- Alibaba to ‘strive’ to keep New York listing despite addition to SEC watchlist (ft)

- Big Tech’s Reign Isn’t Over (barrons)

- Boeing Stock Jumps as 787 Deliveries Can Resume (barrons)

- Alibaba Stock Rises as E-Commerce Giant Resolves to Maintain U.S. Listing (barrons)

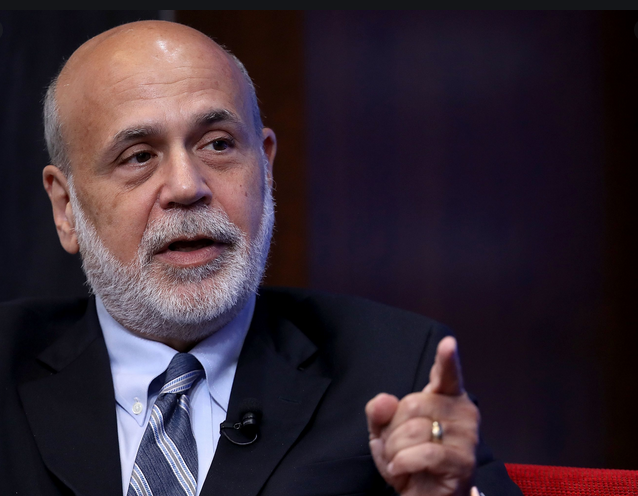

- Bernanke: Why the Fed Didn’t Act Faster to Rein In Inflation (barrons)

- Key Lime Pie Fans Whipped Up Over Dessert Snub (wsj)

- Falling Food Prices Ease Upward Pressure on Global Inflation (wsj)

- China’s Economy Tested by Strained City Finances (wsj)

- Can a ‘Magic’ Protein Slow the Aging Process? (nytimes)

- Bank of America Says a 2% US 10-Year Treasury Yield Is Possible (bloomberg)

- Apple Starts Four-Part Bond Sale to Fund Buybacks, Dividends (bloomberg)

- Tom Brady-Backed Hero Bread in Talks to Raise Convertible Note (bloomberg)

- Shares of Chinese EV makers Nio, Xpeng and Li Auto rise as July car deliveries jump (cnbc)

- The stock market could surge 18% to new highs by year-end as the 2022 bear market is over, Fundstrat says (businessinsider)

- China’s PBOC Pledges Stable Financing for Property Sector (bloomberg)

- Vast majority will pay more in taxes as result of inflation bill (foxbusiness)

- CSRC, China’s securities watchdog, pledges to prevent ‘abnormal fluctuations’ in embattled stock market (scmp)

Be in the know. 22 key reads for Sunday…

- Auto Makers Say Car Sales Will Defy Economic Gloom (wsj)

- Big Tech’s Reign Isn’t Over Yet. These Stocks Look Like Strong Buys. (barrons)

- Amazon Stock Has Gotten Crushed. There’s a Case It Could Double, or Even Triple, From Here. (barrons)

- Smaller Stocks Have Been Big Winners. Why Their Streak Can Continue. (barrons)

- Sarepta Will Seek Approval of Gene Therapy Before Completing Phase 3 Trial (barrons)

- China’s Xi Promotes Team of Allies to Influential Posts, Fortifying His Power (wsj)

- Kyrsten Sinema Is Critical Vote on Manchin-Schumer Climate and Tax Deal (wsj)

- ‘We’ve never seen anything like this’: US retailers compete to clear stock (ft)

- ‘Gumming up’: unwanted debt from buyout boom stuck at investment banks (ft)

- Rolls-Royce’s new CEO says focus will be on opportunity and strategic clarity (ft)

- Boeing Gets FAA Clearance to Restart 787 Dreamliner Delivery (bloomberg)

- SEC Adds Alibaba to List of Chinese Companies Facing Delisting (wsj)

- The Crypto Collapse Has Flooded the Market With Rolex and Patek (bloomberg)

- Tom Lee says the 2022 bear market is over, stocks could hit new highs before year-end (cnbc)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Crops ‘Stored Everywhere’: Ukraine’s Harvest Piles Up (nytimes)

- Liv Boeree, Poker and Life — Core Strategies, Turning $500 into $1.7M, Cage Dancing, Game Theory, and Metaphysical Curiosities (#611) (blog)

- Bloomberg Wealth: Nelson Peltz (bloomberg)

- Nevis Is a Zen Paradise—and One of the Best Undiscovered Caribbean Islands (mensjournal)

- 10 Best Luxury Hotels in the World for a No-Expense-Spared Getaway (mensjournal)

- Can the Iran Nuclear Deal Survive? (cfr)

- Drugs, electric cars, taxes (npr)

Be in the know. 10 key reads for Saturday…

- Negotiated drug prices will only apply to a narrow category of expensive drugs with no generic competition, and then only in relatively small numbers. (washingtonpost)

- Alibaba Chairman and CEO’s Letter to Shareholders (alibabagroup)

- SEC added Alibaba Group Holding Ltd. to a list of Chinese companies at risk of being delisted from the U.S. exchanges if their auditors can’t be inspected before spring 2024. (wsj)

- Amazon stock surges toward biggest monthly gain in 15 years (marketwatch)

- Billionaire investor Ray Dalio warns US can’t keep spending and bring down inflation (foxbusiness)

- Shale Drilling Climbs to Levels Not Seen Since Early Weeks of Pandemic (bloomberg)

- Intel’s Gelsinger Says Stock Deserves to Be Down, Rebound Coming (bloomberg)

- China Evergrande Breaks Silence on Debt-Restructuring Plan (wsj)

- Carried-Interest Change Would Hit Top Wall Street Brass, but Could Be Hard to Make Stick (wsj)

- What Did Joe Manchin Get for $433 Billion? (wsj)

Where is the money flowing?

Be in the know. 17 key reads for Friday…

- Artisan Partners: “BABA’s Shares Could Double, and They Still Would Not Be Expensive” (yahoo)

- Biden & Xi Meet, Gensler Signals Progress On Audit Deal (chinalastnight)

- China’s top leadership vows to give ‘green light’ to a batch of tech deals in sign of policy relaxation (scmp)

- Jack Ma’s exit would smooth Ant’s IPO march (reuters)

- A year after China’s private tutoring crackdown, classes have moved underground as companies struggle to pivot (scmp)

- China’s Politburo Ignites Talk About $220 Billion More in Debt (bloomberg)

- Why the Retreat in Commodities Prices May Last a While Longer (barrons)

- Stock Gains for Apple and Amazon Lift All of Big Tech (barrons)

- Apple Earnings Beat Estimates Thanks to the iPhone. The Stock Is Rising. (barrons)

- Amazon Sales Were Better Than Expected. The Stock Is Soaring. (barrons)

- Elon Musk Says Inflation Might Be Trending Down (barrons)

- The Make-Or-Break Moment Is Here For Highly Rated Neurocrine Biosciences (investors)

- Taiwan Semi’s Spending Spree Will Pay Off Big in the Long Term (barrons)

- Christie’s Charity Auction to Mark the 60th Anniversary of James Bond Films (barrons)

- Alibaba is at the center of a huge Hong Kong-Wall Street realignment (yahoo)

- Biden, Xi Plan In-Person Meet as Taiwan Tensions Intensify (bloomberg)

- What It Would Take for Jack Ma’s Ant to Reboot an IPO (bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 145

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

The “Better Than Feared” Stock Market (and Sentiment Results)…

Where is the money flowing?

Hedge Fund Tips with Tom Hayes – Podcast – Episode 135

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

The “Better Than Feared” Stock Market (and Sentiment Results)…

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 30 key reads for Thursday…

- I Beg to Differ (Howard Marks)

- Alibaba, Meituan are top picks at Daiwa in sector upgrade as internet stocks to benefit most from China stimulus (scmp)

- The Fed is no longer behind the curve, says DoubleLine CEO Jeffrey Gundlach (cnbc)

- US enters technical recession after contraction in second-quarter growth (ft)

- Second straight quarterly decline meets a common definition of recession (wsj)

- Jack Ma to Reportedly Cede Control of Ant Group, Seen as a Boost for Alibaba’s Stake (streetinsider)

- How the Fed Could Lose Its Nerve (wsj)

- China Leaders Call for ‘Best’ Growth Outcome at Key Meeting (bloomberg)

- Grocery Bill Inflation Might Have Peaked (wsj)

- Teva Tries to Put an End to the Opioid Wars (wsj)

- The global recession drum beat is getting louder (reuters)

- Pfizer reports big profit and revenue beats, as COVID drug sales increase by nearly $9 billion (marketwatch)

- Southwest predicts third-quarter revenue above pre-pandemic levels (reuters)

- Merck stock ticks up after profit more than triples to beat expectations (marketwatch)

- Chinese Property Shares Rise as Investors Bet on State Support (bloomberg)

- Energy on Agenda as Saudi Crown Prince to Meet Macron (bloomberg)

- Boeing Reports Drop in Profit but Sees ‘Momentum’ for Turnaround (nytimes)

- Amazon’s Quarter Will Be Bad. What Happens Next? (barrons)

- Intel’s Profitability Outlook (barrons)

- Honeywell Earnings Rise. More People Are on Planes and in the Office. (barrons)

- Jack Ma To Cede Control Of Ant Group Control (zerohedge)

- Facebook Parent Meta Platforms Reports First Ever Revenue Drop (wsj)

- Senate Approves $280 Billion Bill to Boost U.S. Chip Making, Technology (wsj)

- Joe Manchin Reaches Deal With Chuck Schumer on Energy, Healthcare, Tax Package (wsj)

- CBO Expects Significant Rise in Public Debt Burden, Deficit (wsj)

- Ford’s Profit Rises on Higher Sales, More Inventory (wsj)

- US Jobless Claims Fall Slightly, Hold Near Eight-Month High (bloomberg)

- Royal Caribbean beats revenue estimates on pent-up demand (reuters)

- China’s central bank seeks to mobilise $148bn bailout for real estate projects (ft)

- Fed’s Jay Powell calls time on running commentary for rate rises (ft)

- Macau opens for casino licence renewals until September 24 (scmp)