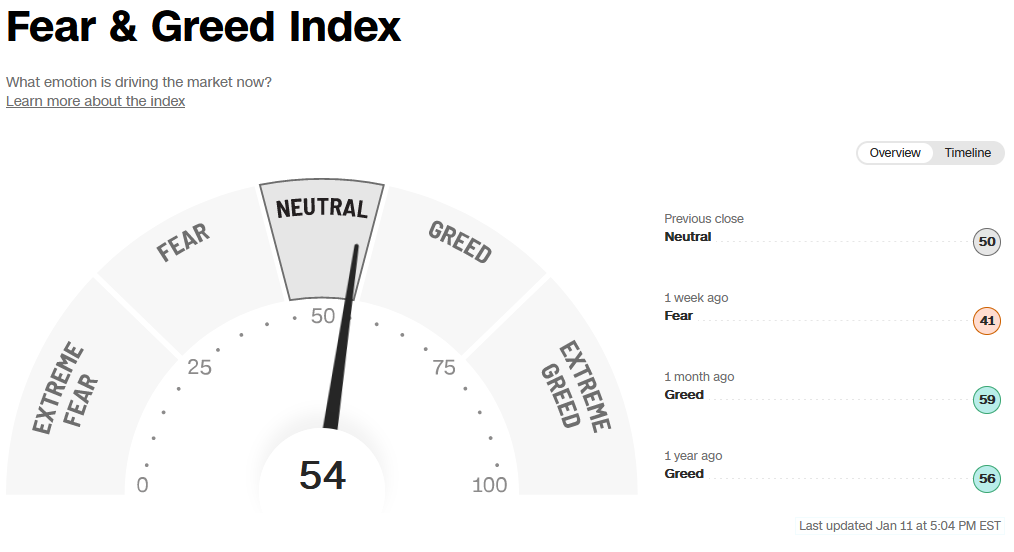

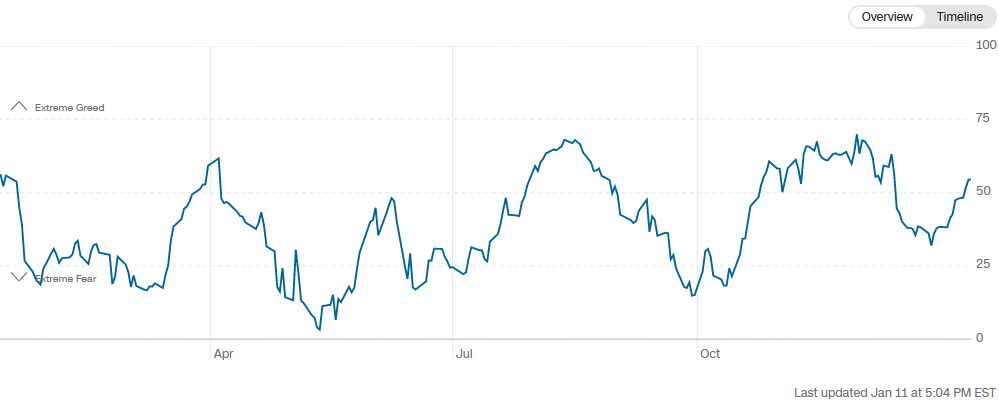

The CNN “Fear and Greed” rose from 40 last week to 54 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” rose from 40 last week to 54 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

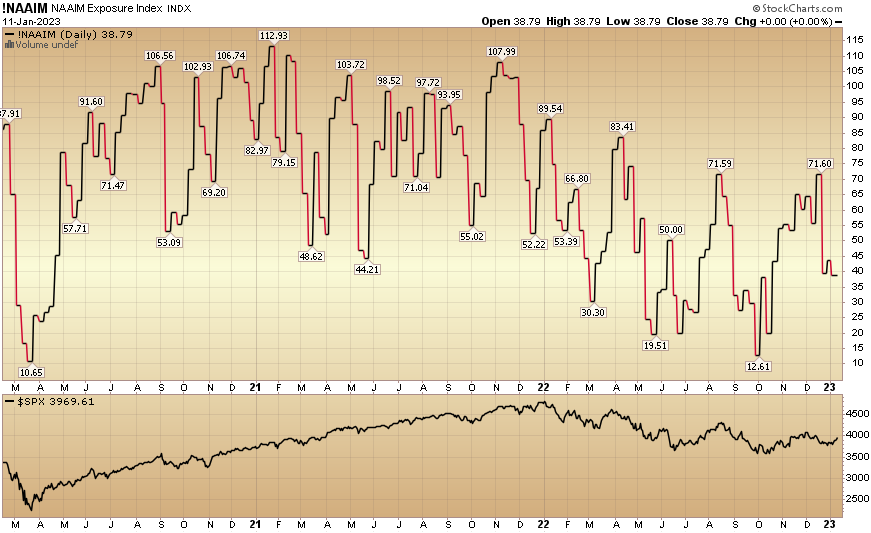

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 38.79% this week from 43.48% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 38.79% this week from 43.48% equity exposure last week.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.