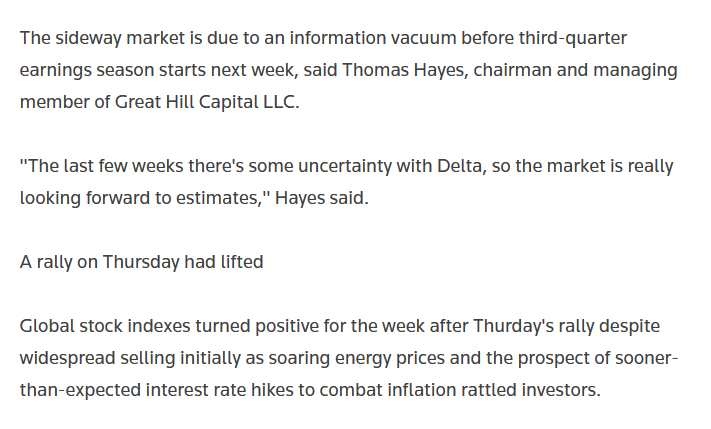

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Monday…

- Sentiment Toward China Is Changing, as Tech Names Rally After Major Fine (Barron’s)

- Why China’s Big Investors Are Still Bullish (Barron’s)

- Merck Submits Covid Pill to FDA for Emergency Approval (Barron’s)

- AstraZeneca Says Drug Reduces Risk of Developing Severe Covid by 50% (Barron’s)

- Charlie Munger’s Firm Doubled Down on Alibaba Investment (Barron’s)

- Why Goldman’s Nick Snowdon says commodities are in the ‘first innings’ of a supercycle (fnlondon)

- JPMorgan puts these two European energy giants on ‘catalyst watch’ ahead of earnings (MarketWatch)

- Biggest U.S. Retailers Charter Private Cargo Ships to Sail Around Port Delays (Wall Street Journal)

- Oil Jumps Above $80, Turbocharged by Supply Shortages (Wall Street Journal)

- China’s Property Market Faces a $5 Trillion Reckoning (Wall Street Journal)

- Goldman and JPMorgan Say Buy the Dip (Bloomberg)

- Goldman’s Hatzius Sees No Fed Hike Next Year as Growth Slows (Bloomberg)

- Dana White Has a Plan for UFC World Domination (Bloomberg)

- Nobel economics prize awarded to 3 U.S.-based economists (CNBC)

- China tech stocks surge rise despite Meituan being hit with antitrust fine (CNBC)

- ‘No Time to Die’ snares $56 million in domestic box office debut, tops $300 million globally (CNBC)

- Goldman Sachs cuts its US GDP forecast for the 3rd month in a row because of the “virus drag” on consumer spending and the global semiconductor crunch (Business Insider)

- Legendary investor Bill Miller touts bitcoin, says Coinbase could rival Tesla in value, and compares his crypto wager to his Amazon bet in a new interview. Here are the 10 best quotes. (Business Insider)

- ‘Fastest Growth Story in Consumer Finance’: Morgan Stanley Starts SoFi (SOFI) at Overweight, Sees Over 50% Upside (streetinsider)

- Will the next web be built on ethereum? (Financial Times)

Tom Hayes – Article Featured on CMT Association – 10/10/2021

Thanks to Rashmi Bhatnagar, CMT for featuring my article in the CMT Association’s October Newsletter “Technically Speaking.” You can find it here:

Thanks to Rashmi Bhatnagar, CMT for featuring my article in the CMT Association’s October Newsletter “Technically Speaking.” You can find it here:

Click here to read the full article at CMT Association

Tom Hayes – Cheddar TV Appearance – 10/11/2021

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – October 11, 2021

Click Here to Watch HD Version Directly on Cheddar

Be in the know. 14 key reads for Sunday…

- Chamath Palihapitiya on Venture Investments (Podcast) (bloomberg)

- BlackRock’s Transfer of Power (nytimes)

- Jobs Forecasters Got Schooled—Here’s Why (Wall Street Journal)

- Money Manager Thomas Lee Sees 17-Year Bull Market Powered By Millennials (Forbes)

