- Chinese Internet Stocks Hit Three-Month High (wsj)

- Alibaba Stock Tears Higher With Chinese Tech. This Time, Thank Videogames. (barrons)

- Carmakers Feel Chip Crisis Easing (bloomberg)

- TSMC Expects 30% Sales Rise Despite Global Economic Ructions (bloomberg)

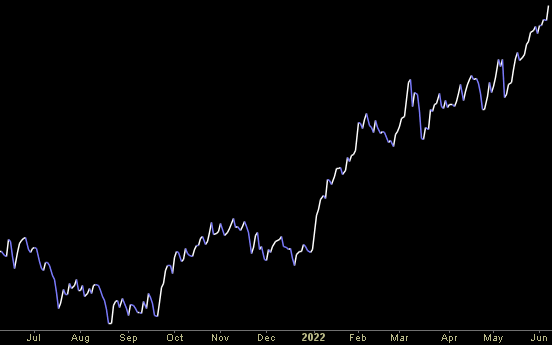

- Market Optimists Make the Case That 2022 Will End on High Note (bloomberg)

- China issues 60 new video game licenses (reuters)

- Even if oil hits $150 a barrel, J.P. Morgan’s Marko Kolanovic predicts stocks will reclaim 2022 highs (cnbc)

- Yellen, World Bank Expect Elevated Inflation to Persist (wsj)

- Gas prices may be leveling off: Phil Flynn (foxbusiness)

- Commentary: The Chances of a Downturn Are Lower Than People Think (barrons)

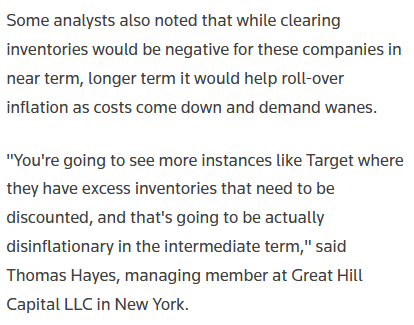

- Target’s Mess Created Opportunities. Here’s What to Consider Buying Now. (barrons)

- Short sellers raise bets against GameStop and AMC to highest level in a year as Wall Street sees more pain ahead (marketwatch)

- Western Digital Stock Is Popping. It May Spin Off Its Flash Memory Business — Just Like Elliott Wants It To (barrons)

- Target Warns Profit to Drop Due to High Inventory Levels (wsj)

- Parabolic Frolic. The Energy Report 06/08/2022 (Phil Flynn)

- Billionaire investor Ray Dalio said that stagflation will force the Fed to slash interest rates by 2024 (businessinsider)

- The U.S. Dollar Is Looking a Bit Stretched (wsj)

- Tesla’s Shanghai plant to exit ‘closed loop’ as Covid-19 fears ease (scmp)

- exclusive | ByteDance’s private valuation down to US$300 billion amid IPO speculation (scmp)

- China welcomes ‘important’ capital inflows with economy still reeling from coronavirus outbreaks (scmp)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/7/2022

Tom Hayes – Quoted in Reuters article – 6/7/2022

Thanks to Devik Jain, Mehnaz Yasmin and Susan Mathew for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is the money flowing?

Indicator of the Day (video): High yield Index Adjusted Spread

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Tuesday…

- Inflation Is Poised to Ease According to These Three Key Indicators (bloomberg)

- JPMorgan’s Kasman Sees No Recession as Dimon’s ‘Hurricane’ Ebbs (bloomberg)

- Target Is Having a Fire Sale. Retail Stocks Are Sliding. (barrons)

- Best Buy’s Founder Bought a Lot of Stock (barrons)

- Every cancer patient enters remission after drug trial at Memorial Sloan Kettering (nypost)

- Citi to Hire 3,000 Staff for Institutional Business in Asia (bloomberg)

- Why Nuclear Energy Is More Relevant Than Ever (zerohedge)

- We’re All Bargain Hunters Now That the Market’s Growth Spurt Is Over (bloomberg)

- ‘Yellowstone’ boom pits lifetime Montana residents against wealthy newcomers (cnbc)

- Why nuclear energy is on the verge of a renaissance (cnbc)

- Cheap valuations, strong growth: Fund manager says it’s time to buy Vietnam stocks (cnbc)

- Why stock-market investors get ‘squirrelly’ when bond yields top 3% (marketwatch)

- Meta Platforms poised to become ‘value’ stock in Russell reshuffling this month, says Jefferies (marketwatch)

- SEC Closes In on Rules That Could Reshape How Stock Market Operates (wsj)

- Greg Norman: Tiger Woods rejected ‘mind-blowingly enormous’ offer from LIV Golf (nypost)

- JPM’s chief economist, others disagree with Dimon’s ‘hurricane’ warning (nypost)

- Goldman Sachs and Credit Suisse are telling investors to double down on stocks rapidly returning cash through dividends and buybacks. Here are their top 27 picks offering yields of at least 6%. (businessinsider)

- For Nordstrom, Allbirds is in and the Trunk Club styling service is out (marketwatch)

- Opinion: New electric DeLorean springs to life after 40 years — and an IPO may accompany it (marketwatch)

- Column: China stimulus ramps up optimism in industrial metals (reuters)

- Ant tilts towards tech and away from finance, analysts say (scmp)

- Return of exports revives Shanghai Port as freight prices soar (scmp)

Where is the money flowing?

