On Tuesday, I joined Ashley Webster on Fox Business – the Claman Countdown – to discuss the Stock Market, Fed and Opportunities. Thanks to Liz and Ellie Terrett for having me on: Continue reading ““Take Your Medicine” Stock Market (and Sentiment Results)…”

Where is the money flowing?

Be in the know. 40 key reads for Wednesday…

- Biden Weighs Ending Some China Tariffs Soon in Response to Inflation (wsj)

- Stores Have Too Much Stuff. Here’s Where They’re Slashing Prices. Expect ‘discounts like you’ve never seen before.’ (wsj)

- China’s hottest live-streaming star emerges from off-campus tutoring crackdown (scmp)

- China “Showed a Momentum of Recovery in May” (gov.cn)

- Tesla Shanghai Back At Full Capacity While China Mulls Additional EV Tax Breaks (zerohedge)

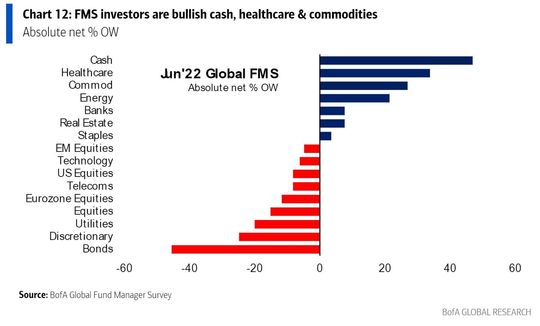

- June 2022 Bank of America Global Fund Manager Survey Results (Summary) (hedgefundtips)

- Natural Gas Could Start to Melt United Front Against Russia (wsj)

- China Economic Data Beats Across The Board In Apparent ZeroCOVID Policy ‘Victory Lap’ (zerohedge)

- ECB Holds Emergency Meeting To Discuss Market Turmoil (zerohedge)

- Biden Sends Threat-Letters To Big Oil: Help Ease “Putin Price Hike” Or Face Our Tools (zerohedge)

- China’s New Oriental education giant finds new life in English live streaming (reuters)

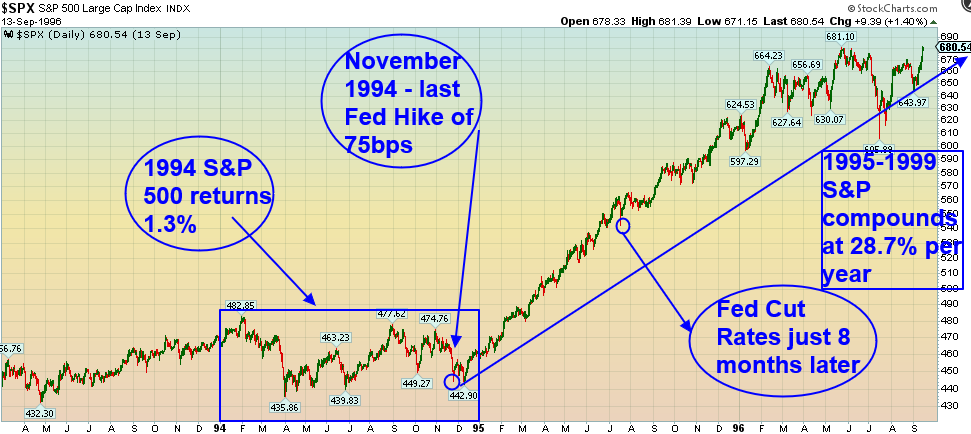

- Here’s everything the Fed is expected to announce, including the biggest rate hike in 28 years (cnbc)

- Hong Kong Sells More U.S. Dollars to Defend Currency Peg (wsj)

- Cliff Asness said value stocks would outperform before the year started. He’s still optimistic. (marketwatch)

- Japanese Bond Futures Suffer Biggest Rout Since 2013, Trigger Circuit-Breakers After ‘Soros’-Style Bets Build (zerohedge)

- China’s chip output rebounds but still lower than a year earlier (scmp)

- Bond Traders Challenge BOJ With Biggest Futures Rout Since 2013 (bloomberg)

- Bill Gates says crypto and NFTs are ’100% based on greater fool theory’ (cnbc)

- ECB ‘Very Open’ to Stepping In If Markets Overreact, Wunsch Says (bloomberg)

- May retail sales unexpectedly decline as consumers confront sizzling hot inflation (foxbusiness)

- Inflation Is Poised to Ease According to These Three Key Indicators (bloomberg)

- Fed will remain ‘behind the curve’ as long as gas prices climb: Expert (foxbusiness)

- Giant Hedge Fund Goes “Soros” On Bank Of Japan: Bets Billions That Japan, And MMT, Will Break (zerohedge)

- Hedge Funds Just Sold Stocks At The Fastest Pace On Record, Surpassing Even Lehman Liquidation Spree (zerohedge)

- Why Investors Are Toning Down Climate Demands (barrons)

- Behind the Fed’s Shift to Consider Bigger Rate Hikes (barrons)

- Apple Stock Has Dropped 25% This Year. Why This Analyst Says It’s Still the Best Bet in Tech. (barrons)

- Italian bond yields dive and euro climbs as ECB announces emergency meeting on market conditions (marketwatch)

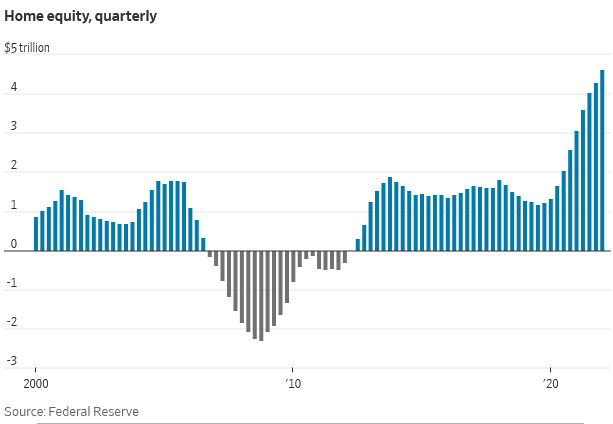

- S. Home Equity Hits Highest Level on Record—$27.8 Trillion (wsj)

- ECB Looks to Tackle Rising Borrowing Costs in Weaker Economies (wsj)

- China’s Economy Shows Signs of Recovery, but Lockdown Threat Remains (wsj)

- The Awful Season That Made the Colorado Avalanche Stanley Cup Contenders (wsj)

- Private Investors Buy Up Retail Real Estate as Bigger Players Remain Cautious (wsj)

- YouTube Reaches 1.5 Billion Users of Shorts, Its TikTok Rival (bloomberg)

- European Central Bank to create new tool to address fragmentation risk and temper bond rout (cnbc)

- ECB has ‘no limits’ in defence of euro from debt turmoil, says executive (ft)

- Hedge Fund Selling Was Never More Furious Than in Last Two Days (yahoo)

- Carl Icahn reduces stake in Cheniere Energy after booking realized and unrealized gains of $1.3 bln (marketwatch)

- Oil Fight for Your Life. The Energy Report 06/15/2022 (Phil Flynn)

- Homebuilder sentiment drops to lowest level in two years as housing demand slows (cnbc)

June 2022 Bank of America Global Fund Manager Survey Results (Summary)

The May survey covered ~266 managers with $747 Billion in assets under management. Continue reading “June 2022 Bank of America Global Fund Manager Survey Results (Summary)”

