- Dyeing the Chicago River green is a St. Patrick’s Day tradition. How did it start? (npr)

- China plans audit concession in face of US delisting threat (ft)

- Credit Suisse Turns Overweight on Stocks, Favors U.S. and China (bloomberg)

- China will encourage publicly traded companies to buy back their shares and money managers to invest in their own funds (scmp)

- China’s elevated Covid cases may not hit the economy as hard as feared (cnbc)

- S. Factory Output Exceeds Forecast, Rises Most in Four Months (bloomberg)

- China Finds a Way to Do Covid Zero While Keeping Factories Open (bloomberg)

- Biden and China’s Xi to discuss Russia and Ukraine in Friday call: White House (marketwatch)

- Home Builder Sees a Strong Housing Market Despite Worries About Affordability (barrons)

- Stocks Brushed Off Fed Hawkishness. The Good News Lies Elsewhere. (barrons)

- Xi Jinping’s Stock-Market “Put” Is Alive And Well (zerohedge)

- Fed Stakes Out Hawkish Stance on Inflation and Keeps a Wary Eye on Ukraine War (barrons)

- The FDA Has a New Chief. Here Are 5 Key Decisions on Drugs to Watch. (barrons)

- China reported a drop in new coronavirus cases as authorities worked to contain outbreaks. (wsj)

- Walmart Aims to Hire 50,000 U.S. Workers by End of April (wsj)

- China Shares Soar After Beijing Signals Support; Alibaba Jumps 37% (wsj)

- Putin Acknowledges Impact of Sanctions on Russian Economy (wsj)

- Michael Price, Who Saw Value in Companies’ Struggles, Dies at 70 (yahoo)

- Cliff Asness: Value Stocks Are More Than Just an Interest-Rate Bet (institutionalinvestor)

- The Shilling For The Green. The Energy Report 03/17/2022 (Phil Flynn)

- com, Alibaba lift Hang Seng again as China’s support spurs confidence (scmp)

- Vice Premier Liu He’s Speech Sends Stocks Flying (chinalastnight)

- Wedbush’s Ives Says Fed Gave a ‘Bright Green Light’ to ‘Aggressively Own Tech Names’ (streetinsider)

- Jobless claims inch lower to 214,000 as workers remain in high demand (foxbusiness)

- Netflix Will Be Sticking to Its Script (wsj)

- Russia claims to have ordered crucial bond payment as it seeks to avoid historic debt default (cnbc)

- Episode 1: When Amazon Nearly Flamed Out, Jeff Bezos Conceived Kindle and Prime (bloomberg)

- Musk’s Starlink Brings Internet to Ukraine, and Attention to a New Space Race (bloomberg)

- Reflections On The Russian Ukraine Crisis (bridgewater)

- U.S. Factory Output Tops Forecasts to Rise Most in Four Months (bloomberg)

Tom Hayes – Guest on The Pitchboard Podcast – 3/17/2022

The Pitchboard Podcast – Thomas Hayes – Chairman of Great Hill Capital – March 17, 2022

Listen Directly on The Pitchboard

“Home Sweet Home” Stock Market (and Sentiment Results)…

In 1985 Motley Crue released one of its major all-time hits, “Home Sweet Home.” Last night, when I was thinking about the journey of Alibaba over the last few months, this song came to mind. The journey has had a few detours, but now it’s on finally on its way back “home” to intrinsic value.

Seeing Alibaba jump ~35% in one day is evidence that the objective business/fundamental analysis was always accurate, it was simply a mercurial government leadership holding the stock back. With the government now stepping out of the way and letting business flourish once again, we expect this marvelous business to work its way back to intrinsic value over time. We may hit a few more potholes and speed bumps, but we’re on our way… Continue reading ““Home Sweet Home” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance Appearance – 3/16/2022

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 16, 2022

Watch in HD directly on Yahoo! Finance

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/16/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 16, 2022

Watch in HD directly on Fox Business

Where. is the money flowing?

Hedge Fund Tips (PMN) – Position Management Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 27 key reads for Wednesday…

- China Makes Strong Vow to Ease Crackdowns After Market Turmoil (bloomberg)

- Rollback of Xi Jinping’s Economic Campaign Exposes Cracks in His Power (wsj)

- Alibaba Jumps. Here’s What Sparked the Turnaround. (barrons)

- Biogen’s stock gains after sharing longer term data for its Alzheimer’s disease (marketwatch)

- China Moves to Stabilize Its Stock Markets and Boost Economic Growth (barrons)

- Fed’s ‘Forward Guidance’ Is More Important Than Its Expected Rate Hike (barrons)

- What happens to money when the Fed starts shrinking its balance sheet? (marketwatch)

- Ukraine and Russia signal progress in talks (ft)

- Intel pours €30bn into chip manufacturing in Europe (ft)

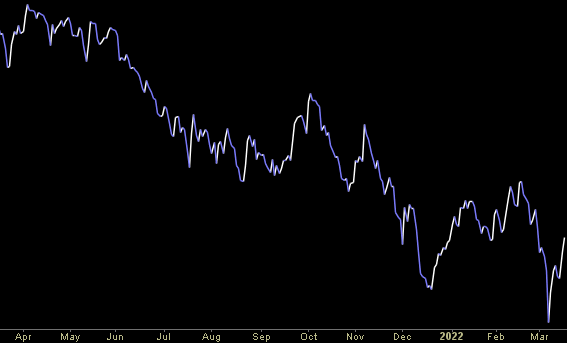

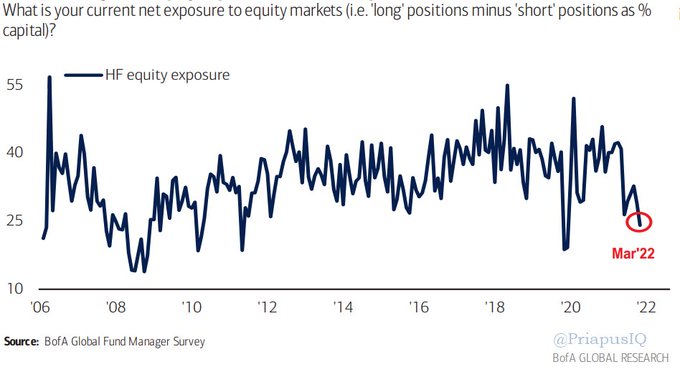

- Hedge funds make retreat from US stocks after big swings hurt returns (ft)

- China makes rare intervention to bolster confidence after market rout (ft)

- Xi Spurs Frantic Stock Buying With Lifeline for China Market (bloomberg)

- China Will Not Expand Its Property Tax Trial This Year (bloomberg)

- Hang Seng Tech Index Explodes 22% as China Pledges to Stabilize Markets and Support Overseas IPOs (streetinsider)

- Baird Adds Boeing (BA) to Its Bullish Fresh Pick List (streetinsider)

- The 5 Highest-Yielding Dividend Aristocrats Are Exceptional Value Buys Now (247wallst)

- Going Neutral. The Energy Report 03/16/2022 (Phil Flynn)

- Investors have been scared out of this group of stocks, says fund manager, who offers five ideas for the rebound to come. (marketwatch)

- Starbucks CEO stepping down with Howard Schultz returning on an interim basis and pay of $1 (marketwatch)

- The 8 worst-performing S&P 500 stocks with the highest ratings are expected to rebound by more than 50% over the next year (marketwatch)

- BANK OF AMERICA: These 10 ‘out of consensus’ stock picks will smash expectations in a market with 34% upside potential in the coming 12 months (businessinsider)

- JPMorgan’s quant guru is sticking to his bullish outlook for stocks and says the economy will avoid falling into a recession (businessinsider)

- Billionaire investor Ray Dalio breaks down the ‘very difficult trade-off’ the Fed must make to fight inflation — and tells us how to diversify a portfolio in this environment (businessinsider)

- Retail traders have been more aggressive buyers of the recent dip in the stock market than in any other correction since the 2008 crisis, Bank of America says (businessinsider)

- Amazon, Alphabet, and 8 Other Beaten-Up Growth Stocks Set to Soar (barrons)

- Retail Investors Are Dropping Out of the Stock Market (barrons)

- Stock Buybacks Are on Course for Another Record (wsj)

March 2022 Bank of America Global Fund Manager Survey Results (Summary)

The March 4-10 survey covered 341 managers with $1 trillion in assets under management. Continue reading “March 2022 Bank of America Global Fund Manager Survey Results (Summary)”