Be in the know. 21 key reads for Thursday…

- How stablecoins are entering the financial mainstream (ft)

- PayPal seeks to launch USD stablecoin on Stellar (yahoo)

- Bessent Says $2 Trillion Reasonable for Dollar Stablecoin Market (bloomberg)

- Ant International and Ant Digital to seek stablecoin licences in Hong Kong (scmp)

- Alibaba’s Joe Tsai says open-sourcing its AI models will boost firm’s cloud business (scmp)

- China Trade Deal ‘Done,’ Other Countries May Get More Time (barrons)

- China Puts Six-Month Limit on Its Ease of Rare-Earth Export Licenses (wsj)

- Bessent floats extending tariff pause for countries in ‘good faith’ trade talks (cnbc)

- Investors pull out of US stocks and into Europe and emerging markets (reuters)

- The World Is Embracing the Dollar, Not Abandoning It: BofA (barrons)

- Rush into safe haven assets pushes euro to highest since late 2021 (streetinsider)

- Everything Soars Higher As Rate-Cut Odds Jump After CPI ‘Miss’ (zerohedge)

- 10-Year Treasury Auction Was Strong Again in Positive Sign for U.S. Assets (barrons)

- Scott Bessent’s Bretton Woods Moment Is Here (barrons)

- Trump’s Fed Chair Pick Could Come Soon. Who the Contenders Are. (barrons)

- Disney and Universal Sue A.I. Firm for Copyright Infringement (nytimes)

- There Aren’t Enough Cables to Meet Growing Electricity Demand (bloomberg)

- Boeing Stock Declines Sharply After Plane Crashes in India (barrons)

- Not sure if Air India crash is a Boeing or GE problem per se, says Mike Boyd (youtube)

- QXO stock initiated with outperform rating by Baird on growth outlook (investing)

- Oppenheimer starts QXO at Outperform on strategic acquisition, growth outlook (investing)

“The GENIUS Trade Nobody Wants” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Wednesday, I joined Stuart Varney on Fox Business’s “Varney & Co.” to discuss markets, outlook, China, inflation, and the Fed. Thanks to Stuart and Christian Dagger for having me on:

Continue reading ““The GENIUS Trade Nobody Wants” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Tom Hayes – Fox Business Appearance – Varney & Co. – 6/11/2025

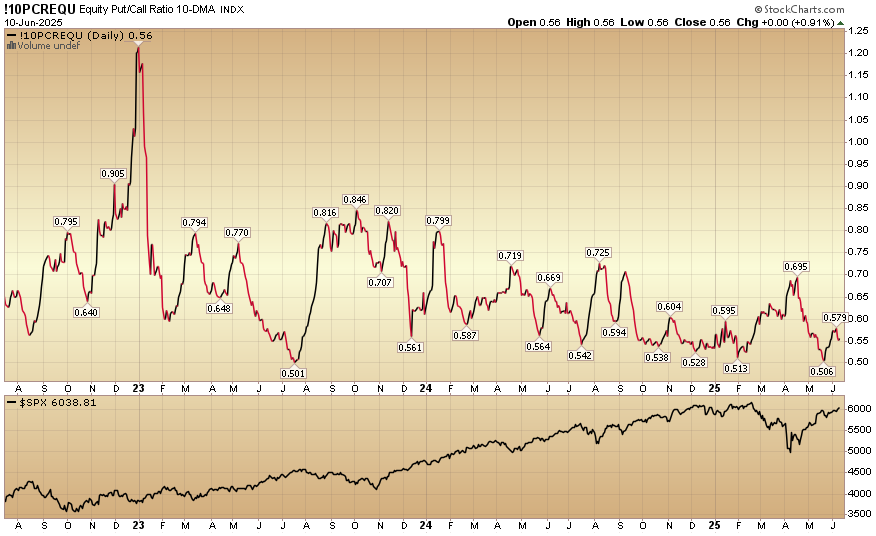

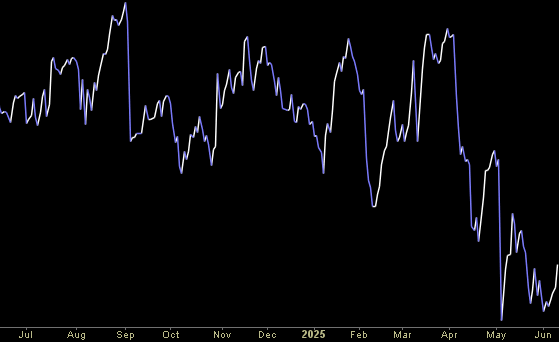

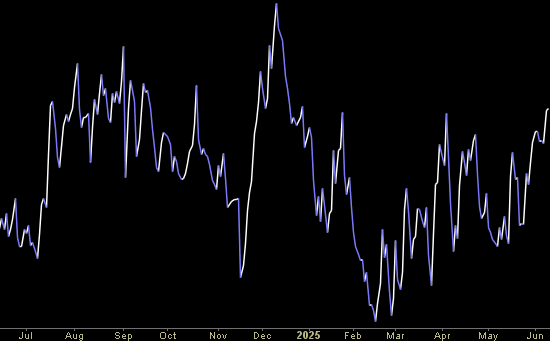

Indicator of the Day (video): Equity Put Call Ratio 10 DMA

Quote of the Day…

Be in the know. 18 key reads for Wednesday…

- US Core Inflation Rises Less Than Forecast for Fourth Month (bloomberg)

- U.S. and China Agree to Get Geneva Pact Back on Track (wsj)

- Trump says China will supply rare earths in ‘done’ deal (cnbc)

- Analysts react to US-China trade agreement (reuters)

- JPMorgan lifts yuan forecast on easing tariff risks, de-dollarisation trend (reuters)

- Chinese automakers pledge faster supplier payments as price wars intensify (ft)

- China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand (zerohedge)

- Boeing books 303 new orders, hits 737 MAX production target in blockbuster May (reuters)

- Data Centers Prompt US to Boost Power-Usage Forecast by 92% (bloomberg)

- Mortgage demand rises to the highest level in over a month, after holiday adjustment (cnbc)

- Roofr and QXO Partner to Bring Real-Time Pricing and Digital Material Ordering to Roofing Contractors (yahoo)

- Disney’s Iger Plans to Hold On to Traditional Television Networks (bloomberg)

- CEO Bob Iger on Disney gaining full control of Hulu: We are ‘very pleased’ with this (youtube)

- BofA institutional clients dump stocks at historic rate, retail keeps buying (streetinsider)

- For Fund Contrarians, ‘Ex’ Can Mark the Spot (morningstar)

- Bessent Emerging as a Contender to Succeed Fed’s Powell (bloomberg)

- GM Plans $4 Billion Investment to Boost U.S. Manufacturing (wsj)

- Why Goldman Sachs says high-flying tech stocks may be headed for a tough stretch (marketwatch)