Be in the know. 25 key reads for Thursday…

- The S&P 500 Took Off at Year’s End. Earnings Could Bring More Gains. (barrons)

- Signs That Prices Might Be Heading Back Down Soon (barrons)

- Why Visa, Juggernaut of the Payments Business, Is a Buy (barrons)

- Fed Minutes Suggest More Stock-Market Turmoil Could Lie Ahead (barrons)

- Biggest Tech Selling in a Decade as Rate Rout Spooks Hedge Funds (bloomberg)

- These Pharma Firms Have the Cash for Acquisitions (barrons)

- Netflix’s Subscriber Growth May Fall Short, Analyst Says. Why He’s Still Upbeat. (barrons)

- Tech Stocks Are Having Their Worst Start to a Year Since 2008. What’s Behind the Selloff. (barrons)

- Meme Stocks, Crypto Sink as Possible Rate Hike Looms. GameStop and AMC Led the Slump. (barrons)

- Walgreens Stock Rises on Profit Beat and Guidance Raise (barrons)

- 20 cheap value stocks that Wall Street expects to rise up to 58% (marketwatch)

- Fed Minutes Point to Possible Rate Increase in March (wsj)

- China’s Unpredictable, Heavy-Handed Governance Threatens Growth (wsj)

- Anger at Xi’an Lockdown Spreads in China (wsj)

- AT&T Shed Media Assets in 2021. This Year It Wants to Add Investors. (wsj)

- Goldman Strategists See Haven in Europe Stocks Amid Rate Hikes (bloomberg)

- Boeing stock gains after Atlas Air orders 4 Boeing 777 freighters (marketwatch)

- Big tech stocks will be ‘bumpy’ in 2022: Bob Doll (foxbusiness)

- Wells Fargo, Bank of America draw price target hikes on bullish loan data (marketwatch)

- Wall Street Loves China More Than Ever (bloomberg)

- China’s digital currency comes to its biggest messaging app WeChat, which has over a billion users (cnbc)

- Warren Buffett’s Berkshire Hathaway may be buying Japanese stocks again, based on its latest bond issue (businessinsider)

- Alibaba bets on the metaverse with DingTalk AR glasses (scmp)

- This tech giant will shape the future of the metaverse, buy its stock: analyst (yahoo)

- Could A Graphite Shortage Derail The $3 Trillion EV Boom? (yahoo)

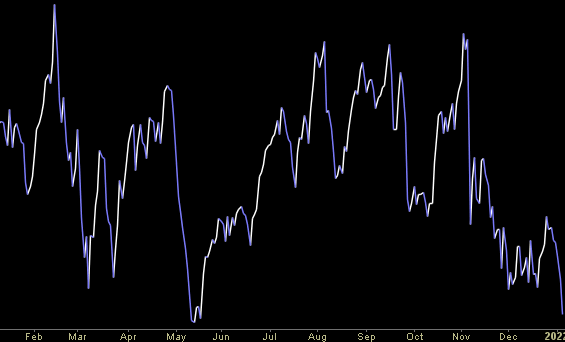

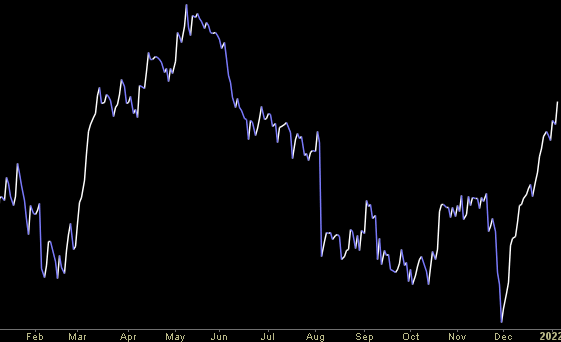

“I Dare You” Stock Market (and Sentiment Results)…

As I get older, I listen less to what people say and simply watch what they do. On Wednesday, the market was down as a reaction to what was said in the Fed Minutes (from the December meeting). Continue reading ““I Dare You” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 25 key reads for Wednesday…

- Charlie Munger’s Firm Doubles Down on Alibaba Investment. Again. (barrons)

- Boeing Stock Rises on New 737 MAX Order (barrons)

- AT&T Shed Media Assets in 2021. Now It Wants Investors. (wsj)

- Chinese Premier Li Urges Bigger Tax Cuts to Ensure Economic Growth (bloomberg)

- Manchin Deflates Democrats’ Hopes of Changing Filibuster, Passing Election Bills (wsj)

- China’s Stocks Had a Tumultuous Year. Analysts Size Up the Market’s Prospects for 2022. (barrons)

- China Tech Selloff Deepens as Tencent Sale Spooks Traders (bloomberg)

- Long Shadows. The Energy Report 01/05/2022 (Phil Flynn)

- Fed Minutes Eyed for Details on Rate Liftoff, Shrinking Assets (bloomberg)

- S. Companies Add Most Jobs in Seven Months, ADP Data Show (bloomberg)

- Gas Tankers Divert From China to Europe in Price Premium Race (bloomberg)

- AT&T Stock Rises After Posting 1.3 Million Subscriber Adds (barrons)

- Omicron seems to have peaked or plateaued in some regions, experts say (cnbc)

- China says apps that could influence public opinion require a security review (cnbc)

- A Slimmer Build Back Better Bill Is Still Possible (barrons)

- Stocks will rally in 2022 even as US interest rates hit 2%, Wharton professor Jeremy Siegel says (businessinsider)

- General Electric upgraded to Outperform from Neutral at Credit Suisse (thefly)

- Turkish Central Bank Revives Bond-Buying Drive to Rein In Yields (bloomberg)

- BofA Securities Out With 10 Favorite Stock Ideas for Q1 2022 (247wallst)

- Opinion: Why the bull market will stay alive in 2022 — plus 8 cheap stocks for your money now (marketwatch)

- Opinion: Charlie Munger, Warren Buffett’s right-hand man, just turned 98 and has some choice words about inflation, EBITDA and marriage (marketwatch)

- Federal Reserve could invert Treasury yield curve by third quarter as it delivers rate hikes, economists say (marketwatch)

- Fed’s Kashkari, a leading dove, backs two interest-rate hikes this year (marketwatch)

- JPM Urges Clients To “Stay Bullish” As Positive Catalysts “Are Not Exhausted” (zerohedge)

- China’s internet watchdog posts revised app rules to tighten cybersecurity provisions (scmp)