Datasource: Finviz

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- A Veteran Bargain Hunter Embraces Europe and China (barrons)

- Oil Rises as China Considers Easing Quarantine Rules (barrons)

- Rent Inflation Might Be Sending the Wrong Message. It Could Trip Up the Fed. (barrons)

- We Need to Talk About Rent Inflation. It May Trip the Fed. (barrons)

- Retail investors take shelter in cash after stock market rout (ft)

- Retail investors are the most bearish they’ve been in months after September’s inflation shock, but a rebound in the S&P 500 would spark new buying spree, research firm says (businessinsider)

- China’s Economy Is Recovering and Improving, Premier Li Says (bloomberg)

- Hong Kong Stocks Poised for 13-Year Low as Growth Woes Bite (bloomberg)

- China Stocks Pare Loss on Report Authorities Mull Quarantine Cut (bloomberg)

- China Stock Bounce Is Short-Lived on News of Quarantine Debate (bloomberg)

- China’s US$3.5 trillion stock sell-off seen nearing end, as share buy-backs, buying by fund managers indicate recovery (scmp)

- American Keeps Airline Earnings Momentum Going. The Stock Is Climbing. (barrons)

- AT&T Tops Earnings Estimates. Cash Flow Guidance Maintained. (barrons)

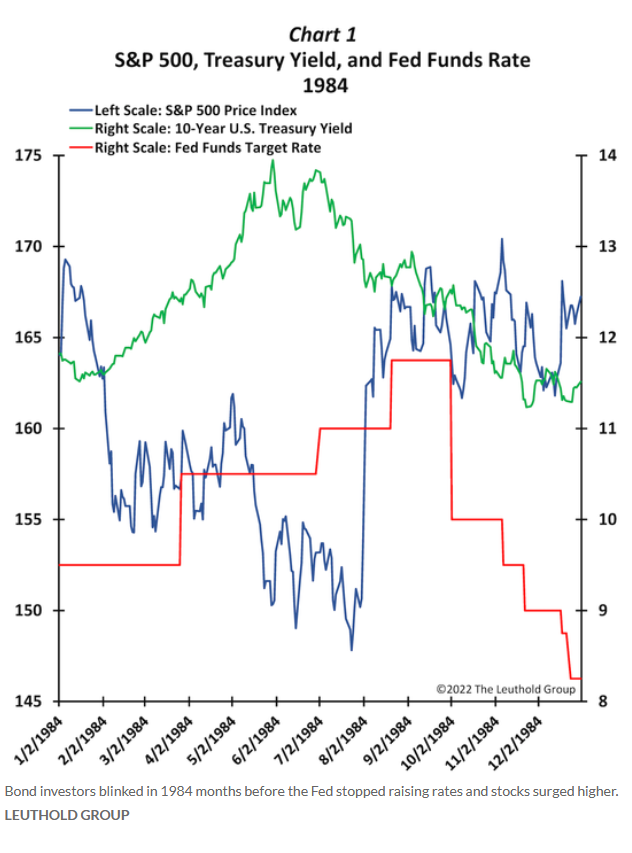

- ‘You can be invested in fixed-income again,’ bond investors say, even before the Fed stops hiking rates (marketwatch)

- Day Traders Go Back to Their Day Jobs as Stock Market Swoons (wsj)

- Biden Says He Will Keep Tapping Oil Reserves (wsj)

- Tencent steps up buybacks as share price sinks (ft)

- China’s Big Leadership Reveal Will Show Extent of Xi’s Power (bloomberg)

- What China’s big party congress this week means for the economy (cnbc)

- Wall Street is warming up to small cap stocks (yahoo)

“What to Watch Now” Stock Market (and Sentiment Results)…

The good news is that sentiment and positioning continues to persist at capitulation levels. The bad news is that the key levers to cause a “buyers panic” into the market have not yet been activated. However, that may change soon:

Continue reading ““What to Watch Now” Stock Market (and Sentiment Results)…”

Where is the money flowing today?

Be in the know. 16 key reads for Wednesday…

- Why stock market investors should wait for the 10-year Treasury to ‘blink’ (marketwatch)

- European Auto Stocks Rally After Sales Rise For Second Month In A Row (zerohedge)

- Tencent to see revenue and profit growth from fourth quarter, Goldman says (scmp)

- Why pickleball has Tom Brady and LeBron James investing (cnbc)

- ASML jumps 6% after earnings; sees limited impact from U.S. China curbs (cnbc)

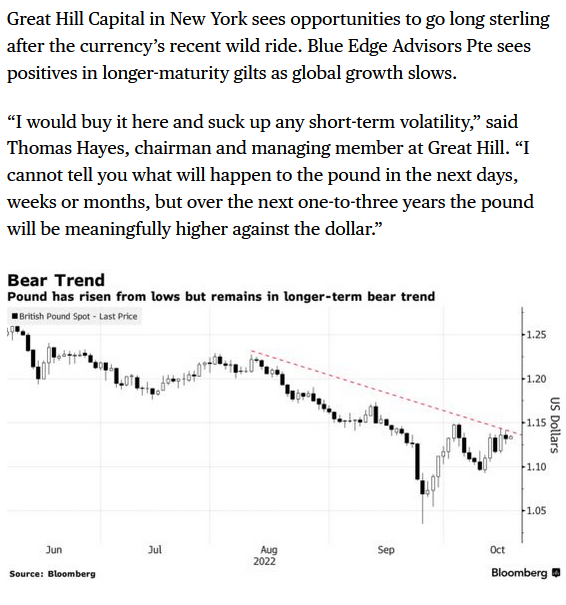

- Hedge Funds Are Betting UK’s Most Battered Assets Will Rebound (bloomberg)

- 11 Healthcare Stocks Thriving in the Bear Market (barrons)

- Apple Reports Next Week. Here’s What One Notable Analyst Will Be Watching. (barrons)

- Netflix’s Subscriber Boost Isn’t the Company’s Only Big Surprise (barrons)

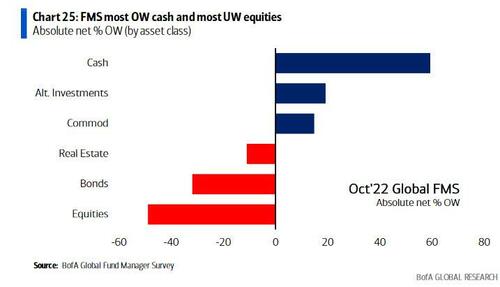

- Fund managers ‘scream capitulation’ as cash levels rise to highest in 21 years, Bank of America says (marketwatch)

- One of Wall Street’s most vocal bulls is scaling back his bullish calls on stocks and trimming risk in his bank’s model portfolio. Here’s why. (marketwatch)

- Remote employees are working less, sleeping and playing more, Fed study finds (marketwatch)

- Biden to Sell More Oil From Strategic Reserve to Keep Gas Prices in Check (wsj)

- Investors’ cash pile is the largest in 21 years. Here’s what that means and why it could signal a rally is on the way (businessinsider)

- China’s Oil Imports Soar As Beijing Prepares To Supply European Fuel Demand (zerohedge)

- Peter Schiff: The Fed Is Going To Have To Choose (zerohedge)

Tom Hayes – Quoted in Bloomberg article – 10/19/2022

Thanks to Ruth Carson and Bei Hu for including me in their article on Bloomberg today. You can find it here:

Click Here to View The Full Article on Bloomberg

October 2022 Bank of America Global Fund Manager Survey Results (Summary)

The October survey covered 371 managers with $1.1 Trillion in assets under management.

Continue reading “October 2022 Bank of America Global Fund Manager Survey Results (Summary)”