- China Promises to Cut RRR When Needed to Boost Economy (bloomberg)

- Investors ‘Unusually Fearful’ Ahead of Earnings – Goldman Sachs (streetinsider)

- What to do with stocks? China’s Covid-19 rules raise spectre of ‘man-made recession’ (scmp)

- Delta Air stock surges after narrower-than-expected loss, big revenue beat (marketwatch)

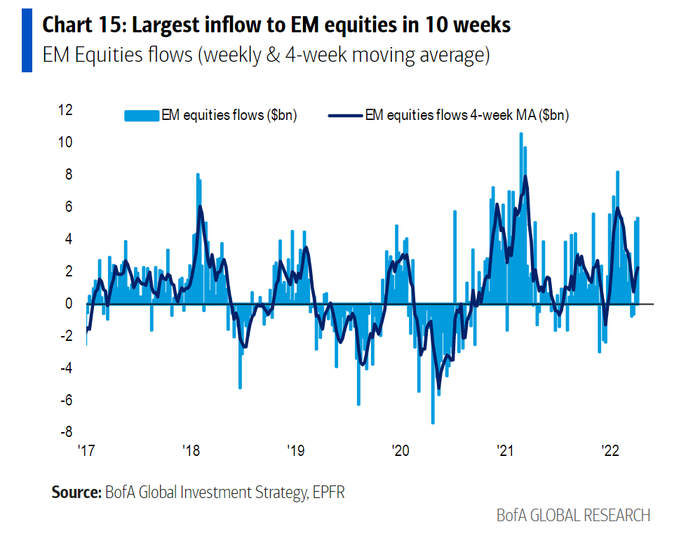

- Opinion: Emerging markets stocks with a host of tailwinds are poised to outperform U.S. equities (marketwatch)

- Why Small-Cap Stocks Could Get an Earnings Pop This Quarter (barrons)

- UBS Upgrades Tech to Overweight, Urges Investors to Focus on Software and Services (streetinsider)

- 10 Beaten-Down Stocks That Investors Are Starting to Like Again (barrons)

- Brazil Retail Sales Beat Forecasts as Omicron Wave Fades Away (bloomberg)

- Twitter (TWTR) Staff ‘Super Stressed’ Over Elon Musk’s Decision Not to Join Board (streetinsider)

- Boeing (BA) Says Conflict in Ukraine is Hurting Orders, Analyst Reaction Mixed (streetinsider)

- 5 Elite and Very Safe Dividend Kings Are Also Wall Street Favorites (24/7 Wall Street)

- JPMorgan profit falls in Q1 on lower trading revenue, slowdown in deal activity (yahoo.finance)

- Game On as Approvals Lead Internet Names Higher (chinalastnight)

- Buffett Showed Tough Negotiation Skills in Alleghany Deal (barrons)

- Supply-Chain Woes Won’t Be Solved by ‘Reshoring,’ Report Says (wsj)

- The Safe Investment That Will Soon Yield Almost 10% (wsj)

- ‘Bond King’ Jeff Gundlach sees a potential ‘calamity’ coming for markets in 2023 as recession hits the US (businessinsider)

- RBC shares why these 16 tech companies are most likely to be bought by competitors and private equity as tech M&A heats up, with $13B in deals already announced this week (businessinsider)

- Putin Says Ukraine Talks ‘at Dead End’, Vows to Pursue War (bloomberg)