Hedge Fund Trade Tip (PIN) – Position Idea Notification

Quote of the Day…

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 25 key reads for Tuesday…

- Hopes of China easing Covid restrictions further take hold as market observers detect a delicate shift in tone (scmp)

- Big hedge funds shop for bargains in corporate debt markets (ft)

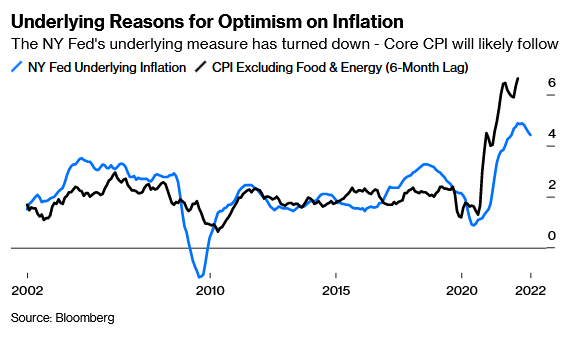

- Reasons Are Adding Up for Optimism on Inflation (bloomberg)

- Xi Jinping Needs to Bring Jack Ma Back Into the Fold (bloomberg)

- China Weighs Gradual Zero-Covid Exit but Proceeds With Caution, Without Timeline (wsj)

- Meta Is Spending Like an Oil Company. It Needs to Stop. (barrons)

- Nvidia Plans New Chip for China to Meet U.S. Rules (barrons)

- Where to Find Stocks That Will Rise 10 Times (barrons)

- Xi’s New No. 2 Faces Challenge to Make China’s Economy Hum Again (bloomberg)

- Why Central Banks Got Serious About Digital Money (bloomberg)

- China Expands Financing Tool That Can Support Ailing Developers (bloomberg)

- Semiconductor stocks have bounced from 2022 lows — and analysts expect upside of at least 28% in the next year (marketwatch)

- What midterm election results mean for the stock-market bounce, according to Morgan Stanley’s Wilson (marketwatch)

- Norwegian Cruise Line Beats Earnings Estimates and Signals Record 2023. The Stock Is Rising. (barrons)

- Jokowi Says Joe Biden, Xi Jinping to Attend G-20 Summit in Bali (bloomberg)

- China’s Lockdowns Fail to Contain Covid as People’s Anger Grows (bloomberg)

- Hedge-Fund Manager Who Helped Expose Luckin Coffee’s Fraud Bets on Chinese Chain’s Comeback (wsj)

- JPMorgan breaks down 4 reasons why it’s time to buy into small and mid-cap stocks amid aggressive monetary tightening (businessinsider)

- There’s only a 35% chance that the US suffers a recession in the next year, top Goldman Sachs economist says (businessinsider)

- Jeremy Siegel says the housing crash will force Fed chief Powell to ‘flip sometime’ on inflation and pivot (businessinsider)

- There are 2 big catalysts that could be a ‘game changer’ for the stock market this week, according to Fundstrat’s Tom Lee (businessinsider)

- Nobel laureate Paul Krugman says ‘true’ US inflation may have cooled to below 4% – and points to falling rental prices and slowing wage growth as proof (businessinsider)

- Alibaba’s international arm is spending millions to expand into South Korea (cnbc)

- Berkshire Sold $5 Billion of Financial Stocks, Possibly Citigroup and Bank of NY (barrons)

- This year’s World Internet Conference to have less glitz and more policy (scmp)

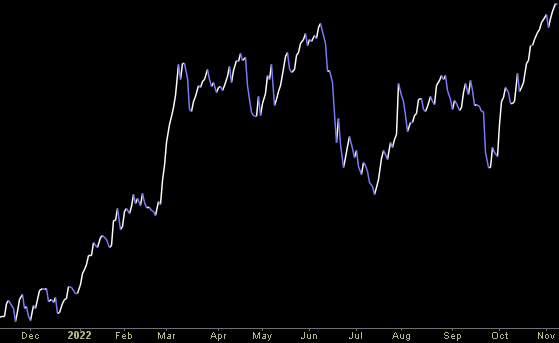

Where is the money flowing today?

