- Biden-Xi Virtual Summit Set for Next Week, With Date to Come (bloomberg)

- China’s Xi says ready to work with U.S. on condition of ‘mutual respect’ (cnbc)

- Inflation Was Sharply Higher Than Expected in October (Barron’s)

- Why Coinbase’s chief expects the NFT market is more like Instagram than eBay (fnlondon)

- More pain likely for hedge funds as leveraged investors unwind wrong-way bond market bets, traders say (marketwatch)

- J&J Lauds Oklahoma Ruling That Tosses Out $465 Million Opioid Judgment (barrons)

- Evergrande Is Courting Default Again as $148 Million Payment Comes Due (barrons)

- Looking For Answers. The Energy Report 11/10/2021 (Phil Flynn)

- Business Costs Are Still Surging. Here’s One Reason for Optimism. (barrons)

- Inflation Was Supposed to Kill Margins. Why Companies Are Turning Higher Profits Anyway. (barrons)

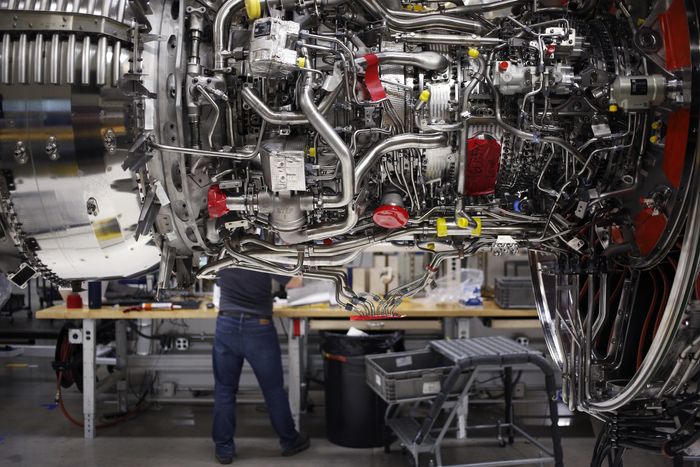

- GE Is Splitting Up. The Pieces Are Worth More Than Wall Street Thinks. (barrons)

- AT&T, Verizon, and T-Mobile Make the Case for Their Beleaguered Stocks (barrons)

- Rolls-Royce plans to build small nuclear power plants in Britain. (New York Times)

- Inflation in U.S. Builds With Biggest Gain in Prices Since 1990 (bloomberg)

- Liquidity drought in Treasury market accompanies unexpected rally (Financial Times)

- China’s factory gate inflation soars to 26-year high on energy crunch (Financial Times)

- Li Ka-Shing Adds Hydrogen Bet to Bolster $31 Billion Fortune (bloomberg)

- Clorox CEO Sticking to Bold Post-Pandemic Plan After Stock Rout (bloomberg)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

