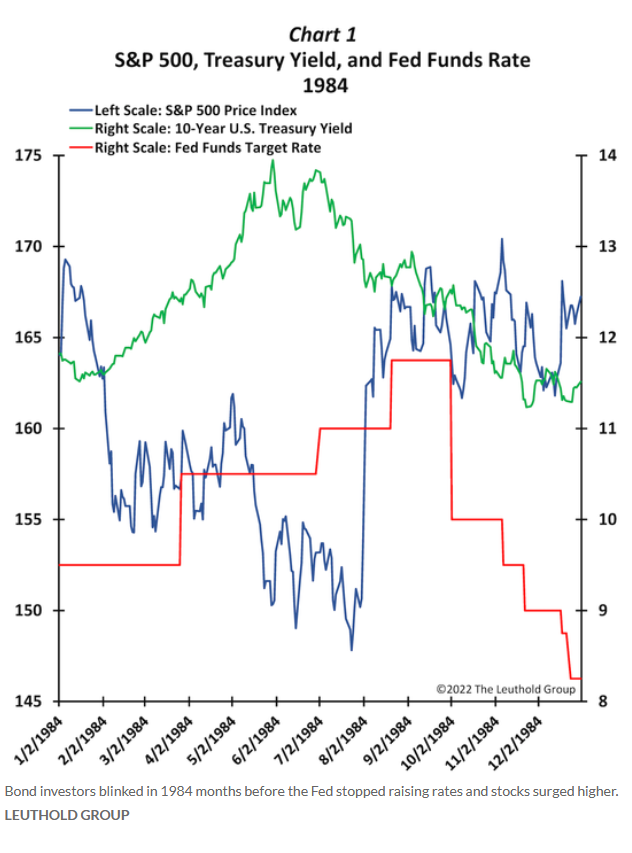

- Why stock market investors should wait for the 10-year Treasury to ‘blink’ (marketwatch)

- European Auto Stocks Rally After Sales Rise For Second Month In A Row (zerohedge)

- Tencent to see revenue and profit growth from fourth quarter, Goldman says (scmp)

- Why pickleball has Tom Brady and LeBron James investing (cnbc)

- ASML jumps 6% after earnings; sees limited impact from U.S. China curbs (cnbc)

- Hedge Funds Are Betting UK’s Most Battered Assets Will Rebound (bloomberg)

- 11 Healthcare Stocks Thriving in the Bear Market (barrons)

- Apple Reports Next Week. Here’s What One Notable Analyst Will Be Watching. (barrons)

- Netflix’s Subscriber Boost Isn’t the Company’s Only Big Surprise (barrons)

- Fund managers ‘scream capitulation’ as cash levels rise to highest in 21 years, Bank of America says (marketwatch)

- One of Wall Street’s most vocal bulls is scaling back his bullish calls on stocks and trimming risk in his bank’s model portfolio. Here’s why. (marketwatch)

- Remote employees are working less, sleeping and playing more, Fed study finds (marketwatch)

- Biden to Sell More Oil From Strategic Reserve to Keep Gas Prices in Check (wsj)

- Investors’ cash pile is the largest in 21 years. Here’s what that means and why it could signal a rally is on the way (businessinsider)

- China’s Oil Imports Soar As Beijing Prepares To Supply European Fuel Demand (zerohedge)

- Peter Schiff: The Fed Is Going To Have To Choose (zerohedge)

Be in the know. 16 key reads for Wednesday…