- Meet The World’s Richest 29-Year-Old: How Sam Bankman-Fried Made A Record Fortune In The Crypto Frenzy (Forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Hydrogen’s moment is here at last (economist)

- Driving James Bond’s Original Aston Martin DB5 Left Us Shaken and Stirred (robbreport)

- Bugatti Bolide Named ‘World’s Most Beautiful Hypercar’ (maxim)

- Airless tires are finally coming in 2024: Here’s why you’ll want a set (cnet)

- The Road Ahead for U.S.-China Trade (CFR)

- Jobs Friday: Where are all the older workers? (npr)

- Why airlines need business travel to return (thehustle)

- Simple Mathematical Law Predicts Movement in Cities around the World (scientificamerican)

Be in the know. 23 key reads for Saturday…

- There’s a lesson from Charlie Munger’s increased bet on Alibaba (marketwatch)

- The Jobs Report Was Ugly. But the Details Tell a More Complicated Story. (Barron’s)

- How Washington Is Rewriting the Rules on Wall Street (Barron’s)

- Beware the Tech Stock Trap. How Bond Yields Can Signal When It’s a Good Time to Buy. (Barron’s)

- TV Isn’t Dying, and This Broadcaster’s Stock Is Underpriced (Barron’s)

- Lyme Disease Vaccine From Pfizer and Valneva Will Try to Avoid Past Pitfalls (Barron’s)

- Hospitality and Leisure Jobs Still Lagging as Industry Struggles to Attract Workers (Barron’s)

- Corning Stock Has 20% Upside, Analyst Says (Barron’s)

- 136 nations agree to biggest corporate tax deal in a century (Financial Times)

- Bridgewater warns fighting inflation risks derailing economic recovery (Financial Times)

- Charts suggest stock market should move higher in late October (CNBC)

- Cramer’s week ahead: Earnings season kicks off with the major banks (CNBC)

- Here’s where the jobs are — in one chart (CNBC)

- Global Supply-Chain Woes Escalate, Threatening Recovery (Wall Street Journal)

- U.S. Job Growth Falls to Slowest Pace of Year (Wall Street Journal)

- Chinese President Xi Jinping vows to pursue ‘reunification’ with Taiwan by peaceful means(CNN)

- 33 Undervalued Stocks for the Fourth Quarter (morningstar)

- Q4 Guide to the Markets (JP Morgan)

- Transcript: Jack Schwager (Bloomberg)

- David Einhorn’s market nihilism(Financial Times)

- Citadel CEO Ken Griffin Sounds Off on Everything from Cryptocurrencies to President Trump (Bloomberg)

- Value stocks could return 5% or more over the market: Rob Arnott Research Affiliates founder (Yahoo! Finance)

- When Should You Sell A Stock? – LI LU (YouTube)

Tom Hayes – Article Featured on MarketWatch – 10/8/2021

Thanks to Steve Goldstein for featuring my article on MarketWatch yesterday You can find it here:

Click here to read the full article at MarketWatch

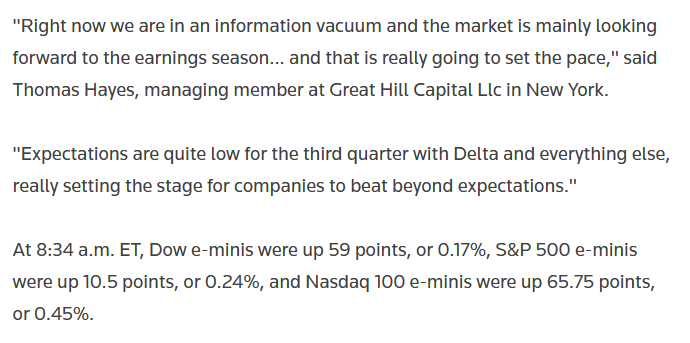

Tom Hayes – Quoted in Reuters article – 10/9/2021

Thanks to Herb Lash and Tommy Wilkes for including me in their article on Reuters today. You can find it here:

Thanks to Herb Lash and Tommy Wilkes for including me in their article on Reuters today. You can find it here: