- China’s factory, services surveys suggest economy struggling to rebound (reuters)

- Putin Formally Annexes Ukrainian Regions (barrons)

- Nike Has Too Many Shoes to Sell and Other Reasons Earnings Disappointed (barrons)

- The SPAC Bubble Has Burst. 6 Stocks That Still Have Potential. (barrons)

- U.S. consumers remain pessimistic about economy even as inflation fears wane (marketwatch)

- Global bonds undergo worst selloff since the 90s: JPM (marketwatch)

- Mortgage Rates Rise to 6.7%, Highest Since 2007 (wsj)

- Speed of sound Supersonic jet would fly from NYC to London in just 80 minutes (nypost)

- China’s ‘Absurd’ Covid Propaganda Stirs Rebellion (nytimes)

- China Tells Banks to Provide $85 Billion in Property Funding (bloomberg)

- China told US banks like Goldman Sachs and JPMorgan to avoid publishing politically sensitive research ahead of a key Communist Party summit, report says (businessinsider)

- China just boosted bank liquidity by 843%, adding further pressure on the yuan as the currency suffers its weakest year in almost 3 decades (businessinsider)

- Market bull Ed Yardeni rings the alarm on further Fed rate hikes, warning they could tank asset prices and drag the US economy into a deep recession (businessinsider)

- China Offers Rare Tax Rebate to Spur Home Purchase in Crisis (bloomberg)

- Stocks Rise as Brainard’s Speech Reassures Traders (bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 154

Hedge Fund Tips with Tom Hayes – Podcast – Episode 144

Tom Hayes – Quoted in TheStreet article – 9/21/2022

Thanks to Ellen Chang for including me in her article on TheStreet.com. You can find it here:

Click Here to View The Full Article on TheStreet.com

Tom Hayes – Yahoo! Finance Appearance – 9/29/2022

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 29, 2022

Watch FULL interview in HD directly on Yahoo! Finance

Where is the money flowing today?

