- China’s factory, services surveys suggest economy struggling to rebound (reuters)

- Putin Formally Annexes Ukrainian Regions (barrons)

- Nike Has Too Many Shoes to Sell and Other Reasons Earnings Disappointed (barrons)

- The SPAC Bubble Has Burst. 6 Stocks That Still Have Potential. (barrons)

- U.S. consumers remain pessimistic about economy even as inflation fears wane (marketwatch)

- Global bonds undergo worst selloff since the 90s: JPM (marketwatch)

- Mortgage Rates Rise to 6.7%, Highest Since 2007 (wsj)

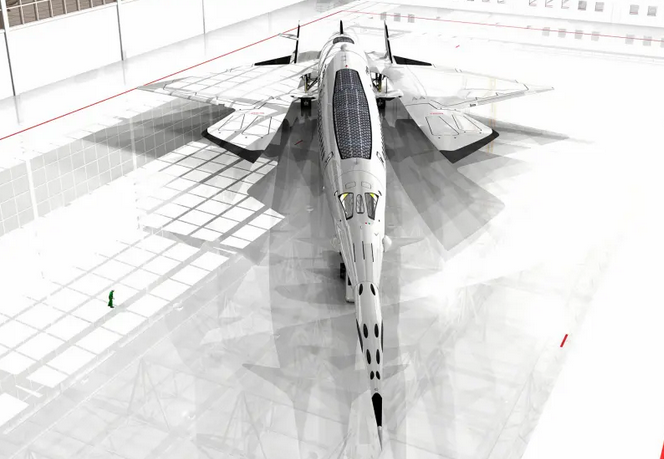

- Speed of sound Supersonic jet would fly from NYC to London in just 80 minutes (nypost)

- China’s ‘Absurd’ Covid Propaganda Stirs Rebellion (nytimes)

- China Tells Banks to Provide $85 Billion in Property Funding (bloomberg)

- China told US banks like Goldman Sachs and JPMorgan to avoid publishing politically sensitive research ahead of a key Communist Party summit, report says (businessinsider)

- China just boosted bank liquidity by 843%, adding further pressure on the yuan as the currency suffers its weakest year in almost 3 decades (businessinsider)

- Market bull Ed Yardeni rings the alarm on further Fed rate hikes, warning they could tank asset prices and drag the US economy into a deep recession (businessinsider)

- China Offers Rare Tax Rebate to Spur Home Purchase in Crisis (bloomberg)

- Stocks Rise as Brainard’s Speech Reassures Traders (bloomberg)

Be in the know. 15 key reads for Friday.