Philip Vassiliou, the CIO of Legatum (who we interviewed a few weeks ago here), thoughtfully sent me this great note on Wednesday – written by another investing legend Howard Marks. I’ve read Howard’s notes over the years, but this was one of the best. The most important lines for me were:

Unconventional behavior is the only road to superior investment results, but it isn’t for everyone. In addition to superior skill, successful investing requires the ability to look wrong for a while and survive some mistakes.

While it’s been nice to see Alibaba bottom in March and Biotech bottom in May, it’s been a long and unpopular road. There will be some who “jump ship” just before the money starts to pour in. There will be some who already sold “in the hole” and will buy back when both investments have already doubled (and then sell on the first 15% consolidation pullback), and there will be some that hold through and make many multiples of their money in a NON-LINEAR fashion (when it comes, it comes all at once!). I know because I’ve been to this movie before many times and it has a very happy ending. The problem I’ve seen is that there are only a few people left in the theater to benefit from the “happy ending” as most great movies all begin with a very rocky start – prior to culminating in a happy resolution. This time will be no different.

Marks goes on to say,

Thus each person has to assess whether he’s temperamentally equipped to do these things and whether his circumstances – in terms of employers, clients and the impact of other people’s opinions – will allow it . . . when the chips are down and the early going makes him look wrong, as it invariably will.

You can’t have it both ways…

Marks’ line, “you can’t have it both ways” is the “key to the kingdom” in this business. Outsized returns do not come to the faint of heart with no process of analysis, no staying power, and no stomach for short term noise/volatility. You simply can’t have it both ways. As I like to say, “they don’t give away multi-baggers for free, you have to earn them.”

I’ll give you the most extreme example I’ve seen. About 14 years ago Charlie Munger convinced Warren Buffett that Berkshire Hathaway should buy 10% of a Chinese battery maker called BYD. They paid $230M for 10% of the company. Today the market cap of BYD is ~$130B – which implies their $230M became ~$13B over 14 years. Let me explain to you why this is so significant:

It’s significant because they were “WRONG” for the first 11.5 years of their investment. Every index, manager, moron, daytrader, psychic, tarot reader, chartist and even a few good investors outperformed the hell out of this investment for more than a decade. Who would stick with such a “ridiculous failure” of an investment? Someone who knows what the hell they are doing, that’s who. Someone who did the work, that’s who. Someone who knew what they owned, that’s who.

While the “stock” did NOTHING for the first 12 years and everything outperformed them, the BUSINESS FUNDAMENTALS IMPROVED CONSISTENTLY. This is one of the most extreme examples I have seen of a stock taking time to catch up with the underlying fundamentals, but it ALWAYS does sooner or later.

This one did to the tune of 56x (56 bagger). It is also 33.4% CAGR for the holding period. Almost 100% of those returns came in the last two years.

When Jeff Bezos asked Warren Buffett one time, “if what you do is so simple, why doesn’t everyone do it?”

Buffett replied, “because no one wants to get rich slow!”

I was at the annual meeting in 2009 when they announced the investment. Buffett’s sell-side trader told me how to buy it in Hong Kong. I passed. The question is, at that stage in my learning process would I have had the fortitude to “hold” an improving business even though the “price” was not confirming the fundamentals for ~11 years? The answer is no.

A couple million would have been worth ~$130M today. The key is to never make the same mistake twice. When I own a quality business that continues to improve over time, I don’t sell regardless of outside pressures and opinions (or short term price). That philosophy has served me very well over the years.

I made a similar case on Alibaba on December 30. The stock price was ~$116. Our basis was much higher. We have been fortunate to bring our blended basis down to $122 (*updated to ~$113.50 on 7/29/2022 through position size increase on weakness) by buying massive options “in the whole” when the famous JPM “China is Uninvestable” report came out in March, but we are still underwater (most people would say WRONG). But most people would be unwilling to burden themselves with the facts we laid out in that note:

This was the key point we made (in the note above) – which has not changed:

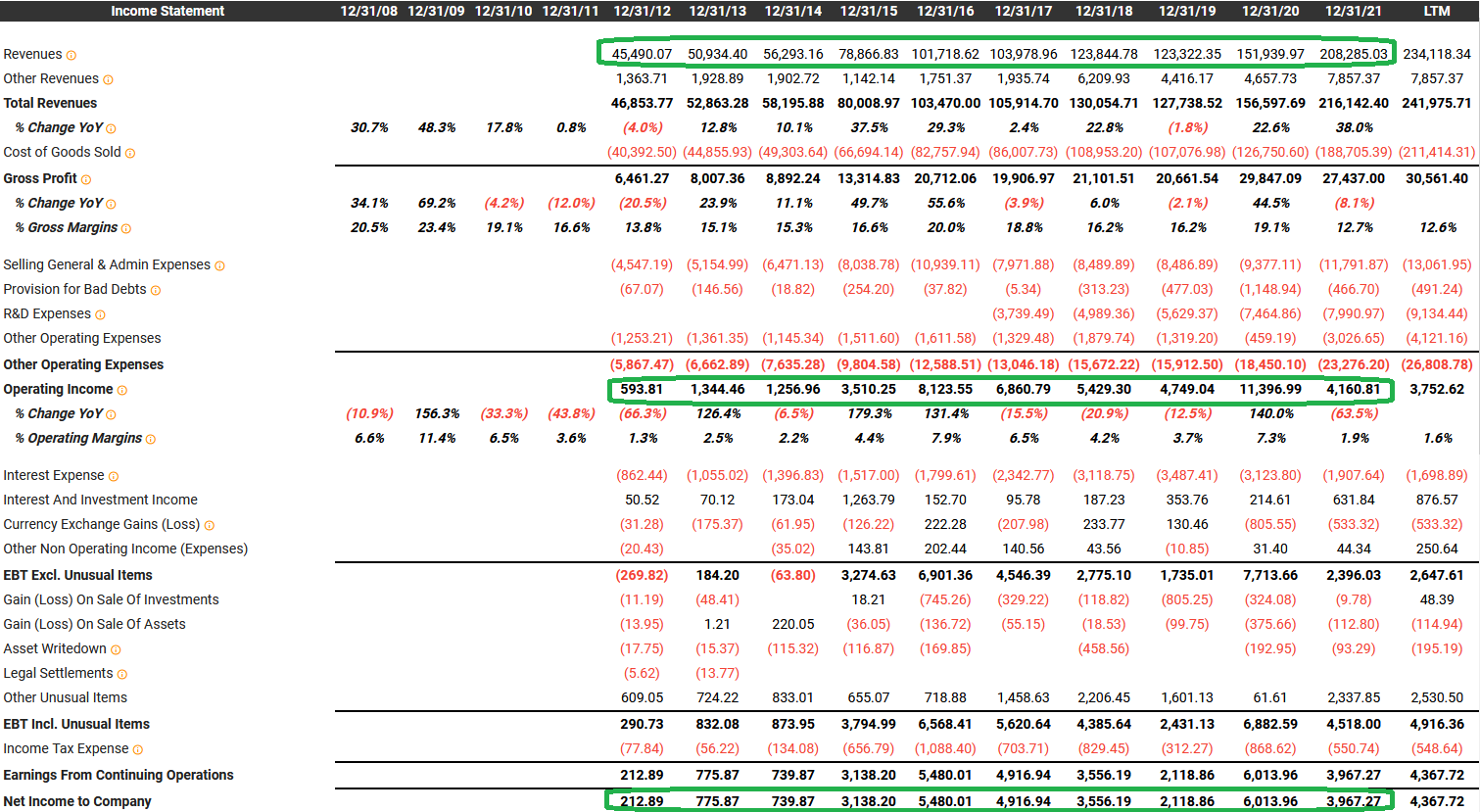

From 2014-2021 (7 years), Alibaba grew –

- Revenues (per share) by 894.93%

- Cash Flow (per share) by 559.46%

- Earnings (per share) by 601.92%

Over the same 7 years, WHILE THE BUSINESS GREW MANY MULTIPLES (~500-900% depending which metric you emphasize), the stock price GAINED ZERO PERCENT. ZERO, ZILCH, NADA…

Ben Graham, “in the short run the market is a voting machine, but in the long run it is a weighing machine.”

But because we KNOW WHAT WE OWN, we added more this week, knowing we own one of the highest quality businesses in the world with a defensible moat. We are buying a business that has grown 5-9x (depending on metric) for the 2014 price it traded at before the growth.

According to the brilliant short-term thinkers who rarely make any real money over time, we are “wrong” just like Munger and Buffett were while the fundamentals of BYD grew (but the stock price did nothing). Like Marks referenced – we are “temperamentally equipped” to see it through as PRICE (voting machine) always catches up with the FUNDAMENTALS (weighing machine) sooner or later. In this case we expect it sooner as a number of catalysts are lining up in that direction in the near term (we will cover them on this week’s podcast|videocast).

Fox Business

Thanks to Ellie Terrett and Ashley Webster for having me on Fox Business – The Claman Countdown on Friday:

Watch in HD directly on Fox Business

Here were my show notes ahead of the segment:

Everyone expected a slowing in Ad Spend for social companies. The goal of the Fed was to reduce demand through tighter policy. They have accomplished that.

-Unlike META, SNAP had led shareholders to believe the changes in Apple’s new iOS would have only a temporary impact. So far it is permanent.

-The final key moving forward is whether the losses faced by SNAP to TikTok are also felt by META and GOOGL ad spend.

META is differentiated in that their average user is older and more embedded to the FB and IG platforms. REELS is gaining traction as a defensive move against TikTok that may prove to be sufficient.

Goldman said: This may be idiosyncratic to SNAP as their channel checks on ad spend were muted, but more optimistic than what we saw from SNAP.

Valuation:

-SNAP was trading at 30x next year’s estimates going into earnings. (no margin of safety)

-META is trading at 12.5x 2023 estimates

-GOOGL is trading at 16.5x 2023 estimates

This gives a much larger “margin of safety” for 2 higher quality businesses – even if earnings come in slightly lower than already feared.

We prefer META if you take a longer term view. Would be buyers on any further weakness after earnings next week. Mark Zuckerberg has a proven history of fixing problems and delivering for shareholders. Taking a 1-3yr view, this time will be no different.

Regardless of what happens next week, if you look back 1-3 years from now, you’ll likely regret not buying AMZN and META at these levels.

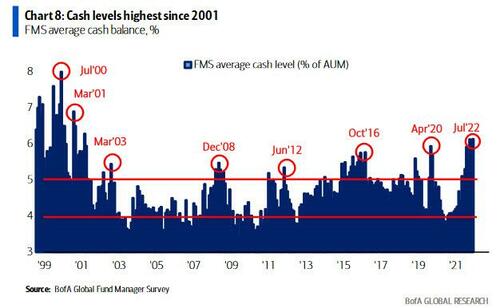

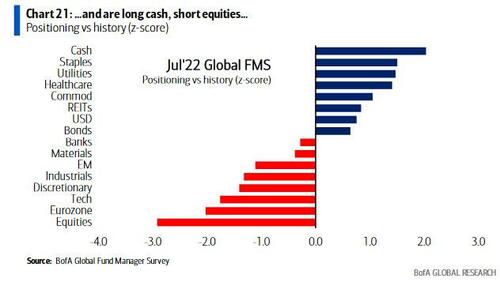

Looking at the BofA Fund Manager Survey this week, one thing was evident:

No one is positioned for any good news (Geopolitical, Inflation, Guidance). Cash levels are the highest since 9/11. Recession fears are the highest since April 2020 (1 month after pandemic lows) and March 2009 (the GFC lows). The Stock Market is a DISCOUNTING MECHANISM so while we may be in or will have a recession, the market will bottom far before it is declared.

Managers will have to CHASE up and “panic buy” any further “unexpected strength”.

IF GDP # comes in negative for Q2 (consistent with Atlanta GDP now), may be a relief rally as recession will be viewed as “in the rearview mirror” versus a dreaded “when is it coming?”

Neg GDP print could also be an impetus for the Fed to slow down or pause (pivot) as early as September. – provided we begin to see lower commodity prices filtering through to cash register in coming weeks/months.