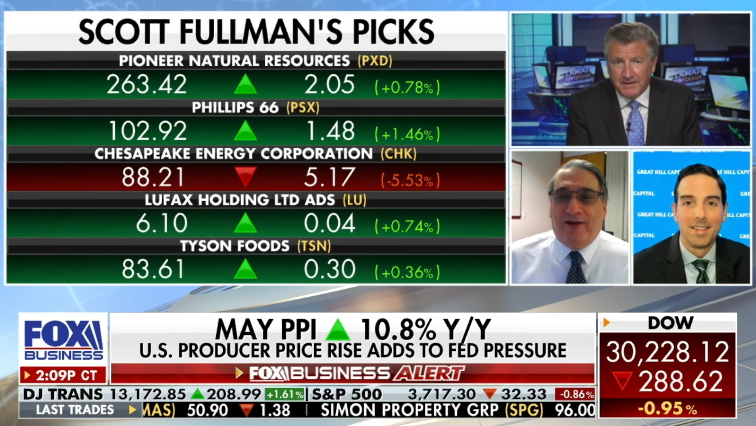

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 14, 2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 14, 2022

Watch in HD directly on Fox Business

Where is the money flowing?

Be in the know. 30 key reads for Tuesday…

- Most factories in Shanghai resume work as Covid controls ease, ministry says (cnbc)

- Fed Likely to Consider 0.75-Percentage-Point Rate Rise This Week (wsj)

- The Fed’s Biggest Interest Rate Hike in 28 Years Could Be Coming (barrons)

- Qualcomm Has Upside Thanks to Apple and Samsung, Analyst Says (barrons)

- FedEx Raises Dividend, Stock Jumps 9% (barrons)

- A Break in Inflation Is on the Way, but It’s the Wrong Break (barrons)

- There Might Be a Recession, but It Won’t Be Long, Wall Street Says (barrons)

- Fund managers are the most fearful of stagflation in 14 years. Here’s what they’re doing about it. (marketwatch)

- Edward O. Thorp — Beating Blackjack and Roulette, Beating the Stock Market, and More (Tim Ferriss)

- As the World Tightens, China Prepares to Ease (chinalastnight)

- Wall Street braced for sharp Fed rate rise to fight soaring inflation (ft)

- The Big Read. BioNTech’s second act: can it transform the fight against cancer? (ft)

- Yen hits 24-year low against dollar as Japan sticks to loose monetary policy (ft)

- Wharton professor Jeremy Siegel is one of the best stock watchers alive. He says the S&P 500 is already pricing in a recession and bear market (yahoo)

- P. Morgan’s Kolanovic Believes Near-Term Recession Will Ultimately be Avoided (streetinsider)

- Gilead’s String of Busts Presents Opportunity (wsj)

- OPEC Sees Halving in Oil Demand Growth Next Year (bloomberg)

- Leon Cooperman Tells CNBC That a Recession Will Hit in 2023 (bloomberg)

- Tech Giants Start Getting Real on Augmented Reality (wsj)

- Russian oil production has jumped 5% so far in June as China and India continue snapping up discounted barrels (businessinsider)

- Oil prices rise even as report says President Biden will visit Saudi Arabia and meet with other top crude producers (businessinsider)

- The stock market is tanking but UBS says companies targeting high income spenders could surge as much as 50%. Here are 38 stocks that fit the bill. (businessinsider)

- Over 80% of investors expect stagflation to shock markets within a year, according to Bank of America (businessinsider)

- Amazon and Spotify Boost Podcast Offerings, and Audiences Soar (bloomberg)

- China City Accused of Using Covid Health Codes to Stop Protests (bloomberg)

- Nasdaq Bulls See Glimmer of Hope in Aggressive Fed (bloomberg)

- The Fed May Discuss the Biggest Interest Rate Increase Since 1994 (nytimes)

- What Happens When Stock Markets Become Bears (nytimes)

- Higher Unemployment Rate Looms as the Fed Fights Inflation (wsj)

- FedEx stock soars toward biggest gain in 29 years (marketwatch)

Tom Hayes – CGTN America Appearance – 6/13/2022

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – June 13, 2022

Watch in HD directly on CGTN America

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Tom Hayes – Benzinga Appearance – 6/13/2022

Benzinga – Thomas Hayes – Chairman of Great Hill Capital – June 13, 2022

Watch Directly On Benzinga HERE