- Biden-Xi Virtual Summit Set for Next Week, With Date to Come (bloomberg)

- China’s Xi says ready to work with U.S. on condition of ‘mutual respect’ (cnbc)

- Inflation Was Sharply Higher Than Expected in October (Barron’s)

- Why Coinbase’s chief expects the NFT market is more like Instagram than eBay (fnlondon)

- More pain likely for hedge funds as leveraged investors unwind wrong-way bond market bets, traders say (marketwatch)

- J&J Lauds Oklahoma Ruling That Tosses Out $465 Million Opioid Judgment (barrons)

- Evergrande Is Courting Default Again as $148 Million Payment Comes Due (barrons)

- Looking For Answers. The Energy Report 11/10/2021 (Phil Flynn)

- Business Costs Are Still Surging. Here’s One Reason for Optimism. (barrons)

- Inflation Was Supposed to Kill Margins. Why Companies Are Turning Higher Profits Anyway. (barrons)

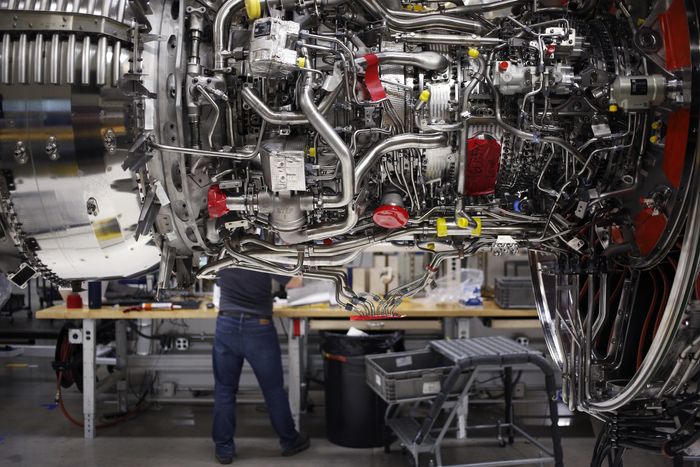

- GE Is Splitting Up. The Pieces Are Worth More Than Wall Street Thinks. (barrons)

- AT&T, Verizon, and T-Mobile Make the Case for Their Beleaguered Stocks (barrons)

- Rolls-Royce plans to build small nuclear power plants in Britain. (New York Times)

- Inflation in U.S. Builds With Biggest Gain in Prices Since 1990 (bloomberg)

- Liquidity drought in Treasury market accompanies unexpected rally (Financial Times)

- China’s factory gate inflation soars to 26-year high on energy crunch (Financial Times)

- Li Ka-Shing Adds Hydrogen Bet to Bolster $31 Billion Fortune (bloomberg)

- Clorox CEO Sticking to Bold Post-Pandemic Plan After Stock Rout (bloomberg)

Be in the know. 18 key reads for Wednesday…