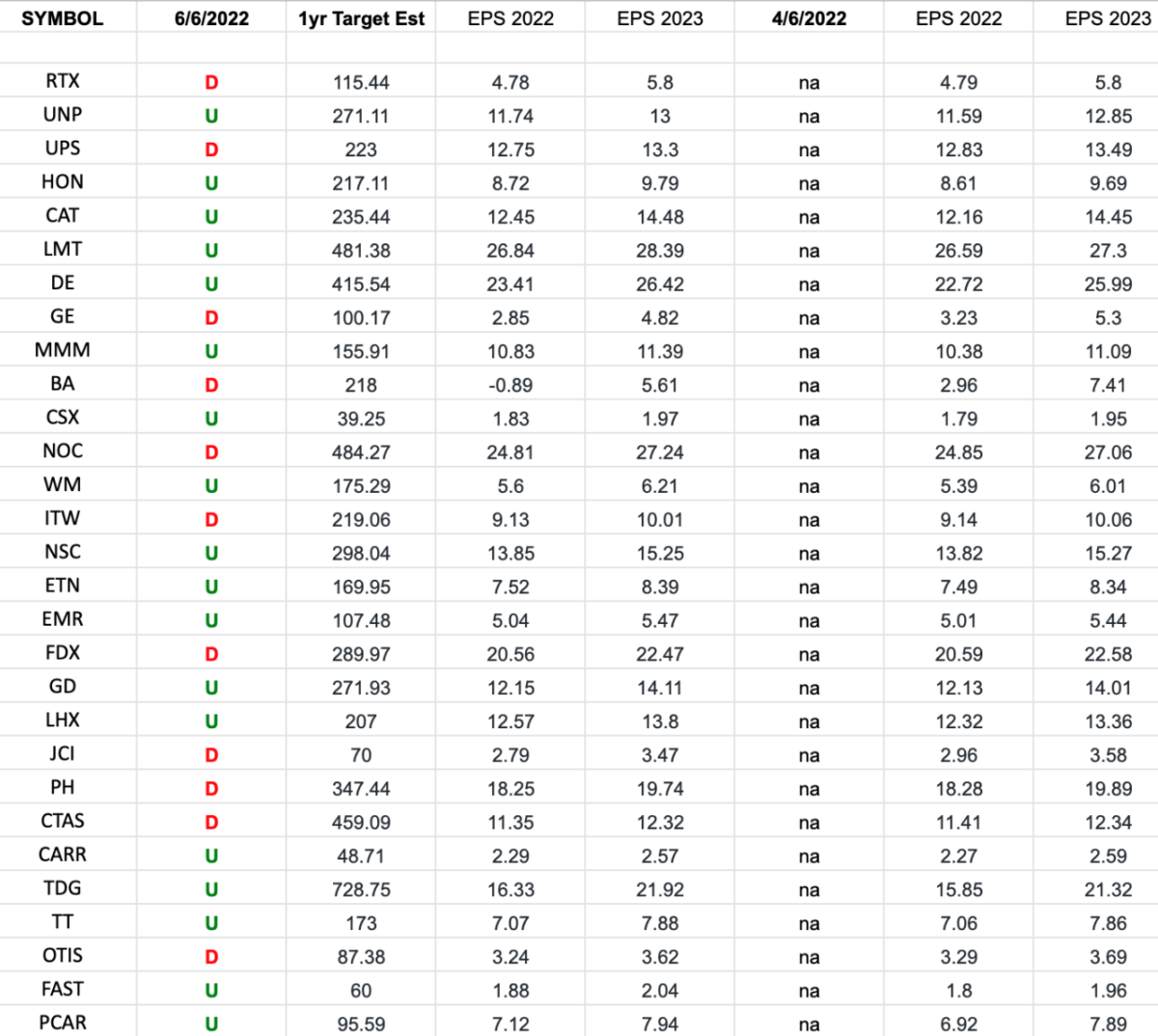

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2022 earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 6/6/2022 has a letter that represents the movement in 2022 earnings estimates since the most recent print (4/6/2022).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 20 key reads for Monday…

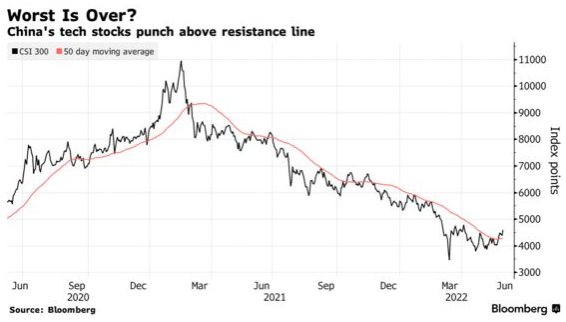

- The Worst May Be Over for China Stocks With Tech Probe’s End in Sight (bloomberg)

- China Software Valuation Likely Bottomed Out, ‘Highly Attractive Sector’ – Analyst (streetinsider)

- China to Conclude Didi Cybersecurity Probe, Lift Ban on New Users (wsj)

- “The Crack Of Dawn For Chinese ADRs”: Didi Soars Over 50% With China Set To End Probe With Just A Penalty, Restore App (zerohedge)

- China tries to shake off the worst of the pandemic in a long, zero-Covid journey (cnbc)

- The Stock Market Gains Amid China Optimism (barrons)

- Amazon’s Split Shouldn’t Mean Much. But It Might Still Help the Stock. (barrons)

- NIO Stocks Jump as Chinese EV Demand Returns. It’s Good News for Tesla, Too. (barrons)

- Spotify Stock ‘Is Not Broken,’ Analyst Says. This Could Be a Time to Buy. (barrons)

- DiDi Global and two other Chinese firms soar on report that probe will end (marketwatch)

- Shanghai Trucking Shortage Gradually Eases But Hurdles Remain (bloomberg)

- Fed Delivers Fuzzier Rate Message as It Gauges Impact of Hikes (bloomberg)

- Goldman Sachs says the US economy will slow to a crawl as the Fed hikes rates, but will dodge a recession (businessinsider)

- An unprecedented gush of income-tax revenue is flowing into the federal government, driven in part by investors and business owners, surprising the nation’s fiscal-policy experts. (wsj)

- ‘Top Gun: Maverick’ Cruises to Another Bumper Box-Office Weekend (wsj)

- Ukraine in ‘very difficult’ fight after Russia’s Donbas advance, says top security official (ft)

- Biden forced into Saudi thaw amid rising oil prices (ft)

- How ESG investing came to a reckoning (ft)

- Has US inflation peaked? (ft)

- Tesla’s China buyers face 24-week wait as carmaker rushes to catch up (scmp)