Be in the know. 20 key reads for Monday…

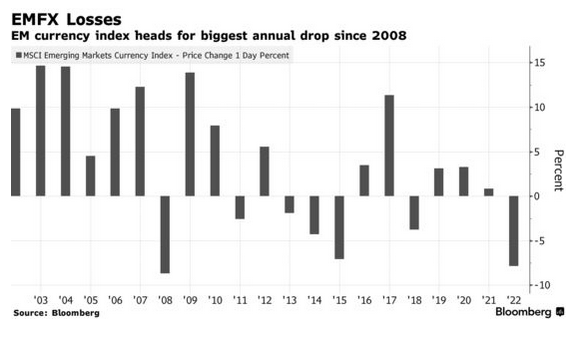

- Worst Looks Over for Emerging Currencies, Morgan Stanley Says (bloomberg)

- Here’s how much China stocks still could rally from zero-COVID, say Goldman Sachs strategists (marketwatch)

- China Traders Look Beyond Covid-Zero Pledge to Snap Up Stocks (bloomberg)

- Alibaba and Other Chinese Stocks Are Rallying Again. (barrons)

- Meta Platforms Braces for Big Layoffs: WSJ (barrons)

- Senior White House Official Involved in Undisclosed Talks With Top Putin Aides (wsj)

- At 49, She’s Running the New York Marathon Faster Than She Ran at 35. (A Lot Faster.) (wsj)

- Amazon Sweetens Prime Offerings as Growth Stalls (wsj)

- Is China About to End Covid Zero? Here’s What We Know Right Now (bloomberg)

- Chinese Trade Unexpectedly Drops as Demand Slowdown Worsens (bloomberg)

- The Beijing Marathon Returns, With Some Covid-Zero Conditions (bloomberg)

- EU says it has serious concerns about Biden’s Inflation Reduction Act (cnbc)

- Investors are seeking further clarity on inflation from Fed speakers. (cnbc)

- Goldman Sachs says China is still ‘months away’ from reopening (cnbc)

- Afraid to cruise? Not at all, say fans who are causing ‘explosion of bookings’ (cnbc)

- Carbon Credits Emerge as a Focus at COP27 (nytimes)

- Cash App Gets the Money (wsj)

- Hedge-Fund Manager Who Helped Expose Luckin Coffee’s Fraud Bets on Chinese Chain’s Comeback (wsj)

- Xi Jinping has secured his power at home. Now he’s stepping back out on the international stage (cnn)

- Morgan Stanley’s Wilson Says US Midterms Could Fuel Equity Rally (bloomberg)

