Datasource: Finviz

Tom Hayes – Yahoo! Finance Appearance – 1/31/2023

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 31, 2023

Watch in HD directly on Yahoo! Finance

Be in the know. 15 key reads for Tuesday…

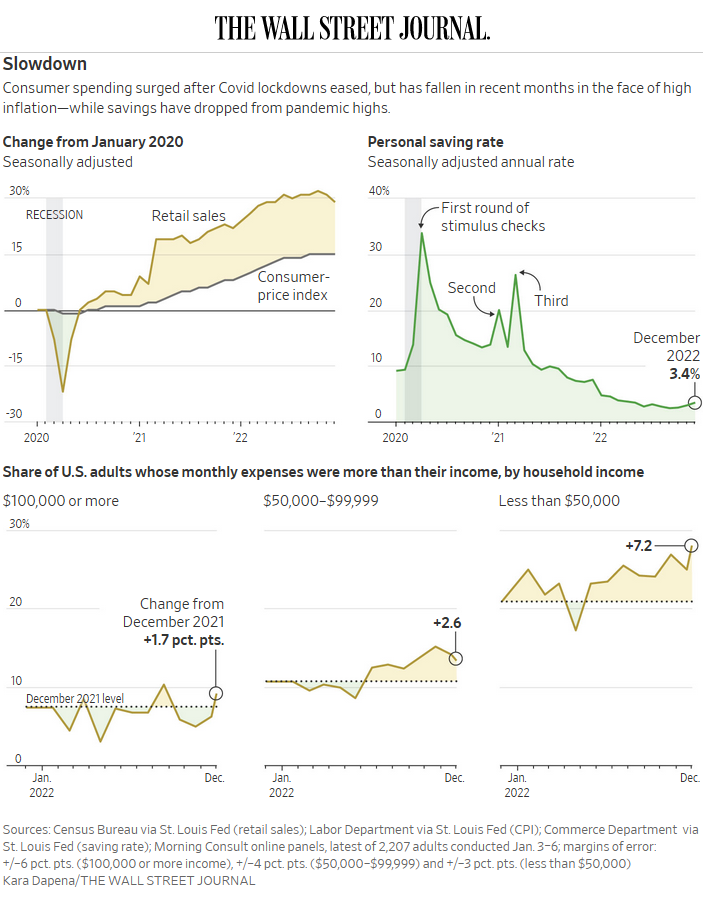

- The U.S. Consumer Is Starting to Freak Out (wsj)

- GM’s Profit Soars as Supply-Chain Problems Ease (wsj)

- Worker Pay Gains Cooled Modestly Late Last Year (wsj)

- China’s Economic Activity Rebounds Sharply After Reopening (bloomberg)

- Foreigners Scoop Up China Shares With January Inflow at Record (bloomberg)

- M.F. Upgrades Global Outlook as Inflation Eases (nytimes)

- Meta Turnaround Could Trap Bears (wsj)

- Pfizer Bids Adieu to Covid Boom Years (wsj)

- New China Rule Threatens to Disrupt U.S. Solar Ambitions (wsj)

- Ford Cuts Prices of EV Mustang Mach-E (wsj)

- Why Auto Marketing Looks Poised for Growth in 2023 (wsj)

- Why China Will Never Lead on Tech (wsj)

- Fed Meeting Preview: Powell Won’t Break S&P 500 Rally; Wage Growth Eases (investors)

- What the Stock Market’s Strong January Means for the Rest of the Year (barrons)

- Home Prices Are Slowing (barrons)

Tom Hayes – TVRI World Appearance – 1/30/2023

TVRI World – Thomas Hayes – Chairman of Great Hill Capital – January 30, 2023

Watch Directly on TVRI World

Where is money flowing today?

Be in the know. 25 key reads for Monday…

- China Vows to Boost Consumption to Power Economic Recovery (bloomberg)

- China Stocks Set to Enter Bull Market on Return From Holidays (bloomberg)

- Hedge Funds Boost Treasury Shorts to Record on Doubts Over Rally (bloomberg)

- China’s Tourist Sites Swarmed During Holiday Despite Covid Risks (bloomberg)

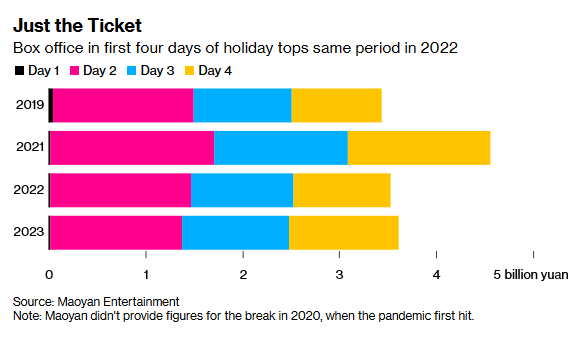

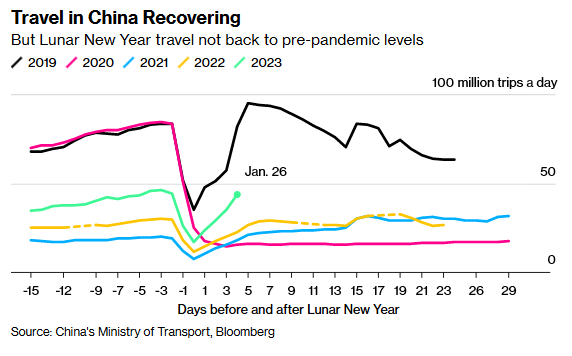

- China Holiday Travel, Box Office Rebound After Covid Zero (bloomberg)

- China Junk Dollar Bond Prices Swing From Record Low to Longest Winning Streak (bloomberg)

- Short Sellers Feel the Pain in Stock Market’s 2023 Rally (wsj)

- Israel Strikes Iran Amid International Push to Contain Tehran (wsj)

- China PBOC Extends Monetary Policy Tools for Green Sector (bloomberg)

- Taiwan Stocks Poised for Bull Market as Chip Shares Extend Gains (bloomberg)

- Bull Market Beckons China Stock Traders as Consumption Revs Up (bloomberg)

- Fed Set to Shrink Rate Hikes Again as Inflation Slows (bloomberg)

- China Says Covid Deaths Fell Even as Lunar Holiday Spread Virus (bloomberg)

- Indonesia Signals End of Hikes as Fed Peak Rate Comes to View (bloomberg)

- Chinese Search Giant Baidu to Launch ChatGPT-Style Bot (bloomberg)

- Fed Debates Whether Wages or Low Unemployment Will Drive Inflation (wsj)

- How Nasdaq’s Stellar Run Could Squash Tech’s Bear Market (barrons)

- The Stock Market Has Flipped the Script. What’s Behind the Reversal. (barrons)

- Dollar’s Decline Is a Rare Nasdaq Tailwind as Earnings Loom (bloomberg)

- Crash Test This Week for Market Versus Real World (bloomberg)

- Wharton professor Jeremy Siegel says the Fed risks sparking a disaster if it hikes rates higher than markets are expecting at its upcoming meeting (businessinsider)

- Buyback Blackout Ends With A Bang: Why Goldman’s Trading Desk Sees Rally Lasting Until Mid-Feb (zerohedge)

- Ford to cut prices while ‘significantly’ increasing Mach-E production amid Tesla cuts (streetinsider)

- Lowe’s successfully tests system to solve organized retail crime (foxbusiness)

- The Year of The Rabbit Hops To It (chinalastnight)

Be in the know. 10 key reads for Sunday…

- How Not to Fight Inflation (project-syndicate)

- Marie Kondo revealed she’s ‘kind of given up’ on being so tidy. People freaked out (npr)

- Mental Models: The Best Way to Make Intelligent Decisions (~100 Models Explained) (fs)

- 40 Facts About Martin Scorsese’s Goodfellas (mentalfloss)

- Scientists use CRISPR to insert an alligator gene into a catfish (bigthink)

- A Neurologist Answers Questions Patients Might Have about the New Alzheimer’s Drug Lecanemab (scientificamerican)

- Why Corporate America Still Runs on Ancient Software That Breaks (bloomberg)

- Worried About ChatGPT? This Cloud CEO Shares Tips to Prepare for the Coming A.I. Shift (inc)

- The 2024 Z06 GT3.R Is the New Face of Corvette Racing (roadandtrack)

- The Porsche 911 GT3 RS Does Things No Road Car Should Be Able to Do (roadandtrack)

Be in the know. 21 key reads for Saturday…

- The Fed Doesn’t Need More Rate Hikes to Beat Inflation (barrons)

- Delta Stock Is Soaring. Chairman Frank Blake Bought Up Shares. (barrons)

- Salesforce Gains Another Activist Investor (barrons)

- China’s Big Comeback Is Just Getting Started. How to Play It. (barrons)

- ChatGPT ‘Arms Race’ Adds $4.6 Billion to Nvidia Founder’s Fortune (bloomberg)

- China Kicks Off 2023 Leading Global Peers in Equity Fundraising (bloomberg)

- Sugar Alcohols Are in Many Sugar-Free Foods. What Are They? (nyptimes)

- The S&P 500 is nearing its first ‘golden cross’ in more than 2 years. What does that portend for stocks? (marketwatch)

- Yale University’s most popular class, on happiness, is now free for teenagers (cnbc)

- China Celebrated Lunar New Year Like Covid No Longer Exists (bloomberg)

- Legendary Investor Bill Gurley on Investing Rules, Finding Outliers, Insights from Jeff Bezos and Howard Marks, Must-Read Books, Creating True Competitive Advantages, Open-Source Strategies, Adapting Mental Models to New Realities, and More (#651) (Tim Ferriss)

- 6 Undervalued Biotech Stocks for 2023 (morningstar)

- Spinoffs Are the New IPOs (morningstar)

- Hartnett: “Another 3-5% Will Feel Like Bathing In Lava If You’re A Bear” (zerohedge)

- Goldman’s Biggest Bear Capitulates: “The Market Is In No Mood To Go Down Right Now” (zerohedge)

- Nomura: Traders Are ‘Re-Risking While Holding Their Noses’ After 2022’s Bizarro World In VIX (zerohedge)

- The ‘Backsies’ Billionaire: Texan Builds Second Fortune From Wreckage Of Real Estate Empire He’d Sold (forbes)

- A Fed economist says the Fed is making inequality worse with its interest rate hikes (fortune)

- The inside story of ChatGPT: How OpenAI founder Sam Altman built the world’s hottest technology with billions from Microsoft (fortune)

- Aston Martin Bids Farewell To Flagship GT With Most Powerful Production Car Yet (maxim)

- Chinese overseas shopping platforms in 2022: Bigger market share, controversies and complaints continue (technode)