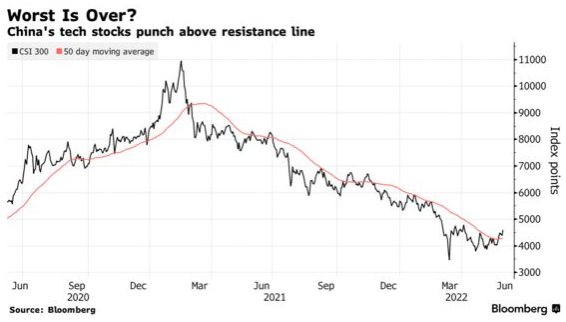

- The Worst May Be Over for China Stocks With Tech Probe’s End in Sight (bloomberg)

- China Software Valuation Likely Bottomed Out, ‘Highly Attractive Sector’ – Analyst (streetinsider)

- China to Conclude Didi Cybersecurity Probe, Lift Ban on New Users (wsj)

- “The Crack Of Dawn For Chinese ADRs”: Didi Soars Over 50% With China Set To End Probe With Just A Penalty, Restore App (zerohedge)

- China tries to shake off the worst of the pandemic in a long, zero-Covid journey (cnbc)

- The Stock Market Gains Amid China Optimism (barrons)

- Amazon’s Split Shouldn’t Mean Much. But It Might Still Help the Stock. (barrons)

- NIO Stocks Jump as Chinese EV Demand Returns. It’s Good News for Tesla, Too. (barrons)

- Spotify Stock ‘Is Not Broken,’ Analyst Says. This Could Be a Time to Buy. (barrons)

- DiDi Global and two other Chinese firms soar on report that probe will end (marketwatch)

- Shanghai Trucking Shortage Gradually Eases But Hurdles Remain (bloomberg)

- Fed Delivers Fuzzier Rate Message as It Gauges Impact of Hikes (bloomberg)

- Goldman Sachs says the US economy will slow to a crawl as the Fed hikes rates, but will dodge a recession (businessinsider)

- An unprecedented gush of income-tax revenue is flowing into the federal government, driven in part by investors and business owners, surprising the nation’s fiscal-policy experts. (wsj)

- ‘Top Gun: Maverick’ Cruises to Another Bumper Box-Office Weekend (wsj)

- Ukraine in ‘very difficult’ fight after Russia’s Donbas advance, says top security official (ft)

- Biden forced into Saudi thaw amid rising oil prices (ft)

- How ESG investing came to a reckoning (ft)

- Has US inflation peaked? (ft)

- Tesla’s China buyers face 24-week wait as carmaker rushes to catch up (scmp)

Be in the know. 20 key reads for Monday…