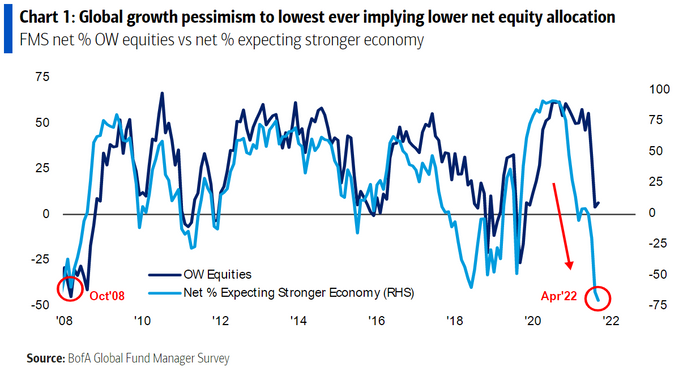

The April 1-7 survey covered 292 managers with $833 Billion in assets under management. Continue reading “April 2022 Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 20 key reads for Wednesday…

- China Promises to Cut RRR When Needed to Boost Economy (bloomberg)

- Investors ‘Unusually Fearful’ Ahead of Earnings – Goldman Sachs (streetinsider)

- What to do with stocks? China’s Covid-19 rules raise spectre of ‘man-made recession’ (scmp)

- Delta Air stock surges after narrower-than-expected loss, big revenue beat (marketwatch)

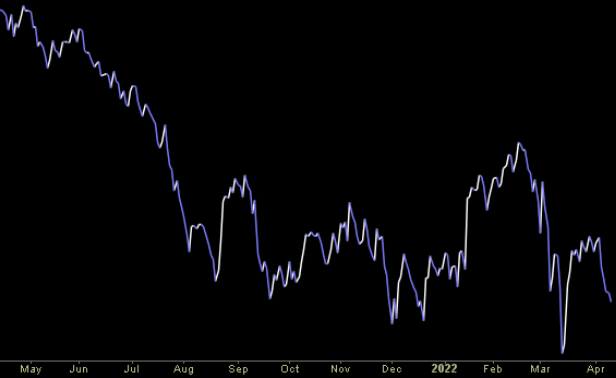

- Opinion: Emerging markets stocks with a host of tailwinds are poised to outperform U.S. equities (marketwatch)

- Why Small-Cap Stocks Could Get an Earnings Pop This Quarter (barrons)

- UBS Upgrades Tech to Overweight, Urges Investors to Focus on Software and Services (streetinsider)

- 10 Beaten-Down Stocks That Investors Are Starting to Like Again (barrons)

- Brazil Retail Sales Beat Forecasts as Omicron Wave Fades Away (bloomberg)

- Twitter (TWTR) Staff ‘Super Stressed’ Over Elon Musk’s Decision Not to Join Board (streetinsider)

- Boeing (BA) Says Conflict in Ukraine is Hurting Orders, Analyst Reaction Mixed (streetinsider)

- 5 Elite and Very Safe Dividend Kings Are Also Wall Street Favorites (24/7 Wall Street)

- JPMorgan profit falls in Q1 on lower trading revenue, slowdown in deal activity (yahoo.finance)

- Game On as Approvals Lead Internet Names Higher (chinalastnight)

- Buffett Showed Tough Negotiation Skills in Alleghany Deal (barrons)

- Supply-Chain Woes Won’t Be Solved by ‘Reshoring,’ Report Says (wsj)

- The Safe Investment That Will Soon Yield Almost 10% (wsj)

- ‘Bond King’ Jeff Gundlach sees a potential ‘calamity’ coming for markets in 2023 as recession hits the US (businessinsider)

- RBC shares why these 16 tech companies are most likely to be bought by competitors and private equity as tech M&A heats up, with $13B in deals already announced this week (businessinsider)

- Putin Says Ukraine Talks ‘at Dead End’, Vows to Pursue War (bloomberg)

