Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – October 11, 2021

Be in the know. 14 key reads for Sunday…

- Chamath Palihapitiya on Venture Investments (Podcast) (bloomberg)

- BlackRock’s Transfer of Power (nytimes)

- Jobs Forecasters Got Schooled—Here’s Why (Wall Street Journal)

- Money Manager Thomas Lee Sees 17-Year Bull Market Powered By Millennials (Forbes)

- Meet The World’s Richest 29-Year-Old: How Sam Bankman-Fried Made A Record Fortune In The Crypto Frenzy (Forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Hydrogen’s moment is here at last (economist)

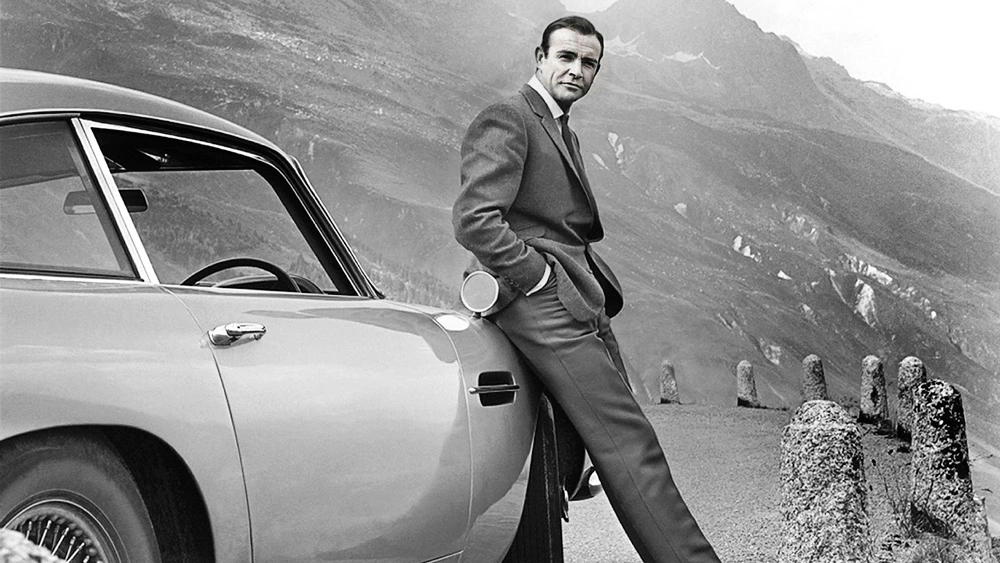

- Driving James Bond’s Original Aston Martin DB5 Left Us Shaken and Stirred (robbreport)

- Bugatti Bolide Named ‘World’s Most Beautiful Hypercar’ (maxim)

- Airless tires are finally coming in 2024: Here’s why you’ll want a set (cnet)

- The Road Ahead for U.S.-China Trade (CFR)

- Jobs Friday: Where are all the older workers? (npr)

- Why airlines need business travel to return (thehustle)

- Simple Mathematical Law Predicts Movement in Cities around the World (scientificamerican)

Be in the know. 23 key reads for Saturday…

- There’s a lesson from Charlie Munger’s increased bet on Alibaba (marketwatch)

- The Jobs Report Was Ugly. But the Details Tell a More Complicated Story. (Barron’s)

- How Washington Is Rewriting the Rules on Wall Street (Barron’s)

- Beware the Tech Stock Trap. How Bond Yields Can Signal When It’s a Good Time to Buy. (Barron’s)

- TV Isn’t Dying, and This Broadcaster’s Stock Is Underpriced (Barron’s)

- Lyme Disease Vaccine From Pfizer and Valneva Will Try to Avoid Past Pitfalls (Barron’s)

- Hospitality and Leisure Jobs Still Lagging as Industry Struggles to Attract Workers (Barron’s)

- Corning Stock Has 20% Upside, Analyst Says (Barron’s)

- 136 nations agree to biggest corporate tax deal in a century (Financial Times)

- Bridgewater warns fighting inflation risks derailing economic recovery (Financial Times)

- Charts suggest stock market should move higher in late October (CNBC)

- Cramer’s week ahead: Earnings season kicks off with the major banks (CNBC)

- Here’s where the jobs are — in one chart (CNBC)

- Global Supply-Chain Woes Escalate, Threatening Recovery (Wall Street Journal)

- U.S. Job Growth Falls to Slowest Pace of Year (Wall Street Journal)

- Chinese President Xi Jinping vows to pursue ‘reunification’ with Taiwan by peaceful means(CNN)

- 33 Undervalued Stocks for the Fourth Quarter (morningstar)

- Q4 Guide to the Markets (JP Morgan)

- Transcript: Jack Schwager (Bloomberg)

- David Einhorn’s market nihilism(Financial Times)

- Citadel CEO Ken Griffin Sounds Off on Everything from Cryptocurrencies to President Trump (Bloomberg)

- Value stocks could return 5% or more over the market: Rob Arnott Research Affiliates founder (Yahoo! Finance)

- When Should You Sell A Stock? – LI LU (YouTube)

Tom Hayes – Article Featured on MarketWatch – 10/8/2021

Thanks to Steve Goldstein for featuring my article on MarketWatch yesterday You can find it here:

Click here to read the full article at MarketWatch

Tom Hayes – Quoted in Reuters article – 10/9/2021

Thanks to Herb Lash and Tommy Wilkes for including me in their article on Reuters today. You can find it here:

Thanks to Herb Lash and Tommy Wilkes for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 12 key reads for Friday…

- Senate Raises the Debt Limit. Default Could Loom Again in Early December. (Barron’s)

- AT&T Stock Has Never Recovered From Covid. Why It Could Be Fairly Valued Now. (Barron’s)

- Conagra, PepsiCo and Other Food Makers Grapple With Higher Costs (Wall Street Journal)

- BlackRock Gives Big Investors Ability to Vote on Shareholder Proposals (Wall Street Journal)

- Dumping Stocks to Punish Bad Corporate Behavior Has Tiny Impact (Bloomberg)

- Tencent Shares Have ‘Priced in’ Gaming Crackdown, Jefferies Says (Bloomberg)

- Taiwan Exports Surge to Record, Defying Predictions of Slowdown (Bloomberg)

- Tesla moves headquarters from California to Texas (CNBC)

- 3 reasons why energy is the best sector of the stock market to invest in right now, according to JPMorgan (businessinsider)

- Amazon CEO, citing ‘rougher’ patch with Seattle, looks to ’burbs (seattletimes)

- JPMorgan Raises Price Target on Walt Disney (DIS) Into ‘De-risked’ FQ4 Earnings, Current Levels Seen as an Attractive Entry Point for LT Investors (streetinsider)

- China orders coal miners to boost output to counter energy crunch (Financial Times)