Cheddar News

On Tuesday I joined Azia Celestino on Cheddar to discuss big tech earnings, a recession and expected market responses. Thanks to Azia, Ally Thomson and Elly Park for having me on:

Watch in HD directly on Cheddar

Fox Business 2

Thanks to Ellie Terrett, Liz Claman and Finley Walker for having me on Fox Business – The Claman Countdown – on Tuesday:

Watch in HD directly on Fox Business

Here were my show notes ahead of the segment:

Walmart down because the company cut its profit expectations as inflation forces shoppers to spend more on food (+energy) and less on electronics and other discretionary categories.

-Aggressive markdowns on items such as clothing are hurting margins. We are seeing discounting across the retail sector as inventories built during covid (disinflationary) and consumer slowing.

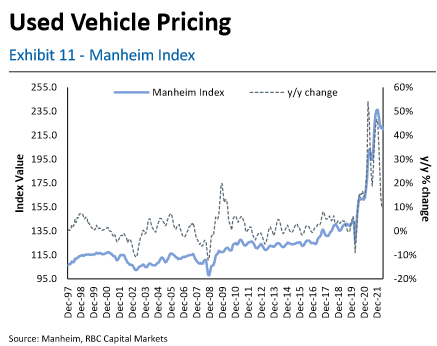

–Other Deflationary News overnight: NXPI reported their Auto Chip business was up 36% yoy. This confirms what we saw from TSM earnings (auto-chips up 16% yoy). GM maintained its full year guidance AND production (despite Q2 hiccup with China shutdown). This means chip shortage abating. As backlog of New Cars hit market, Used Car prices will collapse (major component in CPI). Housing prices beginning to soften (Case-Schiller).

-Key Point for a retail strategy is to focus on higher-end consumer – less impacted by food and gas prices.

–Retail Exposure without Retail Risk: Wait until AFTER AMZN reports and look to accumulate on any weakness (1-3yr view).

-AMZN has been down 40% 7x in its history. Worked back to new highs every time. This time will be no different (despite overbuilding warehouses during covid).

-AWS and the Ad Business together will generate $45 billion in operating income this year (25x multiple = $1.1T ~current value). Get Online Retailer (e-commerce) Whole Foods and Prime for FREE (retail exposure without retail risk)!

-IMF downgraded global GDP today. Fed may slow/pause hikes (starting Sept) if neg GDP print for Q2 this week (technical recession). Pivot=Bullish. Bring record institutional cash in off sidelines (highest since 9/11 according to BofA) as already IN recession. Market is discounting mechanism will start to look forward to recovery (after recession). “Bad news could be Good news…”

-We continue to focus on sectors that can perform in a slower growth environment (like Biotech: XBI) which is now up ~30% off its May lows. Drivers: 1) FDA back to drug approvals (after 2yr focus on COVID) 2) “Animal Spirits” back with ½ dozen multi-billion dollar deals in last 2 months (BHVN, SGEN, etc) 3) Multi-Decade low valuations (Forward PE, P/Operating CF, P/B).

The Fed

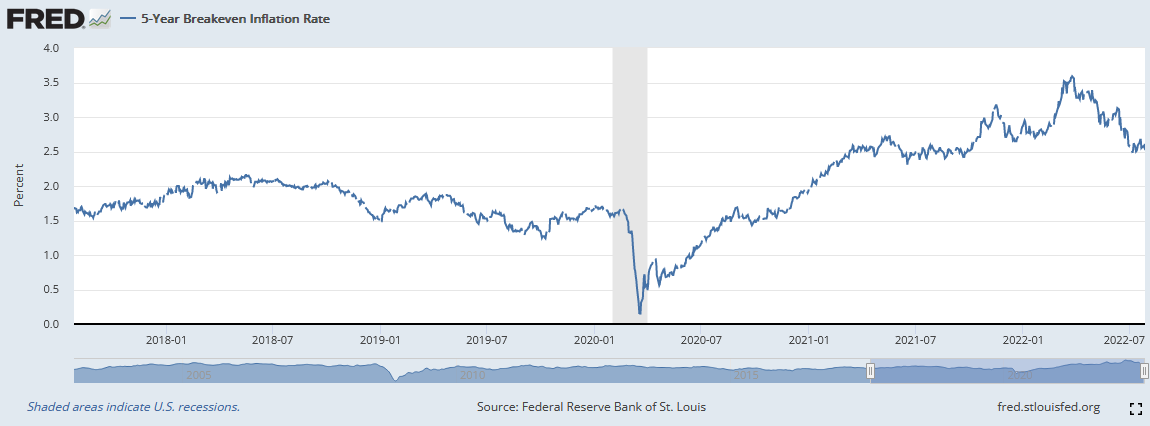

As anticipated the Fed raised 75bps and stated that further moves would be “data dependent”.

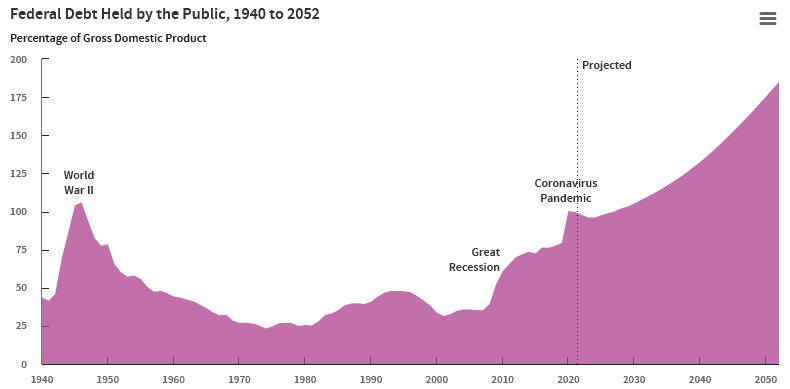

It was no coincidence that the CBO published its “Debt Sustainability” report an hour or so before the Fed announcement. Along with this chart:

The CBO made the following statement:

Debt that is high and rising as a percentage of GDP could slow economic growth, push up interest payments to foreign holders of U.S. debt, heighten the risk of a fiscal crisis, elevate the likelihood of less abrupt adverse effects, make the U.S. fiscal position more vulnerable to an increase in interest rates, and cause lawmakers to feel more constrained in their policy choices.

In other words, EXPECT ABOVE-TREND INFLATION FOR THE FORESEEABLE FUTURE. Not only must the Fed hold rates lower to keep servicing payments manageable, they only way to “pay it back” is to inflate it away as a percentage of GDP (make nominal growth hummm). This is a similar strategy to what succeeded post WWII. Debt to GDP collapsed through above-trend inflation and nominal growth. This time will be no different – which is why they are more focused on inflation EXPECTATIONS than they are ACTUAL inflation. They NEED above-trend inflation (not 9%, but certainly 3-3.5% over the next handful of years will be accepted – and even welcomed).

It is also no coincidence that Treasury Secretary Yellen is scheduled to hold an “economic press conference” after the Q2 GDP number is released today.

If negative, she will explain how 2 quarters of negative GDP no longer means a recession. The market is smarter than that and will likely celebrate the fact that 2 quarters of the recession are already finished and begin to discount the economic recovery coming 6-9 months out when the Fed begins cutting rates once again. Managers with record cash on the sidelines will have to “panic in” and “performance chase” if that scenario plays out.

If the GDP print is positive, Yellen will take a victory lap and the market will likely be subdued – wondering when the recession will actually arrive. In short, BAD NEWS will likely be GOOD NEWS and vica versa. It’s opposite day!

Auto Chips

Our third largest position – which we have discussed on previous podcast|videocast‘s is a special situation auto supplier. Its existence depends on the number of cars the OEMs produce – with its two largest clients being Ford and GM. We have received very good news on this front in a mosaic of recent earnings reports – indicating the tide has shifted as it relates to auto chip supply (improving). This was a core tenet in our investment thesis – which is now starting to manifest.

Taiwan Semiconductor: Auto Chip business up 14% yoy in Q2

NXPI Semiconductor: Auto Chip business up 36% yoy in Q2

Texas Instruments: Beat and Raised on strength in Industrial and Auto Chips. Auto chips rose 20% yoy.

Qualcomm: Automotive chips grew 38% on an annual basis – an all-time-high for Qualcomm.

GM: Maintained full year guidance and production despite a setback in early Q2 due to China lockdowns.

Ford: Maintained full year guidance and production despite a setback in early Q2 due to China lockdowns.

In a research report published Sunday, RBC analyst Joseph Spak wrote that some auto suppliers he follows have seen supply chain situations improve. What’s more, forecasting firm IHS kept its prediction of about 80 million global car sales for the full year 2022 earlier this month, despite volume slipping out of the second quarter because of problems in China.

GM and FORD are key: They can only book revenue when they send the car to dealers. They can only send the car to dealers when they have the auto chips. The color is now that the tide has changed in the latter part of Q2 and the chips are flowing again. This is critical for auto-suppliers as they get paid when OEMs are shipping cars, and OEMs can only ship cars if they have chips. The machine is now unclogging and two years of unfulfilled backlog can now start to be filled. The operating leverage will be enormous.

Earnings: Better Than Feared

Factset: For Q2 2022 (with 21% S&P 500 companies reporting actual results), 68% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue surprise.

Now onto the shorter term view for the General Market:

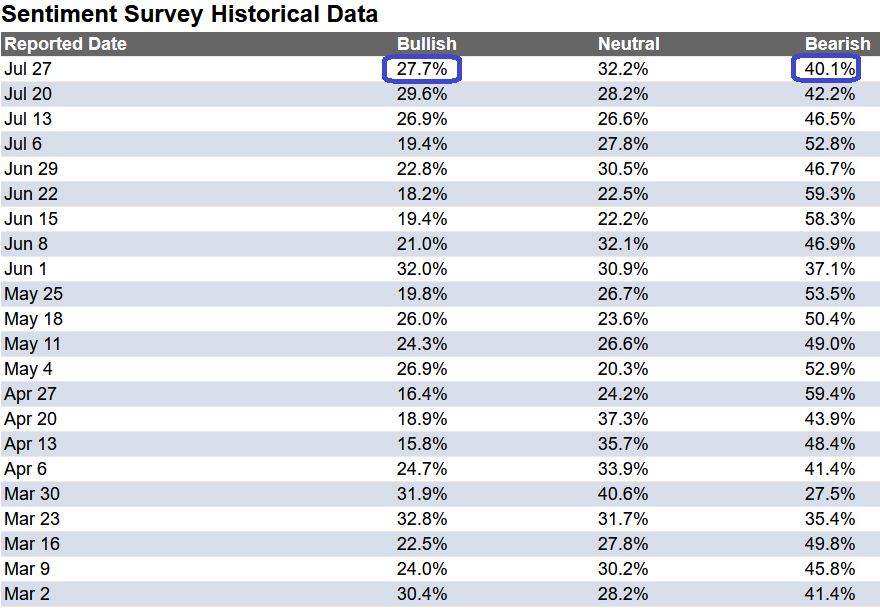

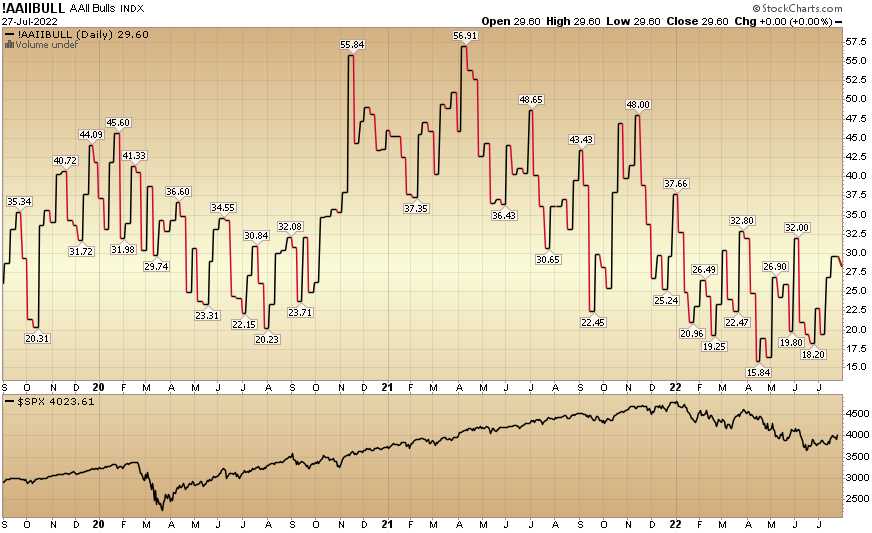

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 27.7% this week from 29.6% last week. Bearish Percent dropped to 40.1% from 42.2%. Retail investors’ fear is slowly starting to thaw.

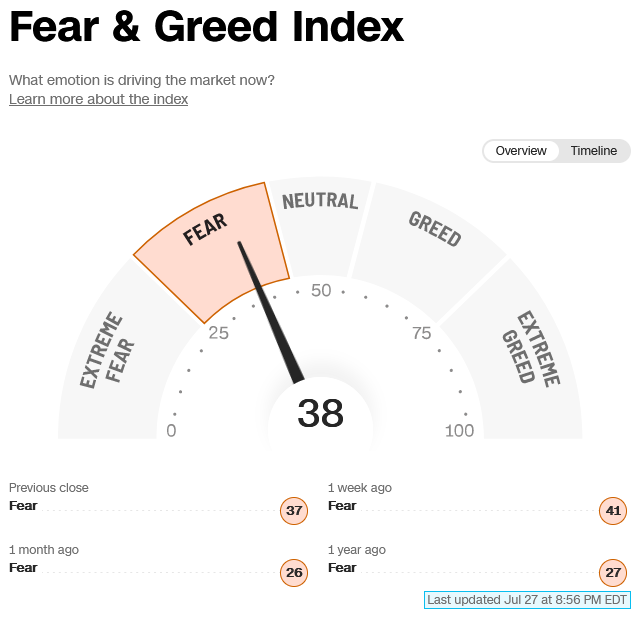

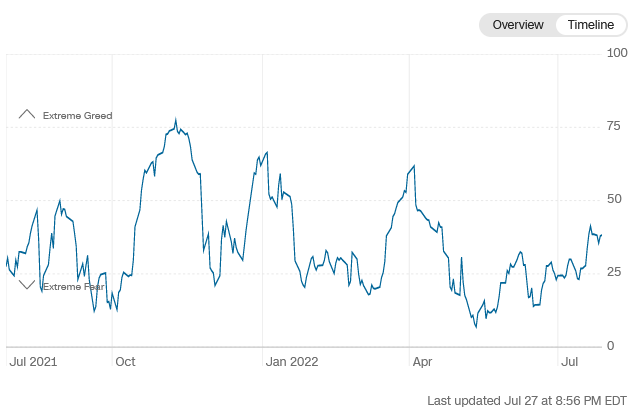

The CNN “Fear and Greed” ticked down from 39 last week to 38 this week. This still shows fear, but it is easing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

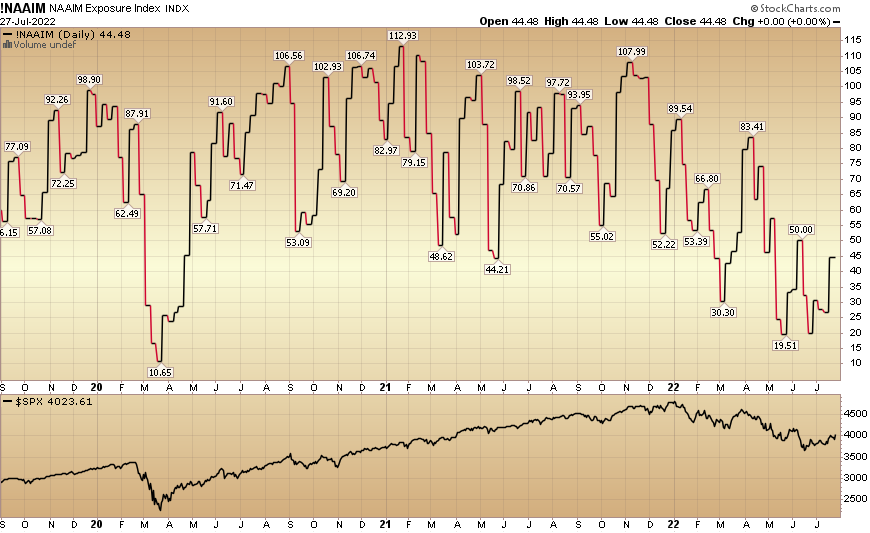

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 44.48% this week from 26.74% equity exposure last week. Active managers are still underweight equities. Any unexpected further positive news will force them back into the market aggressively.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.