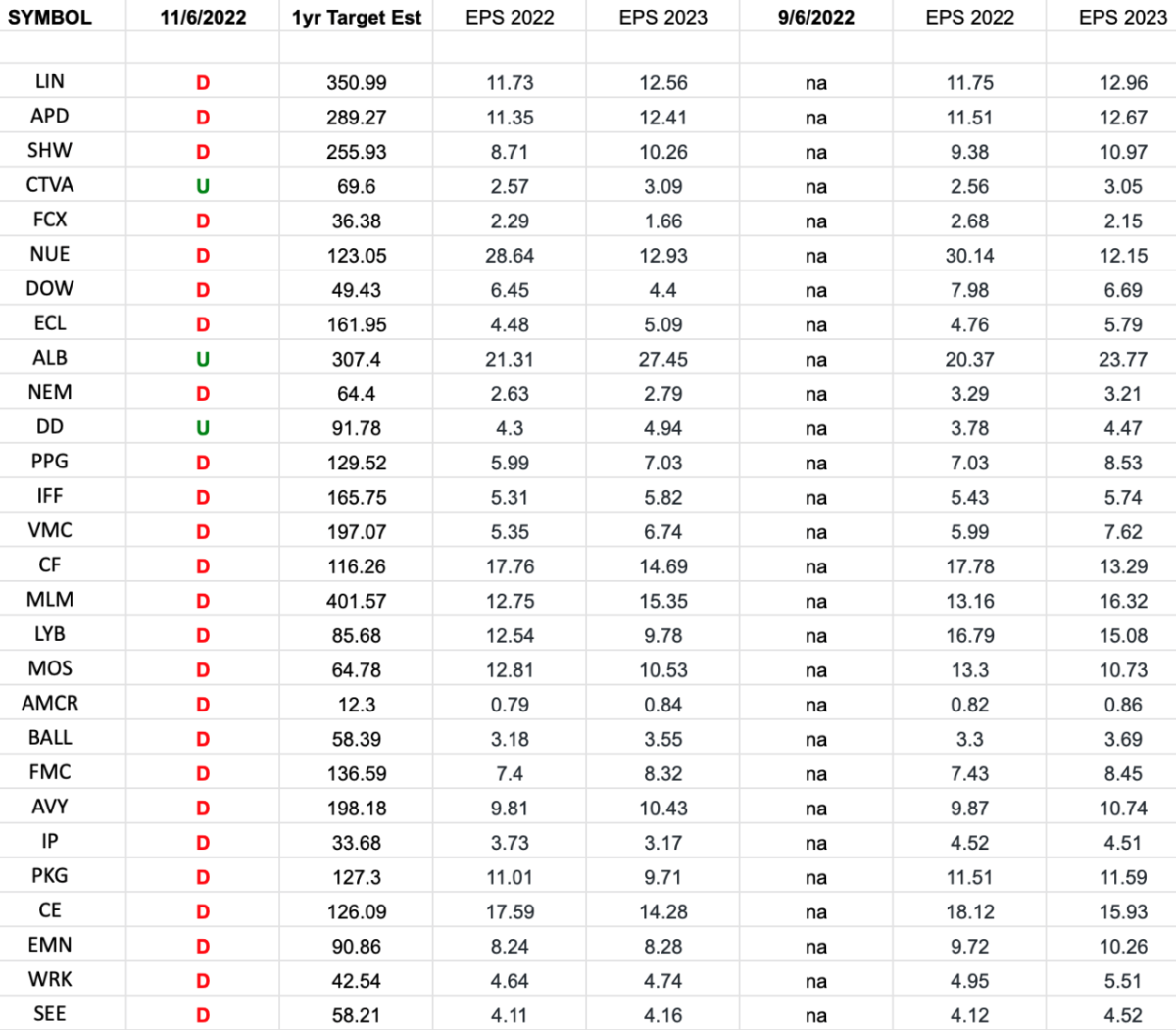

Basic Materials (XLB)- Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2022 and 2023 estimates were: 9/6/2022 and today.

Continue reading “Basic Materials (XLB)- Earnings Estimates/Revisions”

Be in the know. 5 key reads for Sunday…

- U.S. audit inspection of Chinese companies in Hong Kong ends – sources (reuters)

- Election Day and Day After Historically Bullish (Almnanac Trader)

- The 25 Greatest Supercars of the 21st Century (So Far) (robbreport)

- What are Alibaba’s strategies on livestreaming and loyalty membership programs on Singles Day 2022? (technode)

- Mark Bergen on Apple’s Threat to the Online Ad Industry (bloomberg)

Be in the know. 20 key reads for Saturday…

- US Debt-Servicing Costs Skyrocket: $1.4 Trillion In Interest Payments On Deck (zerohedge)

- What Midterm Elections Could Mean for Tech (barrons)

- PayPal Stock Is Down, but Wall Street Likes the Long-Term View (barrons)

- Teva Is ‘on the Way’ to Leaving Opioid Litigation Behind, CEO Says (barrons)

- Berkshire’s Operating Profit Rose 20% in 3Q. Buybacks Totaled $1.1 Billion. (barrons)

- China Quashes Rumors It’s Set to Ease Rigid Covid Containment Measures (barrons)

- Here’s strong new evidence that a U.S. stock-market rally is coming soon (marketwatch)

- A Stock Trader’s Guide to China’s Potential Exit From Covid Zero (bloomberg)

- Fed warns of ‘low’ market liquidity in $24 trillion Treasury market, in latest financial stability report (marketwatch)

- Greg Jensen nailed inflation, the Ray Dalio leadership change, and won at poker. Inside his big year. (marketwatch)

- China’s Xi urges Russia-Ukraine peace talks, warns against nuclear conflict (marketwatch)

- Higher Rates Hammer Home Buyers—and Make Mortgage REITs Lucrative for Investors (barrons)

- For Chip Makers, the Flip from Shortage to Glut Intensifies (wsj)

- Fox Is Cleared to Buy FanDuel Stake for About $3.7 Billion (wsj)

- News in-depth. How Elon Musk’s ‘war room’ of advisers are transforming Twitter (ft)

- Fed warns sharply higher interest rates could spark financial distress (ft)

- Carl Icahn snaps up shares of canning giant Crown. Here’s how he may build value (cnbc)

- Siegel and Schwartz on Stocks for the Long Run (bloomberg)

- 12 Lessons on Money and More From Warren Buffett and Charlie Munger (morningstar)

- Free Cash Flow: Back to Basics (Aswath Damodaran)