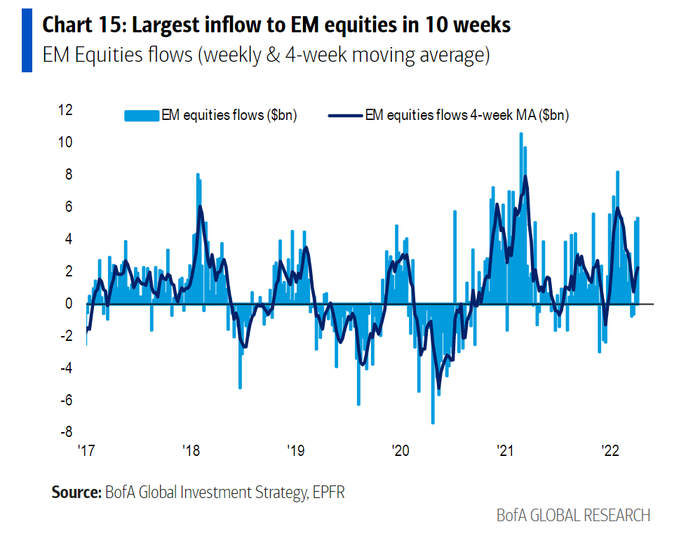

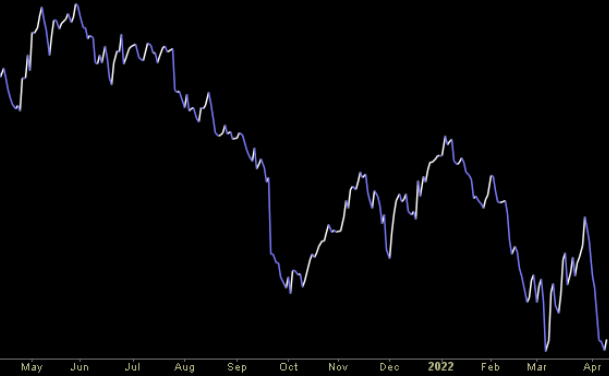

Where is the money flowing?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 4/12/2022

Thanks to Bansari Kamdar for including me in her article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 25 key reads for Tuesday…

- China Steps Up Stimulus With Infrastructure Bond Sales Quota (bloomberg)

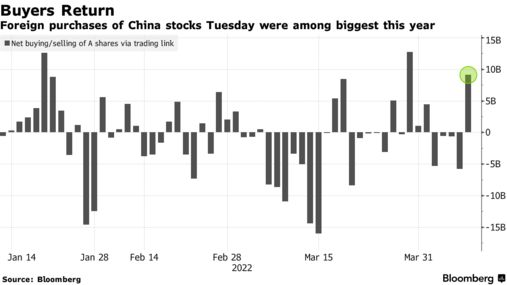

- China Stocks Storm Back on Bets of Policy Support, Covid Shift (bloomberg)

- GOLDMAN SACHS: Buy these 18 deeply oversold stocks that have upside of at least 50% over the next year (businessinsider)

- CSRC renews call that firms buy back shares to boost prices amid sluggish market (scmp)

- Hong Kong stocks climb from 4-week low as China ends freeze on online games (scmp)

- What Record Consumer Credit Says About Inflation—and Recession (barrons)

- Looking for a Stock Boost? Just Wait for Earnings Season (bloomberg)

- China Starts Approving Videogame Licenses Again (wsj)

- The Number of Small Businesses Raising Prices Just Hit Another Record High (bloomberg)

- Elon Musk, Again an Outsider at Twitter, Emerges as Unshackled Wild Card for Company (wsj)

- Charlie Munger’s Daily Journal Slashed Its Stake in Alibaba Stock (barrons)

- This Is How an Elon Musk Twitter Takeover Could Work (bloomberg)

- Airports Clogged With Queues as Travel Rebound Strains Resources (bloomberg)

- This value fund manager is sticking with Netflix and Facebook’s parent — and has a new position in another megacap tech stock (marketwatch)

- EasyJet Summer Bookings Above 2019 Levels: The London Rush (bloomberg)

- Apple Poised to Boost Buybacks by $90 Billion, Citi Analyst Says (bloomberg)

- Oil Rebounds as Investors Assess China’s Easing Virus Lockdown (bloomberg)

- China’s Goal in Covid Zero Pursuit Shifts Amid Omicron Outbreak (bloomberg)

- China Tech Stocks Rise as Gaming Approval Lifts Sentiment (bloomberg)

- Chairman Yi Huiman’s Weekend Speech Positive (chinalastnight)

- Investors Turn Cautious on Consumer Debt (wsj)

- If Crypto Can’t Be Used to Evade Russian Sanctions, What Is the Point? (wsj)

- European Companies Plead China To Revise “COVID Zero” As Beijing Vows Stronger Policies To Reverse Economic Collapse (zerohedge)

- Twitter (TWTR) Staff ‘Super Stressed’ Over Elon Musk’s Decision Not to Join Board (streetinsider)

- Mark Zuckerberg says Meta will test selling virtual goods in the metaverse (cnbc)