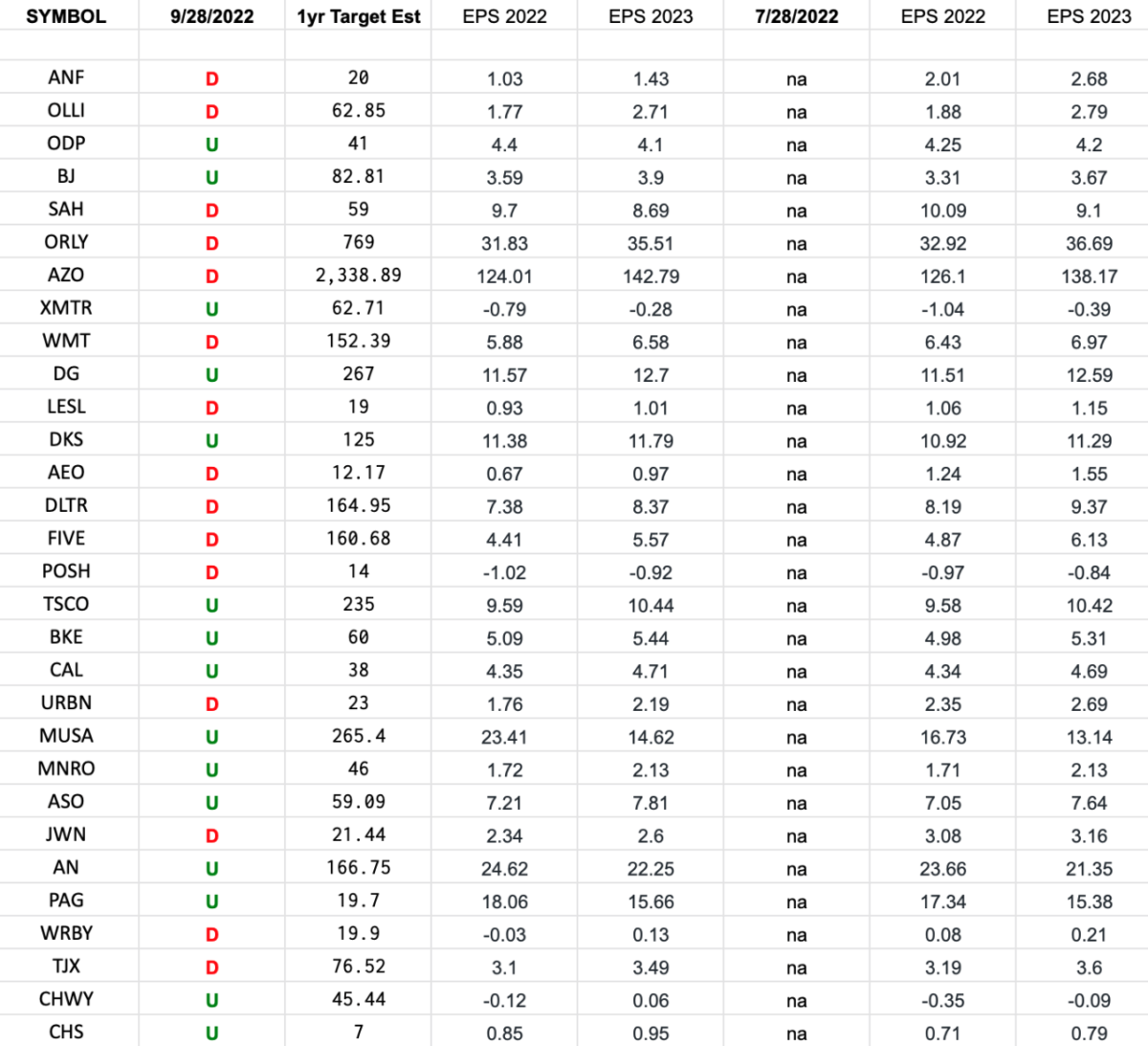

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

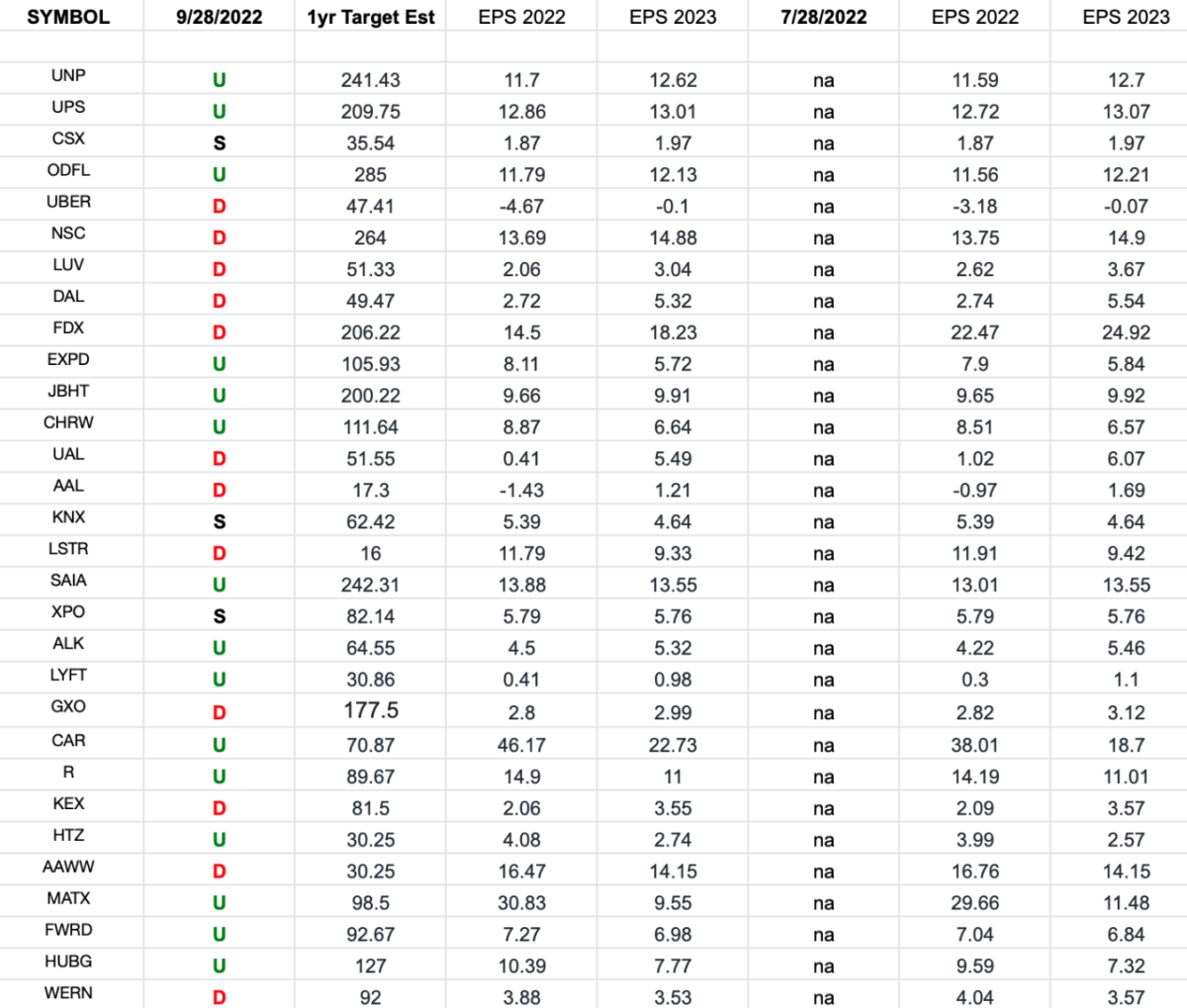

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) top 30 holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 15 key reads for Thursday…

- Alibaba (BABA) Price is ‘Attractive’, Citi Sees Potential for Shares to Rally 70%+ (streetinsider)

- Xi Aide Likely to Be Next Economy Czar Stresses Need for Growth (bloomberg)

- Why no news may be good news for China-watching investors (reuters)

- 10 Markets Where Sellers Are Cutting Home Prices the Most (barrons)

- China’s Communist party at the forefront as Xi Jinping’s coronation looms (ft)

- Did something break? What stock-market investors need to know about U.K. financial chaos. (marketwatch)

- Will something break? What’s next for global financial markets after U.K. meltdown. (marketwatch)

- Things Are Starting to Break. But the Fed and BoE Aren’t Done Hiking. (barrons)

- The Dollar Rises Again. But China Is Ready to Fight Back Against a Weak Yuan. (barrons)

- Bank of England Buys Bonds in Bid to Stop Spread of Crisis (wsj)

- Alzheimer’s Blockbuster Might Spur Investor Bonanza, Higher Medicare Costs (wsj)

- ‘Do not bet’: China’s central bank warns against yuan speculation (cnbc)

- Final GDP reading shows US economy shrank 0.6% in the spring, cementing start of recession (foxbusiness)

- The Big Read. Europe’s energy plan: is it enough to get through winter? (ft)

- Russia to annex four Ukrainian regions (ft)

3 down, 1 to go Stock Market (and Sentiment Results)…

In last week’s note, we laid out our case as to why a walk-back might be in the cards – as it relates to the Fed’s ultra-hawkish stance:

Continue reading “3 down, 1 to go Stock Market (and Sentiment Results)…”