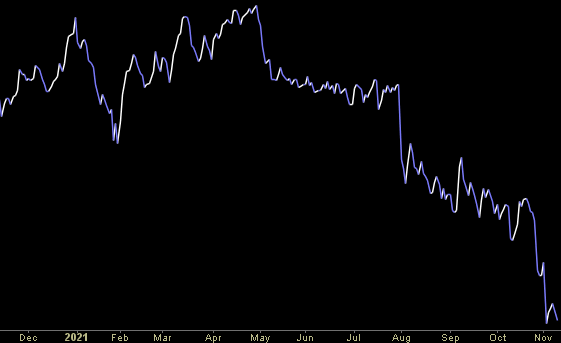

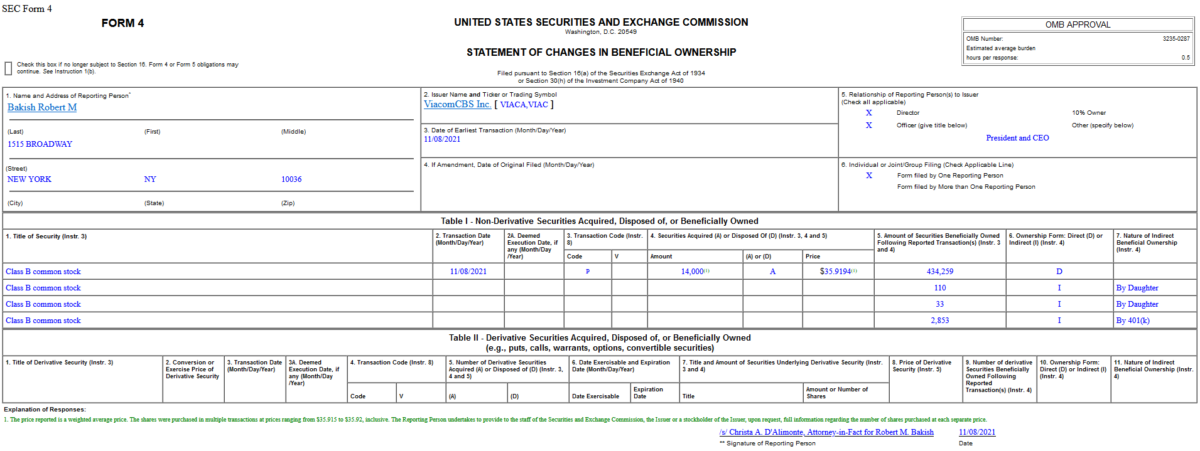

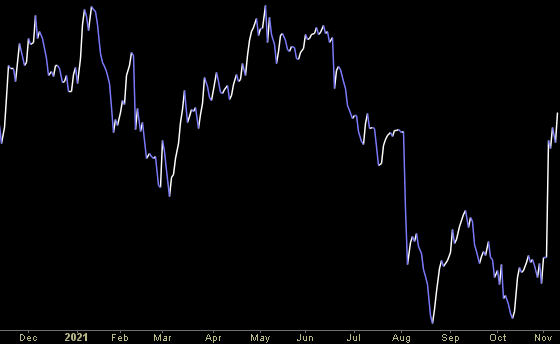

Insider Buying in ViacomCBS Inc. (VIAC)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Tuesday…

- Supply-Chain Constraints Were Harsh. Profit Margins Grew Anyway. (barrons)

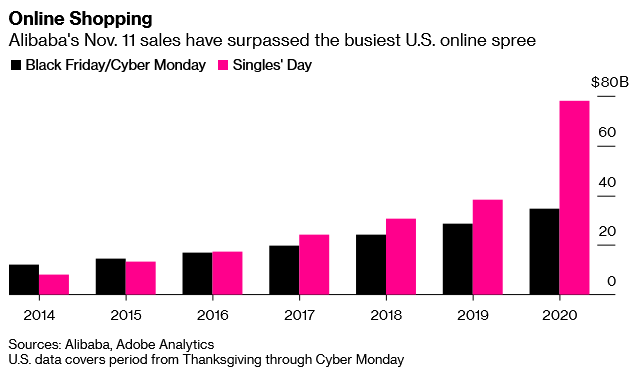

- What China’s Tech Squeeze Is Doing to Singles’ Day (bloomberg)

- Nasdaq 100’s Sizzling Run to Record Flashes Warning (bloomberg)

- GE Will Split Into Three Units, Ending Conglomerate for Good (bloomberg)

- Not So Funny. The Energy Report 11/09/2021 (Phil Flynn)

- SoftBank Sells Off Portfolio of Large-Cap Tech Stocks (Barron’s)

- Larry Culp Is Building a Leaner, Meaner, More Profitable GE (Barron’s)

- Bank Stocks Have Been Big Winners. There’s More Upside in 2022. (Barron’s)

- Beam Gets FDA Nod for First Gene-Editing Trial (Barron’s)

- Following COP26? Look at These 3 Sustainable Investing Strategies and 40 Stock Picks. (barrons)

- Regeneron’s Antibody Drug Cut Risk of Covid-19 by 82%, Company Says (Wall Street Journal)

- S. Opens Borders to Vaccinated Europeans, Others, After More Than 18 Months (Wall Street Journal)

- Chinese Junk Bond Yields Top 25% as Property-Market Strains Intensify (Wall Street Journal)

- Infrastructure Projects to Boost Sales and Prices, Industry Executives Say (Wall Street Journal)

- Brainard Interviewed by Biden for Fed Chair as Search Heats Up (Bloomberg)

- Xi’s Expanding Power Is a Growing Risk for China’s Economy (bloomberg)

- Market bull Tony Dwyer sees the record breakout running through year end (CNBC)

- Wealth management products like Evergrande’s are a big hidden risk for China’s troubled property market, economists say (businessinsider)

- Rolls-Royce mini-nuclear power plant design gets UK state backing (Financial Times)

- China struggles to regulate house prices despite glut of controls (Financial Times)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Monday…

- SoftBank unveils $8.8bn share buyback following investor pressure (Financial Times)

- S.-listed Chinese education companies jump on report of tutoring licensing (marketwatch)

- ChargePoint and Other EV-Charging Stocks Electrified by Infrastructure Bill (Barron’s)

- Coty Stock Surges on Earnings Beat and Outlook Boost (Barron’s)

- Airline Stocks Surge as U.S. Welcomes Travelers From Europe and Other Countries Again (Barron’s)

- Illumina’s Genetic Testing Business is Booming (Barron’s)

- Out Of Control. The Energy Report 11/08/2021 (Phil Flynn)

- Laggards for a Decade and Counting: Emerging-Market Stocks (Bloomberg)

- FANGs Are Getting Fatter on Falling Bond Yields (Bloomberg)

- Regeneron Antibody Prevents Covid Infections for 8 Months (Bloomberg)

- Xi Set to Unveil New Doctrine That Could Let Him Rule for Life (Bloomberg)

- S. Women Are Coming Back to the Job Market (Bloomberg)

- Here comes the travel boom (Yahoo! Finance)

- PwC to boost headcount in China by 20,000 with $1.25bn investment (Financial Times)

- Nuclear reactors are powering China’s energy transition (asiamarkets)

- Investors are sick of paying for private equity’s private jets (Financial Times)

- Chinese auto giant Geely launches electric truck, its rival to Tesla’s Semi (CNBC)

- What’s in the infrastructure bill? Electric vehicles, clean energy, and public transit are all included in $1 trillion policy (businessinsider)

- Are Investors Wrong To Worry About China? Morgan Stanley Responds… (zerohedge)

- Treehouse Foods (THS) Exploring Strategic Alternatives, Including Possible Sale to Maximize Value (streetinsider)