- US Debt-Servicing Costs Skyrocket: $1.4 Trillion In Interest Payments On Deck (zerohedge)

- What Midterm Elections Could Mean for Tech (barrons)

- PayPal Stock Is Down, but Wall Street Likes the Long-Term View (barrons)

- Teva Is ‘on the Way’ to Leaving Opioid Litigation Behind, CEO Says (barrons)

- Berkshire’s Operating Profit Rose 20% in 3Q. Buybacks Totaled $1.1 Billion. (barrons)

- China Quashes Rumors It’s Set to Ease Rigid Covid Containment Measures (barrons)

- Here’s strong new evidence that a U.S. stock-market rally is coming soon (marketwatch)

- A Stock Trader’s Guide to China’s Potential Exit From Covid Zero (bloomberg)

- Fed warns of ‘low’ market liquidity in $24 trillion Treasury market, in latest financial stability report (marketwatch)

- Greg Jensen nailed inflation, the Ray Dalio leadership change, and won at poker. Inside his big year. (marketwatch)

- China’s Xi urges Russia-Ukraine peace talks, warns against nuclear conflict (marketwatch)

- Higher Rates Hammer Home Buyers—and Make Mortgage REITs Lucrative for Investors (barrons)

- For Chip Makers, the Flip from Shortage to Glut Intensifies (wsj)

- Fox Is Cleared to Buy FanDuel Stake for About $3.7 Billion (wsj)

- News in-depth. How Elon Musk’s ‘war room’ of advisers are transforming Twitter (ft)

- Fed warns sharply higher interest rates could spark financial distress (ft)

- Carl Icahn snaps up shares of canning giant Crown. Here’s how he may build value (cnbc)

- Siegel and Schwartz on Stocks for the Long Run (bloomberg)

- 12 Lessons on Money and More From Warren Buffett and Charlie Munger (morningstar)

- Free Cash Flow: Back to Basics (Aswath Damodaran)

Tag: Stock Market

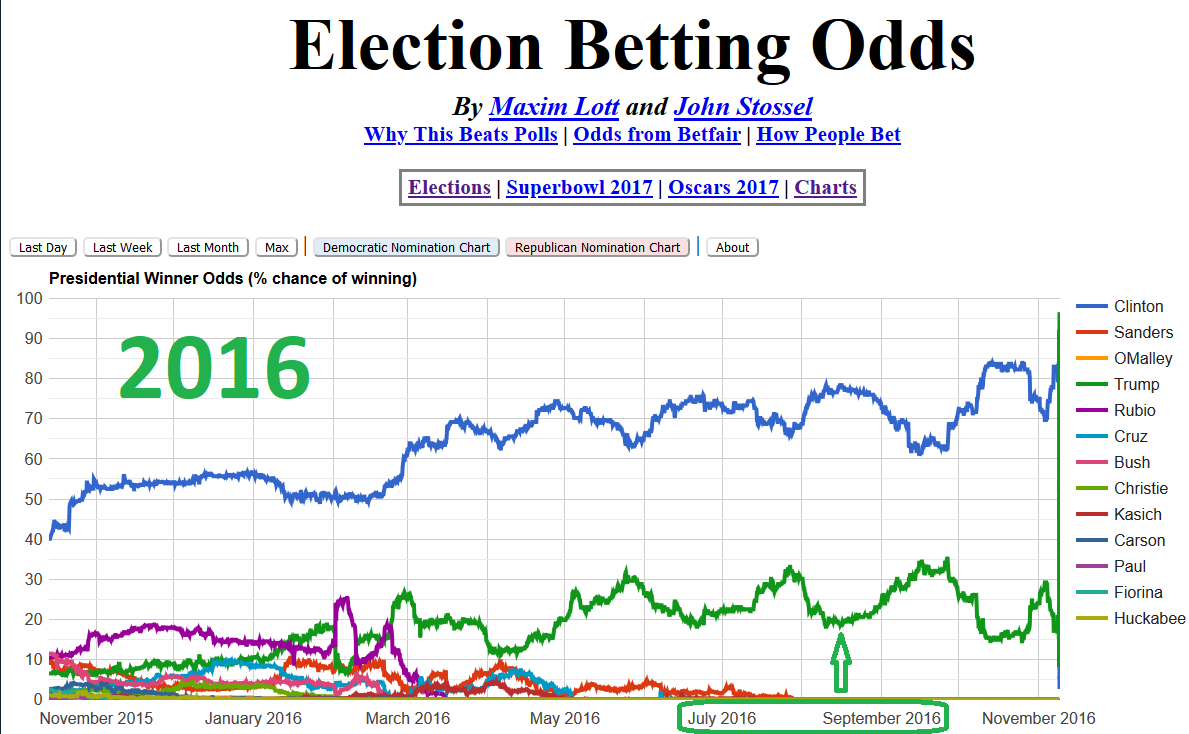

Election Betting Odds for 2016 and 2020:

On last night’s VideoCast (Episode 42) I mentioned the Election Betting Odds data for 2020 (Election Betting Odds 2020) and asked if anyone could provide the same data from 2016. Continue reading “Election Betting Odds for 2016 and 2020:”

Tom Hayes – Quoted in Reuters article – 6/8/2020

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here: